UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-07074

| | |

| 180 DEGREE CAPITAL CORP. |

| (Exact Name of Registrant as Specified in Its Charter) |

| | | | | | | | |

| 7 N. Willow Street, Suite 4B, Montclair NJ | | 07042 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | |

Daniel B. Wolfe

President and Chief Financial Officer

180 Degree Capital Corp.

7 N. Willow Street, Suite 4B

Montclair, NJ 07042 |

| (Name and address of agent for service) |

|

Copy to:

John J. Mahon, Esq.

Proskauer Rose, LLP

1001 Pennsylvania Avenue, NW

Suite 600 South

Washington, DC 20004-2533

(202) 416-6828 |

Registrant's telephone number, including area code: (973) 746-4500

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

Item 1. Report to Shareholders.

Q2 2024 Shareholder Letter

Fellow Stockholders:

As we were exiting Q2 2024, we started to amass a number of charts, tables and other data that continued to show what we have been discussing since mid-2022 regarding the growing disconnect between large and small capitalization stocks, the concentration of capital in a small number of large capitalization stocks, and the historically low valuations afforded to small capitalization stocks on a comparative price-to-earnings basis. Our thought was to provide another shareholder letter comprised primarily of pictures, charts and tables rather than words. Then on July 11, 2024, the public markets received data showing that inflation was slowing significantly, which led to beliefs that rate cuts were on the horizon, and the Russell 2000 Index shot up 10%. Then on August 1, 2024, jobs data came in lighter than expected, recession fears returned to the forefront, and the Russell 2000 Index declined 6%. The movement was even more pronounced for the Russell Microcap Index, which increased ~12%, followed by a decline of 7% during the same time period as the Russell 2000 Index.

While these intra-month dramatic moves can be instructive on one hand, we could care less about them on another. We believe these types of moves are driven primarily by ETFs and other diversified funds that move in and out of positions based on momentum rather than fundamentals. We could also show you data until we are blue in the face supporting this belief and why our asset class is so undervalued. Instead, what happened in July changed what we think is important to focus on for this letter…. As legendary investor Bill Ruane of the Sequoia Fund once said, "We try not to pay attention to the market, just what we own." So, instead of more market-related charts, that is what we are going to do.

The slides for our stockholder update call can be found on our website at https://ir.180degreecapital.com/financial-results. They discuss each of our holdings and the catalysts that we believe can drive value. In this letter, we want to focus on what we own from a slightly different perspective; that is, how we use constructive activism to drive value creation in what we own and our investment universe in general.

Common Ground

We believe one of the reasons management teams and boards of directors often work collaboratively and constructively with us is because we also run a public company. We can directly relate to their struggles to balance business operations with investor relations, particularly since many of these companies, similar to us, do not have the resources of larger companies. We are also not shy about providing direct feedback, good or bad, but always with the goal to help our portfolio company management teams and boards learn from such feedback for future decision making. We are also willing to roll up our sleeves and work hand-in-hand with our management teams and boards to drive outcomes as discussed in more detail below.

While a -11% move in one of any of our holdings, on limited volume without any information to support such move is maddening, it does not change our investment process or approach. Why? Because even though a stock moves one way or another on any given day, our portfolio company management teams are driving toward catalysts they believe can build value. News alert: Just because the investment world doesn't hear something from a company, does not mean there isn't progress being made, strategic initiatives being worked on, and the potential for value creating events on the horizon. This is true at 180 Degree Capital just as it is at all of our portfolio holdings. These efforts usually take longer than anyone would prefer or desire, but that does not mean they cannot or will not occur.

We are not saying that sometimes there is bad news lurking in the absence of information, but today's market and investors take no news as bad news. When coupled with material declines in stock prices, often on limited volume, investors start to make up reasons in their heads as to why such declines are harbingers for catastrophe. This cycle continues and continues without end, until news comes out, and if it is positive, then investors start to pile into a stock like lemmings. We're not arguing for a change in how the market or other investors operate, although that would be welcome. Instead, we want to make it clear, again, that we do not sit around just waiting for things to happen at our portfolio companies, hence our constructive activism.

Identified Catalysts Set Focus of Constructive Activism Efforts

All of our constructive activism efforts require the identification of catalysts that we believe can result in a material increase in value, if they occur. Catalysts can take many forms. Sometimes the simplest catalysts are making sure that investors understand how management is really thinking, rather than allowing investors to come up with their own conclusions. Here is one example from a while back where we were speaking with the management team of one of our portfolio companies:

180 Degree Capital: You know that every investor thinks that you are about to raise capital through a secondary offering, right?

Portfolio Company Management Team: Why would they think that?

180 Degree Capital: Because you haven't said otherwise, and your financial statements suggest you might need additional capital soon. So, if you do not have any intent or need to raise capital, we would recommend you make that clear to the investment world.

Portfolio Company Management Team: Thanks for that color…. We will give that suggestion some thought.

This particular management team then decided to tell investors at a conference that they have no intention to raise capital through an equity offering, nor did they believe they needed additional capital to operate their business. Its stock price doubled that day. Now, it is often not that simple to see value appreciation, but sometimes it is. Often it comes down to how updates are messaged because investors focus on parameters that management teams may or may not be familiar with, or have on top of their minds, as being important given their general, and appropriate, focus on the business itself.

Solving Capital Structure Overhangs

Often catalysts can be created by helping small and microcapitalization companies solve capital structure overhangs. These overhangs can be in the form of a toxic preferred stock instrument that continues to balloon in size due to interest being paid through the issuance of more preferred stock. Sometimes it is a simple debt or preferred security with out-of-market interest rates. Other times it is that a reasonable amount of additional capital can remove the risks of substantial further dilution in the future and/or insolvency, and a forced sale. We have written historically about our successful work with TheStreet, Inc. (TST), to remove a preferred stock overhang at a discount that enable the company to seek strategic alternatives and ultimately resulted in a positive outcome for investors and the company. In 2021, we participated in a financing for Potbelly Corporation (PBPB), that improved its balance sheet and provided the operating flexibility that has allowed PBPB to start the profitable growth phase of its development. In 2021, we helped Synchronoss Technologies, Inc. (SNCR), retire a toxic preferred stock instrument held by Siris Capital that enabled the company to sell off non-core assets and focus on its high-value cloud business.

More recently, SNCR was presented with an opportunity to retire its high-interest preferred stock as well as some of its senior notes, both at a discount to face value. The size of this opportunity was larger than we could take on ourselves, so we worked with SNCR to run a competitive process to identify sources of capital to complete this opportunistic deleveraging and of-capital reducing transaction. We believe it was a significant milestone for SNCR and were pleased to be of assistance in completing the transaction. We are now focused on a number of additional value-creating catalysts that we believe could occur in the near future including receipt of a $28 million tax refund that will enable the company to further deleverage its balance sheet and continued performance of its cloud business that we currently expect to drive meaningful free cash flow generation in 2024 and beyond.

Concentrated Ownership

Sometimes capital structure overhangs are not related to a security such as preferred stock or debt but exist because a significant portion of a company's stock is held by one or a small group of investors, particularly founders of companies. Such situations can lead to small amounts of stock being available for trading, also referred to the float of a company. Small floats make it difficult for institutional investors to take positions in companies because they will be unable to purchase meaningful positions without dramatically impacting the stock, and/or such concentration of control in one or a few individuals can make investors uneasy, particularly if such holders are no longer part of management.

