UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-07074

| | |

| 180 DEGREE CAPITAL CORP. |

| (Exact Name of Registrant as Specified in Its Charter) |

| | | | | | | | |

| 7 N. Willow Street, Suite 4B, Montclair NJ | | 07042 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | |

Daniel B. Wolfe

President and Chief Financial Officer

180 Degree Capital Corp.

7 N. Willow Street, Suite 4B

Montclair, NJ 07042 |

| (Name and address of agent for service) |

|

Copy to:

John J. Mahon, Esq.

Schulte Roth & Zabel, LLP

1152 Fifteenth Street, NW

Suite 850

Washington, DC 20005

(202) 729-7477 |

Registrant's telephone number, including area code: (973) 746-4500

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Beginning on January 1, 2021, and as permitted by a rule adopted by the Securities and Exchange Commission ("SEC"), paper copies of the shareholder reports of 180 Degree Capital Corp. (the "Company") like this one, will no longer be sent to you by mail unless you specifically request that your financial intermediary (i.e., the broker-dealer or bank through which you own your shares) or the Company, as applicable, send you paper copies. Instead, shareholder reports will be made available on a website, and you will be notified by mail each time a report is posted and you will be provided with a website link to access the report.

If you already have elected to receive shareholder reports electronically, you will not be affected by this change and need not take any action. You may elect to receive all future shareholder reports of the Company in paper free of charge. If you own shares through a financial intermediary, you may contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports, or if your shares are not held by a financial intermediary, you may contact the Company's transfer agent, American Stock Transfer & Trust Company, LLC at 800-937-5449, or the Company at 833-293-1769.

Item 1. Report to Shareholders.

Fellow Shareholders,

What a year. If, in late March 2020, with the market being down over 30%, you would have told me we would have a vaccine ready for distribution by the end of 2020 and that our gross total return of cash and securities of publicly traded companies, including carried interest generated from our separately managed account, would be +17.8%1, and our net asset value per share (“NAV”) would have increased by +1.1%, I am not sure I would have believed it. I also would not have believed that in Q1 2021, we would be in discussion to invest in a newly-formed sponsor vehicle that plans to form a new special purpose acquisition company (“SPAC”) (more on that later); but we have, and we are focused on completing the investment. 2020 was like being at Coney Island; albeit without the fun. In Q2 2020, US GDP collapsed by 31% amidst a raging, deadly pandemic. Against the backdrop of over $3 trillion in COVID-relief financial aid, US GDP advanced by 33% in Q3 2020. It was a wild roller coaster of a year to say the least.

I have said as many times as anyone would listen that the 2008 subprime mortgage economic and stock market collapse was a once-in-a-generation economic Pearl Harbor. I don’t know what I think anymore. Was it really once in a generation, or did 2020 prove it was just a once-in-a-12-year event? In 2008, the S&P 500 declined by 57% from its peak to trough. US GDP declined by 2.1% in Q3 2008, 8.4% in Q4 2008, 4.4% in Q1 2009, and 0.6% in Q2 2009. Growth resumed from Q3 2009 onward. The S&P 500 did not recover to the October 2007 high until April 2013, 5.5 years later. The COVID-19 pandemic caused the S&P 500 to decline 31% in one month, only to retrace and find its all-time high just 6 months later. I don’t know which year left me with more scar tissue. The 2008 period had a far longer lasting and damaging impact on the stock market; most specifically because the financial sector, which plays a critical role in allocating credit throughout the economy, was the hardest hit. The 2020 stock market might have only sustained limited and short-lived destruction, but it came with a pandemic that has killed 440,000 of our fellow citizens and left many consumer, travel and leisure sectors in absolute tatters. I guess it is like wondering whether I would rather get hit in the head with a shovel or a bat. Navigating though both periods has had its challenges on one hand, but provided longer term opportunities on the other. That is, if one is willing to take on risk.

Risk. I apologize in advance, for I am about to take you down a diversion from the COVID-19 world we live in to talk about risk, analyzing the attribution of the benchmarks we follow, and conclude on what we think about benchmarking, indexing, etc... for TURN. During my days at BlackRock and Merrill Lynch, following the great financial crisis of 2008, and the subsequent damage done to so many client portfolios, risk departments, which quantify how much risk we have in client portfolios, took on a heightened importance in the investment process at large investment management companies. Strong risk compliance is designed to help fund managers manage the risk we take and ensure that we are operating our funds within the framework that our clients expect. Some simplistic risk analysis was designed to aid portfolio optimization. For instance, I had tools which helped show my investment portfolio’s risk relative to benchmarks of the stocks I owned (based on weightings) and the risk I was taking by not owning certain stocks that were in the index, but not in my portfolio. We also had very sophisticated interdependency studies which analyzed how sectors traded relative to each other and relative to differing economic backdrops. For example, one would think that being overweight financials in a declining interest rate environment would lead to a portfolio that outperforms the index given how well financials perform in those periods. However, at the same time, if I was underweight industrials and materials during that period, the gains I would expect from my overweighting in financials could be offset by losses in materials and industrials. Some of the risk tools were super simple. Others were incredibly cumbersome and complicated. To be clear, in total and if used properly, these tools were very valuable for aiding my ability to outperform for the funds I was managing. Risk management departments were not only essential for the institutional equity world, they were becoming prominent in the retail space as well.

I haven’t spent time talking about attribution versus the benchmark with you since I arrived at TURN, but in looking at 2020, I thought I would spend some time on it. For most of 2020, it was a have and have-not year for the market as a whole. For example, while the S&P 500 advanced 18.4% in 2020, the information technology sector was up 44%. Just alone, Apple and Alphabet represented 33% of the entire move in the S&P 500. Amazon contributed nearly 14% of the entire S&P 500 move in 2020. And yet, at the same time, energy, financials, consumer staples, healthcare, industrials, real estate and utilities were all sectors that underperformed in 2020.

_____________________

1 Past performance included throughout this letter is not an indication or guarantee of future performance. Gross unrealized and realized total returns of 180's cash and securities of publicly traded companies are compounded on a quarterly basis, and intra-quarter cash flows from investments in or proceeds received from privately held investments are treated as inflows or outflows of cash available to invest or withdrawn, respectively, for the purposes of this calculation. 180 is an internally managed registered closed end fund and does not have an external manager that is paid fees based on assets and/or returns. 180 also has a material portion of its investment portfolio in legacy privately held investments. Please see 180's filings with the SEC, including its 2020 Annual Report filed on Form N-CSR for information on its expenses and expense ratios. The carried interest from the separately managed account was accrued as of December 31, 2020, and received on February 19, 2021.

| | | | | | | | | | | |

| Vanguard S&P 500 ETF (VOO) Discretionary |

| Avg. Portfolio Weight | Sector | Contribution to Change | 2020

Total Return |

| 26.4% | Information Technology | 11.0 | 44.0% |

| 14.3% | Healthcare | 2.1 | 13.5% |

| 10.8% | Communication Services | 2.6 | 23.7% |

| 10.7% | Consumer Discretionary | 3.6 | 33.0% |

| 10.6% | Financials | (0.8) | (1.7)% |

| 8.3% | Industrials | 0.8 | 10.5% |

| 7.1% | Consumer Staples | 0.7 | 10.8% |

| 3.2% | Utilities | (0.1) | 0.5% |

| 2.8% | Energy | (1.7) | (33.6)% |

| 2.8% | Real Estate | (0.2) | (2.3)% |

| 2.6% | Materials | 0.6 | 21.0% |

Suppose you competed against this index, but you had an investment style slanted towards value and you didn’t own Apple, Amazon or Alphabet. Are you a terrible investor? Of course, you are not. But that is how you may be measured from the consulting world. In the institutional world, there is endless intense pressure to keep up with indices and buy stocks that are outperforming just because they are outperforming, not because you find them inherently undervalued. The opposite is true; institutional portfolio managers will often also avoid those parts of the market that are underperforming just because they are underperforming and they don’t want to fall behind. I will never forget the pressure I felt to keep pace in 2000 as a value manager during the dot-com bubble. I was told in 2000 by a senior member of the investment committee, that if I wanted to keep up, I needed to add Apple to my portfolio, or run the risk of underperforming and getting fired for bad performance. It was an insane conversation. Him: “You just have to buy it.” Me: “I am sorry I can’t make sense of its valuation.” Him: “Valuation has nothing to do with it. It’s a big part of the index. You are taking a big risk.” Me: “Thanks for the heads up, and the investing advice.” I might have said the last line, but that certainly wasn’t what I was thinking. The actual thoughts in my head were more or less in line with some of those choice comments Earl Weaver or Lou Pinella had for umpires they felt had made a terrible call! Fortunately, Apple didn’t find its way into my portfolio at its then price of $100. A year later, after the dot-com bubble crashed, Apple fell to $10. I actually bought it at $10, which was equal to the net cash it had on the balance sheet. The same person who thought I was crazy for not owning it at $100 literally said to me after hearing we bought it, “Wow, are you sure about that? That feels like a big risk.” I honestly couldn’t make the conversation up if I tried. Serenity now! His version of risk was only centered around risk to the benchmark. My version of risk starts with am I going to make money on this investment?

