| |

1152 Fifteenth Street, NW, Suite 850 Washington, DC 20005 202.729.7470 202.730.4520 fax | |

John Mahon 202.729.7477 | Writer's E-mail Address John.Mahon@srz.com |

| |

1152 Fifteenth Street, NW, Suite 850 Washington, DC 20005 202.729.7470 202.730.4520 fax | |

John Mahon 202.729.7477 | Writer's E-mail Address John.Mahon@srz.com |

1. | Comment: We note your response to prior comment no. 1 set forth in the Prior Response Letter. Please revise the disclosure set forth under the heading "What is HALE.life Corporation …" in the Q&A Section of the Preliminary Proxy Statement to address whether HALE.life Corporation ("HALE") has been founded yet, if it currently conducts operations, and the Company's plan for seeding additional capital into HALE subsequent to the Company's conversion to a registered closed-end investment company as described in the Preliminary Proxy Statement (the "Proposed Restructuring"). In addition, in the third paragraph under the above-referenced heading, please clarify, if true, that HALE will be structured and run as an operating company. |

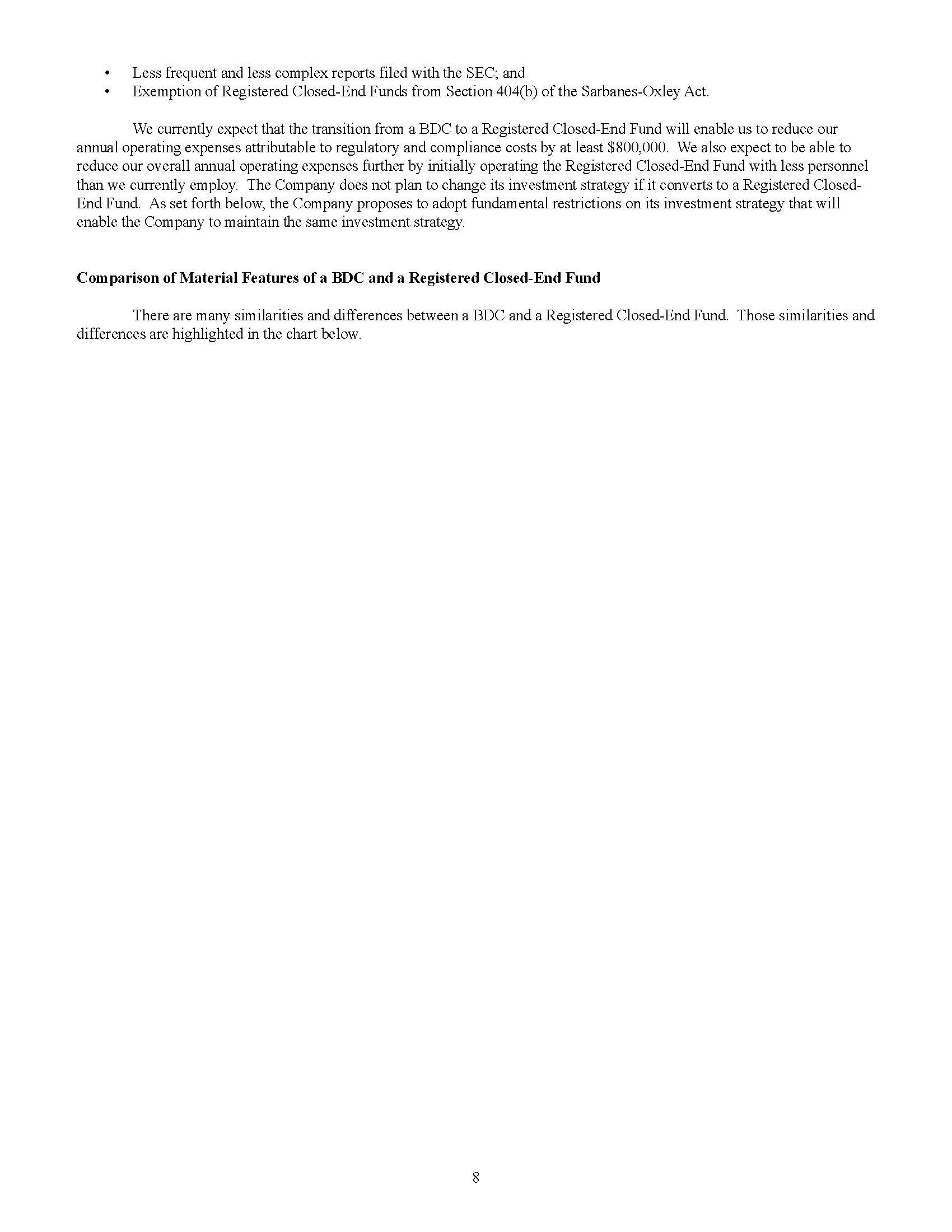

1. | Comment: Under the sub-heading "Comparison of Fees and Expenses" set forth in Proposal 1 of the Preliminary Proxy Statement, please include a statement noting that, because HALE's financial statements will not be consolidated with those of the Company subsequent to the Proposed Restructuring, the expenses of HALE have not been included in the tabular disclosure regarding the Company's comparative fees and expenses. In addition, please confirm to the Staff on a supplemental basis that the Company does not expect to incur any interest expense in the twelve months following the Proposed Restructuring. |

