UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-07074

| | |

| 180 DEGREE CAPITAL CORP. |

| (Exact Name of Registrant as Specified in Its Charter) |

| | | | | | | | |

| 7 N. Willow Street, Suite 4B, Montclair NJ | | 07042 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | |

Daniel B. Wolfe

President and Chief Financial Officer

180 Degree Capital Corp.

7 N. Willow Street, Suite 4B

Montclair, NJ 07042 |

| (Name and address of agent for service) |

|

Copy to:

John J. Mahon, Esq.

Proskauer Rose, LLP

1001 Pennsylvania Avenue, NW

Suite 600 South

Washington, DC 20004-2533

(202) 416-6828 |

Registrant's telephone number, including area code: (973) 746-4500

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Report to Shareholders.

Q4 2023 Shareholder Letter

Fellow Shareholders:

This “recession," which has been one of the drivers of capital away from risk assets to perceived safer assets, has been the most fun and awesome one ever. Persistent predictions of a return to arguably more normal interest rates have not led to an economic calamity. Instead, GDP rose 3.1%, wages and salaries grew 4.7%, real private fixed investment in manufacturing structures reached all-time highs and employment remains strong. I didn’t live through the 1929 recession, but I did experience the near depression in 2008, and 2023 seemed eerily similar to those years…. NOT!

Despite strong macroeconomic trends in 2023, somehow a basket of microcap companies that comprise the Russell Microcap Index underperformed the NASDAQ 100 by over 4600 basis points! In our last shareholder letter, we incorporated a plethora of charts showing that microcap companies are historically inexpensive and undervalued relative to larger-sized companies. While substantially all of those data and charts remain applicable today, I’m not going to regurgitate what was in that letter that you can find at https://ir.180degreecapital.com/financial-results. Instead, I’ll note commentary regarding Q4 2023 from Royce Investment Partners, who we hold in high regard:

Valuations for Small-Cap Are Highly Attractive vs. Large-Cap

We think it bears repeating that, even with a terrific 4Q23 and a positive return in 2023, the Russell 2000 finished the year well shy of its 11/8/21 peak—while large-caps continued to establish new highs in 4Q23. In fact, it’s been 563 days since the current cycle low for the Russell 2000—the third longest span without recovering the prior peak on record.

Fallout from the Internet Bubble saw small-caps need 456 days from their trough to match their previous peak, while it took 704 days for small-caps to recover their prior peak following their trough in the 2008-09 Financial Crisis. Each of these periods saw dramatic developments: the implosion of high-flying technology stocks in 2000-02 and a global financial catastrophe in 2008-09. The current period has seen ample uncertainty, and a record pace of interest rate increases yet lacks the existential threats that characterized the Internet Bubble and, even more so, the Financial Crisis. The latter period also saw less bifurcation between small- and large-cap returns. Yet based on our preferred index valuation metric of enterprise value to earnings before interest and taxes, or EV/EBIT, the Russell 2000 finished 2023 not far from its 25-year low relative to the Russell 1000.

Russell 2000 vs. Russell 1000 Median LTM EV/EBIT¹ (ex. Negative EBIT Companies)

12/31/98-12/31/23

1Last twelve months Enterprise Value/Earnings Before Interest and Taxes

Similarly, small-cap value continued to sell at a below average valuation relative to small-cap growth at the end of the year, as measured by EV/EBIT. Micro-cap stocks also remained very attractively valued relative to large-cap based on EV/EBIT. As small-cap specialists, we see these gaps in valuation and long-term performance as revealing the considerable long-term opportunities that still exist within the small- and micro-cap asset classes—especially when stacked against their large- and mega-cap counterparts.

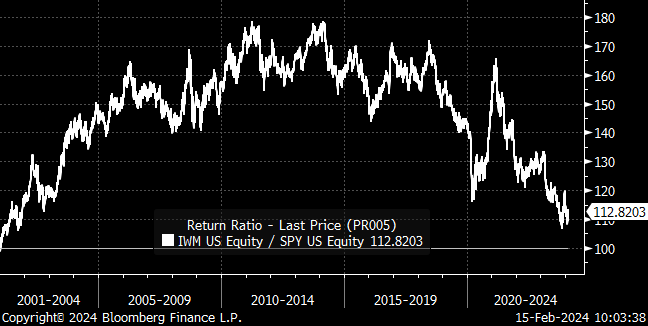

Here is one chart we shared in last quarter’s shareholder letter that we thought would be worth updating and showing again.

Even with the increases in small and microcapitalization stocks in Q4 2023, the IWM/SPY ratio remains at historical lows. We continue to believe that this ratio says nothing about the fundamentals of the businesses that comprise each index, given those fundamentals have held up better for many microcap companies than the index performance would suggest.

We think we are at the end of the Fed hiking cycle. We are not in the camp that the Fed will be cutting rates anytime soon, because we believe the economy will continue to show the resilience that it showed last year. That, in our view, is a positive rather than a negative. Our portfolio companies do not require lower rates to execute and build value for shareholders. They benefit from the types of positive economic trends we saw in 2023 and continue to see in the beginning of 2024. And against that backdrop, we expect that many of our holdings which are trading at historically low valuation levels, have a long runway to rise in value and help us increase our net asset value per share (“NAV”). Let’s look at a few of our current favorite names.

Potbelly Corporation (PBPB)

We have been investors in PBPB since 2019. PBPB is a fast-casual restaurant chain that sells sandwiches, salads, soups and other lunch focused items at company-owned and franchised locations. We have discussed PBPB in detail in prior shareholder letters and whitepapers, so we won’t rehash the entire story here aside from saying we believe PBPB has strong brand recognition, high-quality products, a healthy balance sheet and one of the best management teams we have ever invested in. PBPB has 425 locations, including 75 franchised in 33 states plus the District of Columbia. Additionally, PBPB recently announced that it has development agreements for almost 200 additional shops.

For 2024, we see several potential value-creating catalysts that we believe could push the stock price substantially higher. First, the company has said that it expects to open 40 new franchise stores this coming year, which represents close to 10% growth. Additionally, PBPB is projecting continued growth in average unit volume, shop level margins and adjusted EBITDA margins. Lastly, management expects material generation of positive cash flows that will enable various options for capital allocation including repayment of expensive debt, stock buybacks and/or other forms of return of capital.

Investors are starting to wake up to PBPB’s momentum entering 2024. Should this momentum continue, we believe that PBPB will command a common franchise-level multiple of enterprise value to EBITDA in the mid-to-high teens from its current low teens multiple. This multiple expansion combined with the cash flow and earnings power of the remade business could lead to further material appreciation in PBPB’s common stock.

Synchronoss Technologies, Inc. (SNCR)

SNCR provides white-label technology that enables large corporations to offer customers cloud-based storage of personal data. SNCR’s platform powers the personal cloud offerings of a number of Tier 1 companies including Verizon, SoftBank, AT&T, Assurant, British Telecom and Tracfone under long term contracts. We first invested in SNCR as part of an underwritten financing in June of 2021 that allowed SNCR to pay off its punitive preferred stock and recapitalize the company with reduced interest expense, while also providing flexibility going forward to execute on strategic options for the business. The first of these strategic alternatives was completed in Q4 2023 with the sale of SNCR’s non-core messaging and digital businesses. SNCR is now a pure-play, cloud-focused business with high margins and is on the cusp of generating significant free cash flows.

Our bullish view for 2024 is centered around a number of catalysts that we believe will improve SNCR’s balance sheet and demonstrate the operating leverage of the business. First, SNCR has stated that it expects to receive approximately $28 million from a tax refund at some point in 2024. This inflow of capital will allow SNCR to pay down a portion of its relatively

expensive outstanding preferred stock and/or debt that matures in June 2026. Second, SNCR is expecting to return to top-line revenue growth after the runoff of historical deferred revenue and continued growth in subscribers at its largest customer, Verizon, and its newest customer, Softbank. Third, the end of non-recurring charges related to restructuring and prior litigation and corresponding settlements coupled with revenue growth and a material reduction in interest paid on its outstanding debt should lead to material free cash flow generation in 2024 that we believe could grow substantially in 2025. Lastly, we should note that in December 2023 we were asked to join SNCR’s Board of Directors to help with the company’s execution of its next phase of growth.