In 2023, we were introduced to Mama's Creations, Inc. (MAMA), by our friends Mark Argento and Ryan Meyers at Lake Street Capital Markets. MAMA was generally off the radar of most investors given it had a market capitalization of less than $75 million, but it had just hired Adam Michaels as its new Chief Executive Officer. Adam came from a successful career at Mondelez and brought a new level of rigor and determination to MAMA that had not existed before. While we really liked the

company and what Adam was doing to turn it around, a substantial portion of the ownership was held by its founder and former Chief Executive Officer who was no longer with the company. This concentrated ownership made MAMA uninvestable for us and likely a number of other investors. We encouraged MAMA and Lake Street to find a solution to this issue and offered to meaningfully participate in such a solution. The former CEO agreed to sell his stock and this deal pulled together by Lake Street closed on June 2023, we meaningfully increased our ownership , and, as we believed would be the case, when coupled with the business performance under Adam's management, MAMA's stock price has tripled off the price the stock traded at on that deal.

Using constructive activism to solve capital structure overhangs, including founder/legacy ownership concentration, is a core focus for us, and these opportunities are often more pronounced and numerous in our asset class of small and microcapitalization companies than in larger, more established companies.

Taking Our Constructive Activism to the Next Level - Board Representation

Running a public company is a complicated endeavor that requires a diverse set of skills, experience and knowledge. Small and microcapitalization management teams and boards are often comprised of very accomplished and talented individuals. That said, the challenges small and micro-capitalization companies face are frequently very different than those of large companies, and these challenges require solutions derived from sometimes creative, out-of-the-box approaches. TST faced the challenge of how to maximize the value of three completely separate businesses within one sub-scale public company. As part of the preferred takeout we participated in, we were invited to join TST's Board of Directors to help develop and execute solutions to that problem. Synacor, Inc. (SYNC) was faced with a similar issue in that it had two different businesses that were struggling to grow at a fast enough level to support remaining as an independent entity. We had been shareholders in SYNC since 2017 and developed strong relationships with its management team and board. Based on these relationships, we were invited to join its board in March 2019, and helped SYNC drive to its eventual sale in 2021. More recently, we were invited to join the board of SNCR to help drive strategic opportunities, including the opportunistic retirement of its preferred stock and a portion of its senior notes as a discount to face value.

We join boards when we believe our skillsets can add value and are complementary to those of current board members. There are times where our skillsets are not the ones that we believe are required to drive value creation. In those situations, we work with management teams and boards to find strong individuals with such skillsets. We recently worked with comScore, Inc. (SCOR), to add Matt McLaughlin to its board. Matt was Chief Operating Officer at DoubleVerify Holdings, Inc. He has forgotten more about the adtech industry than we will ever know. He also brings an intensity for driving to and achieving catalysts that we believe has been completely lacking on SCOR's board. We believe we saw the first nuggets of his contribution through SCOR reaching agreement with its preferred stockholders to forgo payment in cash of the accrued dividends, which brings the dividend rate back down to 7.5%, removes the short-term liability from SCOR's balance sheet, helps clarify any investor concern around the payment of such dividends in the near term, and allows SCOR to instead use the cash to fund development and growth. We look forward to Matt's further contributions, that we believe can be a catalyst for significant value appreciation for all stakeholders of SCOR.

More recently, we have been working behind the scenes with the management and board of Lantronix, Inc. ("LTRX") on ways to solidify the strong foundation of the company and set it up for success and significant value creation for stockholders in the future. We believe LTRX's new CEO, Saleel Awsare brings an interesting and successful background to LTRX. What we believe he needed to be in the best position for success were board members who have experience navigating the challenges unique to microcapitalization companies. Following multiple discussions, we introduced Saleel and his board to Narbeh Derhacobian, the former Chief Executive Officer and founder of our former portfolio company, Adesto Technologies, Inc., and one of Adesto's board members, Kevin Palatnik, who has significant experience as a CFO at multiple related businesses. We were pleased to see that LTRX's board saw the same value that we do in these individuals, in terms of helping Saleel and his team to have the best opportunities to achieve multiple catalysts that could lead to material increases in value for LTRX and its stockholders.

Fun fact – The number of proxy campaigns we ran to achieve the additions/changes to the boards detailed above: 0. We think this statistic is relatively unique in the world of activist investing. It is not often that investors are invited on boards, or that their nominees are accepted to join boards without the need for competitive proxy efforts. We credit this to our ability to develop strong relationships with our management teams and boards and our unwavering focus on building value for all stakeholders in businesses.

The discussion above is just a piece of our historical constructive activism. Slides on our website walk through the constructive activism we are working on with each of our current holdings. The slide below is part of our general investor deck and provides additional historical examples of our constructive activism:

Inefficiency Leads to Opportunity

We are often asked why we focus on investing in very small market capitalization companies since these companies often suffer from a lack of meaningful liquidity, little to no analyst coverage and high levels of volatility even in the absence of information that might otherwise account for the moves in the stock. Those are just a few of the reasons why we invest in this asset class. It is really hard to pick individual stocks in general, but imagine trying to find opportunities that have the potential to generate returns of at least 100% in the public markets when there are a lot of eyeballs on them. Furthermore, it is generally uncommon for investors in larger companies to have the level of access we have to our management teams and boards. This access is critical to our past and potential future successful constructive activism.

While the period since November 2021 has been maddening, we are seeing the first fruits of our labors begin to emerge in this investment cycle. We believe there are substantial meaningful catalysts ahead for our portfolio companies that could lead to substantial value creation for 180 Degree Capital and our portfolio company stakeholders. We believe our constructive activism is a key differentiator and we will continue to use it to improve the chances of positive catalysts occurring that lead to this value creation. Our constructive activism was a key component of the above-market returns we generated from 2017-2021. While historical performance is not a guarantee of future success, we believe our constructive activism will be the differentiator for this next investment cycle as well. We are not naïve for how painful this period of underperformance for small cap stocks compared to a small group of large cap companies like NVIDIA has been. Both of us have significant amounts of our personal assets in TURN stock, and we too have directly been negatively impacted by the price of our stock. Just like our spectacular four-year run said nothing about the last 2 plus years, we believe this period says nothing about the next few years. We are convinced we have significant upside in value possible from where we are today, and we will continue our constructive activism to attempt to create such value from the holdings we have currently and those we hold in the future.

Lastly, I, Kevin, would like to thank everyone for their concern and well wishes since my accident a couple of weeks ago. I am fully back to work and laser focused on building value for 180 Degree Capital’s stockholders.

As always, thank you for your support.

Best Regards,

Kevin M. Rendino Daniel B. Wolfe

Chief Executive Officer President

Forward-Looking Statements and Disclaimers

This shareholder letter may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company's current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this press release. Please see the Company's securities filings filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company's business and other significant factors that could affect the Company's actual results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The reference and link to any websites have been provided as a convenience, and the information contained on such website is not incorporated by reference into this shareholder letter. 180 Degree Capital Corp. is not responsible for the contents of third-party websites. The information discussed above is solely the opinion of 180 Degree Capital Corp. Any discussion of past performance is not an indication of future results. Investing in financial markets involves a substantial degree of risk. Investors must be able to withstand a total loss of their investment. The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions.

