UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-07074

| | |

| 180 DEGREE CAPITAL CORP. |

| (Exact Name of Registrant as Specified in Its Charter) |

| | | | | | | | |

| 7 N. Willow Street, Suite 4B, Montclair NJ | | 07042 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | |

Daniel B. Wolfe

President and Chief Financial Officer

180 Degree Capital Corp.

7 N. Willow Street, Suite 4B

Montclair, NJ 07042 |

| (Name and address of agent for service) |

|

Copy to:

John J. Mahon, Esq.

Schulte Roth & Zabel, LLP

1152 Fifteenth Street, NW

Suite 850

Washington, DC 20005

(202) 729-7477 |

Registrant's telephone number, including area code: (973) 746-4500

Date of fiscal year end: December 31

Date of reporting period: June 30, 2021

Item 1. Report to Shareholders.

Fellow Shareholders,

On July 1, 1990, I began my first day working at Merrill Lynch Asset Management for the Basic Value Fund. I was determined to make a better impression than I had two years prior, on my first day working for Merrill in its two- year analyst program. I remember that day back in 1988 like it was yesterday. I was taking the ferry over to the World Financial Center from Hoboken, New Jersey. It was a typical smoldering 90 degree August day with 85% humidity. I absolutely loved the stock market and spent the last four years of school determined to work on Wall Street and today was the big day! Fresh off the 1987 Oliver Stone movie “Wall Street” I was fired up to begin my Gordon Gekko life sporting my best suit and my most prized suspenders. I was going to work on Merrill’s trading floor, a gigantic football field of people yelling and screaming located in the North Tower of the World Financial Center. Given how hot it was, I had my suit jacket draped over my shoulder as I entered the trading floor on one side, having to walk the entire length of the floor to get to my desk. Feeling adrenaline rushing to my head as I walked the floor, I began to feel that with each passing step, people were starting to stand up and, was it possible, staring at me? It couldn’t be. But maybe they were. It must be my self-absorbed vantage point; obviously they were expecting me and knew I was the “new guy.” By the time I approached my trading desk, which was perched up overlooking the entire floor, I turned around to see the entire trading floor standing up, staring at our desk, and slow clapping en-masse. "What was going on here," I thought to myself. As I shook the hand of my new boss and began to take my seat, I assumed the 1,000 people were giving me a standing ovation for my first day. That’s awesome, what a great tradition! Then, at that moment, my boss came over, took out a pair of scissors, and cut my suspenders in half on both sides while ushering me these welcoming words, “Bud, we don’t do freaking suspenders on this floor. Don’t ever wear them again. Ever. Welcome aboard.” And as the suspenders snapped around my shoulder with each snip, the entire floor started cheering as if the Yankees won the 7th game of the World Series. I received a mouthful of humble pie to start my career on day 1.

So, two years later, I was going to try to make a better impression on my colleagues than I did on that trading desk. I made sure I studied what The Basic Value Equity Fund owned and followed all the names leading up to my first day. Basic Value was the first fund Merrill started back in 1977 and was the department’s biggest fund. My boss, Paul Hoffman, lived for the stock market and was willing to take a risk on a very young graduate of the Merrill Lynch analyst program. I couldn’t have been more excited and more thankful to Paul. As he walked into the office and by my cubicle on the morning of my first day, he yelled out “Morning rookie, follow me to my office.” After welcoming me as an analyst on the fund, I was anxious to show him I was paying attention even before I started. My very first words were “I know we own McDonnell Douglas. Did you see the stock was down 10% last week because of weak deliveries of the MD-11 aircraft?” Oh no, bad choice of words. What I meant to say was “I saw McDonnell Douglas was down 10% because of the MD-11 program. Is there any work you want to me do there?” Too late. His response, which I really can’t repeat verbatim for this G-rated shareholder letter, went something like this: “What? Are you (bleeping) kidding me! Did I see the stock was down 10% last week? What the (bleep) do you think we do all day around here. No, I didn’t see one of my top ten holdings, which ruined our (bleeping) quarter was (bleeping) down 10% last week. That must have been the (bleeping) day I took everyone to (bleeping) New York City to see the Nutcracker. Get the (bleep) out of my office!” It was clear my words hit the rawest nerve imaginable. I didn’t even have time to let him know what I meant to say, for if I didn’t leave the office immediately, I think he would have thrown a shoe at me. The entire floor heard the rant directed at me. The entire floor stood with fascination to see the commotion. As I walked back to my cubicle, once again, embarrassed and ashamed on my first day, my future partner, Bob Martorelli, snuck his head in my cubicle in an attempt to humor me and said sarcastically, “Welcome aboard.”

I learned so much on that first day about what it means to manage other people’s money and the type of people that I would trust managing money. There is simply never a day off. You are either paying attention 24 hours a day, 7 days a week, or you aren’t. For crying out loud, of course he knew about McDonnell Douglas. Like he knew about everything that was going on at all times for the 80 companies he owned and the 50 he was looking at as new investments. He stared at his screen all day long and was having incessant conversations about the markets and his holdings with his personal team, the MLAM department, the sell side, as well as gleaning anything of relevance from newspapers, television, and every other source of information that gave him insight. I learned a lot that morning about how much he cared for the people that entrusted him with their money. The man was wired to win and to take care of the dollars entrusted to him by the Basic Value shareholders. I learned that although he didn’t beat the market every day, month, or year, it wasn’t going to be for a lack of effort, time not spent analyzing companies or having the gumption to make investment decisions at all times. I think I learned from my parents not to focus on the tone of the message from those that are attempting to guide you, but rather the message itself. While I didn’t know it at the time (I really just messed up what I was trying to say!), I realized that there was almost nothing else I could have said to more professionally insult Paul. I literally was questioning his work ethic and his attention to detail. His care and consideration for his job and the money he managed on behalf of others has stayed with me my entire career. He simply paid attention all the time to his holdings, to companies he didn’t own but was researching, to the economy, to trends, to all of it. We have always said we are long term investors, and we are. But I always say the long term is made up of a series of short terms and if you don’t pay attention to the short term, you may not be around for the long term. By now, you know we are disciples of Benjamin Graham and David Dodd (for many years, my kids heard their names so often they thought Graham and Dodd were their uncles--I am not kidding). Graham said, “In the short run, the stock market is a voting machine. Yet in the long run, it is a weighing machine.” This statement means that in the short term, the market is reacting to transitory factors that influence the short term

only, while over the long term, the market properly “weights” the long-term inherent value of a business. Essentially psychology and emotion win the day reacting to short term news, but in the end, fundamentals of the business win.

In the preface to the Sixth Edition of Graham and Dodd’s book, Security Analysis, Seth Klarman remarked, “As Graham has instructed, those who view the market as a weighing machine – a precise and efficient assessor of value – are part of the emotionally driven herd. Those who regard the market as a voting machine – a sentiment-driven popularity contest – will be well positioned to take proper advantage of the extremes of market sentiment.” We believe in both managing our assets with a long-term horizon while respecting the news of today and how that can impact stock valuations in meaningful ways. To the point of managing to both the short and long term, I know many of you model our public portfolio in an attempt to predict our quarter-end performance. To do that, you take our quarter-end share count for each position, multiply that by the price change for each security, and then total the amount in order to quantify our performance. What isn’t known is how the portfolio changes during the three months. This was a very busy three months for us with regards to portfolio construction; we made significant changes since we last reported to you. In the quarter, we:

1.Added 81,287 shares of AFI under $5.00. We then cut our position in half at an average sale price of $5.46. This was an example of being very concerned about the short term while still believing in the long-term thesis.

2.Sold 34% of our ALTG position at $13.49. We became worried about short term but still believe in the long term.

3.Sold our remaining shares of BW at an average price of $8.96.

4.Had an undisclosed PFSW position in Q1 2021 and ended Q2 2021 with 530,328 shares. Interestingly enough, we love the short term and are unsure about the long term.

5.Had an undisclosed SNCR position in Q1 2021 and ended Q2 2021 with 3,205,494 shares.

6.Sold 65% of our SONM position at $0.58. We now neither believe in the short term, nor the long term.

In total, had we left the portfolio alone and gone away on vacation for three months, our public portfolio would have been up 0.6%. With all the inter-quarter changes, we were able to achieve a 5.9% gross total return for our public portfolio, or 6.8% if you include the carried interest from our SMA that would have been paid if it was the end of 2021. We continue to believe that success in portfolio management is derived from making sound long term investment decisions while, at the same time, taking advantage of short-term volatility if opportunities arise. As much as we think AFI is going to be a double-digit stock, if we become worried that short-term supply chain issues are going to affect the stock, then we aren’t afraid to cut the position in half with an eye towards buying it back at lower prices. Our research led us to become ultra-concerned in the short term, so that is what we did with our AFI position. Simply put, the short term matters in determining our performance. The second thing I learned from getting chewed out by Paul within the first minutes of starting my first job is that a 10% change in value of a holding is a lot. McDonnell Douglas’s 10% decline completely triggered a level of anger in Paul to the point I thought he was going to have an aneurysm. If you heard me say it once, you have heard me say it 1,000 times; I do not believe the market is efficient with an eye towards the long term. That said, in the short term, I do believe the market is the compilation of everyone’s opinion of what a business is worth based on the information that everyone has about that company; and remember, everyone has their own proprietary information. We sit around all day and stare at Bloomberg screens filled with letters and numbers and colors. For what reason? Bob Martorelli used to scream out to his analysts all the time, “The screen is talking to you, go find out what it’s saying.” What that means is let’s say XYZ company stock price is down 7% while the market is flat and there is no tangible news for why it’s down. Bob was essentially saying, someone has a piece of information that we don’t know about which is causing the share price to be down 7%. He wanted his analysts to track down the information and ascertain whether or not it was market making information or immaterial. Really, the exercise was one in trying to understand what causes a certain stock to move one way or the other. It is gathering information, whether or not we felt the information was material or a complete non-sequitur to our thesis for why we owned a certain company. It is called learning. So, when we see certain stocks trading in non-correlated patterns versus the rest of the market, our job is to figure out why. As I say often to the 180 team when I see a non-correlated move for one of our holdings, “Somebody knows something that we don’t know. Tell me what that is.” A stock doesn’t need to be up or down 10% to get our antennas up; the learning process often happens when stocks are up or down far less. It is the uncorrelated aspect of stock price movements that causes us to dig in and find out what we don’t know. Maybe we learn something. Maybe we don't. Given the volatility of the market these days, maybe 10% moves feel normal not only for individual stocks, but also the market. If you look at the performance of the Russell Microcap Index for the prior six quarters, they were up or down double digits four of the six past quarters (Q1 2020: -32%, Q2 2020: +30.5%, Q4 2020: +31.4%, Q1 2021: +23.9%). I guess relative to the seemingly "normal" double digit return world, achieving a +6.8% gross total return versus the +4.1% gross total return of the Russell Microcap Index seems like a boring nothing quarter. But +6.8% is not a nothing quarter and on a day-to-day basis, this market feels like anything other than quiet and docile. Over the last 100 years, the stock market returns, on average, approximately +10% a year. The day I view a +6.8% quarterly gross total return for our public holdings as anything less than excellent performance is the day I have lost all perspective. I am pleased with how we have performed this past quarter in our public market strategy.