The sandbox we play in, as you know, is the Russell Microcap world and below is an attribution table for the index in 2020. The Russell Microcap Index was up 20.9% in 2020.

| | | | | | | | | | | |

| Russell Microcap Index (RMICRO) |

| Avg. Portfolio Weight | Sector | Contribution to Change | 2020

Total Return |

| 29.5% | Healthcare | 11.6 | 34.8% |

| 20.7% | Financials | (4.8) | (11.8)% |

| 11.5% | Information Technology | 5.4 | 49.4% |

| 11.3% | Industrials | 2.8 | 25.7% |

| 11.0% | Consumer Discretionary | 6.7 | 47.7% |

| 4.1% | Real Estate | (0.4) | 2.8% |

| 3.2% | Energy | (1.6) | (29.5)% |

| 3.1% | Communication Services | 0.6 | 23.8% |

| 2.6% | Materials | 0.4 | 12.9% |

| 2.0% | Consumer Staples | 0.5 | 27.8% |

| 1.2% | Utilities | (0.1) | 1.1% |

There are a couple things to point out. First, the healthcare sector represents 30% of the assets in the Russell Microcap Index, and the 35% return for the healthcare sector in 2020 contributed 55% of the total return for the index. Given our Graham and Dodd value investment focus, we do not have a significant portion of our assets invested in healthcare-related companies. In the chart below, I list the top-ten healthcare performers in the Russell Microcap Index and their corresponding valuation on an enterprise value to forward sales ratio. I am not denigrating these companies as investments or making bearish claims about them. What I am saying is that they are part of an index that we are simply not going to own from a valuation perspective. It’s not what we do.

| | | | | | | | | | | | | | | | | | | | |

| Company | Ticker | Total Return | Index Contr. To Return | Enterprise Value ($mm) | 2021 Est. Sales ($mm) | EV / Est. 2021 Sales |

| Inovio Pharmaceuticals Inc | INO | 168.2% | 0.9 | $1,199 | $16 | 74.9x |

| Novavax Inc | NVAX | 2,701.8% | 0.88 | $7,116 | $3,570 | 2.0x |

| Intellia Therapeutics Inc | NTLA | 270.8% | 0.64 | $3,090 | $45 | 68.7x |

| Owens & Minor Inc | OMI | 423.8% | 0.51 | $3,011 | $8,720 | 0.3x |

| Forty Seven Inc | FTSV | 142.6% | 0.43 | $4,244 | $2 | 2,122.0x |

| Kura Oncology Inc | KURA | 137.5% | 0.36 | $1,836 | $3 | 612.0x |

| Seres Therapeutics Inc | MCRB | 610.1% | 0.36 | $1,963 | $23 | 85.3x |

| ModivCare Inc | MODV | 134.3% | 0.35 | $1,783 | $2,048 | 0.9x |

| CryoPort Inc | CYRX | 166.6% | 0.35 | $1,649 | $199 | 8.3x |

| MacroGenics Inc | MGNX | 110.1% | 0.33 | $1,004 | $148 | 6.8x |

NOTE: FTSV EV and forward sales figures reflect acquisition by GILD completed on 04/08/2020. All other enterprise values as of December 31, 2020 with forward sales figures reflecting analyst consensus estimates as listed on Bloomberg. Actual results may be materially different.

The table below contains the sector attributions and contribution to total return for the Russell Microcap Value Index in 2020. For the year, the Russell Microcap Index was up 8.1%

| | | | | | | | | | | |

| Russell Microcap Value Index (RMICROV) |

| Avg. Portfolio Weight | Sector | Contribution to Change | Total Return |

| 34.0% | Financials | (7.5) | (13.9)% |

| 12.9% | Consumer Discretionary | 7.2 | 47.3% |

| 12.6% | Industrials | 1.4 | 3.5% |

| 12.1% | Health Care | 6.3 | 47.8% |

| 7.7% | Information Technology | 1.6 | 34.5% |

| 5.4% | Real Estate | (1.3) | (10.9)% |

| 5.2% | Energy | (2.4) | (31.3)% |

| 3.8% | Materials | 0.8 | 13.0% |

| 2.9% | Communication Services | 0.2 | 1.0% |

| 2.3% | Consumer Staples | 0.3 | 9.2% |

| 1.1% | Utilities | (0.1) | (4.4)% |

Unlike the Russell Microcap Index, where we were disadvantaged from a group of expensive stocks (as we define it) having massive share appreciation and being outsized contributors to the overall index, we had the advantage of not having a large weight in financial companies (34% of the Russell Microcap Value Index) when compared to the Russel Microcap Value Index. Subject to the safe harbor for such investments set forth in Rule 12d3-1, investment companies like TURN are limited in the amount of any company we can own that generates 15% or more of its revenues from securities-related activities, including as a broker, a dealer, an underwriter, or an investment adviser. So, were we smart not to own financials in 2020 when the group had a total return of -7.6% and represented 34% of the overall index? No. We have a structural impediment and the weighting in the index is irrelevant to how we think about investing. I do not consider us smart for having “predicted” how poorly financial companies would perform last year, thus enabling us to outperform the Russell Microcap Value Index by 1,000 basis points. Nor do I consider us “dumb” for having missed the boat on ten companies, with astronomical valuations, in the Russell Microcap Index causing us to underperform the index by 200 basis points. The relative benchmark game is riddled with these types of silly conundrums. We are not running TURN to beat an index. That’s the institutional and, becoming more and more, the retail mindset. We are focused on generating attractive absolute returns for shareholders. We look at each investment on its own merits; never once analyzing the size of the weight of that company in the index.

I started this discussion by lauding the role that good risk management tools, when used properly, can have in providing portfolio managers with capabilities designed to enhance performance of their portfolios. I also strongly believe there has been a tangible downside to the implementation of these tools, resulting in the unintended consequence of lowering returns of portfolios by forcing managers to obsess on the risks they are taking in their portfolios. To be clear, investors need to take on risk in their portfolios in order to outperform. Let me reiterate… risk is required for outperformance.

At the end of my days at BlackRock, I was becoming increasingly frustrated with the dumbing down of portfolio managers as they overanalyzed the risk they were taking in their portfolios relative to the benchmarks. The industry was rapidly moving to indexing, closet indexing of benchmarks, and overemphasizing portfolio managers during marketing efforts who had lower standards of deviation to their benchmarks. I was spending more and more time in risk meetings, more and more time explaining my risk, more and more time analyzing my risk, and less and less time analyzing the companies we were buying. Over time, and in disturbingly increasing fashion, I felt myself second guessing and questioning why I owned the stocks I owned, and questioning why I didn’t own the stocks I didn’t own. This paralysis by analysis resulted in shrinking alpha for my clients. The downside of underperforming had a greater consequence to my livelihood than did the upside of outperforming. If I outperformed, I kept my job, and if I underperformed, I lost my job. Most of us didn’t want to lose our jobs, so the industry became risk averse, especially against the backdrop of exchange traded funds (ETFs) and index funds that were outperforming active managers by significant amounts and getting all the inflows of money that was coming into the asset management business. The job I had running the Basic Value Fund, which was the only job I ever wanted, was becoming less and less interesting as the industry became more and more focused on limiting risk.

In April and May of 2012, when I was working at BlackRock, JP Morgan had an unexpected $2 billion trading loss in its London office caused by a series of bad derivative transactions in credit default swaps. JP Morgan was my biggest holding, and Jamie Dimon was my favorite CEO. I had a big bet on JP Morgan on both a relative and absolute basis. In a two-week period, the stock declined by 23%. This decline might not seem like a lot based on current volatility, but back then, in that company, it was an enormous collapse. What happens next in the investment process at a big firm was predictable (and necessary I might add). Our internal team had meetings to discuss the impact of JP Morgan on our portfolio, discuss specifically what happened, and determine what our weighting should be as a result of the new news. Do we want to own more? Do we want to own less? Is the long-term story impacted, or is it just a short-term blip? A very deliberate and thorough analysis followed.

We also needed to sit through risk meeting after risk meeting, being asked questions about the position and whether or not we understood the risk attached to the size of the position, etc. So, you know, and to be clear, these lines of questions are everything that a risk department is designed to do - ensuring portfolio managers understand the risk they are taking in individual names. On a name this widely owned, we were spending 24/7 analyzing the situation, both with our team, our clients, our internal colleagues and our risk managers. Everyone had an opinion. Differing ones for sure. After endless meetings of defending, one’s positions, you end up questioning your thesis and whether or not you are taking the appropriate risk. Even though Jamie Dimon said the losses were limited to London, maybe they weren’t. Maybe instead of $2 billion of losses, there are really $4 billion. Maybe the losses were more widespread on the trading desk for other JP Morgan departments. Here is the pushback we would get from folks that thought we should reduce our risk, “Maybe you want to reduce your risk given the news and the uncertainty. Perhaps you are taking on too much risk. Why not wait for the story to clear up and buy more then?” It is so easy to second guess yourself during stressful periods like that. It isn’t so easy to trust your gut when everyone around you is telling you, “It isn’t worth it. Go buy another bank that doesn’t have these kinds of losses.”