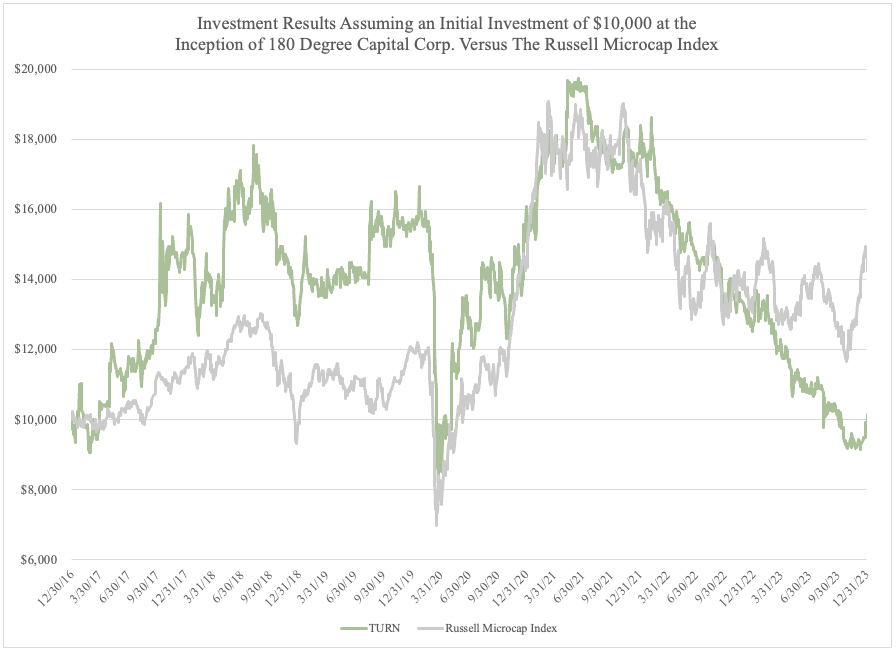

Source: Bloomberg

Note: The graph above assumes the reinvestment of dividend and capital gain distributions, if and, and does not reflect the deduction of taxes that a shareholder would pay, as applicable, on distributions or the redemption of stock by 180 Degree Capital Corp. Past performance does not guarantee future results.

Investment Objective

Our investment objective is to generate capital appreciation and current income from investments and investment-related activities such as managed funds and accounts.

Investment Strategy

Our investment strategy on future new investments is focused on generating capital appreciation and current income from investments in what we believe are deeply undervalued, small publicly traded companies where we believe we can positively impact the business and valuation through constructive activism. Historically, our investment strategy was to achieve long-term capital appreciation investing in venture capital investments. While we continue to provide such resources to our existing legacy portfolio companies, we no longer make venture capital investments. We classify our legacy portfolio companies as Legacy Privately Held Equity and Equity-Related Securities.

We believe we combine new perspectives with the historical knowledge and experience of managing the current portfolio. Our investment approach is comprised of a patient examination of available opportunities through due diligence and close involvement with management of our portfolio companies. We invest our capital directly into portfolio companies or through purchases of securities of publicly traded companies directly and through open-market purchases. We may seek to invest our capital alongside capital from other investors through that we control.

We have discretion in the investment of our capital to achieve our objectives by investing in various types of assets, and we do not currently limit our investments to any security type. Our investments may include, among other asset types: equity, equity-related securities (including warrants and options) and debt with equity features from either private or public issuers; debt obligations of all types having varying terms with respect to security or credit support, subordination, purchase price, interest payments and maturity; foreign securities; and miscellaneous investments.

Investment Policies

Fundamental policies may not be changed without the approval of the holders of a majority of our voting securities, as defined in the 1940 Act. As a matter of fundamental policy, the Company will not:

(1) Issue senior securities, borrow money from banks, brokers or other lenders, or engage in transactions involving the issuance by us of "senior securities" representing indebtedness, except to the extent permitted under the 1940 Act or the rules, regulations or interpretations thereof.

(2) Underwrite securities of other issuers, except insofar as we may be deemed an underwriter under the Securities Act of 1933, as amended (the "Securities Act"), in connection with the disposition of our portfolio securities. We may invest in restricted securities (those that must be registered under the Securities Act before they may be offered or sold to the public) to the extent permitted by the 1940 Act or the rules, regulations or interpretations thereof.

(3) Invest more than 25% of our total assets in the securities of companies or entities engaged in any one industry, or group of industries. This limitation does not apply to investment in the securities of the U.S. Government, its agencies or instrumentalities.

(4) Purchase or sell real estate or interests in real estate (except that we may (a) purchase and sell real estate or interests in real estate in connection with the orderly liquidation of investments, or in connection with foreclosure on collateral, or (b) own the securities of companies that are in the business of buying, selling or developing real estate).

(5) Purchase or sell commodities or commodity contracts, but we may purchase and sell foreign currency and enter into foreign currency forward contracts, and may engage in other transactions in financial instruments, in each case to the extent permitted under the Company's investment policies as in effect from time to time.

(6) Make loans of money or securities to other persons, except through purchasing fixed-income securities or other debt instruments, lending portfolio securities or entering into repurchase agreements in a manner consistent with our investment policies. With respect to these investment restrictions, if a percentage restriction is adhered to at the time of entering into the investment or transaction, a later change in percentage resulting from a change in the values of investments or the value of our total assets, unless otherwise stated or required by law, will not constitute a violation of the restriction or policy.

Valuation Risk

We historically invested in privately held companies, the securities of which are inherently illiquid. We are currently focused on investing in what we believe are deeply undervalued microcapitalization publicly traded companies. Our publicly traded and public company-related securities account for approximately 99 percent of the value of our portfolio of investments. Although these companies are publicly traded, their stock may not trade at high volumes and/or we may own a significant portion of a company's outstanding stock, which may restrict our ability to sell our positions in an orderly fashion and prices at which sales can be made may be volatile and materially different than the closing prices of such positions at each financial statement date. We may also be subject to restrictions on transfer and/or other lock-up provisions after these companies complete public offerings and/or if we invest in unregistered securities of public companies. Many of our legacy privately held and publicly traded companies tend to not have attained profitability, and many of these companies also lack management depth and have limited or no history of operations. Because of the speculative nature of our investments and the lack of a liquid market for and restrictions on transfers of privately held investments, there is greater risk of loss relative to traditional marketable investment securities.

Approximately 2 percent of our portfolio was fair valued and comprised of securities of legacy privately held companies and rights to potential future milestone payments, as well as our warrants of Potbelly Corporation and options of Synchronoss Technologies, Inc. (Level 3 investments) which are securities of publicly traded companies. Because there is typically no public or readily ascertainable market for our securities of our legacy privately held companies, the valuation of the securities in that portion of our portfolio is determined in good faith by our Valuation Committee, which is comprised of all of

the independent members of our Board of Directors. The values are determined in accordance with our Valuation Procedures and are subject to significant estimates and judgments. The fair value of the securities in our portfolio may differ significantly from the values that would be placed on these securities if a ready market for the securities existed. Additionally, inputs may become available after a financial statement date that could result in a material change in value at a future financial statement date from the value reported in the current financial statements. Any changes in valuation are recorded in the Company's Consolidated Statement of Operations as "Change in unrealized appreciation (depreciation) on investments." Changes in valuation of any of our investments in privately held companies from one period to another may be significant.

Diversification Risk

While we are subject to certain diversification requirements regarding the concentration of investments in any one industry or group of industries at the time of each investment, we do not choose investments based on a strategy of diversification. We also do not rebalance the portfolio should one of our portfolio companies increase in value substantially relative to the rest of the portfolio. Therefore, the value of our portfolio may be more vulnerable to microeconomic events affecting a single sector, industry or portfolio company and to general macroeconomic events that may be unrelated to our portfolio companies. These factors may subject the value of our portfolio to greater volatility than a company that follows a diversification strategy. As of June 30, 2024, our largest 10 investments by value accounted for approximately 90 percent of the value of our investment portfolio. Our largest three investments, by value, Potbelly Corporation, Synchronoss Technologies, Inc., and comScore, Inc., accounted for approximately 20 percent, 17 percent and 12 percent, respectively, of our investment portfolio at June 30, 2024. Potbelly Corporation, Synchronoss Technologies, Inc. and comScore, Inc. are publicly traded companies.