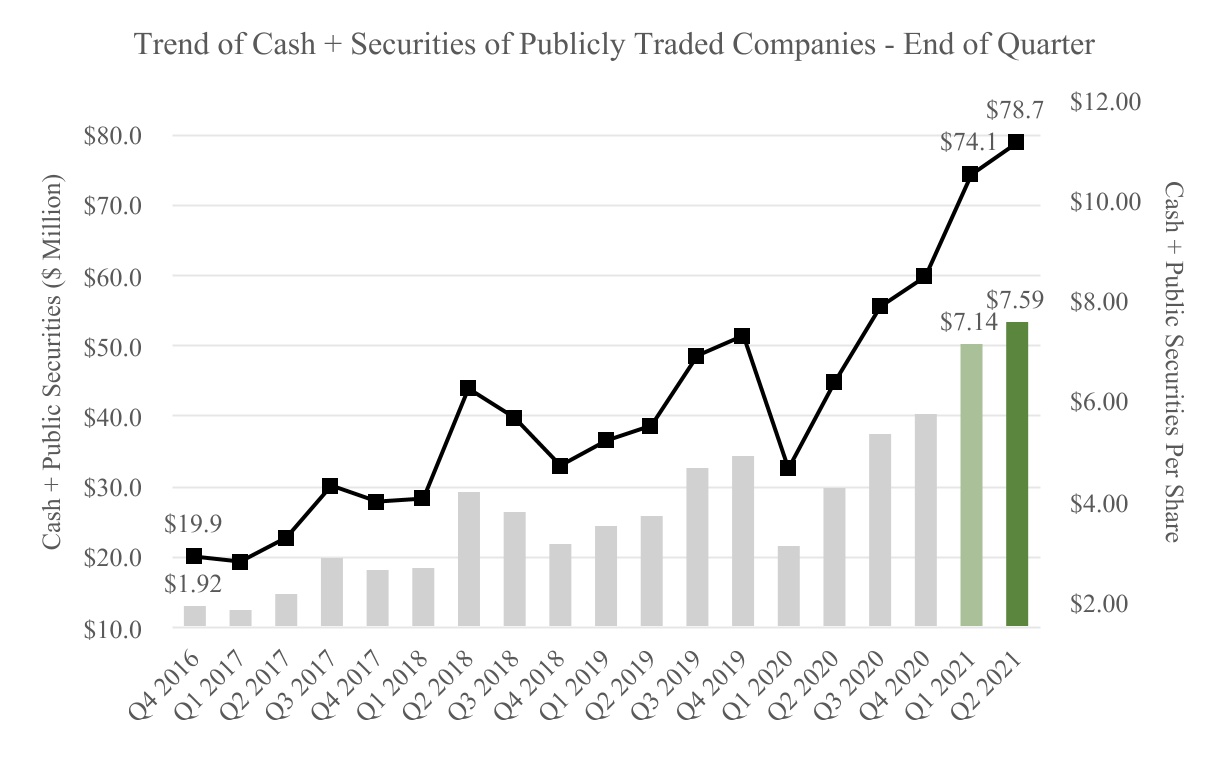

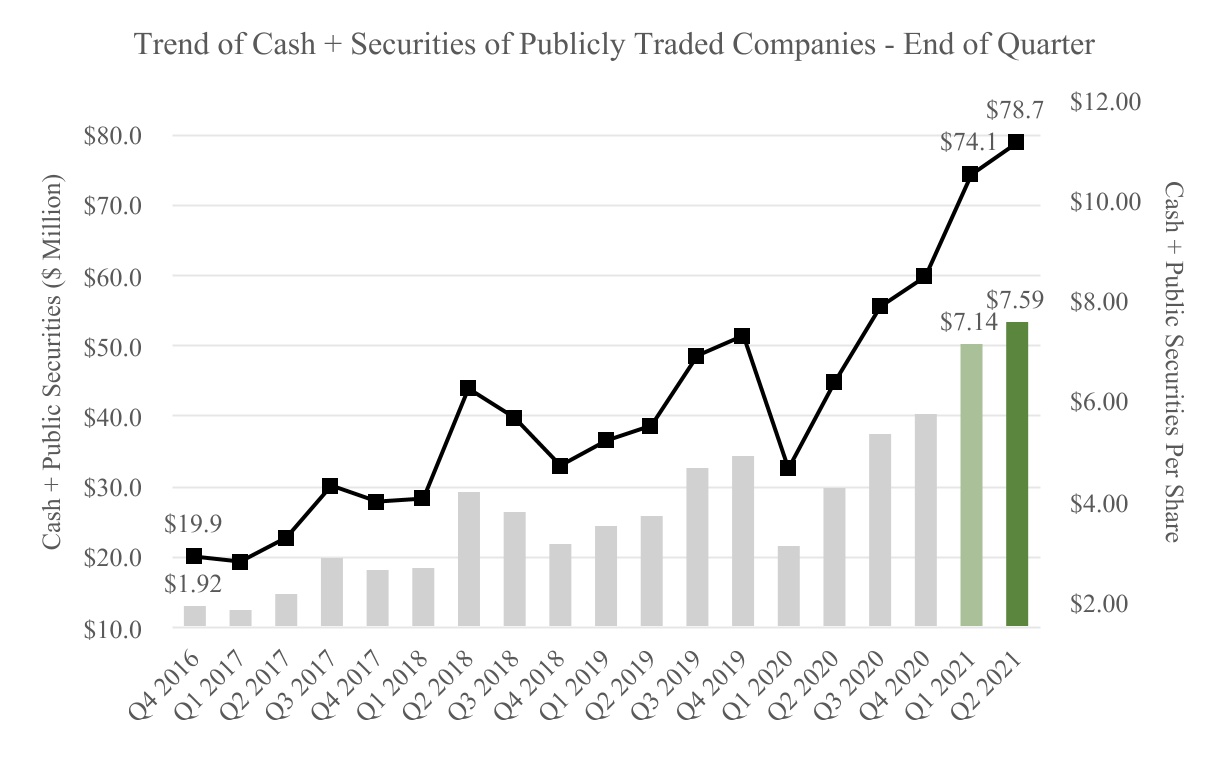

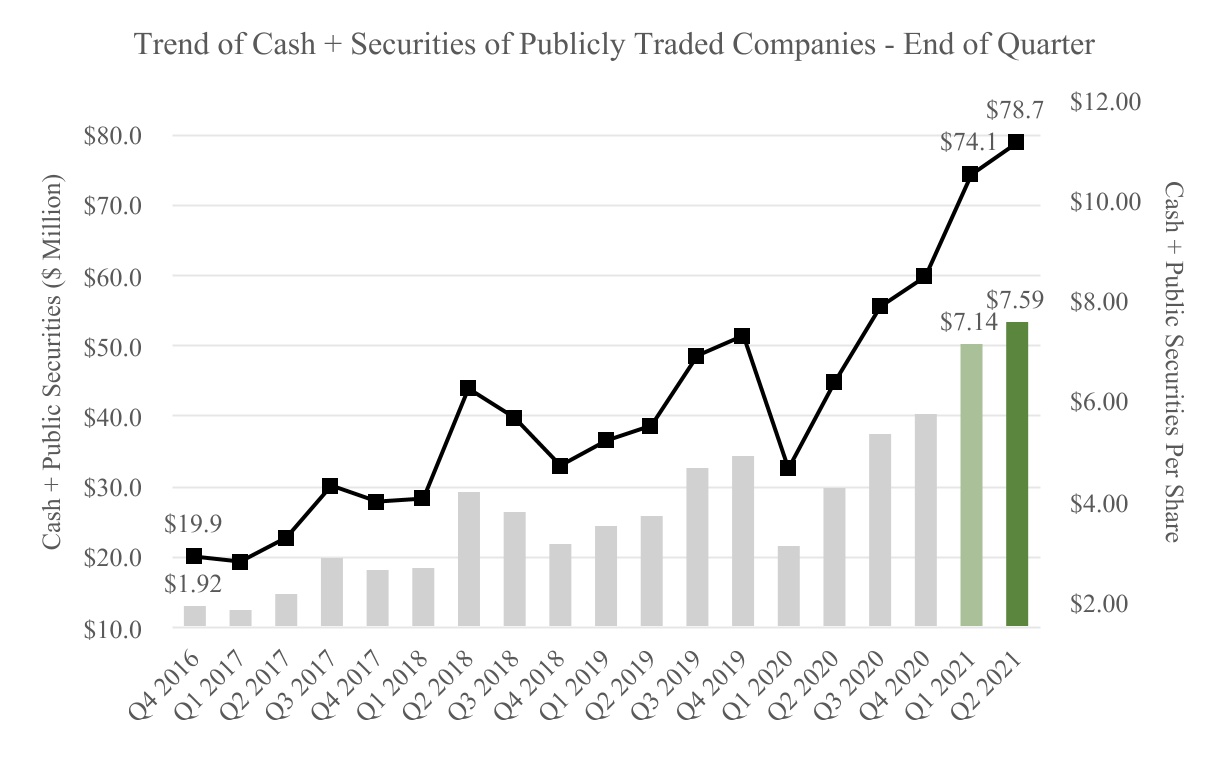

Take a look at this chart that shows the cash and securities of publicly traded companies on our balance sheet as of June 30, 2021. We’ve grown from $19.9 million to $78.7 million since we started in 2017, and we note that this amount does not include potential carried interest in 2021 from our SMA. On a per share basis, our cash and securities of publicly traded companies as of the end of the quarter were greater than TURN’s current stock price. How silly!

