| |

1152 Fifteenth Street, NW, Suite 850 Washington, DC 20005 202.729.7470 202.730.4520 fax | |

John Mahon 202.729.7477 | Writer's E-mail Address John.Mahon@srz.com |

| |

1152 Fifteenth Street, NW, Suite 850 Washington, DC 20005 202.729.7470 202.730.4520 fax | |

John Mahon 202.729.7477 | Writer's E-mail Address John.Mahon@srz.com |

1. | Comment: We note the disclosure included in the Preliminary Proxy Statement regarding the intention of the Company's current Chairman and Chief Executive Officer, Mr. Jamison, to resign from such positions in order to assume similar roles at HALE.life Corporation ("HALE"), a controlled portfolio company of Harris & Harris. Please revise the Q&A section of the Preliminary Proxy Statement to provide a more detailed explanation regarding the expected business activities and purpose of HALE subsequent to completion of the proposed transactions referenced in the Preliminary Proxy Materials (collectively, the "Proposed Restructuring"). |

2. | Comment: Please confirm to the Staff whether any portfolio assets will be transferred by the Company to HALE in connection with the Proposed Restructuring. |

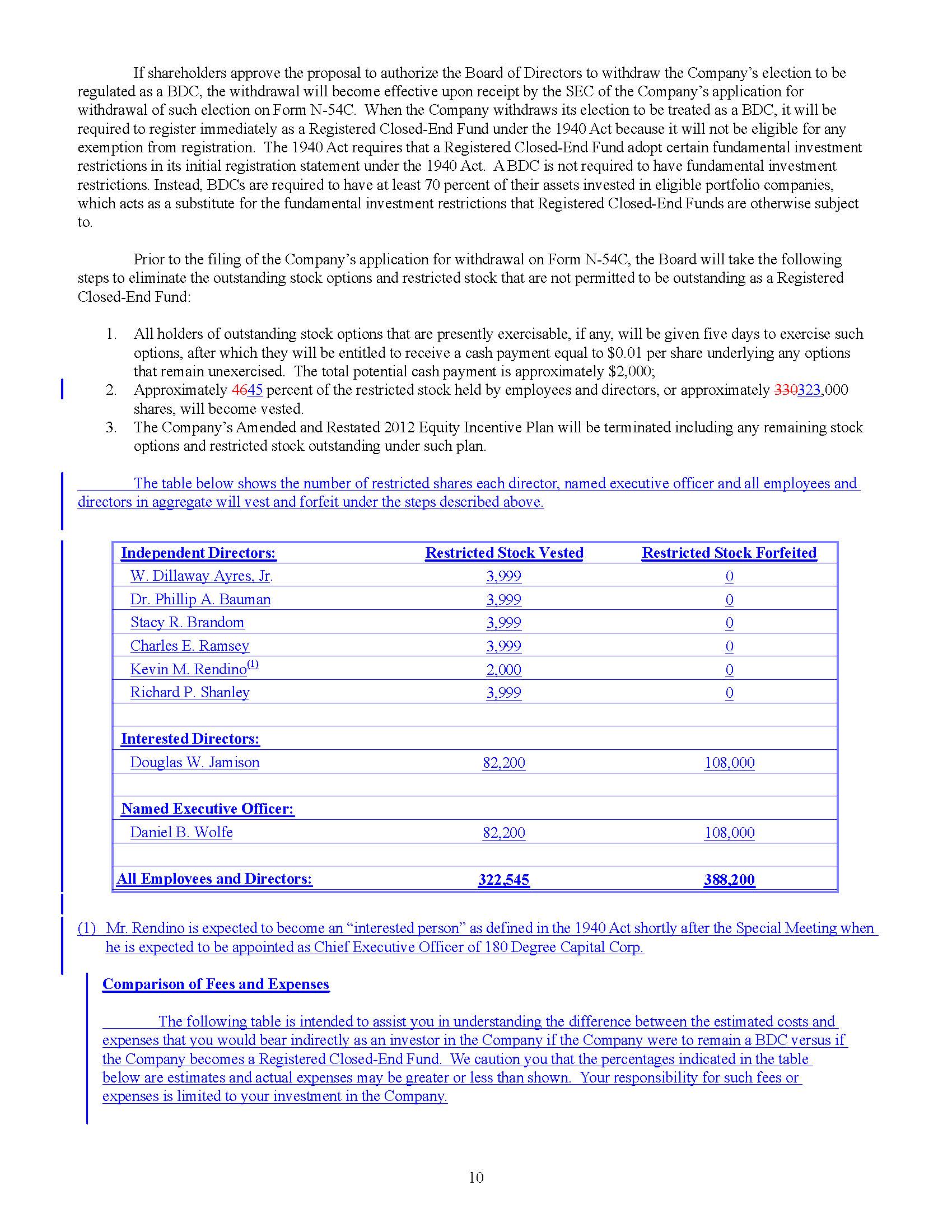

3. | Comment: Please confirm to the Staff whether the Company has any present intention to spin out its equity stake in HALE subsequent to completion of the Proposed Restructuring. |