What was the end result? I saw many portfolio managers reduce their positions and some by a significant amount. I saw some portfolio managers maintain their holdings. I didn’t see a lot of portfolio managers increasing their positions; and that included us. What did we do? We hung on. That’s all. My gut said let’s ignore the next quarter, think about the long term, and increase our weighting. But I didn’t act on my gut. I let the weight of all the inbound pounding on our team convince me we should not take the “added risk” of buying more. I also came to the realization I didn’t want to manage money in this environment any more. I realized during that period that I could no longer invest the way I wanted to. Every day, we would talk benchmarks, standard deviation, beta, r-square, Sharpe ratio, value at risk, Sortino ratio and other risk measures. It was just too much for me. It wasn’t making me a better portfolio manager; it was making me take less risk and be a worse portfolio manager. I was second guessing every decision I made because I didn’t want to stand out like a sore thumb by talking outsized risk. The light bulb came on in my mind and I quietly told my CIO my intention to retire. I wanted to invest in a completely different manner, one in which I would define success, not for how we were positioned versus a benchmark, but how well we did providing above average returns for shareholders over a cycle. By the way, JP Morgan never saw its May 2012 low again and the stock is 4x the price it was at the bottom. This has nothing to do with BlackRock. I love the place and loved my time there. I respect my colleagues in the risk departments and the tools they provided me, and I know a proper risk management process is necessary given the complexities and the size of some of these big firms. For me, all I wanted to do was make money for our clients, and I promised myself the rest of my investment career would not be overwhelmed by benchmarks and relative analysis.

That is a lot of words, and I have already put myself to sleep, but the point for TURN is that just because 35% of the Russell Microcap Index is in healthcare names, we aren’t going to own them just because it’s in the index; especially if we consider them to be expensive with valuation levels that aren't consistent with our investment process. Similarly, but for very different reasons, just because 33% of the Russell Microcap Value Index is in financials, a structural issue for TURN means having a similar weight is not probable. Our strategy is to take significant positions in a small number of companies. We run a concentrated portfolio in an activist manner with a value discipline. We seek to ensure a healthy amount of margin for safety by being disciplined about out entry and sale prices. TURN is here for one reason. We are here to make our shareholders a competitive absolute return in our mostly long-only strategy. TURN does not seek to game the benchmark or start looking like the benchmark. I ran away from that world and I am never looking back. Judging from our performance over the past four years, I think our shareholders will continue to benefit from TURN investing in a microcap world where asymmetrical risk reward exists and where correlation to other asset classes is low.

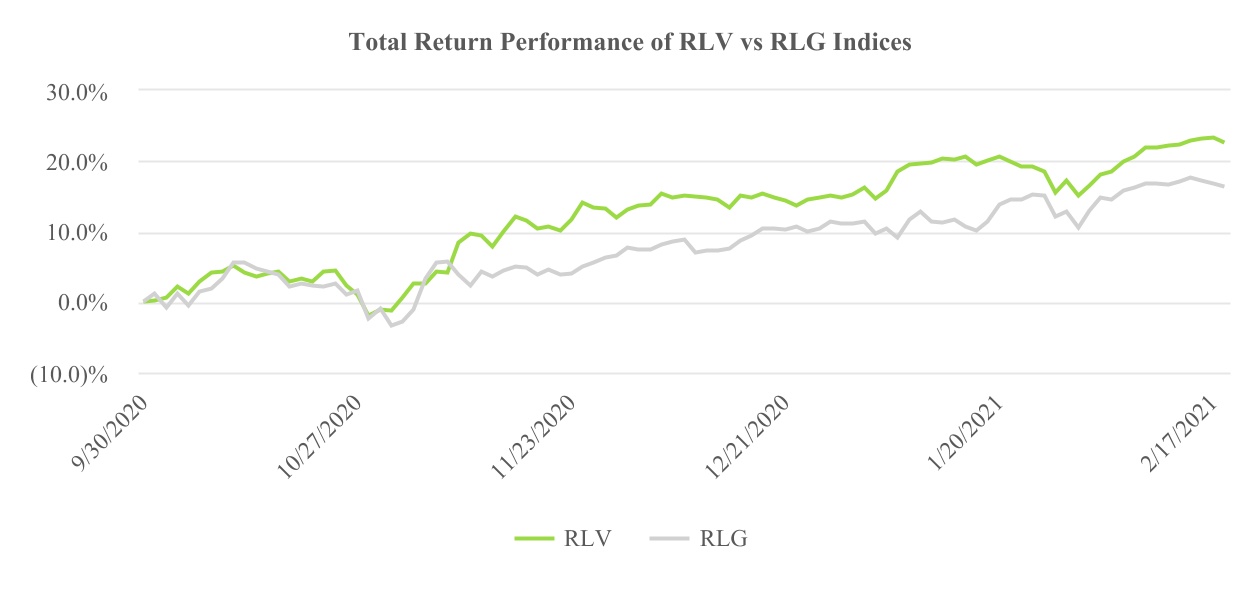

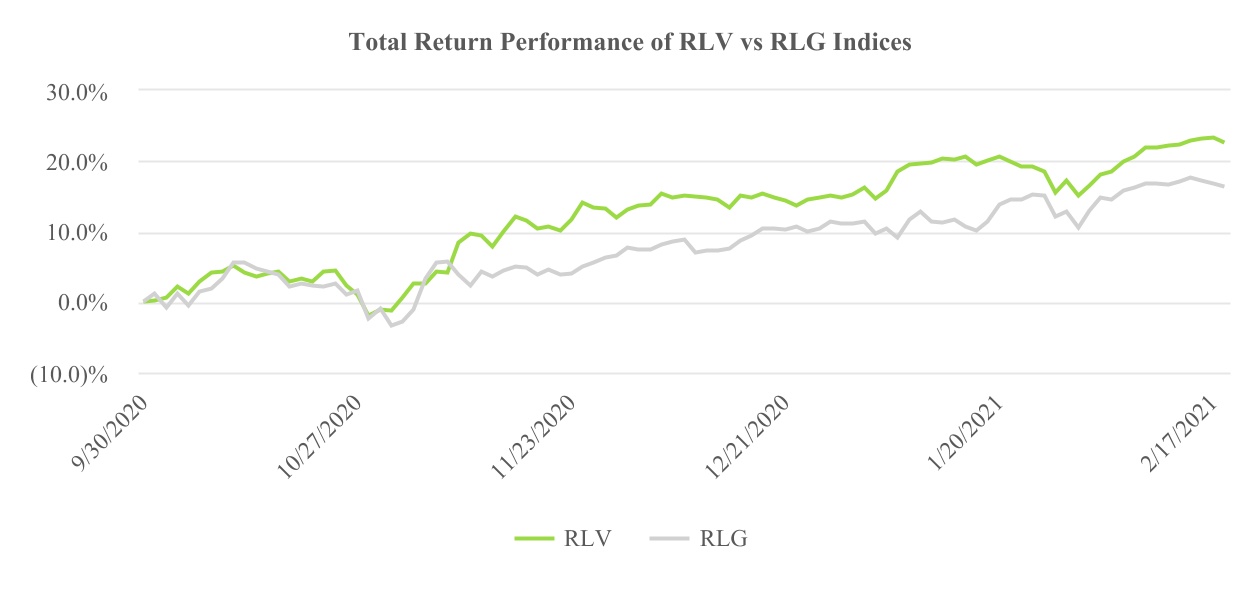

This has been a trying year. Attempting to navigate through the carnage of a global pandemic amidst a high-octane, overly emotional election cycle has been difficult enough. Doing it in the face of the biggest headwind for value fund managers I have experienced in my 32-year career has added a more complex set of obstacles. In past shareholder letters, I have written about how the pandemic and ensuing global economic meltdown exacerbated an already bifurcated stock market between the winners and the losers. Do I understand it given the pandemic? Yes. We have been clear as to what we thought would be the catalyst for the market shift from only a few stocks outperforming to a wider range of stocks participating to the upside. On November 9, 2020, Pfizer announced its coronavirus vaccine trials and suggested the vaccine was highly effective in preventing COVID-19. Moderna soon followed with its successful vaccine and the FDA moved swiftly to authorize the use of both for prevention of infection by COVID-19. As I have said for the last 6 months, this pandemic has an expiration date, and that date is when a vaccine is developed and widely available. Vaccines are here now, and I believe we are near the end of this tragic event in our world’s history. We have said that when the economic recovery takes hold, the market will expand its appetite for more than just a handful of names. That trend has already started. As you can see from the chart below, it is not just a few select growth names fueling the market. We have much better breadth of performance as investors seek to play the recovery in the economy. Since the Pfizer announcement through February 19, 2021, the SPX 500 is up 4.2%, the Russell 1000 Value Index is up 6.1%, the Russell 1000 Growth Index is up 3.8%, the Russell Microcap Index is up 27.1%, the Russell Microcap Value Index is up 21.9%, and the Russell Microcap Growth Index is up 31.9%. The market is now focusing on the recovery of the economy when the pandemic reaches its conclusion.