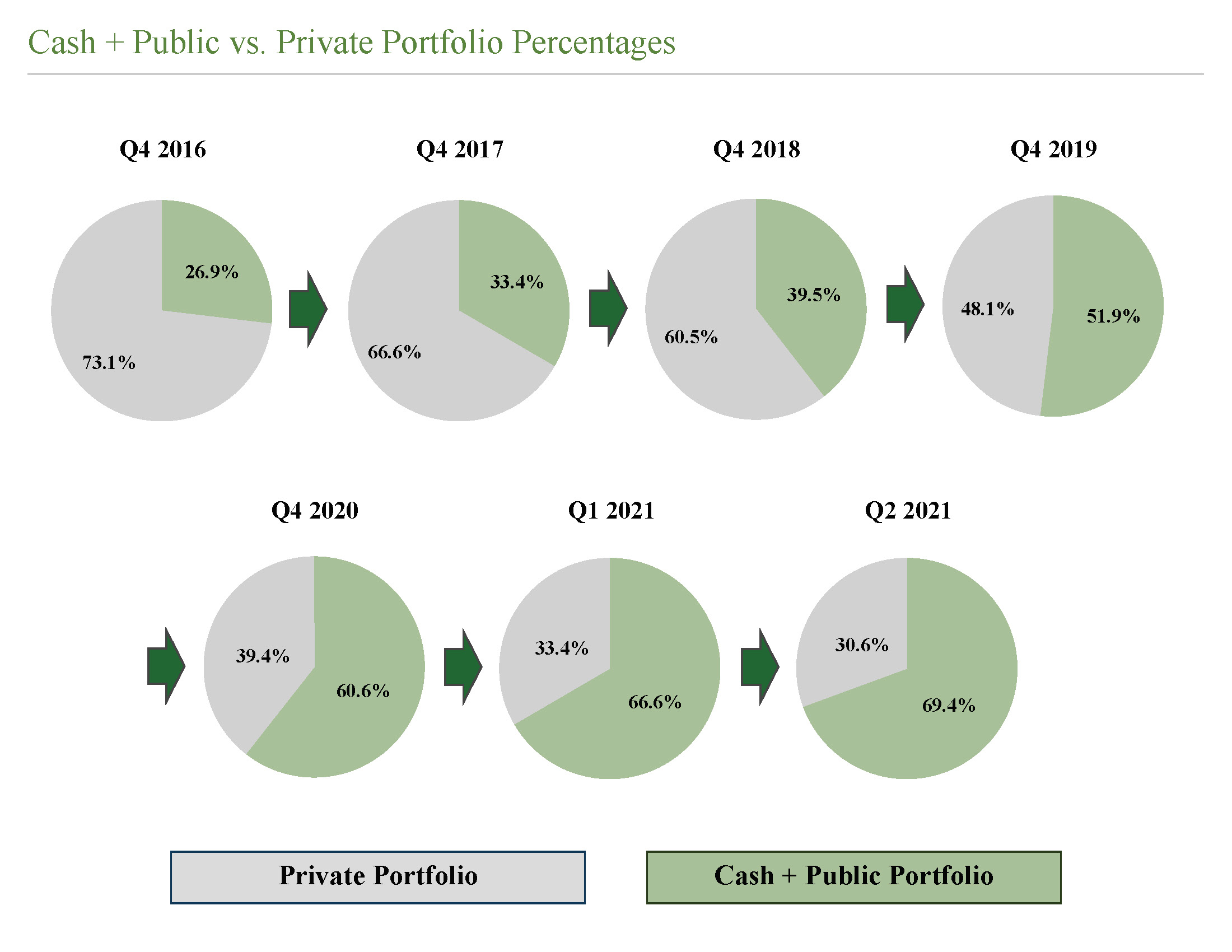

We had a 5.3% decline in our private portfolio in the quarter. While that is maddening to us, it should also be noted that the private portfolio is now just 30% of our total assets, the lowest percentage it has been at any time in our history. The private portfolio simply doesn’t matter as much as it did, and in a quarter where we had a decline of approximately $2.0 million in our private holdings, the drawdown was drowned out by a $4.4 million gain in our public holdings. I have said we expect to have monetization in our private portfolio this year, and this quarter we are pleased to note that the company in which our private portfolio company Black Silicon Holdings, Inc., has a profit interest in, has agreed to be sold to an undisclosed acquirer. We currently anticipate this transaction will close shortly and we will receive approximately $1 million. If at the end of the year we don’t have further news of events for our private portfolio, I will be disappointed and, I might add, surprised. Our share price now trades at our cash and securities of publicly traded companies and provides zero value for our private portfolio. I’ll illustrate that in greater detail in our “Sum of the Parts” section below.

As we mentioned last quarter, 180 is pursuing SPAC opportunities with what we believe are value added partners or management teams who we believe have demonstrated a core competency in sourcing merger candidates. The first of these efforts is in Parabellum Acquisition Corp., where 180 has committed to invest up to $2.7 million in risk capital as a member of the sponsor group in connection with the formation and launch of a new SPAC. In addition, we are currently working with another partner in connection with exploring an additional SPAC sponsor group investment opportunity, although we cannot assure you when or if such investment will ultimately be consummated. We look forward to being able to discuss these continuing efforts in more detail in the future. It is truly gratifying to see our business evolve from one that had no future to where it is today, where we have significantly grown our NAV and are able to take advantage of exciting investment opportunities. We have come a long way.

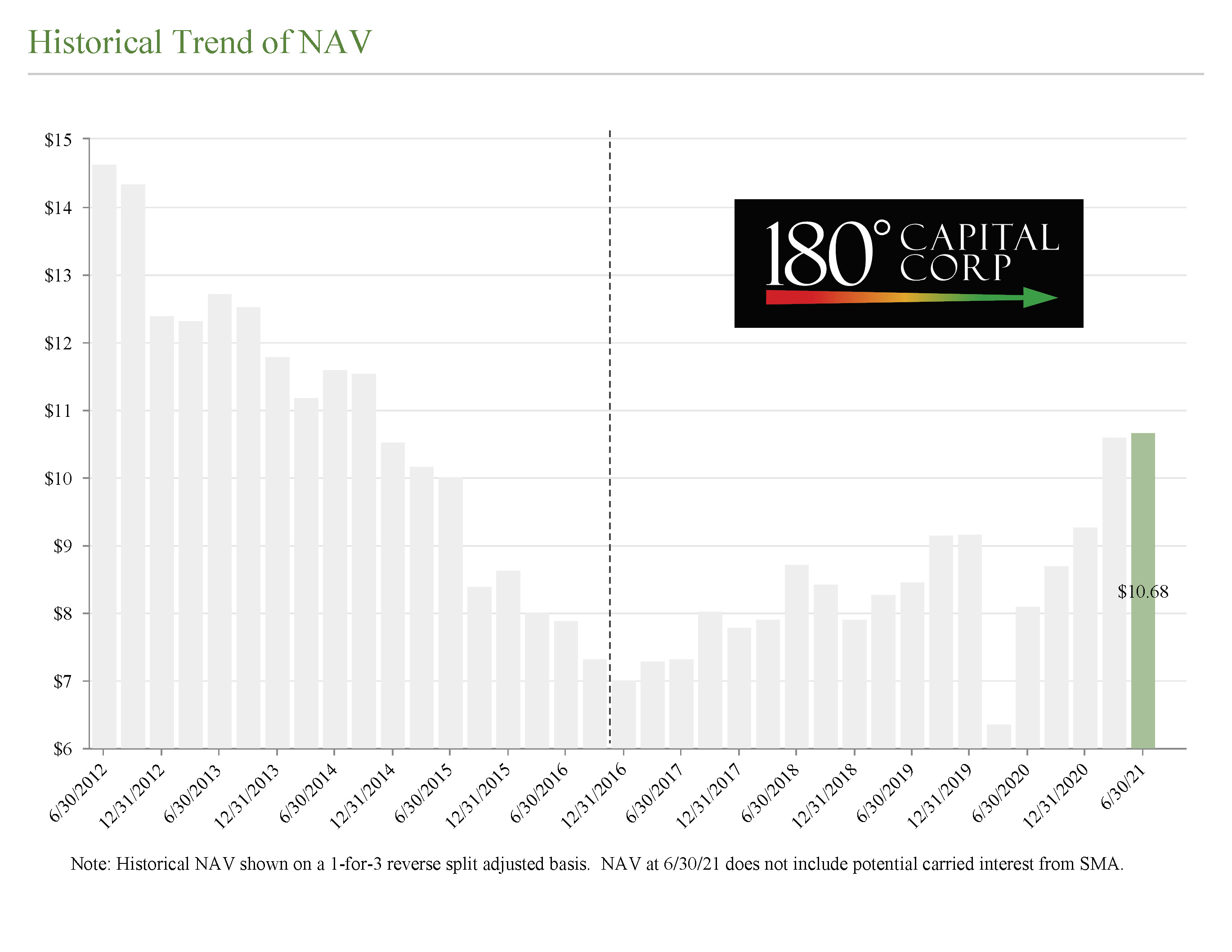

NET ASSET VALUE PER SHARE

Our net asset value per share (“NAV”) increased this quarter from $10.60 to $10.68, or +0.8%. Our Fund has three principal components to the variance in our NAV: our public portfolio, our private portfolio, and our expenses. For the quarter, our public portfolio companies increased our NAV by $0.42, while our private portfolio companies decreased our NAV by $0.19. Operating expenses, both ongoing and accrual for bonus pool, decreased NAV by $0.15.

| | | | | | | | | | | | | | | | | |

| Quarter | YTD | 1 Year | 3 Year | Inception to Date |

| Q2 2021 | Q4 2020-Q2 2021 | Q2 2020-

Q2 2021 | Q2 2018-

Q2 2021 | Q4 2016-Q2 2021 |

| | | | | |

| | | | | |

| | | | | |

| Change in NAV | 0.8% | 15.1% | 31.9% | 22.3% | 52.1% |

| | | | | |

| Russell Microcap Index | 4.1% | 29.0% | 75.7% | 49.9% | 88.0% |

| Russell Microcap Value Index | 3.2% | 34.9% | 85.5% | 40.4% | 73.7% |

| Russell 2000 | 4.3% | 17.5% | 62.0% | 46.2% | 80.4% |

| | | | | |

| | | | | |

| | | | | |

Four and a half years ago, our Board of Directors asked our shareholders to vote on a strategy change for our business. In a significant landslide vote, our shareholders voted for the strategy change. If you weren’t quite sure about whether or not that decision was the right one, please look at the NAV trends for our business, both before and after. I think the chart speaks for itself.

Public Portfolio

In the chart below, you see our quarter to date, year-to-date, one-year, three-year, and inception to date performance numbers. For Q2 2021, we showed a gross total return for our public portfolio of +5.9% (+6.8% including carried interest), versus a gross total return for the Russell Microcap Index of +4.1% and a gross total return for the Russell Microcap Value Index of +3.2%. Year to date, our +35.9% gross total return (+40.8% including carried interest) compares favorably to the +29.0% return for the Russell Microcap and a +34.9% return for the Russell Microcap Value Index. Our long-term results, as seen in the chart below trounce the indices.

| | | | | | | | | | | | | | | | | |

| Quarter | YTD | 1 Year | 3 Year | Inception to Date |

| Q2 2021 | Q4 2020-Q2 2021 | Q2 2020-

Q2 2021 | Q2 2018-

Q2 2021 | Q4 2016-Q2 2021 |

TURN Public Portfolio

Gross Total Return

(Excluding SMA Carried Interest) | 5.9% | 35.9% | 79.5% | 114.1% | 377.9% |

TURN Public Portfolio

Gross Total Return

(Including SMA Carried Interest) | 6.8% | 40.8% | 93.6% | 130.9% | 382.3% |

| | | | | |

| | | | | |

| | | | | |

| Russell Microcap Index | 4.1% | 29.0% | 75.7% | 49.9% | 88.0% |

| Russell Microcap Value Index | 3.2% | 34.9% | 85.5% | 40.4% | 73.7% |

| Russell 2000 | 4.3% | 17.5% | 62.0% | 46.2% | 80.4% |

| | | | | |

| | | | | |

| | | | | |

Let’s dig into the significant sources of the changes in value in our public portfolio in Q2 2021. Sources of material increases in value:

•Potbelly Corporation (NASDAQ: PBPB) - In June 2020, we filed an amended Form 13D noting the poor performance of the company under its then CEO, while commending PBPB’s Board for hiring a new CFO with restaurant experience. Subsequently, PBPB’s Board hired Robert Wright, the former COO of Wendy’s, as its new CEO. PBPB raised capital in Q1 2021 to improve its balance sheet and aid in the restructuring of its debt. The company reported solid results for Q1 2021 and stated that starting in April 2021, average weekly same-store sales exceeded 2019 levels. The company accelerated its expectation of generating positive cash flow to Q3 2021 with enterprise-level profitability in the second half of 2021. The stock advanced 33.7% in the quarter and increased our NAV by $0.27 per share.