Interest Rate Risk

Interest rate sensitivity refers to the change in earnings that may result from changes in the level of interest rates. We may invest in both short- and long-term U.S. government and agency securities. To the extent that we invest in short- and long-term U.S. government and agency securities, changes in interest rates result in changes in the value of these obligations that result in an increase or decrease of our net asset value. The level of interest rate risk exposure at any given point in time depends on the market environment, the expectations of future price and market movements, and the quantity and duration of long-term U.S. government and agency securities held by the Company, and it will vary from period to period.

In addition, market interest rates for high-yield corporate debt may be an input in determining value of our investments in debt securities of privately held and publicly traded companies. Significant changes in these market rates could affect the value of our debt securities as of the valuation date of measurement of value. While we do not currently have any investments in debt securities with floating interest rates, investment income in such securities should we acquire them in the future could be adversely affected by changes in interest rates.

Foreign Currency Risk

We may from time to time invest in securities that are denominated in foreign currencies. As of June 30, 2024, our investments were not subject to foreign currency risk as they were all denominated in U.S. dollars.

Changes in Investment Objective, Investment Policies, Principal Risks or Persons Responsible for Day-to-Day Management of the Company's Investment Portfolio

Since our last annual report to shareholders, there have been no changes in our investment objective, investment policies, principal risks or persons responsible for day-to-day management of our investment portfolio through June 30, 2024.

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES (UNAUDITED) |

| | | | | |

| | June 30, 2024 |

| ASSETS | |

| Investments in securities and other financial instruments, at value: | |

| Unaffiliated publicly traded equity and equity-related securities (cost: $42,044,788) | $ | 22,139,028 | |

| Unaffiliated legacy privately held equity and equity-related securities (cost: $108,258) | 115,091 | |

| Non-controlled affiliated publicly traded equity and equity-related securities (cost: $32,192,781) | 22,892,575 | |

| Non-controlled affiliated legacy privately held equity and equity-related securities (cost: $6,496,930) | 185,974 | |

| Non-controlled affiliated derivative securities (cost: $224,849) | 296,038 | |

| Unaffiliated rights to payments (cost: $0) | 69,459 | |

| Unaffiliated money market fund securities (cost: $131,228) | 131,228 | |

| Prepaid expenses | 116,814 | |

| Lease asset | 17,979 | |

| Other assets | 12,575 | |

| Total assets | $ | 45,976,761 | |

| LIABILITIES & NET ASSETS | |

| |

| Post-retirement plan liabilities | $ | 611,139 | |

| Accounts payable and accrued liabilities | 305,243 | |

| Lease obligation | 17,979 | |

| Total liabilities | $ | 934,361 | |

| Commitments and contingencies (Note 10) | |

| Net assets | $ | 45,042,400 | |

| Net assets are comprised of: | |

| Preferred stock, $0.10 par value, 2,000,000 shares authorized; none issued | $ | 0 | |

| Common stock, $0.03 par value, 15,000,000 shares authorized; 11,541,079 issued | 334,594 | |

| Additional paid in capital | 105,597,715 | |

| Total accumulated distributable loss | (54,628,986) | |

| Treasury stock, at cost 1,540,938 shares | (6,260,923) | |

| Net assets | $ | 45,042,400 | |

| Shares outstanding | 10,000,141 | |

| Net asset value per outstanding share | $ | 4.50 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

10

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF OPERATIONS (UNAUDITED) |

| | | | | |

| Six Months Ended

June 30, 2024 |

| Income: | |

| Board fees from portfolio companies - cash | $ | 32,500 | |

| Board fees from portfolio companies - non-cash | 77,040 | |

| Interest-Unaffiliated money market fund securities | 14,011 | |

| Total income | 123,551 | |

| Operating fees and expenses: | |

| Salaries, bonus and benefits | 1,148,315 | |

| Professional | 344,933 | |

| Administration and operations | 188,417 | |

| Directors | 116,250 | |

| Insurance | 100,620 | |

| Software | 99,205 | |

| Rent | 19,299 | |

| Custody | 15,962 | |

| Other | 3,694 | |

| Total operating expenses | 2,036,695 | |

| Net investment loss before income tax expense | (1,913,144) | |

| Income tax expense | 199 | |

| Net investment loss | (1,913,343) | |

| Net realized gain (loss) from investments: | |

| Unaffiliated publicly traded equity and equity-related securities | 476,241 | |

| Unaffiliated legacy privately held equity and equity-related securities | (710,161) | |

| Non-controlled affiliated publicly traded equity and equity-related securities | 2,516,053 | |

| Unaffiliated rights to payments | 161,513 | |

| Net realized gain from investments | 2,443,646 | |

| Change in unrealized (depreciation) appreciation on investments: | |

| Unaffiliated publicly traded equity and equity-related securities | (3,219,786) | |

| Unaffiliated legacy privately held equity and equity-related securities | 655,679 | |

| Non-controlled affiliated publicly traded equity and equity-related securities | (2,989,357) | |

| Non-controlled affiliated legacy privately held equity and equity-related securities | (15,465) | |

| Unaffiliated rights to payments | (137,134) | |

| Net change in unrealized depreciation on investments | (5,706,063) | |

| Net realized gain and change in unrealized depreciation on investments | (3,262,417) | |

| Net decrease in net assets resulting from operations | $ | (5,175,760) | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

11

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED) |

| | | | | |

| Six Months Ended

June 30, 2024 |

| Cash flows used in operating activities: | |

| Net decrease in net assets resulting from operations | $ | (5,175,760) | |

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash used in operating activities: | |

| Net realized gain | (2,443,646) | |

| Net change in unrealized depreciation on investments | 5,706,063 | |

| Board fees from portfolio companies - non-cash | (77,040) | |

| Depreciation of fixed assets | 3,294 | |

| Purchase of unaffiliated publicly traded equity and equity-related securities | (8,834,230) | |

| Purchase of non-controlled affiliated publicly traded equity and equity-related securities | (2,257,643) | |

| Purchase of unaffiliated money market fund securities, net | (34,783) | |

| Proceeds from sale of unaffiliated publicly traded equity and equity-related securities | 7,616,591 | |

| Proceeds from sale of unaffiliated legacy privately held equity and equity-related securities | 114,054 | |

| Proceeds from sale of non-controlled affiliated publicly traded and equity-related securities | 3,688,567 | |

| Distribution from unaffiliated rights to payments | 1,311,311 | |

| |

| Changes in assets and liabilities: | |

| Decrease in prepaid expenses | 101,275 | |

| Decrease in other assets | 109 | |

| Decrease in post-retirement plan liabilities | (16,147) | |

| Increase in accounts payable and accrued liabilities | 15,818 | |

| Net cash used in operating activities | (282,167) | |

| Net decrease in cash | (282,167) | |

| Cash at beginning of the period | 282,167 | |

Cash at end of the period* | $ | 0 | |

| Supplemental disclosures of cash flow information: | |

| Income taxes paid | $ | 199 | |

| |

* The Company had $131,228 held in money market securities as of June 30, 2024, that is not treated as cash or a cash equivalent for reporting purposes.

The accompanying notes are an integral part of these unaudited consolidated financial statements.