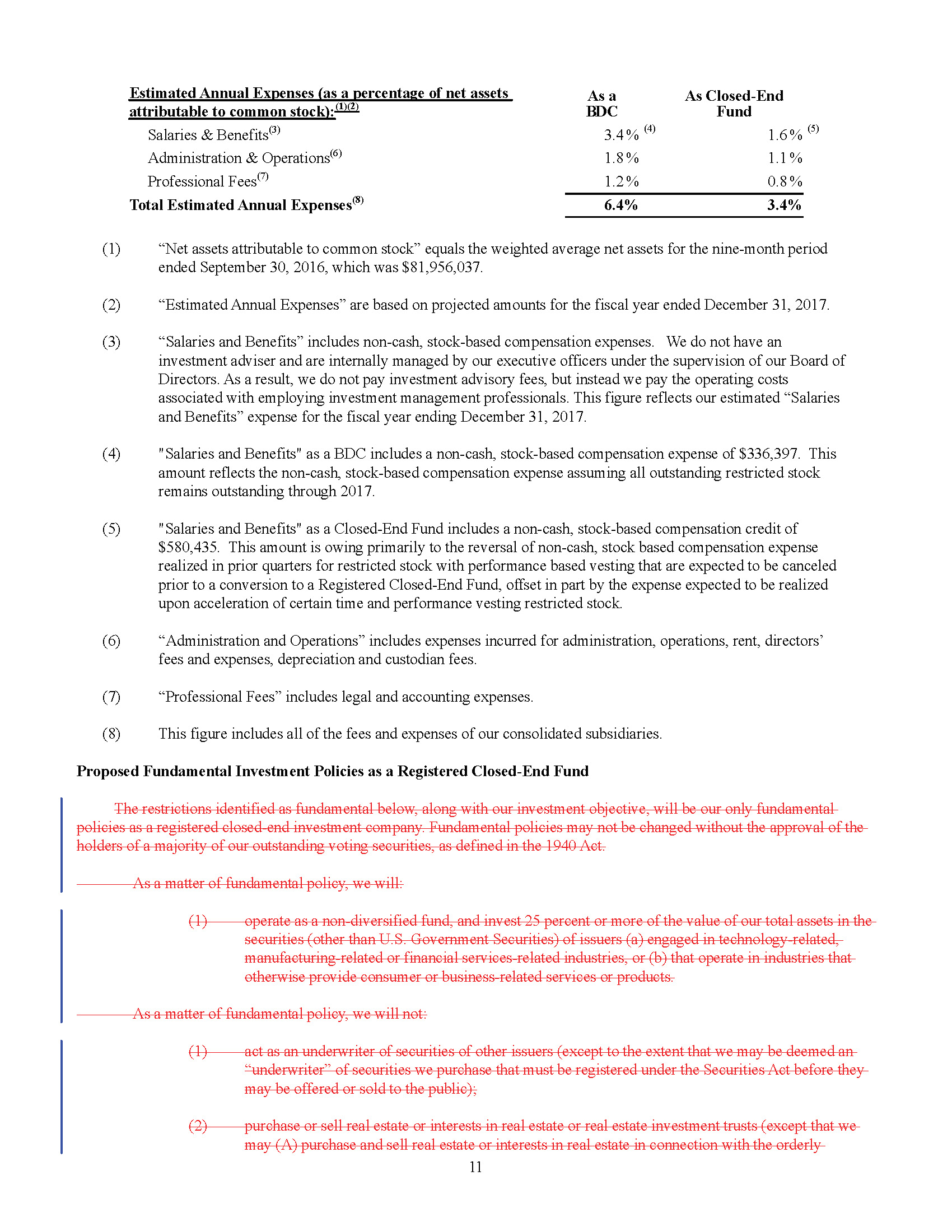

2. | Comment: Under the sub-heading "Proposed Fundamental Investment Policies …" set forth in Proposal 1 of the Preliminary Proxy Statement, please revise the list of industries in which the Company may concentrate subsequent to the Proposed Restructuring to reflect a single industry or group of related industries, rather than enumerating a list of unrelated industries in which the Company may concentrate greater than 25% of its portfolio. |

3. | Comment: We note that the Company intends to operate as a non-diversified fund subsequent to the Proposed Restructuring. Please revise the disclosure included under the sub-heading "Proposed Fundamental Investment Policies …" set forth in Proposal 1 of the Preliminary Proxy Statement to note that the Company will remain subject to the diversification requirements as a regulated investment company for federal income tax purposes. |