•Armstrong Flooring, Inc. (NYSE:AFI) - Following its large asset sale in Q1 2021, AFI reported continued improvement in gross margins, bookings, and its sales pipeline in Q1 2021. AFI’s CFO made material insider purchases of stock during Q2 2021. Prior to end of the quarter, we became concerned that inflationary pressures, primarily related to shipping costs and raw materials, were greater than management had originally expected, and AFI would not have enough scale to deal with the rising costs without them negatively impacting the business. As a result, we cut our position in half by selling 502,523 shares at an average price of $5.46. While we still believe in the long-term potential for this business, we simply have to become more realistic about these inflationary pressures and right sizing the business to operate profitably in the current environment. AFI’s stock was up 26.6% in the quarter and increased our NAV by $0.09.

•Synchronoss Technologies, Inc., (NASDAQ:SNCR) increased our NAV by $0.25, and we discuss this investment in greater detail below.

On the negative side:

•Quantum Corporation (NASDAQ: QMCO) – QMCO reported results for its fiscal fourth quarter that fell short of expectations due to shortages of one critical semiconductor part required for its tape drive systems. The company provided a wide range guidance for 2022 due to uncertainty as to when it’s supply chain issue will be resolved. The stock declined 17.3 % in the quarter and decreased our NAV by $0.16.

•Sonim Technologies, Inc. (NASDAQ: SONM) – In Q2 2021, SONM issued a surprise announcement with its year-end 2020 results that the SEC investigation, believed to be close to completion, was being extended; thus greater than expected pressure on SONM's cash position would occur in future quarters. Following this announcement, SONM noted its cash position may not be enough to fund operations of the company without additional capital raises. Following this announcement as well as reporting poor financial results, the CEO was removed. What was once a promising business environment following our lead in recapitalizing the company at $0.75 last year, has turned into a business we have lost faith in. The biggest miss was being caught by surprise that one of their biggest customers would cancel a phone that SONM had invested millions of dollars of capital on. That said another big mistake was becoming an observer to the Board at SONM. Following the recapitalization, and a couple of decent financial quarters, SONM’s stock advanced over 100% from our entry price. The problem 180 faced was the restriction placed on us as insiders that limited our ability to transact in the stock. We simply missed the window to sell at a gain on our investment that was afforded to every other shareholder who was free to trade. The reasons for owning the business have materially changed and in sticking to our sell discipline, we have decided to exit the position. It is a lesson learned in how being on boards has the potential to negatively impact your ability to create value for your shareholders. Of course, if your

original long-term thesis plays out the way you envision, this headwind wouldn’t occur. In SONM’s case, we got the thesis wrong. The stock declined 31.9% this quarter and hurt our NAV by $0.14 per share.

Subsequent to the end of the quarter, we sold the remainder of our holdings of SONM. We have often talked about how we do our best to minimize our mistakes while maximizing our successes. As much as we got this one wrong, the loss was contained to $1.3 million, or -28.7%. Part of the reason why the loss was contained was adherence to a strict buy discipline which takes out much of the risk given the price we are paying for the business we are buying.

•TheMaven, Inc. (OTC:MVEN) - MVEN is a media coalition of professional content destinations, operating exclusively on a shared digital publishing, advertising, and distribution platform. MVEN provides a major media scale alternative to news and information on social platforms. The high-scale, unified platform offers operating leverage to all participants in MVEN’s ecosystem by eliminating all non-content operating expenses. MVEN’s distributed operating leverage enables its entire suite of services to be provided on a revenue share basis, which creates lower, non-fixed operating costs than if a media company was forced to run its own platform and digital ad sales team. MVEN provides distribution across 100+ million monthly users in a single platform, allowing advertisers to be more successful with return on investments in marketing. Among its many properties, MVEN operates a 100-year license agreement to run Sports Illustrated and owns TheStreet.com, after acquiring that asset in 2019. MVEN continued to make progress in getting its financial statement current with the SEC by filing its 2019 Annual Report on Form 10-K and the first three quarters of 2020 on Form 10-Q. The company raised $20 million from existing investors at a price per share of $0.70 and completed the acquisition of TheSpun. The volume weighted average price per share to reach 1% of outstanding tradable stock (VWAP) declined from $0.7869 to $0.7357 during the quarter and decreased our NAV by $0.07.

We have two positions to highlight: Synchronoss Technologies, Inc. (NASDAQ:SNCR) and PFSweb, Inc. (NASDAQ:PFSW), which became large positions during the quarter. We have included for your viewing a one-page synopsis of both companies in our slide deck for our shareholder update call that can be found on our investor relations website at https://ir.180degreecapital.com/finanical-results.

On SNCR, like TST and HEAR before, we helped anchor a large transaction, designed to take out an expensive and restrictive preferred security held by Siris Capital Group. For SNCR, we believe that removing the overhang of this preferred instrument will materially improve GAAP EPS. Furthermore, if the company is smart enough to sell its messaging business, SNCR will become a pure play cloud company with the majority of its revenue being recurring. We hope to have helped unlock short term value while SNCR works towards a much brighter longer term.

As for PFSW, our investment thesis was simple. The company had two distinct businesses (exactly as TST had), a Board and management team focused on unlocking the value for each of these businesses, and a stock price that we believed did not reflect the fair value for the combined entity. In fact, we believed the sum of the parts value of PFSW was worth close to 100% more than where the stock was trading. The stock did not do much in Q2 2021. 180’s cost basis in PFSW is approximately $7.13 per share, for an implied fully diluted enterprise value of approximately ~$186mm. Using an estimated multiple to revenue of 1.8x for the LiveArea business, we believed it could be valued at $6.00-6.60 per share based on 2020 actual and 2021 estimated revenue, respectively. Using an estimated multiple to EBITDA of 8x for the PFS Operations business, we believed it could be valued at $4.60-5.28 per share based on 2020 actual and 2021 estimated EBITDA, respectively. This sum of the parts analysis yields our estimated value of PFSW on a combined basis of $10.60-11.88 per share. On July 6, 2021, PFSW announced the sale of its LiveArea business to Merkle for $250 million (3x 2021 revenue and 2.7x 2021 estimated revenue). The company estimates net proceeds will be $185-200 million, or $8.22-8.88 per share. This transaction increased our estimated value of PFSW to $12.82-14.16 per share. We note that we owned 105,545 shares of PFSW at the end of Q1 2021 but chose not to disclose the investment as we were in the process of building our position. We ended Q2 2021 with 530,328 shares of PFSW.

Private Portfolio

For the quarter, our private portfolio decreased in value by approximately $2.0 million, or $0.19 per share. The largest decreases were in HALE.life Corporation (financing risk) and AgBiome, LLC (liquidation preference changes in recent financing). As we said above, the company in which Black Silicon Holdings, Inc. has a profit interest in has agreed to be sold, and we currently anticipate this transaction will close before the end of Q3 2021. We will receive approximately $1 million from this transaction. Also, during the quarter, Lodo Therapeutics Corporation was acquired by Zymergen, Inc., in an all-stock transaction. In almost every shareholder letter, we state that while we desire to shepherd our existing private portfolio to exits or explore opportunities to sell our positions in those companies, we have the luxury of being able to sell our private holdings when we believe it makes sense for shareholders, rather than being forced to do so to survive. Because you haven’t seen a monetization in any given quarter, doesn’t mean we have not been active in attempting to monetize the portfolio. We do not have to sell anything, given our success in remaking our balance sheet over the last four years. And we won’t, unless the price makes sense. Since the start of TURN, our private portfolio has reduced NAV by $0.91 per share while our public investing strategy has increased NAV by $6.43 per share. In 2016 we had holdings in 32 private companies. Today we have 19 but only

10 that matter. Those 10 private holdings comprise 93% of all the private assets. Our hope is the ones we still own have limited downside and decent upside.

EXPENSES

As we have noted in previous letters, we have dramatically reduced our cost structure under our new strategy. In 2016, before our Fund’s change in investment focus and management team, our operating expenses, excluding stock-based compensation and interest on outstanding debt, averaged approximately $1.3 million per quarter. For Q2 2021, our operating expenses, excluding accruals for potential bonuses, equaled approximately $780,000. Given our persistent and outsized performance, the Compensation Committee approved an additional accrual of approximately $793,000 in the quarter, for a potential bonus pool at year end 2021. It should be noted the pool amount will fluctuate based on our total performance for the rest of 2021.

TURN/NAV: SUM OF THE PARTS

As of the end of Q2 2021, TURN traded at 75% of NAV. Our securities of publicly traded companies, cash, the pro rata portion of estimated carried interest from our SMA in 2021 and other assets, net of liabilities, were $7.48 per share. Our stock price was $8.06. If we received 100% credit for the value of these assets, net of liabilities, the market is ascribing a value of approximately $0.58 per share, or approximately $6 million, to our private portfolio. Given our private assets are valued at approximately $34.6 million, the market is discounting the value of our private portfolio assets by approximately 83% as of the end of Q2 2021. If you exclude the $1 million we currently expect to receive from the sale of the underlying asset to Black Silicon Holdings, Inc., the market is discounting the value of our remaining private portfolio by 85%.

As we grow our cash and securities of publicly traded companies, the discount our stock trades to NAV should narrow. I have mentioned in previous letters, AgBiome alone is fair valued at a greater value, than the market is pricing the entire portfolio. I will remind you that Petra Pharma Corporation was acquired in Q2 2020, and between our direct ownership in Petra and our indirect ownership through Accelerator IV-New York Corporation, we received approximately $4.7 million in cash. We retain ownership in a spinout company that will seek to monetize additional assets of the company, and we could receive future milestone payments of up to approximately $86.9 million. While the timing and likelihood of achieving these milestones is uncertain, and we could ultimately receive none of these milestone payments, the Petra acquisition was a material and positive event for 180 and its shareholders. We believe that our other private holdings not only have real value today, but also have the potential to monetize into cash in the future.

At the end of the day, the private portfolio is becoming less and less important to our success. From the chart below, look at how dramatically different our balance sheet looks today versus four and a half years ago. Given our performance in the public markets, combined with a stock price that “only” trades at the value of our cash and liquid securities, in my humble opinion, TURN’s stock is grossly mispriced.

And as you have seen almost every quarter, if the valuation gap doesn’t close, our management team will continue to be buyers in the open market.