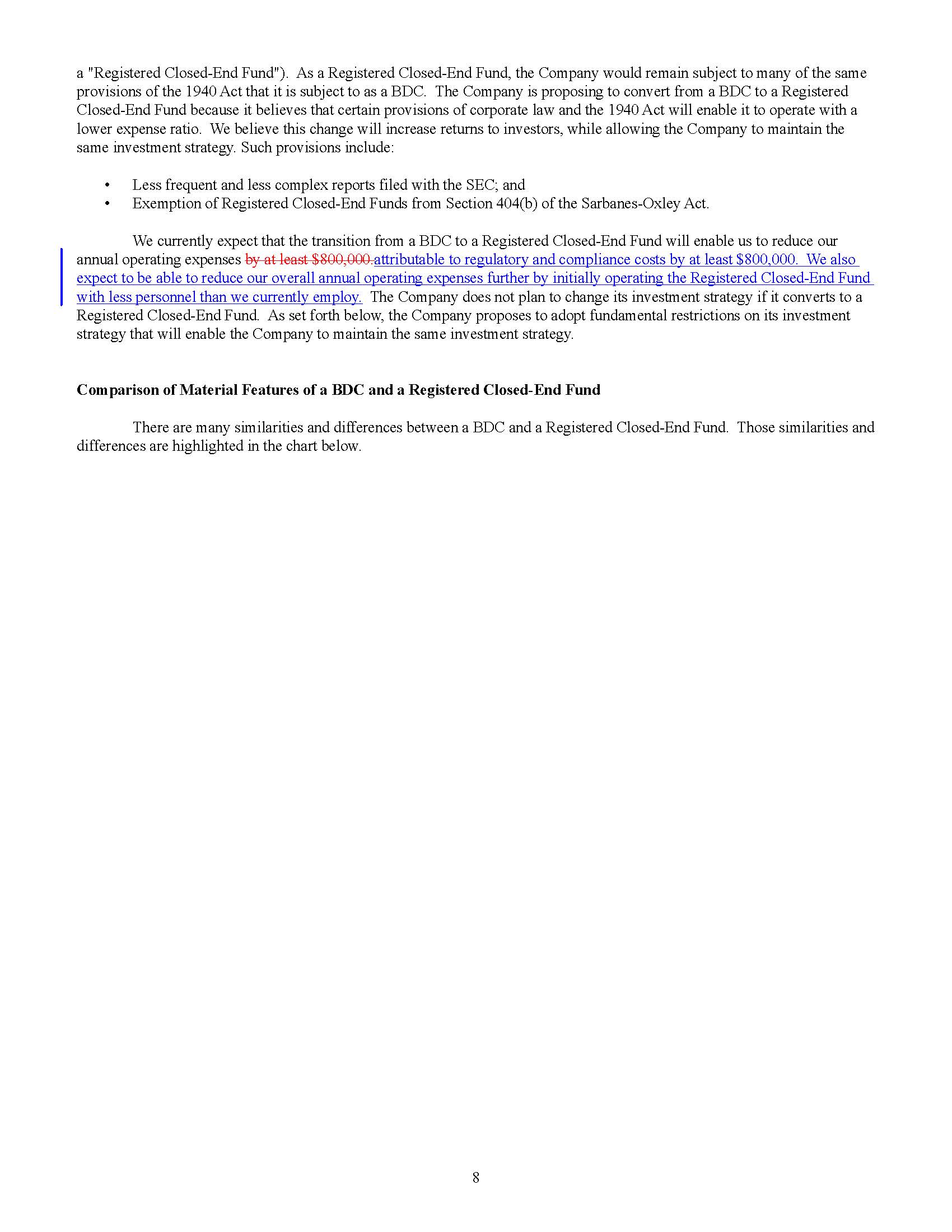

4. | Comment: Please advise the Staff on a supplemental basis whether HALE intends to operate as a "C" corporation for federal income tax purposes subsequent to the Proposed Restructuring. |

5. | Comment: Please advise the Staff on a supplemental basis whether the Company intends to dispose of portfolio assets that do not conform to its new investment objective subsequent to the Proposed Restructuring. |