As we look at what this might mean for the stock price of SNCR, it ended 2023 at $6.21, which equated to a multiple of enterprise value to estimated 2024 EBITDA of approximately 5.6x. This multiple declines to approximately 5.2x if SNCR receives the tax refund and uses it primarily to pay down debt. We do not believe a cloud-focused business with 85-90% recurring revenue, 70-75% gross margins, 25%+ EBITDA margins that also generates positive free cash flow should command such a low multiple. In our opinion, a more appropriate multiple would be in the double digits. SNCR recently reported the completion of significant cost savings initiatives along with strong performance in Q4 2023 and the stock responded positively. We believe this is just the start for SNCR and that 2024 will be a turning point for SNCR both in terms of its business and how investors value SNCR’s common stock.

comScore, Inc. (SCOR)

Our initial investment in SCOR took place in 2021, following its recapitalization by Charter, Cerberus and Liberty Media (Qurate). Our original thesis for our investment was centered on multiple factors including our beliefs that: (i) SCOR was a company with uniquely competitive media measurement offerings and proprietary data; (ii) SCOR’s new investors could help with improved execution, financial performance and overall growth; and (iii) SCOR traded at a significant discount to its peers.

While SCOR’s business has improved dramatically under new management with 33% EBITDA growth over the last two years, SCOR’s stock has declined precipitously. We believe this is due to poor corporate governance and uncertainty around SCOR’s capital structure. As a result, we have ramped up our activism significantly through the nomination of Matthew F. McLaughlin as a director nominee for consideration at SCOR’s upcoming annual meeting of stockholders. Matt is a retired advertising technology executive and Naval officer. Most recently, he served as Chief Operating Officer of DoubleVerify Holdings, Inc. (NYSE: DV) (“DoubleVerify”), a software platform for digital media measurement and analytics, from 2011 to March 2022. As COO of DoubleVerify, Matt directed its Product, Engineering and Sales Operations activity, including managing over half the company’s employees. Given SCOR’s struggles with, and focus on, improving its digital offerings, we could think of nobody more useful to the SCOR Board and management than Matt. Matt is available and happy to speak with any SCOR stockholder that wishes to speak with him so they can judge for themselves whether he is qualified and should serve on SCOR’s Board. While we are actively preparing to run a competitive proxy campaign to support his candidacy, we hope SCOR’s Board will realize the complementary skill set that we believe he can bring to help build value for all of SCOR’s stakeholders and that a competitive proxy contest will not be required.

As we look forward to 2024, we see a number of potential value-creating catalysts (in addition to our activism) that could lead to material appreciation in the stock. These potential catalysts include: (i) SCOR’s preferred stockholders taking steps to demonstrate an alignment of interests across all stakeholders of the company; (ii) SCOR demonstrating the ability to consistently generate double-digit EBITDA margins; and (iii) a return to growth for SCOR’s digital business. Assuming SCOR can continue to generate mid-teens EBITDA in 2024, then its common stock is trading at just 4.7x enterprise value to EBITDA and 0.75x enterprise value to revenue; we believe this will ultimately prove to be an attractive entry price. We do not believe that either of these multiples are appropriate for a company with unique data assets that generate positive cash flows. We believe a more appropriate multiple would be in the double-digit range. We firmly believe that improvements in SCOR’s corporate governance combined with improving financial metrics and the demonstration of alignment of all stakeholders can lead to material appreciation in SCOR’s common stock.

The Arena Group Holdings, Inc. (AREN)

We have been significant shareholders of AREN since June 2019. AREN is a media company that employs a technology platform that allows creators and publishers to publish and monetize content alongside anchor brands including Sports Illustrated, TheStreet, Parade, Men’s Journal, and HubPages to build their businesses. AREN’s content is distributed across a diverse portfolio of over 265 brands, reaching over 100 million users monthly. Throughout the history of our investment there have been periods where we engaged in constructive activism that resulted in what we believe were improvements in management and corporate governance. The advertising market in 2023 was challenging, but AREN’s business held up better than many other companies.

In November 2023, AREN signed a definitive agreement to merge with Bridge Media Networks, LLC (“Bridge Media”), a media group that includes a portfolio of over-the-air television stations, national television networks, streaming platforms and websites for delivering news, sports, automotive and travel content. Bridge Media is a wholly owned subsidiary of Simplify Inventions, LLC, which is owned by Manoj Bhargava, the founder of 5-hour Energy®. Under the terms of the merger, entities associated with Mr. Bhargava will invest $50 million in the combined entity and the consumer brands owned by Mr. Bhargava will commit to approximately $60 million in guaranteed advertising revenue for AREN. Subsequent to the signing of this definitive agreement, Mr. Bhargava purchased the debt and equity of AREN owned by B. Riley and then invested an additional $12 million for working capital purposes while the company seeks the required shareholder and regulatory approvals to complete the merger.

While the start of 2024 has presented additional challenges for AREN, Mr. Bhargava has a history of building significant value across multiple industries. We have had opportunities to speak with both Mr. Bhargava and the new CEO of AREN, Cavitt Randall, and appreciate their candor and desire to build a sustainable business that grows profitably. AREN was the largest source of declines in our portfolio in 2023. We look forward to the completion of the merger in 2024 and to what we believe can be significant value creation under new management led by Mr. Bhargava and Mr. Randall.

Conclusion

I have been managing money for over 30 years and have been an investor or portfolio manager since 1988. Never in my life have I been more convinced that we own a collection of companies that I believe have the potential to rise materially in value as much as the portfolio TURN has put together as we start 2024. We are also at a point where I believe our constructive activism will make a difference in this value creation. While the last 2 years have been incredibly frustrating and disappointing, I have had the 30+ year experience of knowing that challenging performance periods happen. During these periods, it is crucial that you don’t shy away from talking about them, you don’t become over-emotional about them, and you stick to your knitting and process no matter how painful the period can be. My dear friend Phil Appel, who I believe to be one of Merrill Lynch’s best financial advisors and one of the smartest people I have ever met (also a heck of a driver of the golf ball, though not a great putter) sent me a quote years ago that I hold near and dear to my heart:

“The one willing to look stupidest the longest wins.”

We feel stupid on the one hand, yet on the other, we couldn’t be more optimistic about what we own and convinced significant value appreciation is possible in the next few years.