CONCLUSION

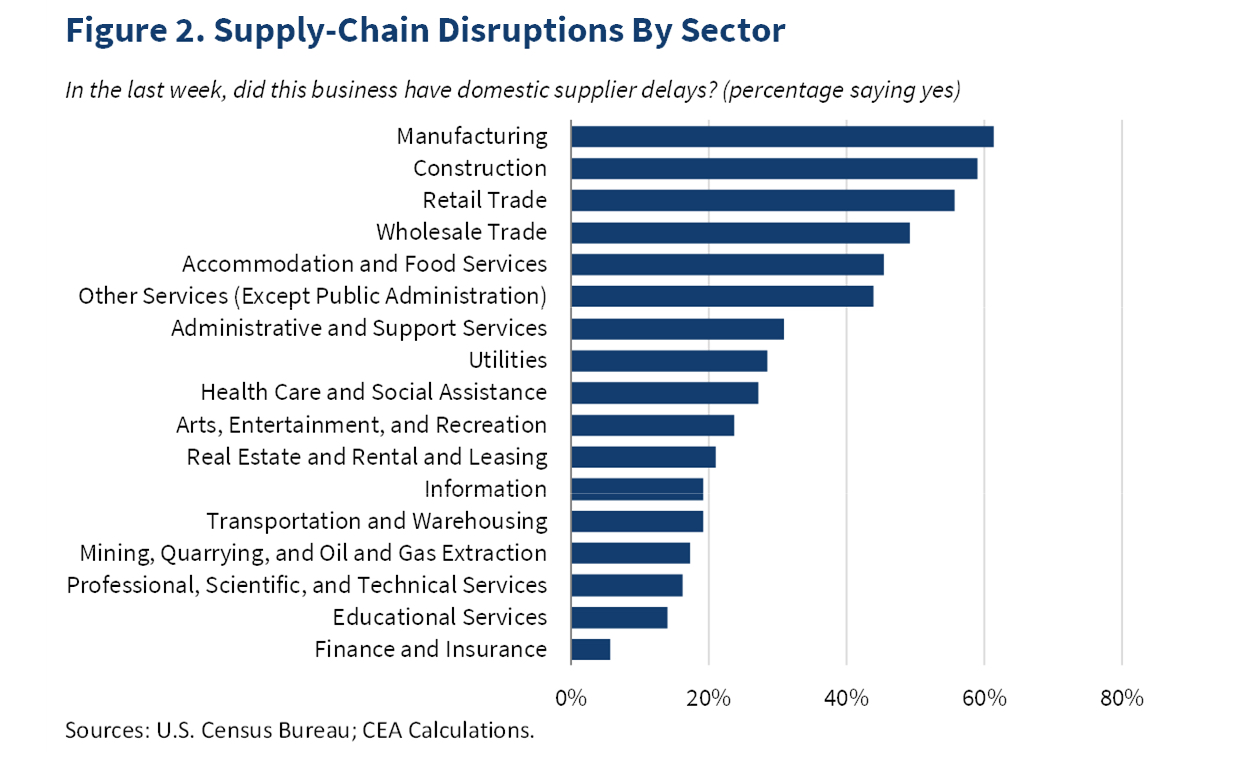

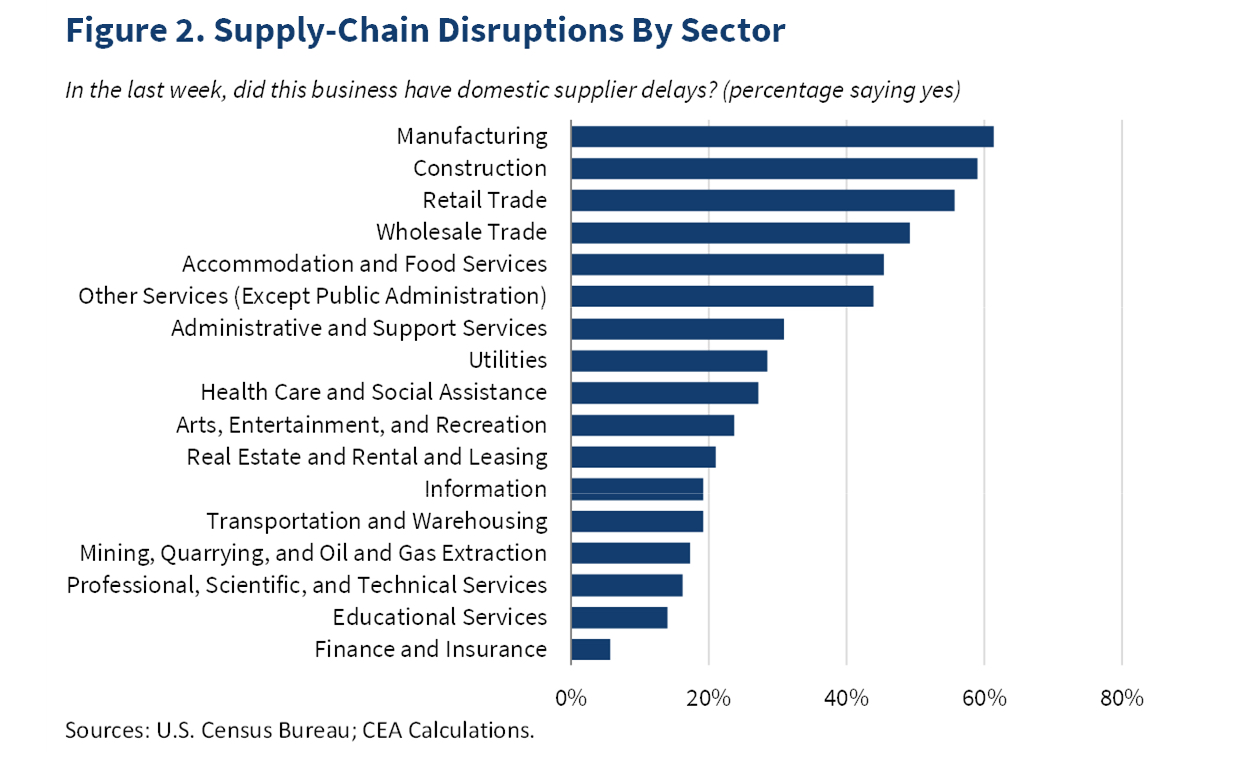

We have generated outsized returns for the first half of 2021. We have plenty of year left and much to navigate through with regards to the economy, the hopeful end or at least substantial reduction of the impact in daily life of COVID-19, inflation fears, and enormous fiscal stimulus resulting in continually growing massive deficits. The start to the third quarter has been extremely choppy and volatile as the Delta variant is spreading very quickly throughout the globe. While I don’t think we will ever be subject to lockdowns as we were in the beginning of the pandemic, the virus is causing continued pain and suffering for those that contract it. It is also causing governments and companies to enforce stricter guidelines to help contain the virus. For example, last week the Mayor of New York City announced that New York City will require proof of COVID-19 vaccinations from employees and customers of indoor eateries, gyms and entertainment centers. I would have thought that having vaccines and administering those vaccines would have ended this pandemic, but simply put, vaccination rates are still not high enough and the original COVID-19 virus has mutated into the more easily transmitted Delta variant. Some days, this feels like this will never end. The worst part is, globally, there are many countries whose vaccination rates are lower than the United States and those countries are far behind in easing any sort of restrictions. For instance, there are full stay at home orders in Japan, which is why we watched the Olympics with no fans. While 180 focuses its investments on US domestic companies, many of our companies still rely on Asian countries for raw materials. We are seeing severe supply chain issues across the board for various raw materials. A recent chart published by the US census bureau, showed the following disruption of supply chains by sector:

We are seeing constraints of availability of semiconductor chips, lumber, wallboard, and roofing products. We are seeing rising shipping costs and employee shortages for service-oriented businesses. We have seen faster inflation as a result of these shortages, and there doesn’t appear to be much relief in the short term. Simply put, while the stock market has cheered vaccinations and the near end of the pandemic, the actual reopening of the global economy has been challenging. We have seen that with our own companies. QMCO talked about the inability to secure a chip used for its tape products. LTRX cannot get enough components to meet demand. AFI has talked about supply chain issues and rising shipping costs. While all of this may be transient, we are a bit bearish on the current environment, thinking improvement for the manufacturing issues the global economy is facing will not occur for the next couple of quarters. The Russell Microcap Index is down 6% due in part to the turmoil caused by the surging Delta variant through the first month of Q3 2021. The good news is we do have vaccines, the pandemic is coming to an end (dare I say that), global demand is returning, and valuations for many companies are still offering good long-term risk/reward characteristics.

We have completely remade our business and created a real business with a real name in our microcap world. When I first joined the Board of Directors in mid-2016, we had just approximately $17 million in cash and securities of public companies net of outstanding debt. As the end of the Q2 2021, we have nearly $79 million in cash and securities of public companies on our balance sheet, and we grew the assets for our SMA client from $25 million to $41 million. For our performance in growing the value of the SMA in 2021, should it remain flat to where we ended Q2 2021, we have a potential to receive $2.8 million in carried interest at year end. This represents approximately 82% of our normal operating expenses, not including bonuses. We have controlled what we can control and have excelled in our public markets investing. We will continue to navigate through whatever waters the market presents and do our best to continue to enhance value for all of TURN’s shareholders.

We look forward to reviewing our subsequent quarters as the year unfolds.

Thank you for your continued support.

Kevin Rendino

Chairman and Chief Executive Officer

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES (UNAUDITED) |

| | | | | |

| | June 30, 2021 |

| ASSETS | |

| Investments in portfolio securities, at value: | |

| Unaffiliated privately held securities (cost: $12,881,482) | $ | 19,675,862 | |

| Unaffiliated publicly traded securities (cost: $23,659,902) | 34,149,015 | |

| Non-controlled affiliated privately held securities (cost: $21,927,580) | 8,591,108 | |

| Non-controlled affiliated publicly traded securities (cost: $24,684,001) | 35,908,262 | |

| Unaffiliated rights to payments (cost: $6,408,684) | 6,341,873 | |

| Controlled privately held securities (cost: $69,400) | 69,400 | |

| Non-controlled affiliated derivative securities (cost: $224,849) | 355,839 | |

| Unaffiliated derivative securities (cost: $36,188) | 2 | |

| Cash | 7,578,517 | |

| Receivable from portfolio companies | 838,160 | |

| Receivable from securities sold | 468,584 | |

| Receivable from managed funds | 152,151 | |

| Prepaid expenses | 169,743 | |

| Other receivables | 9,219 | |

| Other assets | 29,060 | |

| Total assets | $ | 114,336,795 | |

| LIABILITIES & NET ASSETS | |

| |

| Bonus payable (Note 7) | $ | 1,775,629 | |

| Post-retirement plan liabilities | 825,836 | |

| Payable for securities purchased | 705,606 | |

| Accounts payable and accrued liabilities | 263,172 | |

| Total liabilities | $ | 3,570,243 | |

| Commitments and contingencies (Note 10) | |

| Net assets | $ | 110,766,552 | |

| Net assets are comprised of: | |

| Preferred stock, $0.10 par value, 2,000,000 shares authorized; none issued | $ | 0 | |

| Common stock, $0.03 par value, 15,000,000 shares authorized; 11,541,079 issued | 334,594 | |

| Additional paid in capital | 122,250,693 | |

| Total accumulated distributable loss | (7,213,210) | |

| Treasury stock, at cost 1,167,259 shares | (4,605,525) | |

| Net assets | $ | 110,766,552 | |

| Shares outstanding | 10,373,820 | |

| Net asset value per outstanding share | $ | 10.68 | |

The accompanying notes are an integral part of this unaudited consolidated schedule of investments.