As I sit here on a cold, snowy winter day in February (by the way, I hate winter and it won't stop snowing!), year-to-date through February 19, 2021, our NAV has advanced more than 10% to over $10.00 as a result of net increases in the value of our public portfolio, assuming no change in our private legacy portfolio investments from the end of 2020 and normal quarterly expenses of approximately $0.07-0.08 per share per quarter.2 I continue to believe that TURN is undervalued by the public markets. Our story is set up well for value investors… including, dare I say, the WallStreetBets site and/or DeepF-Value (yes, that is the actual name of one of the Reddit authors) on the Reddit community. If I was speaking to them or any investor, I would say something like:

My name is Kevin Rendino, and I am the CEO of 180 Degree Capital Corp. (NASDAQ:TURN). I know some of you are very busy with stocks like GameStop, AMC, and Koss Industries, but I would like to suggest you spend a few minutes on TURN. We are a publicly traded closed-end fund focused primarily on investing in small micro-capitalization companies with a constructive, collegial, and collaborative approach to activism. Our business, as it is currently constructed, didn’t even exist four years ago. Prior to becoming TURN, our predecessor strategy was focused on venture capital investments primarily in very early-stage, private companies. Unfortunately, that focus did not lead to returns on investment that offset the operating expenses. After years of declining stock price and NAV, in the beginning of 2017 our Board supported making a “180 Degree” turn in strategy towards investing in the public markets, and I agreed to become the CEO of TURN.

In the five years prior to the creation of TURN, our NAV under our predecessor strategy declined by 50%. In the four years since we became TURN, we increased our NAV 32.2%, despite being hamstrung by limited resources and a private legacy portfolio that has declined in value over that same period. Leading up to the start of TURN in the first quarter of 2017, our share price under our predecessor strategy declined by 60% over the prior five years. Over the last four years since we became TURN, our share price has risen 60% from $4.14 to $6.66 as of December 31, 2020, and 71.3% to $7.09 as of February 19, 2021. We restarted our company as TURN with cash and securities of publicly traded companies of approximately $20 million. As of the end of 2020, that amount was approximately $60 million2 and as of February 19, 2021, it was approximately $73 million. Cash and securities of publicly traded companies were approximately 27% of the portfolio as of the end of 2016. As of the end of 2020, that percentage was approximately 61% and as of February 19, 2020, it is 65%. In our new strategy since the beginning of 2017, we have generated a gross total return of +17.8%, +137.6% and +265.9% from our public market investment strategy (including fees charged to managed funds and special purpose vehicles) as of December 31, 2020, over the last one year, three years, and since inception (four years), respectively.

Before our Board made the decision to forge ahead with our new strategy, I would argue that the future of our predecessor company was bleak at best. Four years later, I believe we have carved out a great niche for ourselves in the world of small-cap activism, we continue to build the scale of the business, and we have developed a strong reputation in the microcap investing universe.

__________________

2 Cash net of unsettled trades and includes carried interest receivable from separately managed account that was accrued as of December 31, 2020, and received on February 19, 2021. NAV at the end of Q1 2021 may be materially different.

If what we have done is of no use to you, would it help if TURN announced that we were setting up a cryptocurrency, automated vehicle, cannabis, lithium battery, fuel cell, renewable energy business? It will be an all-in-one business. One stop shopping!

I mention the last line of thought purely in jest as an example of the current market environment. We are Graham and Dodd value investors and will continue to be laser focused on that investment approach. That said, there is one buzzword that we can talk about and is applicable to TURN…that is, SPAC, or special purpose acquisition company. As I mentioned earlier in this letter, we have recently reached agreement to invest $2.3 million in a newly-formed sponsor vehicle that plans to form a new SPAC.3 We have worked with the founding management team in a prior investment and will be excited to share the details as events unfold over the next couple months. While this is our first investment in a SPAC sponsor vehicle, it is not likely to be our last. It is truly gratifying to see our business evolve from one that had no future to where it is today, where we have significantly grown our NAV, our stock price, and are able to take advantage of exciting investment opportunities. We have come a long way.

NET ASSET VALUE PER SHARE

Our net asset value per share (“NAV”) increased this quarter from $8.70 to $9.28. Our Fund has three principal components to the variance in our NAV: our public portfolio, our private portfolio, and our expenses. For the quarter, our public portfolio companies increased our NAV by $0.51, while our private portfolio companies increased our NAV by $0.25. Operating expenses decreased NAV by $0.18.

| | | | | | | | | | | | | | | |

| Quarter | | 1 Year | 3 Year | Inception to Date |

| Q4 2020 | | Q4 2019-Q4 2020 | Q4 2017-Q4 2020 | Q4 2016-Q4 2020 |

| | | | | |

| | | | | |

| | | | | |

| Change in NAV | 6.7% | | 1.1% | 19.0% | 32.2% |

| | | | | |

| Russell Microcap Index | 31.4% | | 20.9% | 28.8% | 45.7% |

| Russell Microcap Value Index | 33.6% | | 8.1% | 15.0% | 28.8% |

| Russell 2000 | 31.4% | | 19.9% | 33.9% | 53.5% |

Public Portfolio

In the chart below, you see our quarter to date, one-year, three-year, and inception to date performance numbers. We have often talked about our intentional concentrated structure and the fact that our performance could be episodic. We have seen that in full force in the last two quarters. For Q3 2020, we showed a gross total return for our public portfolio of +25.4%, and growth of our NAV of +7.4% versus a gross total return for the Russell Microcap Index of +3.7% and a gross total return for the Russell Microcap Value Index of +3.0%. In Q4 2020, our public portfolio gross total return was +5.3% excluding the carried interest generated from our SMA and +9.6% including the carried interest. For Q4 2020, the Russell Microcap Index advanced +31.4% and the Russell Microcap Index advanced +33.6%. For the year our +17.8% gross total return for our public portfolio including carried interest slightly underperformed the +20.9% return for the Russell Microcap Index and outperformed the +8.1% for the Russell Microcap Value Index.

__________________

3 This investment, if completed, could become worthless if no business combination occurs.

| | | | | | | | | | | | | | | |

| Quarter | | 1 Year | 3 Year | Inception to Date |

| Q4 2020 | | Q4 2019-Q4 2020 | Q4 2017-Q4 2020 | Q4 2016-Q4 2020 |

TURN Public Portfolio

Gross Total Return (Excluding SMA Carried Interest) | 5.3% | | 13.2% | 128.3% | 251.6% |

TURN Public Portfolio

Gross Total Return (Including SMA Carried Interest) | 9.6% | | 17.8% | 137.6% | 265.9% |

| | | | | |

| | | | | |

| | | | | |

| Russell Microcap Index | 31.4% | | 20.9% | 28.8% | 45.7% |

| Russell Microcap Value Index | 33.6% | | 8.1% | 15.0% | 28.8% |

| Russell 2000 | 31.4% | | 19.9% | 33.9% | 53.5% |

Let’s dig into the significant sources of the changes in value in our public portfolio in Q4 2020.

Sources of material increases in value:

•Quantum Corporation (NASDAQ:QMCO) – QMCO’s primary hyperscaler customer has returned to purchasing following a pause that began at the end of 2019, and there is increased visibility to additional hyperscaler wins. QMCO continued to execute on its product development strategy designed to help the company transition from primarily hardware revenues to software and software as a service (SaaS) revenues. For the quarter, QMCO’s stock increased by 33.0% and increased our NAV by $0.22 per share.

•Alta Equipment Group, Inc. (NASDAQ:ALTG) – We saw a continued recovery in ALTG’s business following the early spring shutdown due to the Pandemic. ALTG announced acquisitions of Howell Tractor & Equipment and the construction dealership assets from Vantage Equipment. ALTG also raised $30 million in a preferred stock offering which helped fund its acquisition of Vantage. For the quarter, ALTG’s stock increased 26.2% and increased our NAV by $0.13 per share.

•Potbelly Corporation (NASDAQ:PBPB) - In June 2020, we filed an amended Form 13D noting the poor performance of the company under its then CEO, while commending PBPB’s Board for hiring a new CFO with restaurant experience. Subsequently, PBPB’s board hired Robert Wright, the former COO of Wendy’s as its new CEO. Q3 2020 results showed improvement in store traffic and the beginning signs of a recovery were evident. Mr. Wright has continued to revamp the management team by bringing in executives with deep restaurant experience. It will take time for the business to fully recover as the pandemic is still with us, but we believe PBPB’s shares have the potential to rise materially from its current levels as the recovery unfolds and COVID-19 becomes a thing of the past. For the quarter, PBPB’s stock was up 16.1% and increased our NAV by $0.07 per share.

Sources of material decreases in value:

•TheMaven, Inc. (OTC:MVEN) - MVEN is a media coalition of professional content destinations, operating exclusively on a shared digital publishing, advertising, and distribution platform. MVEN provides a major media scale alternative to news and information on social platforms. The high-scale, unified platform offers operating leverage to all participants in MVEN’s ecosystem by eliminating all non-content operating expenses. MVEN’s distributed operating leverage enables its entire suite of services to be provided on a revenue share basis, which creates lower, non-fixed operating costs than if a media company was forced to run its own platform and digital ad sales team. MVEN provides distribution across 100+ million monthly users in a single platform, allowing advertisers to be more successful with return on investments in marketing. Among its many properties, MVEN operates a 100-year license agreement to run Sports Illustrated and owns TheStreet.com, after acquiring that asset in 2019. This past year we worked with MVEN’s board, in our capacity as observers to the board, to affect a change in the CEO of the company. MVEN subsequently announced Ross Levinsohn would be the new CEO. Business continued to improve but the company needed to raise capital to offset continued cash burn. The long awaited, and very late, financial filings with the SEC started in 2021 with the filing of MVEN’s 2018 financial statements. We currently expect that MVEN will be current with its filings with the SEC in Q1 2021 and subsequently seek an uplist to a national exchange. During the

quarter, TURN formed a group with B. Riley Financial, Inc., to work toward replacing MVEN’s current board with industry experts. For the quarter, MVEN’s stock declined by 22.2 % (based on a 1% VWAP of outstanding shares less a discount for lack of marketability) and decreased our NAV by $0.24 per share.

