|

HARRIS

& HARRIS GROUP, INC.

|

|

|

(Exact

Name of Registrant as Specified in Its

Charter)

|

|

New

York

|

13-3119827

|

|

(State

or Other Jurisdiction of

|

(I.R.S.

Employer Identification No.)

|

|

Incorporation

or Organization)

|

|

111

West 57th

Street, New York, New York

|

10019

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

|

(212)

582-0900

|

|

(Registrant's

Telephone Number, Including Area

Code)

|

|

Yes

x

|

No

¨

|

|

Large

accelerated filer ¨

|

Accelerated

filer x

|

|

Non-accelerated

filer ¨

|

Smaller

reporting company ¨

|

|

Yes

¨

|

No

x

|

|

Class

|

Outstanding

at November 7, 2008

|

|

Common

Stock, $0.01 par value per share

|

25,859,573 shares

|

|

Page

Number

|

|

|

PART

I. FINANCIAL INFORMATION

|

|

|

Item

1. Consolidated Financial Statements

|

1

|

|

Consolidated

Statements of Assets and Liabilities

|

2

|

|

Consolidated

Statements of Operations

|

3

|

|

Consolidated

Statements of Cash Flows

|

4

|

|

Consolidated

Statements of Changes in Net Assets

|

5

|

|

Consolidated

Schedule of Investments

|

6

|

|

Notes

to Consolidated Financial Statements

|

21

|

|

Financial

Highlights

|

32

|

|

Item

2. Management's Discussion and Analysis of Financial Condition and

Results

of Operations

|

33

|

|

Background

and Overview

|

33

|

|

Results

of Operations

|

37

|

|

Financial

Condition

|

42

|

|

Liquidity

|

44

|

|

Capital

Resources

|

45

|

|

Critical

Accounting Policies

|

45

|

|

Recent

Developments - Other

|

48

|

|

Recent

Developments - Portfolio Companies

|

48

|

|

Forward-Looking

Statements

|

48

|

|

Item

3. Quantitative and Qualitative Disclosures About Market

Risk

|

49

|

|

Item

4. Controls and Procedures

|

51

|

|

PART

II. OTHER INFORMATION

|

|

|

Item

1A. Risk Factors

|

52

|

|

Item

6. Exhibits

|

54

|

|

Signatures

|

55

|

|

Exhibit

Index

|

56

|

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

STATEMENTS OF ASSETS AND

LIABILITIES

|

|

ASSETS

|

|||||||

|

September

30, 2008

|

December

31, 2007

|

||||||

|

(Unaudited)

|

|||||||

|

Investments,

in portfolio securities at value

|

|||||||

|

(cost:

$87,913,862 and $82,677,528, respectively)

|

$

|

63,942,445

|

$

|

78,110,384

|

|||

|

Investments,

in U.S. Treasury obligations at value

|

|||||||

|

(cost:

$56,206,231 and $59,552,933, respectively)

|

57,032,781

|

60,193,593

|

|||||

|

Cash

and cash equivalents

|

937,914

|

330,009

|

|||||

|

Restricted

funds (Note 9)

|

124,664

|

2,667,020

|

|||||

|

Receivable

from portfolio company

|

0

|

524

|

|||||

|

Interest

receivable

|

463,732

|

647,337

|

|||||

|

Prepaid

expenses

|

148,515

|

488,667

|

|||||

|

Other

assets

|

426,449

|

455,798

|

|||||

|

Total

assets

|

$

|

123,076,500

|

$

|

142,893,332

|

|||

|

LIABILITIES

& NET ASSETS

|

|||||||

|

Accounts

payable and accrued liabilities (Note 9)

|

$

|

1,953,125

|

$

|

4,515,463

|

|||

|

Deferred

rent

|

9,715

|

14,525

|

|||||

|

Total

liabilities

|

1,962,840

|

4,529,988

|

|||||

|

Net

assets

|

$

|

121,113,660

|

$

|

138,363,344

|

|||

|

Net

assets are comprised of:

|

|||||||

|

Preferred

stock, $0.10 par value,

|

|||||||

|

2,000,000

shares authorized; none issued

|

$

|

0

|

$

|

0

|

|||

|

Common

stock, $0.01 par value, 45,000,000 shares authorized at 9/30/08 and

12/31/07; 27,688,313 issued at 9/30/08 and 25,143,313 issued at

12/31/07

|

276,884

|

251,434

|

|||||

|

Additional

paid in capital (Note 7)

|

179,619,630

|

160,927,691

|

|||||

|

Accumulated

net realized loss

|

(32,232,456

|

)

|

(15,483,766

|

)

|

|||

|

Accumulated

unrealized depreciation of investments

|

(23,144,867

|

)

|

(3,926,484

|

)

|

|||

|

Treasury

stock, at cost (1,828,740 shares at 9/30/08 and 12/31/07)

|

(3,405,531

|

)

|

(3,405,531

|

)