11

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF OPERATIONS (UNAUDITED) |

| | | | | |

| Six Months Ended

June 30, 2021 |

| Income: | |

| Interest from: | |

| Unaffiliated companies-PIK | $ | 10,363 | |

| Non-controlled affiliated companies-cash | (8,154) | |

| Non-controlled affiliated companies-PIK | 290,067 | |

| Other income (Note 2) | 43,167 | |

| Board fees from portfolio companies-cash | 23,250 | |

| Board fees from portfolio companies-non-cash | 31,449 | |

| Management fee income | 6,083 | |

| Miscellaneous income | 57,587 | |

| Total income | 453,812 | |

| Operating fees and expenses: | |

| Salaries, bonus and benefits | 2,253,398 | |

| Professional | 349,205 | |

| Administration and operations | 168,072 | |

| Directors | 142,500 | |

| Insurance | 155,021 | |

| Rent | 13,674 | |

| Custody | 16,189 | |

| Other | 3,475 | |

| Total operating expenses | 3,101,534 | |

| Net investment loss before income tax expense | (2,647,722) | |

| Income tax expense | 1,557 | |

| Net investment loss | (2,649,279) | |

| Net realized (loss) gain from investments: | |

| Unaffiliated privately held securities | (894,294) | |

| Unaffiliated publicly traded securities | 6,055,881 | |

| Non-controlled affiliated publicly traded securities | 174,575 | |

| Net realized gain from investments | 5,336,162 | |

| Realized gain from funds held in escrow | 163,043 | |

| Net realized gain | 5,499,205 | |

| Change in unrealized appreciation (depreciation) on investments: | |

| Unaffiliated privately held securities | 757,340 | |

| Unaffiliated publicly traded securities | 3,035,737 | |

| Non-controlled affiliated privately held securities | (2,378,260) | |

| Non-controlled affiliated publicly traded securities | 11,562,816 | |

| Unaffiliated rights to payments | (1,378,801) | |

| Net change in unrealized appreciation on investments | 11,598,832 | |

| Net realized gain from investments and change in unrealized appreciation on investments | 17,098,037 | |

| Net increase in net assets resulting from operations | $ | 14,448,758 | |

The accompanying notes are an integral part of this unaudited consolidated schedule of investments.

12

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED) |

| | | | | |

| Six Months Ended

June 30, 2021 |

| Cash flows used in operating activities: | |

| Net increase in net assets resulting from operations | $ | 14,448,758 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: |

| Net realized gain from investments | (5,499,205) | |

| Net change in unrealized appreciation on investments | (11,598,832) | |

| Depreciation of fixed assets | 3,471 | |

| Accretion of bridge note PIK interest income | (300,430) | |

| Board fees from portfolio companies-non-cash | (31,449) | |

| Purchase of unaffiliated publicly traded securities | (22,725,051) | |

| Purchase of non-controlled affiliated publicly traded securities | (9,076,289) | |

| Purchase of controlled privately held securities | (69,400) | |

| Proceeds from sale of unaffiliated publicly traded securities | 21,992,320 | |

| Proceeds from sale of non-controlled affiliated publicly traded securities | 5,833,019 | |

| Proceeds from funds held in escrow from sales of investments | 323,683 | |

| Changes in assets and liabilities: | |

| Increase in receivable from sales of securities | (468,584) | |

| Decrease in receivable from managed funds | 2,486,229 | |

| Increase in receivable from portfolio securities | (43,167) | |

| Decrease in prepaid expenses | 156,202 | |

| Decrease in interest receivable | 8,154 | |

| Decrease in other assets | 4 | |

| Increase in bonus payable | 417,707 | |

| Decrease in post-retirement plan liabilities | (16,530) | |

| Increase in payable for securities purchased | 486,461 | |

| Decrease in accounts payable and accrued liabilities | (252,943) | |

| Net cash used in operating activities | (3,925,872) | |

| Cash flows from investing activities: | |

| Purchase of fixed assets | (4,696) | |

| Net cash used in investing activities | (4,696) | |

| Net decrease in cash and restricted cash | (3,930,568) | |

| Cash and restricted cash at beginning of the period | 11,509,085 | |

| Cash at end of the period | $ | 7,578,517 | |

| |

| Supplemental disclosures of cash flow information: | |

| Income taxes paid | $ | 1,557 | |

| |

| Cash | $ | 7,578,517 | |

| Restricted cash | 0 | |

| Total cash and restricted cash shown in the consolidated statement of cash flows | $ | 7,578,517 | |

| |

The accompanying notes are an integral part of this unaudited consolidated schedule of investments.

13

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | | | | | | | |

| Six Months Ended

June 30, 2021 | | Year Ended December 31, 2020 |

| (UNAUDITED) | | |

| Changes in net assets from operations: | | | |

| Net investment loss | $ | (2,649,279) | | | $ | (510,224) | |

| Net realized gain (loss) on investments | 5,499,205 | | | (1,071,992) | |

| Net change in unrealized appreciation on investments | 11,598,832 | | | 2,709,272 | |

| Share of loss on equity method investment | 0 | | | (22,901) | |

| Net increase in net assets resulting from operations | 14,448,758 | | | 1,104,155 | |

| Net increase in net assets | 14,448,758 | | | 1,104,155 | |

| Net Assets: | | | |

| Beginning of the period/year | 96,317,794 | | | 95,213,639 | |

| End of the period/year | $ | 110,766,552 | | | $ | 96,317,794 | |

| | | |

The accompanying notes are an integral part of this unaudited consolidated schedule of investments.

14

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED FINANCIAL HIGHLIGHTS |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended

Jun. 30, 2021 | | Year Ended Dec. 31 2020# | | Year Ended Dec. 31, 2019# | | Year Ended Dec. 31, 2018# | | Year Ended Dec. 31, 2017# | | Year Ended Dec. 31, 2016# |

| (UNAUDITED) | | | | | | | | | | |

| Per Share Operating Performance: | | | | | | | | | | | |

| Net asset value per share, beginning of the period/year | $ | 9.28 | | | $ | 9.18 | | | $ | 7.92 | | | $ | 7.80 | | | $ | 7.02 | | | $ | 8.64 | |

Net investment loss* | (0.25) | | | (0.05) | | | (0.48) | | | (0.21) | | | (0.36) | | | (0.45) | |

Net realized gain (loss) from investments* | 0.53 | | | (0.11) | | | 0.93 | | | (0.75) | | | (1.14) | | | (0.78) | |

Net change in unrealized appreciation (depreciation) on investments and options*1 | 1.12 | | | 0.26 | | | 0.81 | | | 1.08 | | | 2.40 | | | (0.36) | |

Share of loss on equity method investment*2 | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | |

| Total* | 1.40 | | | 0.10 | | | 1.26 | | | 0.12 | | | 0.90 | | | (1.59) | |

Net (decrease) increase as a result of stock-based compensation expense*2 | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | (0.03) | | | 0.03 | |

Net increase as a result of purchase of treasury stock | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | |

Net decrease as a result of acquisition of vested restricted stock awards related to employee withholding2 | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | (0.06) | | | (0.03) | |

| Total (decrease) increase from capital stock transactions | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | (0.09) | | | 0.00 | |

Net (decrease) increase as a result of other comprehensive (loss) income*2 | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | (0.03) | | | (0.03) | |

| Net increase (decrease) in net asset value | 1.40 | | | 0.10 | | | 1.26 | | | 0.12 | | | 0.78 | | | (1.62) | |

| Net asset value per share, end of the period/year | $ | 10.68 | | | $ | 9.28 | | | $ | 9.18 | | | $ | 7.92 | | | $ | 7.80 | | | $ | 7.02 | |

| | | | | | | | | | | |

| Stock price per share, end of the period/year | $ | 8.06 | | | $ | 6.66 | | | $ | 6.45 | | | $ | 5.25 | | | $ | 5.91 | | | $ | 4.14 | |

| Total return based on stock price | 21.02 | % | | 3.26 | % | | 22.86 | % | | (11.17) | % | | 42.75 | % | | (37.27) | % |

| Supplemental Data: | | | | | | | | | | | |

| Net assets, end of the period/year | $ | 110,766,552 | | | $ | 96,317,794 | | | $ | 95,213,639 | | | $ | 82,034,768 | | | $ | 81,042,989 | | | $ | 72,255,610 | |

| Ratio of expenses, excluding taxes, to average net assets | 2.94 | % | ^ | 4.61 | % | ^ | 6.42 | % | ^ | 3.62 | % | ^ | 6.26 | % | ^ | 7.88 | % |

| Ratio of expenses, including taxes, to average net assets | 2.94 | % | ^ | 4.61 | % | ^ | 6.42 | % | ^ | 3.63 | % | ^ | 6.28 | % | 3^ | 7.89 | % |

| Ratio of net investment loss to average net assets | (2.51) | % | | (0.59) | % | | (5.42) | % | | (2.82) | % | | (4.68) | % | | (5.64) | % |

| Average debt outstanding | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 4,590,164 | |

| Average debt per share | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.45 | |

| Portfolio turnover | 29.54 | % | | 35.16 | % | | 30.17 | % | | 20.43 | % | | 8.83 | % | | ** |

| Number of shares outstanding, end of the period/year | 10,373,820 | | | 10,373,820 | | | 10,373,820 | | | 10,373,820 | | | 10,373,820 | | | 10,301,363 | |

# Reflect a 1-for-3 reverse stock split that became effective on January 4, 2021. Refer to Note 1. The Company, for further information.

* Based on average shares outstanding.

^ The Company has entered into an expense offsetting arrangement with one of its unaffiliated brokers relating to broker fees paid. The total broker fee charged to the Company was applied as a credit to fees charged by an affiliate of the unaffiliated broker who the Company subscribes to for data services billed during the period/year. The Company received an offset to expense totaling approximately $31,900, $15,700, $17,500 and $5,700 with that broker for the years ended December 31, 2020, December 31, 2019, December 31, 2018 and December 31, 2017, respectively. The Company received an offset to expense totaling approximately $24,800 with that broker for the period ended June 30, 2021.

**Prior to March 2017, the Company was a business development company investing primarily in privately held securities. Portfolio turnover was not a relevant indicator for such investments given that the Company did not generally pay brokerage fees on such investments.

1 Net unrealized losses include rounding adjustments to reconcile change in net asset value per share.

2 Amounts listed as zero are amounts calculated as less than $0.005.

3 Ratio of expenses, including taxes and excluding expenses related to restructuring, to quarterly average net assets for the year ended December 31, 2017 was 5.19%.

The accompanying notes are an integral part of this unaudited consolidated schedule of investments.

15

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2021 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Securities (2) - | | | | | | | | | |

| 48.6% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Privately Held Securities (Illiquid) - | | | | | | | | | |

| 17.8% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| AgBiome, LLC (3)(4) | | | Fertilizers & Agricultural Chemicals | | | | | | |

| Develops agricultural products that reduce risk and improve yield | | | | | | | | | |

| Series A-1 Convertible Preferred Units (acquired 1/30/13) | (H) (L3) | | | | 2,000,000 | | | $ | 2,000,000 | | | $ | 9,408,468 | |

| Series A-2 Convertible Preferred Units (acquired 4/9/13-10/15/13) | (H) (L3) | | | | 417,392 | | | 521,740 | | | 1,964,803 | |

| Series B Convertible Preferred Units (acquired 8/7/15) | (H) (L3) | | | | 160,526 | | | 500,006 | | | 769,213 | |

| | | | | | | 3,021,746 | | | 12,142,484 | |

| | | | | | | | | |

| AutoTech Ventures Management I, LLC (3)(4)(5) | | | Asset Management & Custody Banks | | | | | | |

| Venture capital investing in automotive-related companies | | | | | | | | | |

| LLC Interests (acquired 12/1/17) | (M) (L3) | | | | 0 | | | 0 | | | 225,000 | |

| | | | | | | | | |

| D-Wave Systems, Inc. (3)(4)(6)(7) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Develops high-performance quantum computing systems | | | | | | | | | |

| Class A Convertible Preferred Stock (acquired 4/14/20) | (H) (L3) | | | | 1,025,045.6 | | | 1,238,050 | | | 1,635,690 | |

| | | | | | | | | |

| Fleet Health Alliance, LLC (3)(4)(7) | | | Health Care Technology | | | | | | |

| Develops software for information transfer amongst healthcare providers and consumers | | | | | | | | | |

| Unsecured Convertible Bridge Note, 0%, (acquired 4/22/16, no maturity date) | (I) (L3) | | | | $ | 225,000 | | | 225,000 | | | 0 | |

| | | | | | | | | |

| Magnolia Neurosciences Corporation (3)(4)(7) | | | Pharmaceuticals | | | | | | |

| Develops novel therapeutics for treatment of neurodegeneration | | | | | | | | | |

| Series A Convertible Preferred Stock (acquired 8/3/18) | (I) (L3) | | | | 862,872 | | | 862,872 | | | 874,837 | |

| | | | | | | | | |

The accompanying notes are an integral part of this unaudited consolidated schedule of investments.