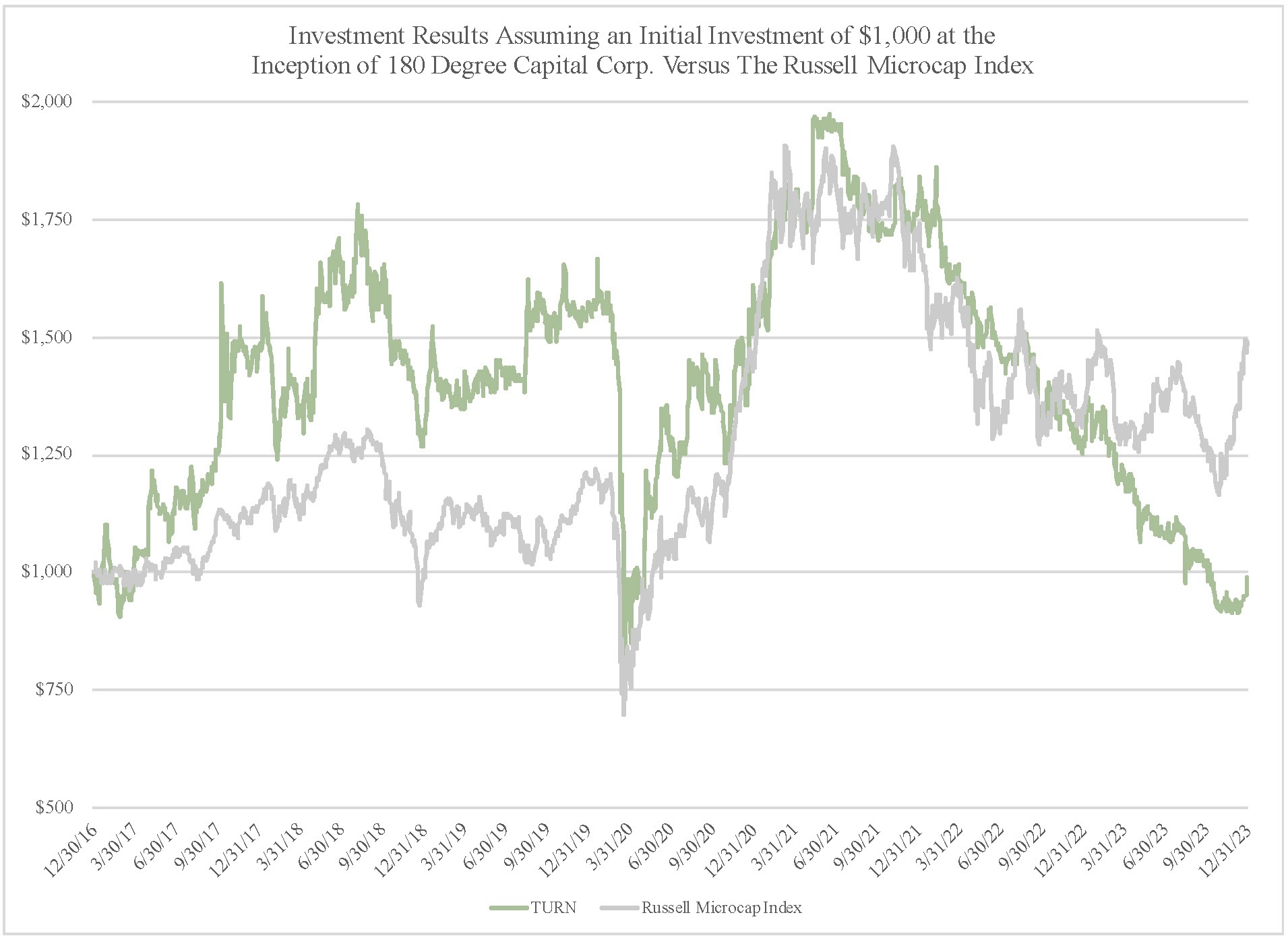

The fourth quarter of 2023 was the start of what we believe will be a return to risk asset classes, including the microcapitalization stocks in which we invest. Our +6.9% gross total return in our public portfolio was the primary contributor to the growth of our NAV per share from $4.91 to $5.02. Our assets on our balance sheet are now almost 100% comprised of investments in public companies and cash. Please see slides that we have posted on our website at https://ir.180degreecapital.com/financial-results for details of the sources of change in our portfolio during Q4 2023, the full year and inception to date. On the macroeconomic front, the resilience of the US economy combined with the apparent end of the Fed’s tightening cycle and likely future reductions in interest rates should be one tailwind for our investments in general in 2024. For 180, we believe 2024 will be a year defined by our constructive activism and by long-awaited catalysts at certain of our portfolio companies that together could lead to material value creation for 180 Degree Capital’s stockholders.

180 Degree Capital’s constructive activism means working with management teams and/or boards of directors of our portfolio companies to build value for all stakeholders in those businesses. We do not have the hubris to believe we know the businesses of our investee companies better than their management teams and boards. We do have complementary skill sets and contacts that can help unlock stunted value. We believe this complementarity is what led to the invitation to join the Board of Directors of SNCR. We have rolled up our sleeves to help SNCR’s management and board wherever possible and could not be more excited about the opportunity for value creation that we believe exists for SNCR. It is unfortunate that the Board of Directors of SCOR does not have the same openness and humility to understand they do not have all the answers in regard to fixing the destruction of value that has occurred under their watch. We believe our nominee, Matt McLaughlin, has both relevant industry experience for where SCOR is heading with its business and can be an advocate for proper corporate governance, particularly for common stockholders, as a significant common stockholder himself. We believe our constructive activism is not only a differentiated investment approach, but also can be an important part of the ultimate unlocking of value for our portfolio holdings and creation of value for 180 Degree Capital’s stockholders.

As we noted in a press release on February 1, 2024, the discount of our NAV to our stock price was approximately 26% as of the end of January 2024. This discount equates to a NAV as of the end of January 2024 that was approximately 8% higher than at the end of 2023. We established the Discount Management Program to make it clear that TURN’s management and Board are serious about our intentions to narrow this discount. We collectively own almost 12% of outstanding shares, and this ownership continues to grow solely through open market purchases. We are laser-focused on creating value for all stockholders of TURN through growth of our NAV and the narrowing of the discount.

As always, thank you for your support.

Best Regards,

Kevin Rendino

Chief Executive Officer

Forward-Looking Statements and Disclaimers

This shareholder letter may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company's current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this press release. Please see the Company's securities filings filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company's business and other significant factors that could affect the Company's actual results. Except as otherwise required by Federal securities laws, the Company

undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The reference and link to any websites have been provided as a convenience, and the information contained on such website is not incorporated by reference into this shareholder letter. 180 Degree Capital Corp. is not responsible for the contents of third-party websites. The information discussed above is solely the opinion of 180 Degree Capital Corp. Any discussion of past performance is not an indication of future results. Investing in financial markets involves a substantial degree of risk. Investors must be able to withstand a total loss of their investment. The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions.

Source: Bloomberg

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES |

| | | | | |

| | December 31, 2023 |

| ASSETS | |

| Investments in securities and other financial instruments, at value: | |

| Unaffiliated publicly traded equity and equity-related securities (cost: $30,544,168) | $ | 21,305,497 | |

| Unaffiliated legacy privately held equity and equity-related securities (cost: $819,619) | 283,627 | |

| Non-controlled affiliated publicly traded equity and equity-related securities (cost: $40,836,951) | 26,894,724 | |

| Non-controlled affiliated legacy privately held equity and equity-related securities (cost: $6,496,930) | 201,439 | |

| Unaffiliated derivative securities (cost: $112,854) | 0 | |

| Non-controlled affiliated derivative securities (cost: $224,849) | 480,114 | |

| Unaffiliated rights to payments (cost: $1,149,799) | 1,356,391 | |

| Unaffiliated money market fund securities (cost: $96,445) | 96,445 | |

| Cash | 282,167 | |

| Prepaid expenses | 218,089 | |

| Lease asset | 36,078 | |

| Other assets | 16,378 | |

| Total assets | $ | 51,170,949 | |

| LIABILITIES & NET ASSETS | |

| |

| Post-retirement plan liabilities | $ | 627,286 | |

| Accounts payable and accrued liabilities | 289,425 | |

| Lease obligation | 36,078 | |

| Total liabilities | $ | 952,789 | |

| Commitments and contingencies (Note 10) | |

| Net assets | $ | 50,218,160 | |

| Net assets are comprised of: | |

| Preferred stock, $0.10 par value, 2,000,000 shares authorized; none issued | $ | 0 | |

| Common stock, $0.03 par value, 15,000,000 shares authorized; 11,541,079 issued | 334,594 | |

| Additional paid in capital | 105,597,715 | |

| Total accumulated distributable loss | (49,453,226) | |

| Treasury stock, at cost 1,540,938 shares | (6,260,923) | |

| Net assets | $ | 50,218,160 | |

| Shares outstanding | 10,000,141 | |

| Net asset value per outstanding share | $ | 5.02 | |

The accompanying notes are an integral part of these consolidated financial statements.