In other public portfolio notes, we bought and sold Kirkland's, Inc. (NASDAQ:KIRK) intra-quarter for a gain of approximately $500,000. We also sold Perion Network, Ltd. (NASDAQ:PERI) for a total gain of approximately $890,000. We also initiated starter positions in four new holdings that we look forward to sharing with shareholders in future periods.

Private Portfolio

For the quarter, our private portfolio increased in value by $2.6 million, or $0.25 per share. The largest increases were in ORIG3N, Inc. (+$0.13/share), HALE.life Corporation (+$0.11/share) and Black Silicon Holdings, Inc. (+$0.06/share). We had slight decreases in value in AgBiome, LLC (‑$0.02/share) and EchoPixel (-$0.02/share).

In almost every shareholder letter, we state that while we desire to shepherd our existing private portfolio to exits or explore opportunities to sell our positions in those companies, “we have the luxury of being able to sell our private holdings when we believe it makes sense for shareholders rather than being forced to do so to survive.” Because you haven’t seen a monetization in any given quarter, doesn’t mean we have not been active in attempting to monetize certain holdings. The remaking of our business and the significant cash and securities of public portfolio companies that we have built means we don’t have to sell anything unless we feel that it is the right thing to do for shareholders. I can tell you that we have rejected numerous bids for the private portfolio from “sharks” thinking they can come in and steal the portfolio from us. That will never happen under our watch. I can’t emphasize enough the difference between having to sell and wanting to sell. We do not have to sell anything, given our success in remaking our balance sheet over the last four years. And we won’t unless the price makes sense. Since the start of TURN, our private portfolio has reduced NAV by $0.58/share while our public investing strategy has increased NAV by $4.42/share. It is important to note that future results may be materially different than prior results.

EXPENSES

As we have noted in previous letters, we have dramatically reduced our cost structure under our new strategy. In 2016, before our Fund’s change in investment focus and management team, our operating expenses, excluding stock-based compensation and interest on outstanding debt, averaged approximately $1.3 million per quarter. For Q4 2020, our operating expenses equaled approximately $645,000, which included an approximately $400,000 reduction in our medical retirement benefit accrual. Given our persistent performance, the Compensation Committee approved approximately $638,000 of prior deferred bonuses awarded in 2019 and is accrued and included in NAV. The Compensation Committee also set aggregate 2020 bonuses at $849,000, $720,000 of which is included in NAV as of December 31, 2020. The remainder will be paid over the next two years if performance in 2020 is persistent at the discretion of the Compensation Committee.

TURN/NAV: SUM OF THE PARTS

As of the end of Q4 2020, TURN traded at 72% of NAV. Our securities of publicly traded companies, cash, and other assets net of liabilities were $5.55 per share. Our stock price was $6.66. If we received 100% credit for the value of these assets net of liabilities, the market is ascribing a value of approximately $1.11 per share, or $11.5 million, to our private portfolio. Given our private assets are valued at approximately $38.7 million, the market is discounting the value of our private portfolio assets by 70% as of the end of Q4 2020.

As we grow our cash and securities of publicly traded companies, the discount our stock trades to NAV should narrow. At the beginning of our strategy in 2017, we had 27% of our cash and total investments in cash and public securities, and we were trading at a 41% discount to NAV. At the end of Q4 2020 we had 61% of our assets and cash and securities of public companies and our stock traded at a 30% discount to NAV. I have mentioned in previous letters, the value of AgBiome alone is fair valued at a greater value than the market is pricing the entire portfolio. I will remind you that Petra Pharma Corporation was acquired in Q2 2020, and between our direct ownership in Petra and our indirect ownership through Accelerator IV-New York Corporation, we received approximately $4.7 million in cash. We have the ability to receive an additional $350,000 held in escrow in May 2021, we retain ownership in a spinout company that will seek to monetize additional assets of the company, and we could receive future milestone payments of up to approximately $86.9 million. While the timing and likelihood of achieving these milestones is uncertain, and we could ultimately receive none of these milestone payments, the Petra acquisition was a material and positive event for 180 and its shareholders. We believe that our other private holdings not only have real value today, but also have the potential to monetize into cash in the future.

CONCLUSION

I am glad 2020 is over. It was yet another year in which the decision we made to focus on the public markets, and not the private markets has proven to be a sound decision by our Board. For the year, our nearly +18% gross total return in our public portfolio, including carried interest generated from our SMA, netted out to increasing our NAV by $0.88 per share. During the same period, we had declines of nearly $0.40 per share in our private portfolio. Our strategy of combining our value approach with constructive activism has accrued to the benefit of our shareholders. Our three-year gross total return, including carried interest from our SMA, of +137.6% compares favorably to a +28.8% gross total return for the Russell Microcap Index and a +15.0% return for the Russell Microcap Value Index. We have often said it is our job to seek to create value for our shareholders in all market environments, and we are pleased to have survived this year by growing our NAV.

We have completely remade our business. When I first joined the Board of Directors in mid-2016, we had just approximately $17 million in cash and securities of public companies net of outstanding debt. As of February 19, 2021, we have nearly $73 million on our balance sheet and grew the assets for our SMA client from $25 million to $38 million. For our performance in growing the value of the SMA in 2020, we were able to generate approximately $2.4 million in carried interest which represents approximately 77% of our normal operating expenses not including bonuses. In 2021, we will continue to build our asset base for those that want to invest in our strategy. Much of our investing results are episodic. There may be quarters where we don’t participate on the upside or perhaps underperform on the downside. We take significant positions in microcap names and use activism as a mechanism to create value. Sometimes we get paid quickly (HEAR, PRCP) and other times it takes longer (TST), but from start to finish our numbers are what our numbers are and, since we started, that equates to a +265.9% gross total return, including carried interest from our SMA, versus a +45.7% gross total return for the Russell Microcap Index and a +28.8% gross total return for the Russell Microcap Value Index. We did that by not trying to game an index or look like an index; but by instilling a rigorous bottom-up research process and identifying those companies' stocks we believe can offer at least 100% upside over a three-year cycle with a margin of safety on the downside should our investment thesis not play out.

So, let’s dream for a minute…We are building scale, and we aren’t stopping here. We started with $20 million in cash and securities of publicly traded companies and have grown that to nearly $73 million as of February 19, 2021. I think we all can agree that it is harder to turn $20 million into $73 million than it is to turn $73 million to $150 million. Just $150 million alone would give us a $14.46 stock price before giving us any credit for our private portfolio. I am allowed to dream. Suppose we grow the $73 million to $300 million. That would give us a $28.91 share price. Here is the thing, while there is no guarantee that future results will mirror past results, we do not believe that achieving that growth isn’t some imaginary pipe dream. If we can replicate our performance for shareholders over the next 5 years, we can get there. And, if we find additional interesting SPAC opportunities like the one we think we have uncovered in early 2021, we believe future is bright.

Thank you for your continued support.

Kevin Rendino

Chairman and Chief Executive Officer

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES |

| | | | | |

| | December 31, 2020 |

| ASSETS | |

| Investments in portfolio securities, at value: | |

| Unaffiliated privately held companies (cost: $14,161,430) | $ | 20,161,923 | |

| Unaffiliated publicly traded securities (cost: $11,666,164) | 14,784,543 | |

| Non-controlled affiliated privately held companies (cost: $21,637,513) | 10,679,301 | |

| Non-controlled affiliated publicly traded securities (cost: $26,304,854) | 30,431,503 | |

| Unaffiliated rights to payments (adjusted cost basis: $6,408,684) | 7,720,674 | |

| Cash | 11,497,446 | |

| Restricted cash | 11,639 | |

| Funds held in escrow from sales of investment, at value | 161,779 | |

| Receivable from managed funds | 2,638,380 | |

| Receivable from portfolio companies | 794,993 | |

| Prepaid expenses | 325,945 | |

| Interest receivable | 8,154 | |

| Other receivables | 9,219 | |

| Other assets | 27,843 | |

| Total assets | $ | 99,253,342 | |

| LIABILITIES & NET ASSETS | |

| |

| Bonus payable (Note 7) | $ | 1,357,922 | |

| Post-retirement plan liabilities | 842,366 | |

| Accounts payable and accrued liabilities | 516,115 | |

| Payable for securities purchased | 219,145 | |

| Total liabilities | $ | 2,935,548 | |

| Commitments and contingencies (Note 10) | |

| Net assets | $ | 96,317,794 | |

| Net assets are comprised of: | |

| Preferred stock, $0.10 par value, 2,000,000 shares authorized; none issued | $ | 0 | |

| Common stock, $0.03 par value, 15,000,000 shares authorized; 11,541,079 issued* | 334,594 | |

| Additional paid in capital | 122,250,693 | |

| Total accumulated distributable loss | (21,661,968) | |

| Treasury stock, at cost 1,167,259 shares* | (4,605,525) | |

| Net assets | $ | 96,317,794 | |

| Shares outstanding* | 10,373,820 | |

| Net asset value per outstanding share | $ | 9.28 | |

*Reflects a 1-for-3 reverse stock split that became effective on January 4, 2021. Refer to Note 1. The Company, for further information.