16

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2021 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Securities (2) - | | | | | | | | | |

| 48.6% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Privately Held Securities (Illiquid) - | | | | | | | | | |

| 17.8% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Nanosys, Inc. (3)(4)(7)(8) | | | Specialty Chemicals | | | | | | |

| Develops inorganic nanowires and quantum dots for use in LED-backlit devices | | | | | | | | | |

| Series A-1 Convertible Preferred Stock (acquired 5/22/21) | (H) (L3) | | | | 496,572 | | | $ | 496,573 | | | $ | 437,425 | |

| Series A-2 Convertible Preferred Stock (acquired 5/22/21) | (H) (L3) | | | | 2,232,001 | | | 4,500,003 | | | 1,660,747 | |

| | | | | | | 4,996,576 | | | 2,098,172 | |

| | | | | | | | | |

| Phylagen, Inc. (3)(4)(7) | | | Research & Consulting Services | | | | | | |

| Develops technology to improve human health and business productivity | | | | | | | | | |

| Series A Convertible Preferred Stock (acquired 11/14/18) | (M) (L3) | | | | 548,031 | | | 233,845 | | | 374,689 | |

| | | | | | | | | |

| Ravenna Pharmaceuticals, Inc. (3)(4)(7)(9)(10) | | | Pharmaceuticals | | | | | | |

| Holding company for intellectual property in oncology therapeutics | | | | | | | | | |

| Common Stock (acquired 5/14/20) | (M) (L3) | | | | 2,584,763 | | | 103,391 | | | 62,746 | |

| | | | | | | | | |

| Seaport Diagnostics, Inc. (3)(4)(7)(11) | | | Health Care Technology | | | | | | |

| Develops consumer focused genetic tests | | | | | | | | | |

| Series 1 Convertible Preferred Stock (acquired 2/5/15-8/5/15) | (H) (L3) | | | | 1,195,315 | | | 500,000 | | | 939,139 | |

| Series A Convertible Preferred Stock (acquired 11/25/15-9/7/16) | (H) (L3) | | | | 1,364,666 | | | 1,500,000 | | | 1,158,949 | |

| Series A-2 Convertible Preferred Stock (acquired 5/11/17-2/8/18) | (H) (L3) | | | | 176,386 | | | 200,002 | | | 164,156 | |

| | | | | | | 2,200,002 | | | 2,262,244 | |

| | | | | | | | | |

| Total Unaffiliated Privately Held Securities (cost: $12,881,482) | | | | | | | | | $ | 19,675,862 | |

| | | | | | | | | |

The accompanying notes are an integral part of this unaudited consolidated schedule of investments.

17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2021 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Securities (2) - | | | | | | | | | |

| 48.6% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Publicly Traded Securities - | | | | | | | | | |

| 30.8% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Alta Equipment Group, Inc. (4) | | | Trading Companies & Distributors | | | | | | |

| Operates as an industrial and construction equipment company | | | | | | | | | |

| Common Stock (acquired 2/14/20-11/12/20) | (M) (L1) | | | | 491,729 | | | $ | 3,790,118 | | | $ | 6,535,078 | |

| | | | | | | | | |

| Armstrong Flooring, Inc. (4) | | | Building Products | | | | | | |

| Produces flooring products | | | | | | | | | |

| Common Stock (acquired 12/22/20-4/21/21) | (M) (L1) | | | | 506,690 | | | 2,377,598 | | | 3,136,411 | |

| | | | | | | | | |

| Enzo Biochem, Inc. (4) | | | Health Care Services | | | | | | |

| Develops health care products and provides diagnostic services | | | | | | | | | |

| Common Stock (acquired 1/13/21-2/23/21) | (M) (L1) | | | | 436,201 | | | 1,326,902 | | | 1,382,757 | |

| | | | | | | | | |

| Everspin Technologies, Inc. (4) | | | Semiconductors | | | | | | |

| Develops magnetic random access memory products | | | | | | | | | |

| Common Stock (acquired 1/6/21-5/17/21) | (M) (L1) | | | | 330,347 | | | 1,839,474 | | | 2,124,131 | |

| | | | | | | | | |

| Lantronix, Inc. (4) | | | Communications Equipment | | | | | | |

| Provides secure data access and management solutions | | | | | | | | | |

| Common Stock (acquired 9/18/18-5/26/21) | (M) (L1) | | | | 653,490 | | | 2,307,933 | | | 3,372,008 | |

| | | | | | | | | |

| PFSweb, Inc. (4) | | | IT Consulting & Other Services | | | | | | |

| Provides management services for ecommerce | | | | | | | | | |

| Common Stock (acquired 3/19/21-6/30/21) | (M) (L1) | | | | 530,328 | | | 3,780,312 | | | 3,913,821 | |

| | | | | | | | | |

| Quantum Corporation (4) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Provides high-density data storage and high-speed data processing solutions | | | | | | | | | |

| Common Stock (acquired 2/4/19-6/28/21) | (M) (L1) | | | | 1,211,510 | | | 3,524,799 | | | 8,347,304 | |

| | | | | | | | | |

The accompanying notes are an integral part of this unaudited consolidated schedule of investments.

18

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2021 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Securities (2) - | | | | | | | | | |

| 48.6% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Publicly Traded Securities - | | | | | | | | | |

| 30.8% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Sonim Technologies, Inc. (4) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Provides rugged communications products | | | | | | | | | |

| Common Stock (acquired 6/5/20-6/30/21) | (M) (L1) | | | | 1,907,054 | | | $ | 1,437,535 | | | $ | 1,064,136 | |

| | | | | | | | | |

| Zymergen, Inc. (3)(4)(7)(12) | | | Specialty Chemicals | | | | | | |

| Provides biomanufacturing technology and services | | | | | | | | | |

| Common Stock (acquired 5/17/21) | (M) (L3) | | | | 10,735 | | | 360,615 | | | 429,507 | |

| | | | | | | | | |

| Miscellaneous Common Stocks (13) | (M) (L1) | | | | | | 2,914,616 | | | 3,843,862 | |

| | | | | | | | | |

| Total Unaffiliated Publicly Traded Securities (cost: $23,659,902) | | | | | | | | | $ | 34,149,015 | |

| | | | | | | | | |

| Total Investments in Unaffiliated Securities (cost: $36,541,384) | | | | | | | | | $ | 53,824,877 | |

| | | | | | | | | |

| Investments in Non-Controlled Affiliated Securities (2) - | | | | | | | | | |

| 40.2% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Privately Held Securities (Illiquid) - | | | | | | | | | |

| 7.8% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| ABSMaterials, Inc. (3)(7)(10) | | | Specialty Chemicals | | | | | | |

| Develops nano-structured absorbent materials for water remediation and consumer applications | | | | | | | | | |

| Series A Convertible Preferred Stock (acquired 2/17/10-10/24/11) | (I) (L3) | | | | 390,000 | | | $ | 435,000 | | | $ | 0 | |

| Series B Convertible Preferred Stock (acquired 11/8/13-6/25/14) | (I) (L3) | | | | 1,037,751 | | | 1,217,644 | | | 0 | |

| Secured Convertible Bridge Note, 8% PIK, (acquired 1/20/16, maturing 12/31/21) | (I) (L3) | | | | $ | 100,000 | | | 100,000 | | | 0 | |

| Secured Convertible Bridge Note, 8% PIK, (acquired 3/28/17, maturing 12/31/21) | (I) (L3) | | | | $ | 25,000 | | | 25,000 | | | 0 | |

| | | | | | | 1,777,644 | | | 0 | |

| | | | | | | | | |

The accompanying notes are an integral part of this unaudited consolidated schedule of investments.

19

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2021 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Securities (2) - | | | | | | | | | |

| 40.2% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Privately Held Securities (Illiquid) - | | | | | | | | | |

| 7.8% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Accelerator IV-New York Corporation (3)(7)(14) | | | Research & Consulting Services | | | | | | |

| Identifies and managing emerging biotechnology companies | | | | | | | | | |

| Series A Common Stock (acquired 7/21/14-12/12/18) | (I) (L3) | | | | 833,333 | | | $ | 0 | | | $ | 587,462 | |

| | | | | | | | | |

| Black Silicon Holdings, Inc. (3)(7)(10)(15) | | | Semiconductors | | | | | | |

| Holding company for interest in a company that develops silicon-based optoelectronic products | | | | | | | | | |

| Series A Convertible Preferred Stock (acquired 8/4/15) | (M) (L3) | | | | 233,499 | | | 750,000 | | | 0 | |

| Series A-1 Convertible Preferred Stock (acquired 8/4/15) | (M) (L3) | | | | 2,966,667 | | | 890,000 | | | 0 | |

| Series A-2 Convertible Preferred Stock (acquired 8/4/15) | (M) (L3) | | | | 4,207,537 | | | 2,445,000 | | | 0 | |

| Series B-1 Convertible Preferred Stock (acquired 8/4/15) | (M) (L3) | | | | 1,892,836 | | | 1,169,561 | | | 0 | |

| Series C Convertible Preferred Stock (acquired 8/4/15) | (M) (L3) | | | | 1,674,030 | | | 1,171,316 | | | 0 | |

| Secured Convertible Bridge Note, 8% PIK, (acquired 8/25/16, maturing 8/4/21) | (M) (L3) | | | | $ | 1,278,453 | | | 1,781,596 | | | 1,007,596 | |

| | | | | | | 8,207,473 | | | 1,007,596 | |

| | | | | | | | | |

| EchoPixel, Inc. (3)(4)(7) | | | Health Care Equipment | | | | | | |

| Develops virtual reality 3-D visualization software for life sciences and health care applications | | | | | | | | | |

| Series Seed Convertible Preferred Stock (acquired 6/21/13-6/30/14) | (I) (L3) | | | | 4,194,630 | | | 1,250,000 | | | 787,976 | |

| Series Seed-2 Convertible Preferred Stock (acquired 1/22/16) | (I) (L3) | | | | 1,476,668 | | | 500,000 | | | 281,094 | |

| Series A-2 Convertible Preferred Stock (acquired 3/23/17) | (I) (L3) | | | | 1,471,577 | | | 350,000 | | | 337,920 | |

| | | | | | | 2,100,000 | | | 1,406,990 | |

| | | | | | | | | |

The accompanying notes are an integral part of this unaudited consolidated schedule of investments.