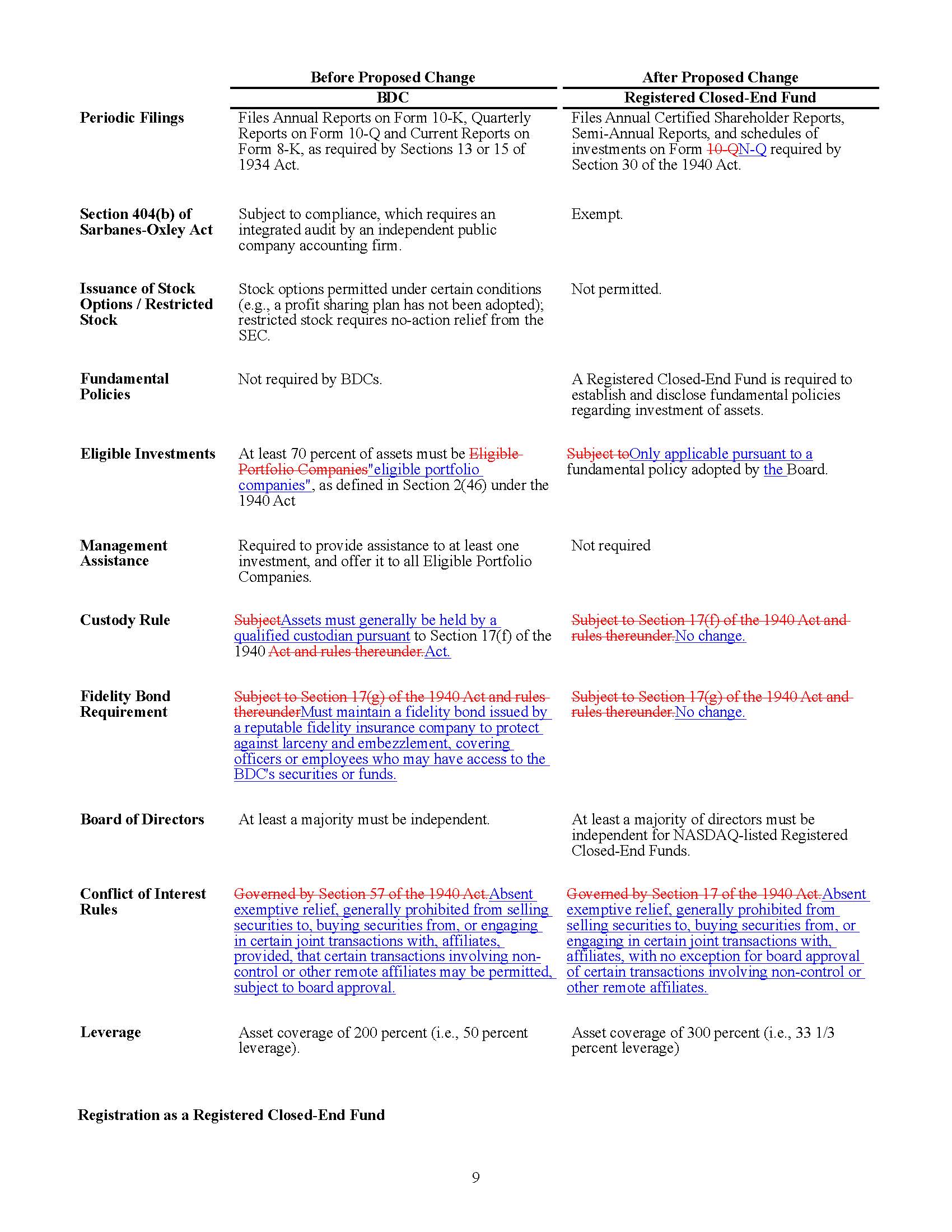

6. | Comment: Please advise the Staff on a supplemental basis whether HALE is expected to fall within the definition of "significant subsidiary", as such term is defined in Rule 1-02(w) of Regulation S-X, subsequent to the Proposed Restructuring. If so, please confirm that the Company will provide the disclosure required by Rule 3.09 or Rule 4.08(g), as applicable, with respect to HALE. |

7. | Comment: Please revise the Q&A section of the Preliminary Proxy Statement to provide an aggregate, all inclusive, estimate of expenses the Company expects to incur in connection with the special meeting, including legal, accounting and printing costs, in addition to providing the amounts the Company expects to pay for proxy solicitation and related services. |

8. | Comment: Please revise the disclosure under Proposal 1 in the Preliminary Proxy Statement to include a comparative fees and expenses table, showing the estimated impact of any anticipated changes in fees and expenses as a result of the Proposed Restructuring. |

9. | Comment: Under the sub-heading "Comparison of Material Features …" in Proposal 1 of the Preliminary Proxy Statement, please revise the tabular disclosure to explain the differences between business development companies and registered closed-end investment companies using more "plain English" language. |

10. | Comment: Under the sub-heading "Registration as a Registered Closed-End Fund" in Proposal 1 of the Preliminary Proxy Statement, we note the reference to outstanding but unexercised options. Please advise the Staff whether any such outstanding options are presently "in-the-money", and if so, whether any that are unvested will become vested and exercisable as a result of the Proposed Restructuring. |

11. | Comment: Under the sub-heading "Registration as a Registered Closed-End Fund" in Proposal 1 of the Preliminary Proxy Statement, we note the reference to the automatic vesting of certain restricted stock awards. Please provide tabular disclosure noting the number of restricted shares each current executive officers and directors will have vest as a result of the Proposed Restructuring. In addition, please advise the Staff on a supplemental basis whether the Company expects to incur any compensation expense as a result of the vesting of such restricted shares. If so, please revise the disclosure set forth in the above-referenced sub-heading to detail the aggregate compensation expense the Company anticipates incurring as a result of such vesting. |

12. | Please describe the tax consequences to the Company of the Proposed Restructuring, including whether the Proposed Restructuring will result in the loss of any tax loss carry-forwards to which the Company may presently be entitled. |

13. | Comment: Please revise the disclosure set forth under the sub-heading "Proposed Fundamental Investment Policies …" in Proposal 1 of the Preliminary Proxy Statement to ensure that each of the policies referenced in Section 8(b) of the Investment Company Act of 1940, as amended, have been addressed in accordance with the Staff's interpretive positions with respect thereto. |