8

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF OPERATIONS |

| | | | | |

| Year Ended

December 31, 2023 |

| Income: | |

| Dividend | $ | 28,156 | |

| Interest-Unaffiliated money market fund securities | 26,837 | |

| Total income | 54,993 | |

| Operating fees and expenses: | |

| Salaries, bonus and benefits | 1,972,850 | |

| Professional | 768,287 | |

| Administration and operations | 255,356 | |

| Directors | 253,517 | |

| Insurance | 231,298 | |

| Software | 207,949 | |

| Rent | 36,245 | |

| Custody | 31,940 | |

| Other | 8,159 | |

| Total operating expenses | 3,765,601 | |

| Net investment loss before income tax expense | (3,710,608) | |

| Income tax expense | 833 | |

| Net investment loss | (3,711,441) | |

| Net realized gain (loss) from investments: | |

| Unaffiliated publicly traded equity and equity-related securities | 4,919,236 | |

| Unaffiliated legacy privately held equity and equity-related securities | (8,252,168) | |

| Non-controlled affiliated publicly traded equity and equity-related securities | 1,009,539 | |

| Controlled affiliated equity and equity-related securities | (2,923,003) | |

| Unaffiliated rights to payments | (548,998) | |

| Net realized loss from investments | (5,795,394) | |

| Sale of equity-180 Degree Capital BD, LLC (Note 2) | 100,000 | |

| Net realized loss | (5,695,394) | |

| Change in unrealized (depreciation) appreciation on investments: | |

| Unaffiliated publicly traded equity and equity-related securities | (5,699,016) | |

| Unaffiliated legacy privately held equity and equity-related securities | 2,060,982 | |

| Non-controlled affiliated publicly traded equity and equity-related securities | (1,570,022) | |

| Non-controlled affiliated legacy privately held equity and equity-related securities | 42,553 | |

| Controlled affiliated equity and equity-related securities | 216,431 | |

| Unaffiliated rights to payments | 684,316 | |

| Net change in unrealized depreciation on investments | (4,264,756) | |

| Net realized loss and change in unrealized depreciation on investments | (9,960,150) | |

| Net decrease in net assets resulting from operations | $ | (13,671,591) | |

The accompanying notes are an integral part of these consolidated financial statements.

9

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF CASH FLOWS |

| | | | | |

| Year Ended

December 31, 2023 |

| Cash flows provided by operating activities: | |

| Net decrease in net assets resulting from operations | $ | (13,671,591) | |

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash provided by operating activities: | |

| Net realized loss | 5,695,394 | |

| Net change in unrealized depreciation on investments | 4,264,756 | |

| Depreciation of fixed assets | 9,073 | |

| Purchase of unaffiliated publicly traded equity and equity-related securities | (13,494,045) | |

| Purchase of non-controlled affiliated publicly traded equity and equity-related securities | (5,110,813) | |

| Purchase of unaffiliated money market fund securities, net | (96,445) | |

| Proceeds from sale of unaffiliated publicly traded equity and equity-related securities | 19,757,440 | |

| Proceeds from sale of unaffiliated legacy privately held equity and equity-related securities | 37,175 | |

| Proceeds from sale of non-controlled affiliated publicly traded and equity-related securities | 2,296,280 | |

| Distribution from unaffiliated rights to payments | 1,621,741 | |

| Proceeds from sale equity of 180 Degree Capital BD, LLC | 100,000 | |

| Changes in assets and liabilities: | |

| Decrease in receivable from managed funds | 152,151 | |

| Decrease in receivable from securities sold | 108,512 | |

| Decrease in prepaid expenses | 32,350 | |

| Increase in other assets | (313) | |

| Decrease in other receivables | 2,278 | |

| Decrease in post-retirement plan liabilities | (18,351) | |

| Decrease in accounts payable and accrued liabilities | (218,792) | |

| Decrease in payable for securities purchased | (180,971) | |

| Net cash provided by operating activities | 1,285,829 | |

| Cash flows from investing activities | |

| Purchase of fixed assets | (3,723) | |

| Net cash used in investing activities | (3,723) | |

| Cash flows from financing activities | |

| Purchase of treasury stock | (1,655,398) | |

| Net cash used in financing activities | (1,655,398) | |

| Net decrease in cash | (373,292) | |

| Cash at beginning of the year | 655,459 | |

| Cash at end of the year | $ | 282,167 | |

| Supplemental disclosures of cash flow information: | |

| Income taxes paid | $ | 833 | |

| |

The accompanying notes are an integral part of these consolidated financial statements.

10

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | | | | | | | |

| Year Ended December 31, 2023 | | Year Ended December 31, 2022 |

| | | |

| Changes in net assets from operations: | | | |

| Net investment loss | $ | (3,711,441) | | | $ | (2,583,203) | |

| Net realized (loss) gain | (5,695,394) | | | 2,204,654 | |

| Net change in unrealized depreciation on investments | (4,264,756) | | | (44,652,254) | |

| Net decrease in net assets resulting from operations | (13,671,591) | | | (45,030,803) | |

| | | |

| Changes in net assets from capital stock transactions: | | | |

| Treasury stock purchase | (1,655,398) | | | 0 | |

| Net decrease in net assets resulting from capital stock transactions | (1,655,398) | | | 0 | |

| Net decrease in net assets | (15,326,989) | | | (45,030,803) | |

| Net Assets: | | | |

| Beginning of the year | 65,545,149 | | | 110,575,952 | |

| End of the year | $ | 50,218,160 | | | $ | 65,545,149 | |

| | | |

The accompanying notes are an integral part of these consolidated financial statements.

11

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED FINANCIAL HIGHLIGHTS |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended Dec. 31, 2023 | | Year Ended Dec. 31, 2022 | | Year Ended Dec. 31, 2021 | | Year Ended Dec. 31 2020# | | Year Ended Dec. 31 2019# | | | | | | | |

| | | | | | | | | | | | | | | | |

| Per Share Operating Performance: | | | | | | | | | | | | | | | | |

| Net asset value per share, beginning of the year | $ | 6.32 | | | $ | 10.66 | | | $ | 9.28 | | | $ | 9.18 | | | $ | 7.92 | | | | | | | | |

Net investment loss* | (0.38) | | | (0.25) | | | (0.33) | | | (0.05) | | | (0.48) | | | | | | | | |

Net realized (loss) gain* | (0.56) | | | 0.21 | | | 0.20 | | | (0.11) | | | 0.93 | | | | | | | | |

Net change in unrealized (depreciation) appreciation on investments and options*1 | (0.42) | | | (4.30) | | | 1.51 | | | 0.26 | | | 0.81 | | | | | | | | |

| Total from investment operations* | (1.36) | | | (4.34) | | | 1.38 | | | 0.10 | | | 1.26 | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net increase as a result of purchase of treasury stock | 0.06 | | | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | | | | | | |

| Net (decrease) increase in net asset value | (1.30) | | | (4.34) | | | 1.38 | | | 0.10 | | | 1.26 | | | | | | | | |

| Net asset value per share, end of the year | $ | 5.02 | | | $ | 6.32 | | | $ | 10.66 | | | $ | 9.28 | | | $ | 9.18 | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Stock price per share, end of the year | $ | 4.10 | | | $ | 5.28 | | | $ | 7.35 | | | $ | 6.66 | | | $ | 6.45 | | | | | | | | |

| Total return based on stock price | (22.35) | % | | (28.16) | % | | 10.36 | % | | 3.26 | % | | 22.86 | % | | | | | | | |

| Supplemental Data: | | | | | | | | | | | | | | | | |

| Net assets, end of the year | $ | 50,218,160 | | | $ | 65,545,149 | | | $ | 110,575,952 | | | $ | 96,317,794 | | | $ | 95,213,639 | | | | | | | | |

| Ratio of expenses to average net assets | 6.39 | % | | 3.20 | % | ^ | 5.87 | % | ^ | 4.61 | % | ^ | 6.42 | % | ^ | | | | | | |

| Ratio of net investment loss to average net assets | (6.30) | % | | (2.88) | % | | (3.26) | % | | (0.59) | % | | (5.42) | % | | | | | | | |

| Portfolio turnover | 31.56 | % | | 30.95 | % | | 44.46 | % | | 35.16 | % | | 30.17 | % | | | | | | | |

| Number of shares outstanding, end of the year | 10,000,141 | | | 10,373,820 | | | 10,373,820 | | | 10,373,820 | | | 10,373,820 | | | | | | | | |

# Reflect a 1-for-3 reverse stock split that became effective on January 4, 2021.

* Based on average shares outstanding.

^ The Company has entered into an expense offsetting arrangement with one of its unaffiliated brokers relating to broker fees paid. The total broker fee charged to the Company was applied as a credit to fees charged by an affiliate of the unaffiliated broker who the Company subscribes to for data services billed during the year. The Company received an offset to expense totaling approximately $20,600, $84,800, $31,900, and $15,700, with that broker for the years ended December 31, 2022-2019, respectively.

1 Net unrealized losses include rounding adjustments to reconcile change in net asset value per share.

The accompanying notes are an integral part of these consolidated financial statements.