20

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2021 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Securities (2) - | | | | | | | | | |

| 40.2% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Privately Held Securities (Illiquid) - | | | | | | | | | |

| 7.8% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Essential Health Solutions, Inc. (3)(7) | | | Health Care Technology | | | | | | |

| Develops software for information transfer amongst healthcare providers and consumers | | | | | | | | | |

| Common Stock (acquired 11/18/16) | (I) (L3) | | | | 200,000 | | | $ | 20 | | | $ | 0 | |

| Series A Convertible Preferred Stock (acquired 11/18/16) | (I) (L3) | | | | 2,750,000 | | | 2,750,000 | | | 44,975 | |

| Unsecured Convertible Bridge Note, 8%, (acquired 12/19/18, maturing 12/19/21) | (I) (L3) | | | | $ | 50,000 | | | 50,000 | | | 2,225 | |

| | | | | | | 2,800,020 | | | 47,200 | |

| | | | | | | | | |

| HALE.life Corporation (3)(4)(7) | | | Health Care Technology | | | | | | |

| Develops a platform to facilitate precision health and medicine | | | | | | | | | |

| Common Stock (acquired 3/1/16) | (I) (L3) | | | | 1,000,000 | | | 10 | | | 72,218 | |

| Series Seed-1 Convertible Preferred Stock (acquired 3/28/17) | (I) (L3) | | | | 11,000,000 | | | 1,896,920 | | | 1,098,079 | |

| Series Seed-2 Convertible Preferred Stock (acquired 12/28/18) | (I) (L3) | | | | 12,083,132 | | | 2,500,000 | | | 1,280,288 | |

| | | | | | | 4,396,930 | | | 2,450,585 | |

| | | | | | | | | |

| TARA Biosystems, Inc. (3)(4)(7) | | | Life Sciences Tools & Services | | | | | | |

| Develops human tissue models for toxicology and drug discovery applications | | | | | | | | | |

| Common Stock (acquired 8/20/14) | (I) (L3) | | | | 2,000,000 | | | 20 | | | 557,373 | |

| Series A Convertible Preferred Stock (acquired 3/31/17) | (I) (L3) | | | | 6,878,572 | | | 2,545,493 | | | 2,455,711 | |

| Series A-2 Convertible Preferred Stock (acquired 4/18/19) | (I) (L3) | | | | 208,577 | | | 100,000 | | | 78,191 | |

| | | | | | | 2,645,513 | | | 3,091,275 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Privately Held Securities (cost: $21,927,580) | | | | | | | | | $ | 8,591,108 | |

| | | | | | | | | |

The accompanying notes are an integral part of this unaudited consolidated schedule of investments.

21

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2021 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Securities (2) - | | | | | | | | | |

| 40.2% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Non-Controlled Affiliated Publicly Traded Securities - | | | | | | | | | |

| 32.4% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Potbelly Corporation (4)(16) | | | Restaurants | | | | | | |

| Operates a chain of sandwich shops | | | | | | | | | |

| Common Stock (acquired 6/24/19-2/10/21) | (M) (L1) | | | | 1,243,059 | | | $ | 5,097,814 | | | $ | 9,820,166 | |

| | | | | | | | | |

| Synalloy Corporation (4)(16) | | | Steel | | | | | | |

| Manufactures metals and chemicals | | | | | | | | | |

| Common Stock (acquired 12/7/20-5/25/21) | (M) (L1) | | | | 323,138 | | | 2,795,173 | | | 3,228,149 | |

| | | | | | | | | |

| Synchronoss Technologies, Inc. (4)(16) | | | Application Software | | | | | | |

| Provides white-label cloud storage, messaging and other digital analytic services | | | | | | | | | |

| Common Stock (acquired 7/17/20-6/25/21) | (M) (L1) | | | | 3,205,494 | | | 8,791,014 | | | 11,507,723 | |

| | | | | | | | | |

| TheMaven, Inc. (3)(4)(16) | | | Interactive Media & Services | | | | | | |

| Provides a shared digital publishing, advertising and distribution platform | | | | | | | | | |

| Series H Convertible Preferred Stock (acquired 6/27/19) (17) | (M) (L3) | | | | 1,320 | | | 2,000,000 | | | 2,943,589 | |

| Common Stock (acquired 12/18/20) | (M) (L3) | | | | 11,429,000 | | | 6,000,000 | | | 8,408,635 | |

| | | | | | | 8,000,000 | | | 11,352,224 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Publicly Traded Securities (cost: $24,684,001) | | | | | | | | | $ | 35,908,262 | |

| | | | | | | | | |

| Total Investments in Non-Controlled Affiliated Securities (cost: $46,611,581) | | | | | | | | | $ | 44,499,370 | |

| | | | | | | | | |

The accompanying notes are an integral part of this unaudited consolidated schedule of investments.

22

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2021 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Controlled Affiliated Privately Held Securities (2) - | | | | | | | | | |

| 0.1% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| LS180 Acquisition Holdings, LLC (3)(4) | | | Specialized Finance | | | | | | |

| Holding company for Special Purpose Acquisition Company (SPAC) interests | | | | | | | | | |

| Common Units (acquired 4/13/21) | (M) (L3) | | | | 1,300,000 | | | $ | 13,000 | | | $ | 13,000 | |

| Unsecured Promissory Note, 0% (acquired 5/10/21, maturing 12/31/21) | (M) (L3) | | | | $ | 50,000 | | | 50,000 | | | 50,000 | |

| | | | | | | 63,000 | | | 63,000 | |

| | | | | | | | | |

| Parabellum Acquisition Holdings, LLC (3)(4) | | | Specialized Finance | | | | | | |

| Holding company for Special Purpose Acquisition Company (SPAC) interests | | | | | | | | | |

| Common Units (acquired 4/22/21) | (M) (L3) | | | | 640,000 | | | 6,400 | | | 6,400 | |

| | | | | | | | | |

| Total Controlled Affiliated Privately Held Securities (cost: $69,400) | | | | | | | | | $ | 69,400 | |

| | | | | | | | | |

| Total Investments in Privately Held Securities and Publicly Traded Securities (cost: $83,222,365) | | | | | | | | | $ | 98,393,647 | |

| | | | | | | | | |

| Derivative Securities - | | | | | | | | | |

| 0.3% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Derivative Securities (2) - | | | | | | | | | |

| 0.0% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| NanoTerra, Inc. (3)(4)(10) | | | Research & Consulting Services | | | | | | |

| Develops surface chemistry and nano-manufacturing solutions | | | | | | | | | |

| Warrants for Series A-3 Preferred Stock expiring on 11/15/22 (acquired 11/15/12) | (I) (L3) | | | | 47,508 | | | $ | 35,403 | | | $ | 0 | |

| | | | | | | | | |

| OpGen, Inc. (4) | | | Biotechnology | | | | | | |

| Developing tools for genomic sequence assembly and analysis | | | | | | | | | |

| Warrants for the Purchase of Common Stock expiring 2/17/25 (acquired 5/5/15) | (I) (L3) | | | | 62 | | | 785 | | | 2 | |

| | | | | | | | | |

| Total Unaffiliated Derivative Securities (cost: $36,188) | | | | | | | | | $ | 2 | |

| | | | | | | | | |

The accompanying notes are an integral part of this unaudited consolidated schedule of investments.

23

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2021 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-Controlled Affiliated Derivative Securities (2) - | | | | | | | | | |

| 0.3% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Potbelly Corporation (3)(4) | | | Restaurants | | | | | | |

| Operates a chain of sandwich shops | | | | | | | | | |

| Warrants for the Purchase of Common Stock expiring 2/12/26 (acquired 2/10/21) | (I) (L3) | | | | 80,605 | | | $ | 224,849 | | | $ | 355,839 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Derivative Securities (cost: $224,849) | | | | | | | | | $ | 355,839 | |

| | | | | | | | | |

| Total Derivative Securities (cost: $261,037) | | | | | | | | | $ | 355,841 | |

| | | | | | | | | |

| Total Investments (cost: $83,483,402) | | | | | | | | | $ | 98,749,488 | |

| | | | | | | | | |

| Other Financial Instruments (18) - | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Rights to Payments (Illiquid) (2) - | | | | | | | | | |

| 5.7% of net assets at value | | | | | | | | | |

| | | Biotechnology | | | | | | |

| Rights to Milestone Payments from Acquisition of BioVex Group, Inc. (acquired 3/4/11) (3)(4)(7)(19) | (I) (L3) | | | | $ | 548,998 | | | $ | 548,998 | | | $ | 407,668 | |

| | | | | | | | | |

| | | Pharmaceuticals | | | | | | |

| Rights to Milestone Payments from Acquisition of Petra Pharma Corporation (acquired 5/14/20) (3)(4)(7)(20) | (I) (L3) | | | | $ | 5,859,686 | | | 5,859,686 | | | 5,934,205 | |

| | | | | | | | | |

| Total Unaffiliated Rights to Payments (cost: $6,408,684) | | | | | | | | | $ | 6,341,873 | |

| | | | | | | | | |

| Total Investments in Privately Held Securities and Publicly Traded Securities and Derivative Securities and Other Financial Instruments (cost: $89,892,086) | | | | | | | | | $ | 105,091,361 | |

The accompanying notes are an integral part of this unaudited consolidated schedule of investments.

24

180 DEGREE CAPITAL CORP.

NOTES TO CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2021

(UNAUDITED)

Notes to Consolidated Schedule of Investments

(1)See Note 2. Summary of Significant Accounting Policies: Portfolio Investment Valuations.

(2)Investments in unaffiliated securities consist of investments in which the Company owns less than five percent of the voting shares of the portfolio company. Investments in non-controlled affiliated securities consist of investments in which the Company owns five percent or more, but less than 25 percent, of the voting shares of the portfolio company, or where the Company controls one or more seats on the portfolio company’s board of directors but do not control the company. Investments in controlled affiliated securities consist of investments in which the Company owns 25 percent or more of the outstanding voting rights of the portfolio company or otherwise control the company, including control of a majority of the seats on the board of directors, or more than 25 percent of the seats on the board of directors, with no other entity or person in control of more director seats than us.

(3)The Company is subject to legal restrictions on the sale of all or a portion of our investment(s) in this company. The total amount of restricted securities held is $46,815,813, or 42.3 percent of net assets.

(4)Represents a non-income producing investment. Investments that have not paid dividends or interest within the last 12 months or are on non-accrual status for at least 12 consecutive months are considered to be non-income producing.

(5)The Company received LLC Interests of 1.25 percent in AutoTech Ventures Management I, LLC ("AutoTech") pursuant to an Administrative Services Agreement between us and AutoTech and due to us following the termination of a former employee of the Company. These LLC Interests were separate from the compensation received for providing the administrative services under the agreement that were paid in cash. The LLC interests have a capital percentage of 0 percent.

(6)The Company initially invested in D-Wave Systems, Inc. starting in 2008 and through 2014, acquiring various classes of preferred stock. On April 14, 2020, D-Wave Systems, Inc. reorganized as a subsidiary of a new company, DWSI Holdings, Inc. ("DWSI"). As part of the reorganization, all of the outstanding stock of D-Wave Systems, Inc., was consolidated into a single class of preferred stock of DWSI on a one-for-one basis. DWSI then completed a 1-for-5 reverse stock split. In January 2021, D-Wave Systems completed an amalgamation of the reorganized business and changed its corporate name back to D-Wave Systems, Inc. The company is located and doing business primarily in Canada.