The accompanying notes are an integral part of these consolidated financial statements.

12

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF OPERATIONS |

| | | | | |

| Year Ended

December 31, 2020 |

| Income: | |

| Interest from: | |

| Unaffiliated companies-PIK | $ | 43,024 | |

| Non-controlled affiliated companies-cash | 4,011 | |

| Non-controlled affiliated companies-PIK | 10,027 | |

| Carried interest | 2,371,223 | |

| Other income (Note 2) | 688,401 | |

| Dividend income | 266,089 | |

| Fee income for providing managerial assistance to portfolio companies-non-cash | 59,170 | |

| Management fee income | 24,736 | |

| Total income | 3,466,681 | |

| Operating fees and expenses: | |

| Salaries, bonus and benefits | 2,230,613 | |

| Professional | 818,876 | |

| Administration and operations | 297,087 | |

| Directors | 266,587 | |

| Insurance | 243,238 | |

| Rent | 89,448 | |

| Custody | 24,750 | |

| Other | 5,393 | |

| Total operating expenses | 3,975,992 | |

| Net investment loss before income tax expense | (509,311) | |

| Income tax expense | 913 | |

| Net investment loss | (510,224) | |

| Net realized gain (loss) from investments: | |

| Unaffiliated privately held companies | 3,539,069 | |

| Unaffiliated publicly traded securities | 4,285,387 | |

| Non-controlled affiliated privately held companies | (10,181,797) | |

| Non-controlled affiliated publicly traded securities | 1,532,677 | |

| Unaffiliated rights to payments | 23,976 | |

| Call options | (271,304) | |

| Net realized loss from investments | (1,071,992) | |

| Change in unrealized (depreciation) appreciation on investments: | |

| Unaffiliated privately held companies | (4,576,677) | |

| Unaffiliated publicly traded securities | 4,592,278 | |

| Non-controlled affiliated privately held companies | 6,971,084 | |

| Non-controlled affiliated publicly traded securities | (4,364,303) | |

| Unaffiliated rights to payments | 86,890 | |

| Net change in unrealized appreciation on investments | 2,709,272 | |

| Net realized loss from investments and change in unrealized appreciation on investments | 1,637,280 | |

| Share of loss on equity method investment | (22,901) | |

| Net increase in net assets resulting from operations | $ | 1,104,155 | |

The accompanying notes are an integral part of these consolidated financial statements.

13

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF CASH FLOWS |

| | | | | |

| Year Ended

December 31, 2020 |

| Cash flows provided by operating activities: | |

| Net increase in net assets resulting from operations | $ | 1,104,155 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities: |

| Net realized loss from investments | 1,071,992 | |

| Net change in unrealized appreciation on investments | (2,709,272) | |

| Share of loss on equity method investee | 22,901 | |

| Depreciation of fixed assets | 5,511 | |

| Accretion of bridge note PIK interest income | (53,051) | |

| Fee income for providing managerial assistance to portfolio companies-non-cash | (59,170) | |

| Call options purchased | (523,562) | |

| Call options written | 252,258 | |

| Purchase of unaffiliated publicly traded securities | (21,077,598) | |

| Purchase of non-controlled affiliated publicly traded securities | (6,304,562) | |

| Distributions from sale of unaffiliated privately held companies | 4,605,796 | |

| Proceeds from sale of unaffiliated publicly traded securities | 24,638,373 | |

| Proceeds from unaffiliated rights to payments | 45,194 | |

| Proceeds from sale of non-controlled affiliated publicly traded securities | 3,306,001 | |

| Proceeds from sale of non-controlled affiliated privately held companies | 87,500 | |

| Changes in assets and liabilities: | |

| Increase in receivable from managed funds | (2,500,251) | |

| Increase in receivable from portfolio companies | (688,323) | |

| Increase in prepaid expenses | (57,992) | |

| Increase in interest receivable | (4,012) | |

| Decrease in other receivables | 57,621 | |

| Increase in other assets | (114) | |

| Decrease in receivable from sales of securities | 559,233 | |

| Decrease in bonus payable | (1,223,363) | |

| Decrease in post-retirement plan liabilities | (414,838) | |

| Increase in accounts payable and accrued liabilities | 137,459 | |

| Decrease in payable for securities purchased | (137,468) | |

| Net cash provided by operating activities | 140,418 | |

| Cash flows from investing activities: | |

| Purchase of fixed assets | (5,974) | |

| Net cash used in investing activities | (5,974) | |

| Net increase in cash and restricted cash | 134,444 | |

| Cash and restricted cash at beginning of the year | 11,374,641 | |

| Cash and restricted cash at end of the year | $ | 11,509,085 | |

| Supplemental disclosures of cash flow information: | |

| Income taxes paid | $ | 913 | |

| |

| Cash | $ | 11,497,446 | |

| Restricted cash | 11,639 | |

| Total cash and restricted cash shown in the consolidated statement of cash flows | $ | 11,509,085 | |

| |

The accompanying notes are an integral part of these consolidated financial statements.

14

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | | | | | | | |

| Year Ended

December 31, 2020 | | Year Ended December 31, 2019 |

| | | |

| Changes in net assets from operations: | | | |

| Net investment loss | $ | (510,224) | | | $ | (4,831,721) | |

| Net realized (loss) gain on investments | (1,071,992) | | | 9,642,262 | |

| Net change in unrealized appreciation on investments | 2,709,272 | | | 8,410,882 | |

| Share of loss on equity method investment | (22,901) | | | (42,552) | |

| Net increase in net assets resulting from operations | 1,104,155 | | | 13,178,871 | |

| Net increase in net assets | 1,104,155 | | | 13,178,871 | |

| Net Assets: | | | |

| Beginning of the year | 95,213,639 | | | 82,034,768 | |

| End of the year | $ | 96,317,794 | | | $ | 95,213,639 | |

| | | |

The accompanying notes are an integral part of these consolidated financial statements.

15

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED FINANCIAL HIGHLIGHTS |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended

Dec. 31 2020 | | Year Ended

Dec. 31, 2019 | | Year Ended

Dec. 31, 2018 | | Year Ended

Dec. 31, 2017 | | Year Ended

Dec. 31, 2016 | |

| | | | | | | | | | |

| Per Share Operating Performance#: | | | | | | | | | | |

| Net asset value per share, beginning of the year | $ | 9.18 | | | $ | 7.92 | | | $ | 7.80 | | | $ | 7.02 | | | $ | 8.64 | | |

Net investment loss* | (0.05) | | | (0.48) | | | (0.21) | | | (0.36) | | | (0.45) | | |

Net realized (loss) gain from investments* | (0.11) | | | 0.93 | | | (0.75) | | | (1.14) | | | (0.78) | | |

Net change in unrealized appreciation (depreciation) on investments and options*1 | 0.26 | | | 0.81 | | | 1.08 | | | 2.40 | | | (0.36) | | |

Share of loss on equity method investment*2 | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | |

| Total* | 0.10 | | | 1.26 | | | 0.12 | | | 0.90 | | | (1.59) | | |

Net (decrease) increase as a result of stock-based compensation expense*2 | 0.00 | | | 0.00 | | | 0.00 | | | (0.03) | | | 0.03 | | |

Net increase as a result of purchase of treasury stock | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | |

Net decrease as a result of acquisition of vested restricted stock awards related to employee withholding2 | 0.00 | | | 0.00 | | | 0.00 | | | (0.06) | | | (0.03) | | |

| Total (decrease) increase from capital stock transactions | 0.00 | | | 0.00 | | | 0.00 | | | (0.09) | | | 0.00 | | |

Net (decrease) increase as a result of other comprehensive (loss) income*2 | 0.00 | | | 0.00 | | | 0.00 | | | (0.03) | | | (0.03) | | |

| Net increase (decrease) in net asset value | 0.10 | | | 1.26 | | | 0.12 | | | 0.78 | | | (1.62) | | |

| Net asset value per share, end of the year | $ | 9.28 | | | $ | 9.18 | | | $ | 7.92 | | | $ | 7.80 | | | $ | 7.02 | | |

| | | | | | | | | | |

| Stock price per share, end of the year | $ | 6.66 | | | $ | 6.45 | | | $ | 5.25 | | | $ | 5.91 | | | $ | 4.14 | | |

| Total return based on stock price | 3.26 | % | | 22.86 | % | | (11.17) | % | | 42.75 | % | | (37.27) | % | |

| Supplemental Data: | | | | | | | | | | |

| Net assets, end of the year | $ | 96,317,794 | | | $ | 95,213,639 | | | $ | 82,034,768 | | | $ | 81,042,989 | | | $ | 72,255,610 | | |

| Ratio of expenses, excluding taxes, to average net assets | 4.61 | % | ^ | 6.42 | % | ^ | 3.62 | % | ^ | 6.26 | % | ^ | 7.88 | % | |

| Ratio of expenses, including taxes, to average net assets | 4.61 | % | ^ | 6.42 | % | ^ | 3.63 | % | ^ | 6.28 | % | 3^ | 7.89 | % | |

| Ratio of net investment loss to average net assets | (0.59) | % | | (5.42) | % | | (2.82) | % | | (4.68) | % | | (5.64) | % | |

| Average debt outstanding | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 4,590,164 | | |

| Average debt per share | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.45 | | |

| Portfolio turnover | 35.16 | % | | 30.17 | % | | 20.43 | % | | 8.83 | % | | ** | |

| Number of shares outstanding, end of the year | 10,373,820 | | | 10,373,820 | | | 10,373,820 | | | 10,373,820 | | | 10,301,363 | | |

#Reflects a 1-for-3 reverse stock split that became effective on January 4, 2021. Refer to Note 1. The Company, for further information.