12

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | | | | | | | |

| Six Months Ended June 30, 2024 | | Year Ended December 31, 2023 |

| UNAUDITED | | AUDITED |

| Changes in net assets from operations: | | | |

| Net investment loss | $ | (1,913,343) | | | $ | (3,711,441) | |

| Net realized gain (loss) | 2,443,646 | | | (5,695,394) | |

| Net change in unrealized depreciation on investments | (5,706,063) | | | (4,264,756) | |

| Net decrease in net assets resulting from operations | (5,175,760) | | | (13,671,591) | |

| | | |

| Changes in net assets from capital stock transactions: | | | |

| Treasury stock purchase | 0 | | | (1,655,398) | |

| Net decrease in net assets resulting from capital stock transactions | 0 | | | (1,655,398) | |

| Net decrease in net assets | (5,175,760) | | | (15,326,989) | |

| Net Assets: | | | |

| Beginning of the period/year | 50,218,160 | | | 65,545,149 | |

| End of the period/year | $ | 45,042,400 | | | $ | 50,218,160 | |

| | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

13

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED FINANCIAL HIGHLIGHTS |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended Jun. 30, 2024 | | Year Ended Dec. 31, 2023 | | Year Ended Dec. 31, 2022 | | Year Ended Dec. 31, 2021 | | Year Ended Dec. 31 2020# | | Year Ended Dec. 31 2019# | | | | | | | |

| (UNAUDITED) | | AUDITED | | AUDITED | | AUDITED | | AUDITED | | AUDITED | | | | | | | |

| Per Share Operating Performance: | | | | | | | | | | | | | | | | | | |

| Net asset value per share, beginning of the period/year | $ | 5.02 | | | $ | 6.32 | | | $ | 10.66 | | | $ | 9.28 | | | $ | 9.18 | | | $ | 7.92 | | | | | | | | |

Net investment loss* | (0.19) | | | (0.38) | | | (0.25) | | | (0.33) | | | (0.05) | | | (0.48) | | | | | | | | |

Net realized (loss) gain* | 0.25 | | | (0.56) | | | 0.21 | | | 0.20 | | | (0.11) | | | 0.93 | | | | | | | | |

Net change in unrealized (depreciation) appreciation on investments and options*1 | (0.58) | | | (0.42) | | | (4.30) | | | 1.51 | | | 0.26 | | | 0.81 | | | | | | | | |

| Total from investment operations* | (0.52) | | | (1.36) | | | (4.34) | | | 1.38 | | | 0.10 | | | 1.26 | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Net increase as a result of purchase of treasury stock | 0.00 | | | 0.06 | | | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | | | | | | |

| Net (decrease) increase in net asset value | (0.52) | | | (1.30) | | | (4.34) | | | 1.38 | | | 0.10 | | | 1.26 | | | | | | | | |

| Net asset value per share, end of the period/year | $ | 4.50 | | | $ | 5.02 | | | $ | 6.32 | | | $ | 10.66 | | | $ | 9.28 | | | $ | 9.18 | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Stock price per share, end of the period/year | $ | 3.79 | | | $ | 4.10 | | | $ | 5.28 | | | $ | 7.35 | | | $ | 6.66 | | | $ | 6.45 | | | | | | | | |

| Total return based on stock price | (7.56) | % | | (22.35) | % | | (28.16) | % | | 10.36 | % | | 3.26 | % | | 22.86 | % | | | | | | | |

| Supplemental Data: | | | | | | | | | | | | | | | | | | |

| Net assets, end of the period/year | $ | 45,042,400 | | | $ | 50,218,160 | | | $ | 65,545,149 | | | $ | 110,575,952 | | | $ | 96,317,794 | | | $ | 95,213,659 | | | | | | | | |

| Ratio of expenses to average net assets | 4.16 | % | | 6.39 | % | | 3.20 | % | ^ | 5.87 | % | ^ | 4.61 | % | ^ | 6.42 | % | ^ | | | | | | |

| Ratio of net investment loss to average net assets | (3.91) | % | | (6.30) | % | | (2.88) | % | | (3.26) | % | | (0.59) | % | | (5.42) | % | | | | | | | |

| Portfolio turnover | 22.41 | % | | 31.56 | % | | 30.95 | % | | 44.46 | % | | 35.16 | % | | 30.17 | % | | | | | | | |

| Number of shares outstanding, end of the period/year | 10,000,141 | | | 10,000,141 | | | 10,373,820 | | | 10,373,820 | | | 10,373,820 | | | 10,373,820 | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

# Reflect a 1-for-3 reverse stock split that became effective on January 4, 2021.

* Based on average shares outstanding.

^ The Company has entered into an expense offsetting arrangement with one of its unaffiliated brokers relating to broker fees paid. The total broker fee charged to the Company was applied as a credit to fees charged by an affiliate of the unaffiliated broker who the Company subscribes to for data services billed during the year. The Company received an offset to expense totaling approximately $20,600, $84,800, $31,900, and $15,700, with that broker for the years ended December 31, 2022-2019, respectively.

1 Net unrealized losses include rounding adjustments to reconcile change in net asset value per share.

The accompanying notes are an integral part of these unaudited consolidated financial statements.

14

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2024 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 49.7% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Publicly Traded Equity and Equity-Related Securities - | | | | | | | | | |

| 49.1% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Arena Group Holdings, Inc. (3) | | | Interactive Media & Services | | | | | | |

| Provides a shared digital publishing, advertising and distribution platform | | | | | | | | | |

| Common Stock | (L1) | | | | 991,192 | | $ | 9,806,339 | | | $ | 763,218 | |

| | | | | | | | | |

| Ascent Industries Co. (3) | | | Steel | | | | | | |

| Manufactures metals and chemicals | | | | | | | | | |

| Common Stock | (L1) | | | | 357,155 | | 3,773,895 | | | 3,485,833 | |

| | | | | | | | | |

| Aviat Networks, Inc. (3) | | | Communications Equipment | | | | | | |

| Provides solutions to wireless and private network operators | | | | | | | | | |

| Common Stock | (L1) | | | | 62,104 | | 1,903,810 | | | 1,781,764 | |

| | | | | | | | | |

| Brightcove, Inc. (3) | | | Internet Services & Infrastructure | | | | | | |

| Provides video hosting and publishing services | | | | | | | | | |

| Common Stock | (L1) | | | | 1,361,366 | | 3,495,997 | | | 3,226,437 | |

| | | | | | | | | |

| Commercial Vehicle Group, Inc. (3) | | | Construction Machinery & Heavy Trucks | | | | | | |

| Supplier of vehicle components | | | | | | | | | |

| Common Stock | (L1) | | | | 432,523 | | 2,407,730 | | | 2,119,363 | |

| | | | | | | | | |

| D-Wave Quantum, Inc. (3)(4) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Develops high-performance quantum computing systems | | | | | | | | | |

| Common Stock | (L1) | | | | 650,000 | | 882,442 | | | 741,000 | |

| | | | | | | | | |

| Hudson Technologies, Inc. (3) | | | Trading Companies & Distributors | | | | | | |

| Provides solutions for chiller and refrigeration systems | | | | | | | | | |

| Common Stock | (L1) | | | | 69,708 | | 639,950 | | | 612,733 | |

| | | | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

15

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2024 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 49.7% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Publicly Traded Equity and Equity-Related Securities - | | | | | | | | | |

| 49.1% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Intevac, Inc. (3) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Develops solutions for the application and engineering of thin-films | | | | | | | | | |

| Common Stock | (L1) | | | | 914,217 | | $ | 4,232,706 | | | $ | 3,528,878 | |

| | | | | | | | | |

| Lantronix, Inc. (3) | | | Communications Equipment | | | | | | |

| Provides secure data access and management solutions | | | | | | | | | |

| Common Stock | (L1) | | | | 693,291 | | 2,749,784 | | | 2,461,183 | |

| | | | | | | | | |

| Quantum Corporation (3) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Provides high-density data storage and high-speed data processing solutions | | | | | | | | | |