12

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2023 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 43.2% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Publicly Traded Equity and Equity-Related Securities - | | | | | | | | | |

| 42.4% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Ascent Industries Co. (3) | | | Steel | | | | | | |

| Manufactures metals and chemicals | | | | | | | | | |

| Common Stock | (L1) | | | | 305,380 | | $ | 3,240,810 | | | $ | 2,919,433 | |

| | | | | | | | | |

| Brightcove, Inc. (3) | | | Internet Services & Infrastructure | | | | | | |

| Provides video hosting and publishing services | | | | | | | | | |

| Common Stock | (L1) | | | | 319,079 | | 1,473,621 | | | 826,415 | |

| | | | | | | | | |

| Commercial Vehicle Group, Inc. (3) | | | Construction Machinery & Heavy Trucks | | | | | | |

| Supplier of vehicle components | | | | | | | | | |

| Common Stock | (L1) | | | | 322,418 | | 1,818,556 | | | 2,260,150 | |

| | | | | | | | | |

| D-Wave Quantum, Inc. (3)(4) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Develops high-performance quantum computing systems | | | | | | | | | |

| Common Stock | (L1) | | | | 770,000 | | 1,045,355 | | | 677,677 | |

| | | | | | | | | |

| Intevac, Inc. (3) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Develops solutions for the application and engineering of thin-films | | | | | | | | | |

| Common Stock | (L1) | | | | 939,337 | | 4,356,573 | | | 4,057,936 | |

| | | | | | | | | |

| Lantronix, Inc. (3) | | | Communications Equipment | | | | | | |

| Provides secure data access and management solutions | | | | | | | | | |

| Common Stock | (L1) | | | | 552,048 | | 2,766,859 | | | 3,235,001 | |

| | | | | | | | | |

| Mama's Creations, Inc. (3) | | | Packaged Foods & Meats | | | | | | |

| Sells specialty pre-prepared and refigerated foods | | | | | | | | | |

| Common Stock | (L1) | | | | 547,900 | | 1,423,893 | | | 2,690,189 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

13

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2023 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 43.2% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Publicly Traded Equity and Equity-Related Securities - | | | | | | | | | |

| 42.4% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Quantum Corporation (3) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Provides high-density data storage and high-speed data processing solutions | | | | | | | | | |

| Common Stock | (L1) | | | | 3,221,192 | | $ | 8,787,175 | | | $ | 1,124,196 | |

| | | | | | | | | |

| Rayonier Advanced Materials, Inc. (3) | | | Specialty Chemicals | | | | | | |

| Produces specialty cellulose fibers | | | | | | | | | |

| Common Stock | (L1) | | | | 530,000 | | 2,789,675 | | | 2,146,500 | |

| | | | | | | | | |

| RF Industries, Ltd. (3) | | | Electronic Manufacturing Services | | | | | | |

| Provides products that enable wired and wireless communications | | | | | | | | | |

| Common Stock | (L1) | | | | 450,000 | | 2,841,651 | | | 1,368,000 | |

| | | | | | | | | |

| Total Unaffiliated Publicly Traded Equity and Equity-Related Securities (cost: $30,544,168) | | | | | | | | | $ | 21,305,497 | |

| | | | | | | | | |

| Investments in Unaffiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 43.2% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Money Market Fund Securities - | | | | | | | | | |

| 0.2% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| JPMorgan 100% U.S. Treasury Securities Money Market Mutual Fund | | | | | | | | | |

| Institutional Class Shares (Yield 5.23%) | (L1) | | | | 96,445 | | | $ | 96,445 | | | $ | 96,445 | |

| | | | | | | | | |

| Total Unaffiliated Money Market Fund Securities (cost: $96,445) | | | | | | | | | $ | 96,445 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

14

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2023 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 43.2% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Legacy Privately Held Equity and Equity-Related Securities - | | | | | | | | | |

| 0.6% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| AutoTech Ventures Management I, LLC (3)(5)(6) | | | Asset Management & Custody Banks | | | | | | |

| Venture capital investing in automotive-related companies | | | | | | | | | |

| LLC Interests (acquired 12/1/17) | (M) (L3) | | | | 0 | | $ | 0 | | | $ | 150,000 | |

| | | | | | | | | |

| Magnolia Neurosciences Corporation (3)(5)(7)(8) | | | Pharmaceuticals | | | | | | |

| Develops novel therapeutics for treatment of neurodegeneration | | | | | | | | | |

| Series A Convertible Preferred Stock (acquired 8/3/18) | (I) (L3) | | | | 862,872 | | 711,361 | | | 118,536 | |

| | | | | | | | | |

| Ravenna Pharmaceuticals, Inc. (3)(5)(7)(8)(9) | | | Pharmaceuticals | | | | | | |

| Holding company for intellectual property in oncology therapeutics | | | | | | | | | |

| Common Stock (acquired 5/14/20-8/26/21) | (M) (L3) | | | | 2,785,274 | | 108,258 | | | 15,091 | |

| | | | | | | | | |

| Total Unaffiliated Legacy Privately Held Equity and Equity-Related Securities (cost: $819,619) | | | | | | | | | $ | 283,627 | |

| | | | | | | | | |

| Total Investments in Unaffiliated Equity and Equity-Related Securities (cost: $31,460,232) | | | | | | | | | $ | 21,685,569 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

15

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2023 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 53.9% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Non-Controlled Affiliated Publicly Traded Equity and Equity-Related Securities - | | | | | | | | | |

| 53.5% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Arena Group Holdings, Inc. (3)(10) | | | Interactive Media & Services | | | | | | |

| Provides a shared digital publishing, advertising and distribution platform | | | | | | | | | |

| Common Stock | (L1) | | | | 991,192 | | $ | 9,806,339 | | | $ | 2,359,037 | |

| | | | | | | | | |

| comScore, Inc. (3)(10) | | | Advertising | | | | | | |

| Provides technology and services that measure audiences, brands and consumer behavior | | | | | | | | | |

| Common Stock | (L1) | | | | 328,258 | | 12,175,182 | | | 5,481,909 | |

| | | | | | | | | |

| Potbelly Corporation (3)(10) | | | Restaurants | | | | | | |

| Operates a chain of sandwich shops | | | | | | | | | |

| Common Stock | (L1) | | | | 1,335,801 | | 6,098,592 | | | 13,919,046 | |

| | | | | | | | | |

| Synchronoss Technologies, Inc. (3)(10) | | | Application Software | | | | | | |

| Provides white-label cloud storage, messaging and other digital analytic services | | | | | | | | | |

| Common Stock | (L1) | | | | 826,849 | | 12,756,838 | | | 5,134,732 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Publicly Traded Equity and Equity-Related Securities (cost: $40,836,951) | | | | | | | | | $ | 26,894,724 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

16

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2023 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 53.9% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Non-Controlled Affiliated Legacy Privately Held Equity and Equity-Related Securities - | | | | | | | | | |

| 0.4% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| EchoPixel, Inc. (3)(5)(7) | | | Health Care Equipment | | | | | | |

| Develops virtual reality 3-D visualization software for life sciences and health care applications | | | | | | | | | |

| Series Seed Convertible Preferred Stock (acquired 6/21/13-6/30/14) | (I) (L3) | | | | 4,194,630 | | $ | 1,250,000 | | | $ | 105,304 | |

| Series Seed-2 Convertible Preferred Stock (acquired 1/22/16) | (I) (L3) | | | | 1,476,668 | | 500,000 | | | 37,818 | |

| Series A-2 Convertible Preferred Stock (acquired 3/23/17) | (I) (L3) | | | | 1,471,577 | | 350,000 | | | 58,317 | |

| | | | | | | | 2,100,000 | | | 201,439 | |

| | | | | | | | | |

| HALE.life Corporation (3)(5)(7) | | | Health Care Technology | | | | | | |

| Develops a platform to facilitate precision health and medicine | | | | | | | | | |

| Common Stock (acquired 3/1/16) | (I) (L3) | | | | 1,000,000 | | 10 | | | 0 | |

| Series Seed-1 Convertible Preferred Stock (acquired 3/28/17) | (I) (L3) | | | | 11,000,000 | | 1,896,920 | | | 0 | |

| Series Seed-2 Convertible Preferred Stock (acquired 12/28/18) | (I) (L3) | | | | 12,083,132 | | 2,500,000 | | | 0 | |