*Based on average shares outstanding.

^ The Company has entered into an expense offsetting arrangement with one of its unaffiliated brokers relating to broker fees paid. The total broker fee charged to the Company was applied as a credit to fees charged by an affiliate of the unaffiliated broker who the Company subscribes to for data services billed during the year. The Company received an offset to expense totaling approximately $15,700, $17,500 and $5,700 with that broker for the years ended December 31, 2019, December 31, 2018 and December 31, 2017, respectively. The Company received an offset to expense totaling approximately $31,900 with that broker for the year ended December 31, 2020.

**Prior to March 2017, the Company was a business development company investing primarily in privately held securities. Portfolio turnover was not a relevant indicator for such investments given that the Company did not generally pay brokerage fees on such investments.

1 Net unrealized losses include rounding adjustments to reconcile change in net asset value per share.

2 Amounts listed as zero are amounts calculated as less than $0.005.

3 Ratio of expenses, including taxes and excluding expenses related to restructuring, to quarterly average net assets for the year ended December 31, 2017 was 5.19%.

The accompanying notes are an integral part of these consolidated financial statements.

16

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2020 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Companies (2) - | | | | | | | | | |

| 36.3% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Privately Held Companies (Illiquid) - | | | | | | | | | |

| 20.9% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| AgBiome, LLC (3)(4) | | | Fertilizers & Agricultural Chemicals | | | | | | |

| Develops agricultural products that reduce risk and improve yield | | | | | | | | | |

| Series A-1 Convertible Preferred Units (acquired 1/30/13) | (I) (L3) | | | | 2,000,000 | | | $ | 2,000,000 | | | $ | 10,101,888 | |

| Series A-2 Convertible Preferred Units (acquired 4/9/13-10/15/13) | (I) (L3) | | | | 417,392 | | | 521,740 | | | 2,146,445 | |

| Series B Convertible Preferred Units (acquired 8/7/15) | (I) (L3) | | | | 160,526 | | | 500,006 | | | 935,155 | |

| | | | | | | 3,021,746 | | | 13,183,488 | |

| | | | | | | | | |

| AutoTech Ventures Management I, LLC (3)(4)(5) | | | Asset Management & Custody Banks | | | | | | |

| Venture capital investing in automotive-related companies | | | | | | | | | |

| LLC Interests (acquired 12/1/17) | (M) (L3) | | | | 0 | | | 0 | | | 137,500 | |

| | | | | | | | | |

| DWSI Holdings, Inc. (3)(4)(6)(7) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Develops high-performance quantum computing systems | | | | | | | | | |

| Class A Convertible Preferred Stock (acquired 4/14/20) | (I) (L3) | | | | 1,025,045.6 | | | 1,238,050 | | | 1,246,161 | |

| | | | | | | | | |

| Fleet Health Alliance, LLC (3)(4)(7) | | | Health Care Technology | | | | | | |

| Develops software for information transfer amongst healthcare providers and consumers | | | | | | | | | |

| Unsecured Convertible Bridge Note, 0%, (acquired 4/22/16, no maturity date) | (I) (L3) | | | | $ | 225,000 | | | 225,000 | | | 0 | |

| | | | | | | | | |

| Lodo Therapeutics Corporation (3)(7) | | | Pharmaceuticals | | | | | | |

| Develops novel therapeutics derived from a metagenome-based Natural Product Discovery Platform | | | | | | | | | |

| Series A Convertible Preferred Stock (acquired 12/21/15-4/22/16) | (I) (L3) | | | | 658,190 | | | 658,190 | | | 84,806 | |

| Secured Convertible Bridge Note, 6% PIK, (acquired 6/27/19, maturing 5/7/21) | (I) (L3) | | | | $ | 474,019 | | | 517,187 | | | 87,743 | |

| | | | | | | 1,175,377 | | | 172,549 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2020 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Companies (2) - | | | | | | | | | |

| 36.3% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Privately Held Companies (Illiquid) - | | | | | | | | | |

| 20.9% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Magnolia Neurosciences Corporation (3)(4)(7) | | | Pharmaceuticals | | | | | | |

| Develops novel therapeutics for treatment of neurodegeneration | | | | | | | | | |

| Series A Convertible Preferred Stock (acquired 8/3/18) | (I) (L3) | | | | 862,872 | | | $ | 862,872 | | | $ | 864,590 | |

| | | | | | | | | |

| Nanosys, Inc. (3)(4)(7) | | | Specialty Chemicals | | | | | | |

| Develops inorganic nanowires and quantum dots for use in LED-backlit devices | | | | | | | | | |

| Series C Convertible Preferred Stock (acquired 4/10/03) | (I) (L3) | | | | 803,428 | | | 1,500,000 | | | 436,896 | |

| Series D Convertible Preferred Stock (acquired 11/7/05) | (I) (L3) | | | | 1,016,950 | | | 3,000,003 | | | 888,762 | |

| Series E Convertible Preferred Stock (acquired 8/13/10) | (I) (L3) | | | | 433,688 | | | 496,573 | | | 467,404 | |

| | | | | | | 4,996,576 | | | 1,793,062 | |

| | | | | | | | | |

| NanoTerra, Inc. (3)(4) | | | Research & Consulting Services | | | | | | |

| Develops surface chemistry and nano-manufacturing solutions | | | | | | | | | |

| Warrants for Common Stock expiring on 2/22/21 (acquired 2/22/11) | (I) (L3) | | | | 4,462 | | | 69,168 | | | 0 | |

| Warrants for Series A-3 Preferred Stock expiring on 11/15/22 (acquired 11/15/12) | (I) (L3) | | | | 47,508 | | | 35,403 | | | 0 | |

| | | | | | | 104,571 | | | 0 | |

| | | | | | | | | |

| ORIG3N, Inc. (3)(4)(7) | | | Health Care Technology | | | | | | |

| Develops consumer focused genetic tests | | | | | | | | | |

| Series 1 Convertible Preferred Stock (acquired 2/5/15-8/5/15) | (H) (L3) | | | | 1,195,315 | | 500,000 | | 955,024 |

| Series A Convertible Preferred Stock (acquired 11/25/15-9/7/16) | (H) (L3) | | | | 1,364,666 | | 1,500,000 | | 1,167,677 |

| Series A-2 Convertible Preferred Stock (acquired 5/11/17-2/8/18) | (H) (L3) | | | | 176,386 | | 200,002 | | 163,792 |

| | | | | | | 2,200,002 | | 2,286,493 |

| | | | | | | | | |

| Phylagen, Inc. (3)(4)(7) | | | Research & Consulting Services | | | | | | |

| Develops technology to improve human health and business productivity | | | | | | | | | |

| Series A Convertible Preferred Stock (acquired 11/14/18) | (M) (L3) | | | | 548,031 | | | 233,845 | | | 374,689 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