| Common Stock | (L1) | | | | 4,467,199 | | 9,291,808 | | | 1,827,531 | |

| | | | | | | | | |

| RF Industries, Ltd. (3) | | | Electronic Manufacturing Services | | | | | | |

| Provides products that enable wired and wireless communications | | | | | | | | | |

| Common Stock | (L1) | | | | 455,899 | | 2,860,327 | | | 1,591,088 | |

| | | | | | | | | |

| Total Unaffiliated Publicly Traded Equity and Equity-Related Securities (cost: $42,044,788) | | | | | | | | | $ | 22,139,028 | |

| | | | | | | | | |

| Investments in Unaffiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 49.7% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Money Market Fund Securities - | | | | | | | | | |

| 0.3% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| JPMorgan 100% U.S. Treasury Securities Money Market Fund - Capital | | | | | | | | | |

| Common Stock (Yield 5.17%) | (L1) | | | | 131,228 | | | $ | 131,228 | | | $ | 131,228 | |

| | | | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

16

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2024 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Unaffiliated Money Market Fund Securities (cost: $131,228) | | | | | | | | | $ | 131,228 | |

| | | | | | | | | |

| Investments in Unaffiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 49.7% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Legacy Privately Held Equity and Equity-Related Securities - | | | | | | | | | |

| 0.3% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| AutoTech Ventures Management I, LLC (3)(5)(6) | | | Asset Management & Custody Banks | | | | | | |

| Venture capital investing in automotive-related companies | | | | | | | | | |

| LLC Interests (acquired 12/1/17) | (M) (L3) | | | | 0 | | $ | 0 | | | $ | 100,000 | |

| | | | | | | | | |

| Ravenna Pharmaceuticals, Inc. (3)(5)(7)(8)(9) | | | Pharmaceuticals | | | | | | |

| Holding company for intellectual property in oncology therapeutics | | | | | | | | | |

| Common Stock (acquired 5/14/20-8/26/21) | (M) (L3) | | | | 2,785,274 | | 108,258 | | | 15,091 | |

| | | | | | | | | |

| Total Unaffiliated Legacy Privately Held Equity and Equity-Related Securities (cost: $108,258) | | | | | | | | | $ | 115,091 | |

| | | | | | | | | |

| Total Investments in Unaffiliated Equity and Equity-Related Securities (cost: $42,284,274) | | | | | | | | | $ | 22,385,347 | |

| | | | | | | | | |

| Investments in Non-Controlled Affiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 51.2% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Non-Controlled Affiliated Publicly Traded Equity and Equity-Related Securities - | | | | | | | | | |

| 50.8% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| comScore, Inc. (3)(10) | | | Advertising | | | | | | |

| Provides technology and services that measure audiences, brands and consumer behavior | | | | | | | | | |

| Common Stock | (L1) | | | | 400,135 | | $ | 13,365,642 | | | $ | 5,677,916 | |

| | | | | | | | | |

| Potbelly Corporation (3)(10) | | | Restaurants | | | | | | |

| Operates a chain of sandwich shops | | | | | | | | | |

| Common Stock | (L1) | | | | 1,142,574 | | 5,816,897 | | | 9,174,869 | |

| | | | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2024 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 51.2% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Non-Controlled Affiliated Publicly Traded Equity and Equity-Related Securities - | | | | | | | | | |

| 50.8% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Synchronoss Technologies, Inc. (3)(10) | | | Application Software | | | | | | |

| Provides white-label cloud storage, messaging and other digital analytic services | | | | | | | | | |

| Common Stock | (L1) | | | | 854,788 | | $ | 12,933,202 | | | $ | 7,949,528 | |

| Common Stock-Restricted (5)(11) | (M) (L2) | | | | 12,000 | | 77,040 | | | 90,262 | |

| | | | | | | 13,010,242 | | | 8,039,790 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Publicly Traded Equity and Equity-Related Securities (cost: $32,192,781) | | | | | | | | | $ | 22,892,575 | |

| | | | | | | | | |

| Non-Controlled Affiliated Legacy Privately Held Equity and Equity-Related Securities - | | | | | | | | | |

| 0.4% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| EchoPixel, Inc. (3)(5)(7) | | | Health Care Equipment | | | | | | |

| Develops virtual reality 3-D visualization software for life sciences and health care applications | | | | | | | | | |

| Series Seed Convertible Preferred Stock (acquired 6/21/13-6/30/14) | (I) (L3) | | | | 4,194,630 | | $ | 1,250,000 | | | $ | 102,182 | |

| Series Seed-2 Convertible Preferred Stock (acquired 1/22/16) | (I) (L3) | | | | 1,476,668 | | 500,000 | | | 36,382 | |

| Series A-2 Convertible Preferred Stock (acquired 3/23/17) | (I) (L3) | | | | 1,471,577 | | 350,000 | | | 47,410 | |

| | | | | | | | 2,100,000 | | | 185,974 | |

| | | | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

18

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2024 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 51.2% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Non-Controlled Affiliated Legacy Privately Held Equity and Equity-Related Securities - | | | | | | | | | |

| 0.4% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| HALE.life Corporation (3)(5)(7) | | | Health Care Technology | | | | | | |

| Develops a platform to facilitate precision health and medicine | | | | | | | | | |

| Common Stock (acquired 3/1/16) | (I) (L3) | | | | 1,000,000 | | $ | 10 | | | $ | 0 | |

| Series Seed-1 Convertible Preferred Stock (acquired 3/28/17) | (I) (L3) | | | | 11,000,000 | | 1,896,920 | | | 0 | |

| Series Seed-2 Convertible Preferred Stock (acquired 12/28/18) | (I) (L3) | | | | 12,083,132 | | 2,500,000 | | | 0 | |

| | | | | | | | 4,396,930 | | | 0 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Legacy Privately Held Equity and Equity-Related Securities (cost: $6,496,930) | | | | | | | | | $ | 185,974 | |

| | | | | | | | | |

| Total Investments in Non-Controlled Affiliated Equity and Equity-Related Securities (cost: $38,689,711) | | | | | | | | | $ | 23,078,549 | |

| | | | | | | | | |

| Total Investments in Publicly Traded Equity and Equity-Related Securities, Money Market Funds, and Legacy Privately Held Equity and Equity-Related Securities (cost: $80,973,985) | | | | | | | | | $ | 45,463,896 | |

| | | | | | | | | |

| Derivative Securities - | | | | | | | | | |

| 0.7% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Non-Controlled Affiliated Derivative Securities (2) - | | | | | | | | | |

| 0.7% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Potbelly Corporation (3)(10) | | | Restaurants | | | | | | |

| Operates a chain of sandwich shops | | | | | | | | | |

| Warrants for the Purchase of Common Stock expiring 2/12/26 (acquired 2/10/21) | (I) (L3) | | | | 80,605 | | $ | 224,849 | | | $ | 276,179 | |

| | | | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

19

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2024 (UNAUDITED) |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Derivative Securities - | | | | | | | | | |

| 0.7% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Non-Controlled Affiliated Derivative Securities (2) - | | | | | | | | | |

| 0.7% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Synchronoss Technologies, Inc. (3)(5)(10)(11) | | | Application Software | | | | | | |

| Provides white-label cloud storage, messaging and other digital analytic services | | | | | | | | | |