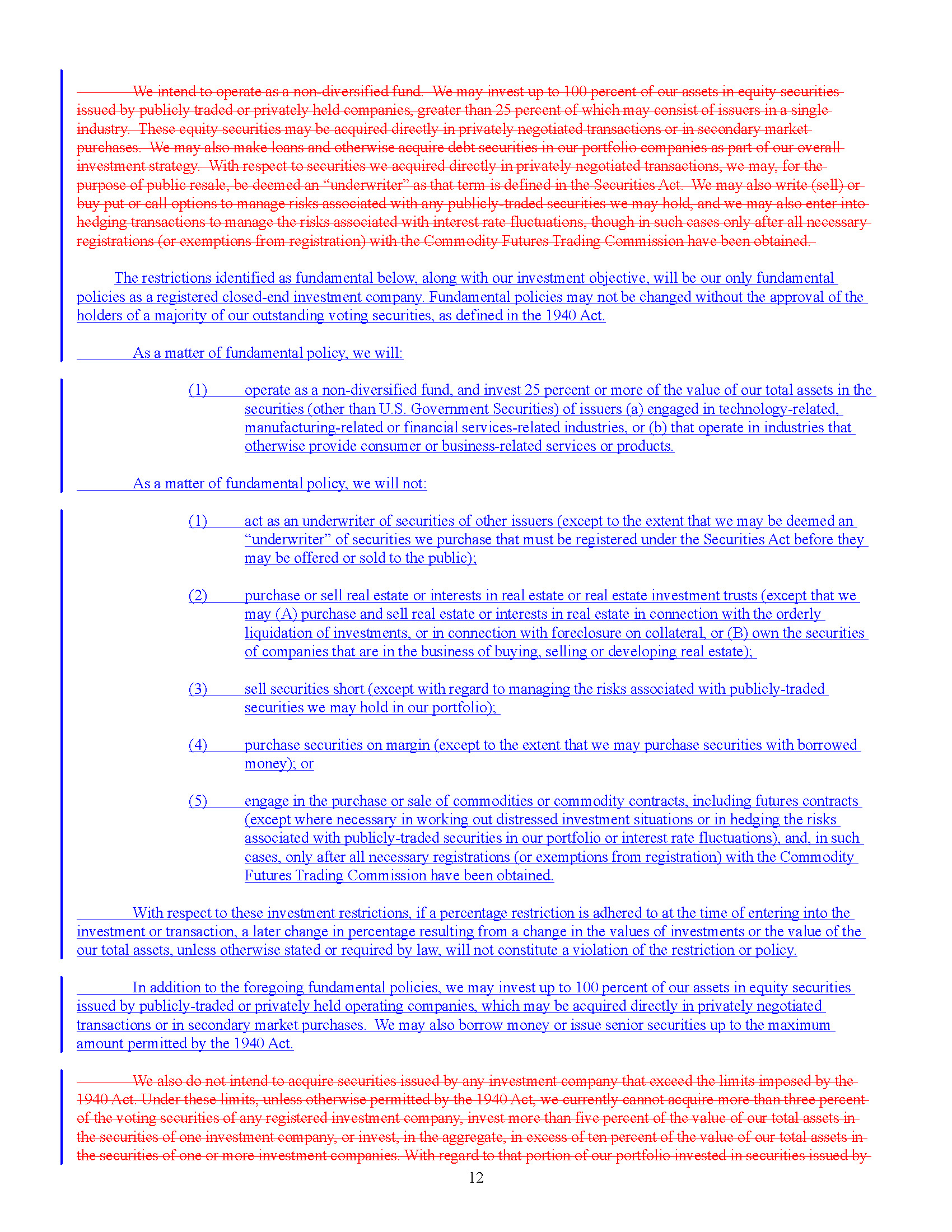

14. | Comment: Under the sub-heading "Expected Management Team" in Proposal 1 of the Preliminary Proxy Statement, we note the reference to the appointment of Mr. Wolfe as a new director of the Company in connection with the Proposed Restructuring. Please confirm to the Staff that the Board of Directors of the Company has the authority to appoint Mr. Wolfe without a shareholder vote. In addition, please confirm that Mr. Wolfe will be submitted for election as a director at the Company's 2017 annual meeting of stockholders. |

15. | Comment: Under the sub-heading "Expected Management Team" in Proposal 1 of the Preliminary Proxy Statement, we note that Mr. Jamison will be resigning as Chairman and Chief Executive Officer of the Company to take on similar roles at HALE. Please provide disclosure under the above-referenced sub-heading regarding the expected compensation of Mr. Jamison for his service to HALE subsequent to the Proposed Restructuring. |