| | | | | | | | 4,396,930 | | | 0 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Legacy Privately Held Equity and Equity-Related Securities (cost: $6,496,930) | | | | | | | | | $ | 201,439 | |

| | | | | | | | | |

| Total Investments in Non-Controlled Affiliated Equity and Equity-Related Securities (cost: $47,333,881) | | | | | | | | | $ | 27,096,163 | |

| | | | | | | | | |

| Total Investments in Publicly Traded Equity and Equity-Related Securities, Money Market Funds, and Legacy Privately Held Equity and Equity-Related Securities (cost: $78,794,113) | | | | | | | | | $ | 48,781,732 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2023 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Derivative Securities - | | | | | | | | | |

| 1.0% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Derivative Securities (2) - | | | | | | | | | |

| 0.0% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Magnolia Neurosciences Corporation (3)(5)(7)(8) | | | Pharmaceuticals | | | | | | |

| Developed neurodegeration therapeutics | | | | | | | | | |

| Warrants for the Purchase of Common Stock expiring 8/3/28 (acquired 8/26/21) | (I) (L3) | | | | 138,059 | | | $ | 112,854 | | | $ | 0 | |

| | | | | | | | | |

| Total Unaffiliated Derivative Securities (cost: $112,854) | | | | | | | | | $ | 0 | |

| | | | | | | | | |

| Non-Controlled Affiliated Derivative Securities (2) - | | | | | | | | | |

| 1.0% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Potbelly Corporation (3)(10) | | | Restaurants | | | | | | |

| Operates a chain of sandwich shops | | | | | | | | | |

| Warrants for the Purchase of Common Stock expiring 2/12/26 (acquired 2/10/21) | (I) (L3) | | | | 80,605 | | $ | 224,849 | | | $ | 467,485 | |

| | | | | | | | | |

| Synchronoss Technologies, Inc. (3)(5)(10)(11) | | | Application Software | | | | | | |

| Provides white-label cloud storage, messaging and other digital analytic services | | | | | | | | | |

| Stock Options for Common Stock Expiring 12/4/30 (acquired 12/4/23) | (I) (L3) | | | | 3,334 | | 0 | | | 12,629 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Derivative Securities (cost: $224,849) | | | | | | | | | $ | 480,114 | |

| | | | | | | | | |

| Total Derivative Securities (cost: $337,703) | | | | | | | | | $ | 480,114 | |

| | | | | | | | | |

| Total Investments (cost: $79,131,816) | | | | | | | | | $ | 49,261,846 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

18

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2023 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Financial Instruments (12) - | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Rights to Payments (2) - | | | | | | | | | |

| 2.7% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Rights to Milestone Payments from Acquisition of TARA Biosystems, Inc. (acquired 4/1/22) (3)(5)(7)(13) | (I) (L3) | | Pharmaceuticals | | $ | 1,149,799 | | | $ | 1,149,799 | | | $ | 1,356,391 | |

| | | | | | | | | |

| Total Unaffiliated Rights to Payments (cost: $1,149,799) | | | | | | | | | $ | 1,356,391 | |

| | | | | | | | | |

| Total Investments in Publicly Traded and Privately Held Equity, Money Market Fund and Equity-Related Securities, Derivative Securities and Other Financial Instruments (cost: $80,281,615) | | | | | | | | | $ | 50,618,237 | |

The accompanying notes are an integral part of these consolidated financial statements.

19

180 DEGREE CAPITAL CORP.

NOTES TO CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2023

Notes to Consolidated Schedule of Investments

(1)See Note 2. Summary of Significant Accounting Policies: Portfolio Investment Valuation.

(2)Investments in unaffiliated securities consist of investments in which the Company owns less than five percent of the voting shares of the portfolio company. Investments in non-controlled affiliated securities consist of investments in which the Company owns five percent or more, but less than 25 percent, of the voting shares of the portfolio company, or where the Company controls one or more seats on the portfolio company’s board of directors but do not control the company. Investments in controlled affiliated securities consist of investments in which the Company owns 25 percent or more of the outstanding voting rights of the portfolio company or otherwise control the company, including control of a majority of the seats on the board of directors, or more than 25 percent of the seats on the board of directors, with no other entity or person in control of more director seats than us.

(3)Represents a non-income producing investment. Investments that have not paid dividends or interest within the last 12 months or are on non-accrual status for at least 12 consecutive months are considered to be non-income producing.

(4)D-Wave Quantum Inc., ("QBTS") was formed through the merger of D-Wave Systems, Inc., and DPCM Capital, Inc., a special purpose acquisition company (SPAC). D-Wave Systems, Inc. was a legacy private portfolio holding of the Company. The Company initially invested in D-Wave Systems, Inc. starting in 2008 and through 2014, acquiring various classes of preferred stock. While the shares of QBTS owned by the Company are registered, the Company entered into a lockup agreement with QBTS that prevented the Company from trading or hedging these shares until February 5, 2023. As of that date, the Company's shares of common stock of QBTS are no longer subject to lockup restrictions.

(5)The Company is subject to legal restrictions on the sale of all or a portion of our investment(s) in this company. The total amount of restricted securities held is $1,854,086, or 3.7 percent of net assets.

(6)The Company received LLC Interests of 1.25 percent in AutoTech Ventures Management I, LLC ("AutoTech") pursuant to an Administrative Services Agreement between us and AutoTech and due to us following the termination of a former employee of the Company. These LLC Interests were separate from the compensation received for providing the administrative services under the agreement that were paid in cash. The LLC interests have a capital percentage of 0 percent.

(7)These securities are held by the Company's wholly owned subsidiary, 180 Degree Private Holdings, LLC ("180PH"), which were transferred from the Company to 180PH in the fourth quarter of 2020. The acquisition dates of the securities reflect the dates such securities were obtained by the Company rather than the transfer date.

(8)Represents a non-operating entity that exists to collect future payments from licenses or other engagements, monetize assets for future distributions to investors and debt holders, or is in the process of shutting down and distributing remaining assets according to a liquidation waterfall.

(9)The Company received shares of Ravenna Pharmaceuticals, Inc., as part of the consideration of the acquisition of Petra Pharma Corporation.

(10)The Company is the Investment Manager of separately managed accounts ("SMAs") that owns shares of these portfolio companies. Under our investment management agreement for the SMAs, the Company has the right to control the votes of the securities held by the SMAs. The Company has voting ownership between 5 percent and 25 percent in these companies when the shares held by us and our SMAs are aggregated.

(11)These stock options were granted to Kevin Rendino upon his appointment to the Board of Directors of Synchronoss Technologies, Inc. Mr. Rendino entered into an assignment and assumption agreement with the Company that transfers all beneficial and voting interest to the Company.

(12)Other financial instruments are holdings of the Company that do not meet the definition of a security or a derivative.

The accompanying notes are an integral part of these consolidated financial statements.

20

180 DEGREE CAPITAL CORP.

NOTES TO CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2023

(13)If all the remaining milestones are met and the time-based payments are completed, the Company would receive approximately $4.0 million. Of this amount, approximately $1.3 million is due to be paid to the Company on April 1, 2024. There can be no assurance as to how much of the remaining approximately $2.7 million in potential milestone-based payments will ultimately be realized or when they will be realized, if at all.

The accompanying notes are an integral part of these consolidated financial statements.

21

180 DEGREE CAPITAL CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. THE COMPANY

180 Degree Capital Corp. (including its wholly owned subsidiaries, the "Company," "us," "our" and "we"), withdrew its election to be treated as a business development company on March 30, 2017, and subsequently returned to its prior status as a registered non-diversified closed-end management investment company ("Closed-End Fund" or "CEF") under the Investment Company Act of 1940 (the "1940 Act"). We operate as an internally managed investment company whereby our officers and employees, under the general supervision of our Board of Directors, conduct our operations. As of May 22, 2020, we are also registered with the Securities and Exchange Commission as a Registered Investment Adviser under the Investment Advisers Act of 1940 (the "Advisers Act").

180 Degree Private Holdings, LLC ("180PH"), is a wholly owned limited liability company that was created in October 2020 to hold certain of the Company's securities of privately held companies. 180PH was consolidated for financial reporting purposes and is a disregarded entity for tax purposes under the Internal Revenue Code ("Code").