| Stock Options for Common Stock Expiring 12/4/30 (acquired 12/4/23) | (I) (L3) | | | | 3,334 | | $ | 0 | | | $ | 19,859 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Derivative Securities (cost: $224,849) | | | | | | | | | $ | 296,038 | |

| | | | | | | | | |

| Total Derivative Securities (cost: $224,849) | | | | | | | | | $ | 296,038 | |

| | | | | | | | | |

| Total Investments (cost: $81,198,834) | | | | | | | | | $ | 45,759,934 | |

| | | | | | | | | |

| Other Financial Instruments (12) - | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Rights to Payments (Illiquid) (2) - | | | | | | | | | |

| 0.2% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Rights to Milestone Payments from Acquisition of TARA Biosystems, Inc. (acquired 4/1/22) (3)(5)(7)(13) | (I) (L3) | | Pharmaceuticals | | $ | 0 | | | $ | 0 | | | $ | 69,459 | |

| | | | | | | | | |

| Total Unaffiliated Rights to Payments (cost: $0) | | | | | | | | | $ | 69,459 | |

| | | | | | | | | |

| Total Investments in Publicly Traded and Privately Held Equity, Money Market Fund and Equity-Related Securities, Derivative Securities and Other Financial Instruments (cost: $81,198,834) | | | | | | | | | $ | 45,829,393 | |

| | | | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

20

180 DEGREE CAPITAL CORP.

NOTES TO CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2024

(UNAUDITED)

Notes to Consolidated Schedule of Investments

(1)See Note 2. Summary of Significant Accounting Policies: Portfolio Investment Valuations.

(2)Investments in unaffiliated securities consist of investments in which the Company owns less than five percent of the voting shares of the portfolio company. Investments in non-controlled affiliated securities consist of investments in which the Company owns five percent or more, but less than 25 percent, of the voting shares of the portfolio company, or where the Company controls one or more seats on the portfolio company’s board of directors but do not control the company. Investments in controlled affiliated securities consist of investments in which the Company owns 25 percent or more of the outstanding voting rights of the portfolio company or otherwise control the company, including control of a majority of the seats on the board of directors, or more than 25 percent of the seats on the board of directors, with no other entity or person in control of more director seats than us.

(3)Represents a non-income producing investment. Investments that have not paid dividends or interest within the last 12 months or are on non-accrual status for at least 12 consecutive months are considered to be non-income producing.

(4)D-Wave Quantum Inc., ("QBTS") was formed through the merger of D-Wave Systems, Inc., and DPCM Capital, Inc., a special purpose acquisition company (SPAC). D-Wave Systems, Inc. was a legacy private portfolio holding of the Company. The Company initially invested in D-Wave Systems, Inc. starting in 2008 and through 2014, acquiring various classes of preferred stock.

(5)The Company is subject to legal restrictions on the sale of all or a portion of our investment(s) in this company. The total amount of restricted securities held is $480,645, or 1.1 percent of net assets.

(6)The Company received LLC Interests of 1.25 percent in AutoTech Ventures Management I, LLC ("AutoTech") pursuant to an Administrative Services Agreement between us and AutoTech and due to us following the termination of a former employee of the Company. These LLC Interests were separate from the compensation received for providing the administrative services under the agreement that were paid in cash. The LLC interests have a capital percentage of 0 percent.

(7)These securities are held by the Company's wholly owned subsidiary, 180 Degree Private Holdings, LLC ("180PH"), which were transferred from the Company to 180PH in the fourth quarter of 2020. The acquisition dates of the securities reflect the dates such securities were obtained by the Company rather than the transfer date.

(8)Represents a non-operating entity that exists to collect future payments from licenses or other engagements, monetize assets for future distributions to investors and debt holders, or is in the process of shutting down and distributing remaining assets according to a liquidation waterfall.

(9)The Company received shares of Ravenna Pharmaceuticals, Inc., as part of the consideration of the acquisition of Petra Pharma Corporation.

(10)The Company is the Investment Manager of separately managed accounts ("SMAs") that owns shares of these portfolio companies. Under our investment management agreement for the SMAs, the Company has the right to control the votes of the securities held by the SMAs. The Company has voting ownership between 5 percent and 25 percent in these companies directly or when the shares held by us and our SMAs are aggregated.

(11)These restricted shares of common stock and stock options for the purchase of common stock were granted to Kevin Rendino in connection with his service as a member of the Board of Directors of Synchronoss Technologies, Inc. Mr. Rendino entered into an assignment and assumption agreement with the Company that transfers all beneficial and voting interest to the Company.

(12)Other financial instruments are holdings of the Company that do not meet the definition of a security or a derivative.

The accompanying notes are an integral part of these unaudited consolidated financial statements.

21

180 DEGREE CAPITAL CORP.

NOTES TO CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2024

(UNAUDITED)

(13)If all the remaining milestones are met, the Company would receive approximately $2.7 million. There can be no assurance as to how much of the remaining approximately $2.7 million in potential milestone-based payments will ultimately be realized or when they will be realized, if at all.

The accompanying notes are an integral part of these unaudited consolidated financial statements.

22

180 DEGREE CAPITAL CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 1. THE COMPANY

180 Degree Capital Corp. (including its wholly owned subsidiaries, the "Company," "us," "our" and "we"), withdrew its election to be treated as a business development company on March 30, 2017, and subsequently returned to its prior status as a registered non-diversified closed-end management investment company ("Closed-End Fund" or "CEF") under the Investment Company Act of 1940 (the "1940 Act"). We operate as an internally managed investment company whereby our officers and employees, under the general supervision of our Board of Directors, conduct our operations. As of May 22, 2020, we are also registered with the Securities and Exchange Commission as a Registered Investment Adviser under the Investment Advisers Act of 1940 (the "Advisers Act").

180 Degree Private Holdings, LLC ("180PH"), is a wholly owned limited liability company that was created in October 2020 to hold certain of the Company's securities of privately held companies. 180PH was consolidated for financial reporting purposes and is a disregarded entity for tax purposes under the Internal Revenue Code ("Code").

180 Degree Capital BD, LLC ("180BD") was a 100 percent owned subsidiary of the Company that was sold to an unrelated buyer and the transaction closed in February 2023. 180BD was registered by the Company as a broker-dealer with the Financial Industry Regulatory Authority ("FINRA") that was formed to provide services to the Company related to fundraising for co-investment funds and not for investment returns. Historically, the Company consolidated 180BD for financial reporting purposes.

The Company is the Managing Member of 180 Degree Capital Management, LLC ("180CM"), a limited liability company formed to facilitate the opportunity for interested investors to co-invest alongside the Company in individual publicly traded portfolio companies. As of June 30, 2024, the Company has no capital under management in 180CM.

As of June 30, 2024, the Company manages approximately $6.3 million in net assets in two separately managed accounts ("SMA").

The Company may, in certain cases, receive management fees and carried interest on profits generated on invested capital from any capital under management if and when capital is raised and if and when profits are realized, respectively. The Company does not consolidate the operations of any capital managed in separate series of 180CM, or in the separately managed accounts.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed in the preparation of the consolidated financial statements:

Principles of Consolidation. The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the US ("GAAP") and Articles 6 and 12 of Regulation S-X of the Securities Exchange Commission ("SEC") and include the accounts of the Company and its wholly owned subsidiaries. The Company is an investment company following accounting and reporting guidance in Accounting Standards Codification 946. In accordance with GAAP and Regulation S-X under 17 C.F.R. Part 210, the Company may only consolidate its interests in investment company subsidiaries and controlled operating companies whose business consists of providing services to the Company. Prior to February 2023, our wholly owned subsidiary, 180BD, was a controlled operating company that provided services to us and was, therefore, consolidated. 180PH is a controlled operating company that provide services to us and is, therefore, consolidated. All significant intercompany accounts and transactions were eliminated in the consolidated financial statements.