18

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2020 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Companies (2) - | | | | | | | | | |

| 36.3% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Privately Held Companies (Illiquid) - | | | | | | | | | |

| 20.9% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Ravenna Pharmaceuticals, Inc. (3)(4)(7)(8)(9) | | | Pharmaceuticals | | | | | | |

| Holding company for intellectual property in oncology therapeutics | | | | | | | | | |

| Common Stock (acquired 5/14/20) | (M) (L3) | | | | 2,584,763 | | $ | 103,391 | | | $ | 103,391 | |

| | | | | | | | | |

| Total Unaffiliated Privately Held Companies (cost: $14,161,430) | | | | | | | | | $ | 20,161,923 | |

| | | | | | | | | |

| Unaffiliated Publicly Traded Securities - | | | | | | | | | |

| 15.4% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Alta Equipment Group, Inc. (4) | | | Trading Companies & Distributors | | | | | | |

| Operates as an industrial and construction equipment company | | | | | | | | | |

| Common Stock (Unrestricted) (acquired 2/14/20-11/12/20) | (M) (L1) | | | | 693,231 | | | $ | 5,444,737 | | | $ | 6,849,122 | |

| Warrants for the Purchase of Common Stock expiring 4/8/24 (acquired 2/14/20) | (M) (L1) | | | | 150,000 | | | 237,853 | | | 299,250 | |

| | | | | | | 5,682,590 | | | 7,148,372 | |

| | | | | | | | | |

| Lantronix, Inc. (4) | | | Communications Equipment | | | | | | |

| Provides secure data access and management solutions | | | | | | | | | |

| Common Stock (acquired 9/18/18-12/1/20) | (M) (L1) | | | | 745,754 | | | 2,440,229 | | | 3,311,148 | |

| | | | | | | | | |

| Manitex International, Inc. (4) | | | Construction Machinery & Heavy Trucks | | | | | | |

| Provides specialized and custom configured heavy equipment | | | | | | | | | |

| Common Stock (acquired 12/15/20-12/17/20) | (M) (L1) | | | | 67,858 | | | 290,349 | | | 350,147 | |

| | | | | | | | | |

| OpGen, Inc. (4) | | | Biotechnology | | | | | | |

| Developing tools for genomic sequence assembly and analysis | | | | | | | | | |

| Warrants for the Purchase of Common Stock expiring 2/17/25 (acquired 5/5/15) | (I) (L3) | | | | 62 | | | 785 | | | 3 | |

| | | | | | | | | |

| Miscellaneous Common Stocks (10) | (M) (L1) | | | | | | 3,252,211 | | | 3,974,873 | |

| | | | | | | | | |

| Total Unaffiliated Publicly Traded Securities (cost: $11,666,164) | | | | | | | | | $ | 14,784,543 | |

| | | | | | | | | |

| Total Investments in Unaffiliated Companies (cost: $25,827,594) | | | | | | | | | $ | 34,946,466 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

19

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2020 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Companies (2) - | | | | | | | | | |

| 42.7% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Privately Held Companies (Illiquid) - | | | | | | | | | |

| 11.1% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| ABSMaterials, Inc. (3)(7) | | | Specialty Chemicals | | | | | | |

| Develops nano-structured absorbent materials for water remediation and consumer applications | | | | | | | | | |

| Series A Convertible Preferred Stock (acquired 2/17/10-10/24/11) | (I) (L3) | | | | 390,000 | | | $ | 435,000 | | | $ | 28,691 | |

| Series B Convertible Preferred Stock (acquired 11/8/13-6/25/14) | (I) (L3) | | | | 1,037,751 | | | 1,217,644 | | | 343,821 | |

| Secured Convertible Bridge Note, 8% PIK, (acquired 1/20/16, maturing 12/31/21) | (M) (L3) | | | | $ | 100,000 | | | 139,627 | | | 139,627 | |

| Secured Convertible Bridge Note, 8% PIK, (acquired 3/28/17, maturing 12/31/21) | (M) (L3) | | | | $ | 25,000 | | | 32,534 | | | 32,534 | |

| | | | | | | 1,824,805 | | | 544,673 | |

| | | | | | | | | |

| Accelerator IV-New York Corporation (3)(7)(11) | | | Research & Consulting Services | | | | | | |

| Identifies and managing emerging biotechnology companies | | | | | | | | | |

| Series A Common Stock (acquired 7/21/14-12/12/18) | (I) (L3) | | | | 833,333 | | 0 | | 669,010 | |

| | | | | | | | | |

| Black Silicon Holdings, Inc. (3)(4)(7)(9)(12) | | | Semiconductors | | | | | | |

| Holding company for interest in a company that develops silicon-based optoelectronic products | | | | | | | | | |

| Series A Convertible Preferred Stock (acquired 8/4/15) | (M) (L3) | | | | 233,499 | | | 750,000 | | | 0 | |

| Series A-1 Convertible Preferred Stock (acquired 8/4/15) | (M) (L3) | | | | 2,966,667 | | | 890,000 | | | 0 | |

| Series A-2 Convertible Preferred Stock (acquired 8/4/15) | (M) (L3) | | | | 4,207,537 | | | 2,445,000 | | | 0 | |

| Series B-1 Convertible Preferred Stock (acquired 8/4/15) | (M) (L3) | | | | 1,892,836 | | | 1,169,561 | | | 0 | |

| Series C Convertible Preferred Stock (acquired 8/4/15) | (M) (L3) | | | | 1,674,030 | | | 1,171,316 | | | 0 | |

| Secured Convertible Bridge Note, 8% PIK, (acquired 8/25/16, maturing 8/4/21) | (M) (L3) | | | | $ | 1,278,453 | | | 1,444,368 | | | 836,798 | |

| | | | | | | 7,870,245 | | | 836,798 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

20

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2020 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Companies (2) - | | | | | | | | | |

| 42.7% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Privately Held Companies (Illiquid) - | | | | | | | | | |

| 11.1% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| EchoPixel, Inc. (3)(4)(7) | | | Health Care Equipment | | | | | | |

| Develops virtual reality 3-D visualization software for life sciences and health care applications | | | | | | | | | |

| Series Seed Convertible Preferred Stock (acquired 6/21/13-6/30/14) | (I) (L3) | | | | 4,194,630 | | | $ | 1,250,000 | | | $ | 885,465 | |

| Series Seed-2 Convertible Preferred Stock (acquired 1/22/16) | (I) (L3) | | | | 1,476,668 | | | 500,000 | | | 315,884 | |

| Series A-2 Convertible Preferred Stock (acquired 3/23/17) | (I) (L3) | | | | 1,471,577 | | | 350,000 | | | 376,990 | |

| | | | | | | 2,100,000 | | | 1,578,339 | |

| | | | | | | | | |

| Essential Health Solutions, Inc. (3)(7) | | | Health Care Technology | | | | | | |

| Develops software for information transfer amongst healthcare providers and consumers | | | | | | | | | |

| Common Stock (acquired 11/18/16) | (I) (L3) | | | | 200,000 | | | 20 | | | 0 | |

| Series A Convertible Preferred Stock (acquired 11/18/16) | (I) (L3) | | | | 2,750,000 | | | 2,750,000 | | | 327,907 | |

| Unsecured Convertible Bridge Note, 8%, (acquired 12/19/18, maturing 12/19/21) | (I) (L3) | | | | $ | 50,000 | | | 50,000 | | | 11,196 | |

| | | | | | | 2,800,020 | | | 339,103 | |

| | | | | | | | | |

| HALE.life Corporation (3)(4)(7) | | | Health Care Technology | | | | | | |

| Develops a platform to facilitate precision health and medicine | | | | | | | | | |

| Common Stock (acquired 3/1/16) | (I) (L3) | | | | 1,000,000 | | | 10 | | | 111,747 | |

| Series Seed-1 Convertible Preferred Stock (acquired 3/28/17) | (I) (L3) | | | | 11,000,000 | | | 1,896,920 | | | 1,632,048 | |

| Series Seed-2 Convertible Preferred Stock (acquired 12/28/18) | (I) (L3) | | | | 12,083,132 | | | 2,500,000 | | | 1,892,116 | |

| | | | | | | 4,396,930 | | | 3,635,911 | |

| | | | | | | | | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

21

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2020 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Companies (2) - | | | | | | | | | |

| 42.7% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Privately Held Companies (Illiquid) - | | | | | | | | | |

| 11.1% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| TARA Biosystems, Inc. (3)(4)(7) | | | Life Sciences Tools & Services | | | | | | |

| Develops human tissue models for toxicology and drug discovery applications | | | | | | | | | |

| Common Stock (acquired 8/20/14) | (I) (L3) | | | | 2,000,000 | | | $ | 20 | | | $ | 552,902 | |

| Series A Convertible Preferred Stock (acquired 3/31/17) | (I) (L3) | | | | 6,878,572 | | | 2,545,493 | | | 2,444,684 | |

| Series A-2 Convertible Preferred Stock (acquired 4/18/19) | (I) (L3) | | | | 208,577 | | | 100,000 | | | 77,881 | |

| | | | | | | 2,645,513 | | | 3,075,467 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Privately Held Companies (cost: $21,637,513) | | | | | | | | | $ | 10,679,301 | |

| | | | | | | | | |

| Non-Controlled Affiliated Publicly Traded Securities - | | | | | | | | | |

| 31.6% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Potbelly Corporation (4) | | | Restaurants | | | | | | |

| Operates a chain of sandwich shops | | | | | | | | | |

| Common Stock (acquired 6/24/19-6/1/20) | (M) (L1) | | | | 1,268,099 | | | $ | 5,275,094 | | | $ | 5,579,636 | |

| | | | | | | | | |

| Quantum Corporation (4)(13) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Provides high-density data storage and high-speed data processing solutions | | | | | | | | | |

| Common Stock (acquired 2/4/19-12/9/20) | (M) (L1) | | | | 1,484,955 | | | 3,969,084 | | | 9,087,925 | |

| | | | | | | | | |

| Sonim Technologies, Inc. (4) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Provides rugged communications products | | | | | | | | | |

| Common Stock (acquired 6/5/20-7/14/20) | (M) (L1) | | | | 6,045,229 | | | 4,541,166 | | | 4,376,746 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

22

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2020 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Companies (2) - | | | | | | | | | |

| 42.7% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Non-Controlled Affiliated Publicly Traded Securities - | | | | | | | | | |

| 31.6% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Synacor, Inc. (4)(14) | | | Application Software | | | | | | |