180 Degree Capital BD, LLC ("180BD") was a 100 percent owned subsidiary of the Company that was sold to an unrelated buyer and the transaction closed in February 2023. 180BD was registered by the Company as a broker-dealer with the Financial Industry Regulatory Authority ("FINRA") that was formed to provide services to the Company related to fundraising for co-investment funds and not for investment returns. Historically, the Company consolidated 180BD for financial reporting purposes.

The Company is the Managing Member of 180 Degree Capital Management, LLC ("180CM"), a limited liability company formed to facilitate the opportunity for interested investors to co-invest alongside the Company in individual publicly traded portfolio companies. As of December 31, 2023, the Company has no capital under management in 180CM.

The Company was the General Partner of 180 Phoenix Fund, L.P., ("180 Phoenix") a limited partnership formed to facilitate the opportunity to manage capital for investors in a traditional limited partnership structure. The Company did not raise capital into 180 Phoenix. Based on conversations with potential investors that indicated more interest in management of separate accounts rather than a limited partnership structure, in December 2023, the Company elected to file a certificate of cancellation to terminate the existence of the entity.

As of December 31, 2023, the Company manages approximately $10.6 million in net assets in two separately managed accounts ("SMA").

The Company may, in certain cases, receive management fees and carried interest on profits generated on invested capital from any capital under management if and when capital is raised and if and when profits are realized, respectively. The Company does not consolidate the operations of any capital managed in separate series of 180CM, or in the separately managed accounts.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed in the preparation of the consolidated financial statements:

Principles of Consolidation. The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the US ("GAAP") and Articles 6 and 12 of Regulation S-X of the Securities Exchange Commission ("SEC") and include the accounts of the Company and its wholly owned subsidiaries. The Company is an investment company following accounting and reporting guidance in Accounting Standards Codification 946. In accordance with GAAP and Regulation S-X under 17 C.F.R. Part 210, the Company may only consolidate its interests in investment company subsidiaries and controlled operating companies whose business consists of providing services to the Company. Prior to February 2023, our wholly owned subsidiary, 180BD, was a controlled operating company that provided services to us and was, therefore, consolidated. 180PH is a controlled operating company that provide services to us and is, therefore, consolidated. All significant intercompany accounts and transactions were eliminated in the consolidated financial statements.

Accounting Standards Codification (ASC) Topic 810, "Consolidation”, provides guidance on the consolidation of financial statements when a company has control over another entity. ASC 810-10-40 addresses the accounting for the deconsolidation of a subsidiary and outlines the criteria for determining when to deconsolidate a subsidiary. The Company derecognized 180BD as the Company ceased to have a controlling financial interest of 180BD as of February 2023, following the sale of its equity of 180BD to an unrelated third party. The Company recognized $100,000 in net realized gain on the deconsolidation.

Use of Estimates. The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and contingent assets and liabilities and the reported amounts of revenues and expenses. Actual results could differ from these estimates, and the differences could be material. The most significant estimates relate to the fair valuations of our investments.

Portfolio Investment Valuations. Investments are stated at "value" as defined in the 1940 Act and in the applicable regulations of the SEC and in accordance with GAAP. Value, as defined in Section 2(a)(41) of the 1940 Act, is (i) the market price for those securities for which a market quotation is readily available and (ii) the fair value as determined in good faith by, or under the direction of, the Board of Directors for all other assets. The Valuation Committee, comprised of all of the independent Board members, is responsible for determining the valuation of the Company’s assets within the guidelines established by the Board of Directors, pursuant with SEC Rule 2a-5. The Valuation Committee receives information and recommendations from management. The Company may from time to time use an independent valuation firm to review select portfolio company valuations on an as needed basis. The independent valuation firm, when engaged by the Company, does not provide independent valuations. The fair values assigned to these investments are based on available information and do not necessarily represent amounts that might ultimately be realized when that investment is sold, as such amounts depend on future circumstances and cannot reasonably be determined until the individual investments are actually liquidated or become readily marketable. The Valuation Committee values the Company's investment assets as of the end of each calendar quarter and as of any other time requested by the Board of Directors.

Accounting Standards Codification Topic 820, "Fair Value Measurements," ("ASC 820") defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (exit price). It applies fair value terminology to all valuations whereas the 1940 Act applies market value terminology to readily marketable assets and fair value terminology to other assets.

The main approaches to measuring fair value utilized are the market approach, the income approach and the hybrid approach.

•Market Approach (M): The market approach focuses on inputs and not techniques. The market approach may use quantitative inputs such as prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities and the values of market multiples derived from a set of comparable companies. The market approach may also use qualitative inputs such as progress toward milestones, the long-term potential of the business, current and future financing requirements and the rights and preferences of certain securities versus those of other securities. The selection of the relevant inputs used to derive value under the market approach requires judgment considering factors specific to the significance and relevance of each input to deriving value.

•Income Approach (I): The income approach focuses on techniques and not inputs. The income approach uses valuation techniques to convert future amounts (for example, revenue, cash flows or earnings) to a single present value amount (discounted). The measurement is based on the value indicated by current market expectations about those future amounts. Those valuation techniques include present value techniques; option-pricing models, such as the Black-Scholes-Merton formula (a closed-form model) and a binomial model (a lattice model), which incorporate present value techniques; and the multi-period excess earnings method, which is used to measure the fair value of certain assets.

•Hybrid Approach (H): The hybrid approach uses elements of both the market approach and the income approach. The hybrid approach calculates values using the market and income approach, individually. The resulting values are then distributed among the share classes based on probability of exit outcomes.

ASC Topic 820 classifies the inputs used to measure fair value by these approaches into the following hierarchy:

•Level 1 (L1): Unadjusted quoted prices in active markets for identical assets or liabilities;

•Level 2 (L2): Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. These include quoted prices in active markets for similar assets or liabilities, or quoted prices for identical or similar assets or liabilities in markets that are not active, or inputs other than quoted prices that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. Level 2 inputs are in those markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers; and

•Level 3 (L3): Inputs to the valuation methodology are unobservable and significant to the fair value measurement. Unobservable inputs are those inputs that reflect our own assumptions that market participants would use to price the asset or liability based upon the best available information.

Financial assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement and are not necessarily an indication of risks associated with the investment.

As of December 31, 2023, our financial statements include investments fair valued by the Board of Directors of $2,321,571. The fair values were determined in good faith by, or under the direction of, the Board of Directors. The fair value amount includes the values of our investments in legacy privately held companies and rights to future milestone payments, as well as our warrants of Potbelly Corporation and Magnolia Neurosciences Corporation, and our stock options for common stock of Synchronoss Technologies, Inc.

Cash. Cash includes demand deposits. Cash is carried at cost, which approximates fair value.

Unaffiliated Rights to Payments. At December 31, 2023, the outstanding potential milestone and time-based payments from the acquisition of TARA Biosystems, Inc., by Valo Health, LLC were valued at $1,356,391. The milestone payments are valued using the probability-adjusted, present value of proceeds from future payments that would be due upon successful completion of certain regulatory milestones. There can be no assurance as to how much of the amounts related to milestone payments that we will ultimately realize or when they will be realized, if at all. The time-based payments are valued using a discount for time-value of money that includes estimated default risk of the acquirer.

Prepaid Expenses. We include prepaid insurance premiums in "Prepaid expenses." Prepaid insurance premiums are recognized over the term of the insurance contract and are included in "Insurance" in the Company's Consolidated Statement of Operations.

Property and Equipment. Property and equipment are included in "Other assets" and are carried at $9,799 at December 31, 2023, representing cost of $229,818, less accumulated depreciation of $220,019. Depreciation is provided using the straight-line method over the estimated useful lives of the property and equipment. We estimate the useful lives to be five to ten years for furniture and fixtures, and three years for computer equipment.