Use of Estimates. The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and contingent assets and liabilities and the reported amounts of revenues and expenses. Actual results could differ from these estimates, and the differences could be material. The most significant estimates relate to the fair valuations of our investments.

Portfolio Investment Valuations. Investments are stated at "value" as defined in the 1940 Act and in the applicable regulations of the SEC and in accordance with GAAP. Value, as defined in Section 2(a)(41) of the 1940 Act, is (i) the market price for those securities for which a market quotation is readily available and (ii) the fair value as determined in good faith by, or under the direction of, the Board of Directors for all other assets. The Valuation Committee, comprised of all of the independent Board members, is responsible for determining the valuation of the Company’s assets within the guidelines established by the Board of Directors, pursuant with SEC Rule 2a-5. The Valuation Committee receives information and recommendations from management. The Company may from time to time use an independent valuation firm to review select portfolio company valuations on an as needed basis. The independent valuation firm, when engaged by the Company, does not provide independent valuations. The fair values assigned to these investments are based on available information and do not necessarily represent amounts that might ultimately be realized when that investment is sold, as such amounts depend on future circumstances and cannot reasonably be determined until the individual investments are actually liquidated or become readily marketable. The Valuation Committee values the Company's investment assets as of the end of each calendar quarter and as of any other time requested by the Board of Directors.

Accounting Standards Codification Topic 820, "Fair Value Measurements," ("ASC 820") defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (exit price). It applies fair value terminology to all valuations whereas the 1940 Act applies market value terminology to readily marketable assets and fair value terminology to other assets.

The main approaches to measuring fair value utilized are the market approach, the income approach and the hybrid approach.

•Market Approach (M): The market approach focuses on inputs and not techniques. The market approach may use quantitative inputs such as prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities and the values of market multiples derived from a set of comparable companies. The market approach may also use qualitative inputs such as progress toward milestones, the long-term potential of the business, current and future financing requirements and the rights and preferences of certain securities versus those of other securities. The selection of the relevant inputs used to derive value under the market approach requires judgment considering factors specific to the significance and relevance of each input to deriving value.

•Income Approach (I): The income approach focuses on techniques and not inputs. The income approach uses valuation techniques to convert future amounts (for example, revenue, cash flows or earnings) to a single present value amount (discounted). The measurement is based on the value indicated by current market expectations about those future amounts. Those valuation techniques include present value techniques; option-pricing models, such as the Black-Scholes-Merton formula (a closed-form model) and a binomial model (a lattice model), which incorporate present value techniques; and the multi-period excess earnings method, which is used to measure the fair value of certain assets.

•Hybrid Approach (H): The hybrid approach uses elements of both the market approach and the income approach. The hybrid approach calculates values using the market and income approach, individually. The resulting values are then distributed among the share classes based on probability of exit outcomes.

ASC Topic 820 classifies the inputs used to measure fair value by these approaches into the following hierarchy:

•Level 1 (L1): Unadjusted quoted prices in active markets for identical assets or liabilities;

•Level 2 (L2): Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. These include quoted prices in active markets for similar assets or liabilities, or quoted prices for identical or similar assets or liabilities in markets that are not active, or inputs other than quoted prices that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. Level 2 inputs are in those markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers; and

•Level 3 (L3): Inputs to the valuation methodology are unobservable and significant to the fair value measurement. Unobservable inputs are those inputs that reflect our own assumptions that market participants would use to price the asset or liability based upon the best available information.

Financial assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement and are not necessarily an indication of risks associated with the investment.

As of June 30, 2024, our financial statements include investments fair valued by the Board of Directors of $756,824. The fair values were determined in good faith by, or under the direction of, the Board of Directors. The fair value amount includes the values of our investments in legacy privately held companies and rights to future milestone payments, as well as our warrants for the purchase of common stock of Potbelly Corporation, our options for the purchase of common stock of Synchronoss Technologies, Inc., and our restricted common stock of Synchronoss Technologies, Inc.

Cash. Cash includes demand deposits. Cash is carried at cost, which approximates fair value.

Unaffiliated Rights to Payments. At June 30, 2024, the outstanding potential milestone and time-based payments from the acquisition of TARA Biosystems, Inc., by Valo Health, LLC were valued at $69,459. The milestone payments are valued using the probability-adjusted, present value of proceeds from future payments that would be due upon successful completion of certain regulatory milestones. There can be no assurance as to how much of the amounts related to milestone payments that we will ultimately realize or when they will be realized, if at all. The time-based payments are valued using a discount for time-value of money that includes estimated default risk of the acquirer.

Prepaid Expenses. We include prepaid insurance premiums in "Prepaid expenses." Prepaid insurance premiums are recognized over the term of the insurance contract and are included in "Insurance" in the Company's Consolidated Statement of Operations.

Property and Equipment. Property and equipment are included in "Other assets" and are carried at $5,996 at June 30, 2024, representing cost of $229,818, less accumulated depreciation of $223,822. Depreciation is provided using the straight-line method over the estimated useful lives of the property and equipment. We estimate the useful lives to be five to ten years for furniture and fixtures, and three years for computer equipment.

Post-Retirement Plan Liabilities. Until it was terminated on April 27, 2017, the Company provided a Retiree Medical Benefit Plan for employees who met certain eligibility requirements. Until it was terminated on May 5, 2011, the Company also provided an Executive Mandatory Retirement Benefit Plan for certain individuals employed by us in a bona fide executive or high policy-making position. The net periodic post-retirement benefit cost includes service cost and interest cost on the accumulated post-retirement benefit obligation. Unrecognized actuarial gains and losses are recognized as net periodic benefit cost, pursuant to the Company's historical accounting policy in "Salaries, bonus and benefits" in the Company's Consolidated Statement of Operations. The impact of plan amendments was amortized over the employee's average service period as a reduction of net periodic benefit cost. Unamortized prior service cost was fully amortized during 2017 as a result of the termination of the Retiree Medical Benefit Plan.

Interest Income Recognition. Interest income, including amortization of premium and accretion of discount, is recorded on an accrual basis. When accrued interest is determined not to be recoverable, the Company ceases accruing interest and writes off any previously accrued interest. Write-offs are netted in interest income. Securities are deemed to be non-income producing if investments have not paid dividends or interest within the last 12 months or are on non-accrual status for at least 12 consecutive months. When the fair value of a security that includes PIK interest is less than the accrued interest, the Company may place the security on non-accrued status.

Board Fees From Portfolio Companies. The Company recognizes revenues from board fees as those services are provided.

Management Fees and Performance Fees/Carried Interest from Managed Funds. As a Registered Investment Adviser under the Advisers Act, the Company may be entitled to receive management fees and performance fees from clients including separately managed accounts (SMAs) and special purpose vehicles (SPVs). When applicable, the Company accrues management fees on SPVs that are to be paid upon liquidation of the entity regardless of performance. Performance fees or carried interest, if any, is paid annually by SMAs based on a fixed percentage of the increase in net assets during the year. Performance fees on SPVs, if any, are generally paid based on the amount of increase in net assets at the time of any distribution of capital above the amount of initial invested capital plus accrued expenses. The timing and payment terms of management fees and performance fees for future client accounts may be different than those of our current SMAs.

The Company does not include accruals for carried interest in the consolidated financial statements until such carried interest is received and/or the Company concludes that it is probable that a reversal of any accrual will not occur. The Company did not earn or accrue any carried interest in the period ended June 30, 2024.