Post-Retirement Plan Liabilities. Until it was terminated on April 27, 2017, the Company provided a Retiree Medical Benefit Plan for employees who met certain eligibility requirements. Until it was terminated on May 5, 2011, the Company also provided an Executive Mandatory Retirement Benefit Plan for certain individuals employed by us in a bona fide executive or high policy-making position. The net periodic post-retirement benefit cost includes service cost and interest cost on the accumulated post-retirement benefit obligation. Unrecognized actuarial gains and losses are recognized as net periodic benefit cost, pursuant to the Company's historical accounting policy in "Salaries, bonus and benefits" in the Company's Consolidated Statement of Operations. The impact of plan amendments was amortized over the employee's average service period as a reduction of net periodic benefit cost. Unamortized prior service cost was fully amortized during 2017 as a result of the termination of the Retiree Medical Benefit Plan.

Interest Income Recognition. Interest income, including amortization of premium and accretion of discount, is recorded on an accrual basis. When accrued interest is determined not to be recoverable, the Company ceases accruing interest and writes off any previously accrued interest. Write-offs are netted in interest income. Securities are deemed to be non-income producing if investments have not paid dividends or interest within the last 12 months or are on non-accrual status for at least 12 consecutive months. When the fair value of a security that includes PIK interest is less than the accrued interest, the Company may place the security on non-accrued status.

Board Fees From Portfolio Companies. The Company recognizes revenues from fee income from board fees as those services are provided.

Management Fees and Performance Fees/Carried Interest from Managed Funds. As a Registered Investment Adviser under the Advisers Act, the Company may be entitled to receive management fees and performance fees from clients including separately managed accounts (SMAs) and special purpose vehicles (SPVs). When applicable, the Company accrues management fees on SPVs that are to be paid upon liquidation of the entity regardless of performance. Performance fees or carried interest, if any, is paid annually by SMAs based on a fixed percentage of the increase in net assets during the year. Performance fees on SPVs, if any, are generally paid based on the amount of increase in net assets at the time of any distribution of capital above the amount of initial invested capital plus accrued expenses. The timing and payment terms of management fees and performance fees for future client accounts may be different than those of our current SMAs.

The Company does not include accruals for carried interest in the consolidated financial statements until such carried interest is received and/or the Company concludes that it is probable that a reversal of any accrual will not occur. The Company did not earn or accrue any carried interest in the year ended December 31, 2023.

Other Income. The Company may purchase restricted securities issued by publicly traded companies that include provisions that provide for payment of partial liquidated damages in the event the issuer does not meet obligations specified in the purchase agreement or other ancillary documents associated with the transaction. These obligations most commonly are associated with the filing of registration statements and/or being up to date with the filing of the issuer's financial statements with the SEC.

Put and Call Options. The Company may purchase options on publicly traded securities as an investment and/or with the intention of limiting its downside risk. When the Company purchases an option, an amount equal to the premium paid is recorded in the Consolidated Statement of Assets and Liabilities as an investment. The Company may also purchase an option at one price and write/sell an option at another price in a simultaneous transaction referred to as a spread. The amount of these assets is subsequently marked-to-market to reflect the current value of the options. In the event that the options are exercised, the Company would be required to deliver those shares to the counterparty. When the options expire unexercised, the Company realizes a loss on the premium paid, or the difference between the premium paid and the premium received, as applicable.

Rent Expense. The Company currently leases and runs daily operations in approximately 1,250 square feet of office space in Montclair, New Jersey. Prior to November 17, 2021, the Company leased this space on a month-to-month basis at a base rent of approximately $26 per square foot per year. On November 17, 2021, the Company entered into a three-year lease extension that set the average base rent beginning January 1, 2022, at approximately $30 per square foot over the term of the extension. Either the Company or the landlord may terminate the lease at any time with two months' written notice to either party. As of December 31, 2023, the present value of the future lease payments (lease liability) is recorded as an asset and a liability in the Company's Consolidated Statement of Assets and Liabilities. The amount is calculated using weighted average discount rate of 1.32 percent and weighted based on the terms of the the lease agreement. As of December 31, 2023, the remaining commitment on the lease is less than $40,000.

Realized Gain or Loss and Unrealized Appreciation or Depreciation of Portfolio Investments. Realized gain or loss is recognized when an investment is disposed of and is computed as the difference between the Company's cost basis in the investment at the disposition date and the net proceeds received from such disposition. Realized gain or loss on investment transactions are determined by specific identification. Unrealized appreciation or depreciation is computed as the difference between the fair value of the investment and the cost basis of such investment.

Income Taxes. As discussed in Note 9. Income Taxes, the Company did not qualify as a regulated investment company ("RIC") under Subchapter M of the Code in 2023, and will therefore be taxed as a C-Corporation in 2023. The Company did not accrue for any income taxes as of December 31, 2023 as it did not generate ordinary income. The Company has capital loss carryforwards that can be used to offset net realized capital gains. The Company also has operating loss carryforwards that can be used to offset operating income and net realized capital gains in years when it fails to qualify as a RIC. The Company recognizes interest and penalties in income tax expense. See Note 9. Income Taxes for further discussion.

Foreign Currency Translation. The accounting records of the Company are maintained in U.S. dollars. All assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the rate of exchange of such currencies against U.S. dollars on the date of valuation. If Company has assets denominated in foreign currencies, it does not isolate the portion of the results of operations that arises from changes in foreign currency rates on investments held on its Consolidated Statement of Operations.

Securities Transactions. Securities transactions are accounted for on the date the transaction for the purchase or sale of the securities is entered into by the Company (i.e., trade date). Securities transactions outside conventional channels, such as private transactions, are recorded as of the date the Company obtains the right to demand the securities purchased or to collect the proceeds from a sale and incurs the obligation to pay for the securities purchased or to deliver the securities sold.

Concentration of Credit Risk. The Company places its cash with financial institutions and, at times, cash held in depository accounts may exceed the Federal Deposit Insurance Corporation's insured limit and is subject to the credit risk of such institutions to the extent it exceeds such limit.

Recent Accounting Pronouncements and Adoptions. On December 14, 2023, the Financial Accounting Standards Board ("FASB") issued ASU 2023-09, "Income Taxes (Topic 740): Improvements to Income Tax Disclosures". This ASU requires additional disaggregation of the reconciliation between the statutory and effective tax rate for an entity and of income taxes paid, both of which are disclosures required by current GAAP. The amendments improve the transparency of income tax disclosures by requiring (1) consistent categories and greater disaggregation of information in the rate reconciliation and (2) income taxes paid disaggregated by jurisdiction. The guidance is effective for fiscal years, including interim periods within those fiscal years, beginning after December 15, 2024, and early adoption is permitted. This ASU is not expected to have a material impact on the Company's consolidated financial statements as the Company does not have tax liabilities in foreign jurisdictions.

On October 9, 2023, the FASB issued ASU 2023-06, "Disclosure Improvements: Codification Amendments in Response to the SEC's Disclosure Update and Simplification Initiative." This ASU amends the disclosure or presentation requirements related to various subtopics in the FASB Accounting Standards Codification (the “Codification”). This ASU was issued in response to the SEC’s August 2018 Final Rule 2 that updated and simplified disclosure requirements that the SEC believed were “redundant, duplicative, overlapping, outdated, or superseded.” The effective date for each amendment will be the date on which the SEC’s removal of that related disclosure requirement from Regulation S-X or Regulation S-K becomes effective, with early adoption prohibited. The new guidance is intended to align GAAP requirements with those of the SEC and to facilitate the application of GAAP for all entities. This ASU is not expected to have a material impact on the Company's consolidated financial statements.

NOTE 3. BUSINESS RISKS AND UNCERTAINTIES

Our business activities contain elements of risk. We consider the principal types of market risk to be valuation risk, diversification risk, interest rate risk and foreign currency risk. Although we are risk-seeking rather than risk-averse in our investments, we consider the management of risk to be essential to our business.

Investment Objective

Our investment objective is to generate capital appreciation and current income from investments and investment-related activities such as managed funds and accounts.

Investment Strategy

Our investment strategy on future new investments is focused on generating capital appreciation and current income from investments in what we believe are deeply undervalued, small publicly traded companies where we believe we can positively impact the business and valuation through constructive activism. Historically, our investment strategy was to achieve long-term capital appreciation investing in venture capital investments. While we continue to provide such resources to our existing legacy portfolio companies, we no longer make venture capital investments. We classify our legacy portfolio companies as Legacy Privately Held Equity and Equity-Related Securities.