|

|||

|

Net

assets

|

$

|

121,113,660

|

$

|

138,363,344

|

|||

|

Shares

outstanding

|

25,859,573

|

23,314,573

|

|||||

|

Net

asset value per outstanding share

|

$

|

4.68

|

$

|

5.93

|

|||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

|

|

Three

Months Ended Sept. 30

|

Nine

Months Ended Sept. 30

|

||||||||||||

|

2008

|

2007

|

2008

|

2007

|

||||||||||

|

Investment

income:

|

|||||||||||||

|

Interest

from:

|

|||||||||||||

|

Fixed-income

securities

|

$

|

585,418

|

$

|

743,375

|

$

|

1,626,176

|

$

|

2,033,574

|

|||||

|

Miscellaneous

income

|

2,500

|

39

|

5,669

|

39

|

|||||||||

|

Total

investment income

|

587,918

|

743,414

|

1,631,845

|

2,033,613

|

|||||||||

|

Expenses:

|

|||||||||||||

|

Salaries,

benefits and stock-based compensation (Note 5)

|

2,205,980

|

3,230,838

|

7,101,077

|

8,409,888

|

|||||||||

|

Administration

and operations

|

252,884

|

311,332

|

838,100

|

1,049,375

|

|||||||||

|

Professional

fees

|

138,461

|

155,999

|

478,559

|

673,261

|

|||||||||

|

Rent

|

80,358

|

60,314

|

197,960

|

178,634

|

|||||||||

|

Directors’

fees and expenses

|

79,318

|

80,364

|

263,633

|

333,717

|

|||||||||

|

Depreciation

|

13,447

|

16,734

|

41,251

|

47,955

|

|||||||||

|

Custodian

fees

|

14,209

|

5,428

|

26,905

|

17,163

|

|||||||||

|

Total

expenses

|

2,784,657

|

3,861,009

|

8,947,485

|

10,709,993

|

|||||||||

|

Net

operating loss

|

(2,196,739

|

)

|

(3,117,595

|

)

|

(7,315,640

|

)

|

(8,676,380

|

)

|

|||||

|

Net

realized (loss) gain from investments:

|

|||||||||||||

|

Realized

(loss) gain from investments

|

(4,373,124

|

)

|

14,828

|

(9,384,082

|

)

|

5,941

|

|||||||

|

Income

tax expense (Note 6)

|

2,102

|

4,083

|

48,968

|

88,988

|

|||||||||

|

Net

realized (loss) gain from investments

|

(4,375,226

|

)

|

10,745

|

(9,433,050

|

)

|

(83,047

|

)

|

||||||

|

Net

(increase) decrease in unrealized depreciation on

investments:

|

|||||||||||||

|

Change

as a result of investment sales

|

4,278,500

|

0

|

9,293,153

|

0

|

|||||||||

|

Change

on investments held

|

(31,739,282

|

)

|

3,711,087

|

(28,511,536

|

)

|

(1,120,140

|

)

|

||||||

|

Net

(increase) decrease in unrealized depreciation on

investments

|

(27,460,782

|

)

|

3,711,087

|

(19,218,383

|

)

|

(1,120,140

|

)

|

||||||

|

Net

(decrease) increase in net assets resulting from

operations

|

$

|

(34,032,747

|

)

|

$

|

604,237

|

$

|

(35,967,073

|

)

|

$

|

(9,879,567

|

)

|

||

|

Per

average basic and diluted outstanding share

|

$

|

(1.32

|

)

|

$

|

0.03

|

$

|

(1.48

|

)

|

$

|

(0.45

|

)

|

||

|

Average

outstanding shares

|

25,859,573

|

23,235,023

|

24,271,270

|

22,084,893

|

|||||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

Nine

Months Ended

|

Nine

Months Ended

|

||||||

|

September

30, 2008

|

September

30, 2007

|

||||||

|

Cash

flows used in operating activities:

|

|||||||

|

Net

decrease in net assets resulting from operations

|

$

|

(35,967,073

|

)

|

$

|

(9,879,567

|

)

|

|

|

Adjustments

to reconcile net decrease in net assets resulting from operations

to net

cash used in operating activities:

|

|||||||

|

Net

realized and unrealized loss on investments

|

28,602,465

|

1,114,199

|

|||||

|

Depreciation

of fixed assets, amortization of premium or discount on U.S. government

securities, and bridge note interest

|

(160,283

|

)

|

31,425

|

||||

|

Stock-based

compensation expense

|

4,333,892

|

5,725,031

|

|||||

|

Changes

in assets and liabilities:

|

|||||||

|

Restricted

funds

|

2,542,356

|

(384,144

|

)

|

||||

|

Receivable

from portfolio company

|

524

|

(5,000

|

)

|

||||

|

Receivable

from broker

|

0

|

819,905

|

|||||

|

Interest

receivable

|

213,520

|

126,292

|

|||||

|

Income

tax receivable

|

0

|

7,209

|

|||||

|

Prepaid

expenses

|

340,152

|

(131,514

|

)

|

||||

|

Other

assets

|

1,619

|

25,630

|

|||||

|

Accounts

payable and accrued liabilities

|

(2,562,338

|

)

|

122,356

|

||||

|

Accrued

profit sharing

|

0

|

(261,661

|

)

|

||||

|

Deferred

rent

|

(4,810

|

)

|

(5,101

|

)

|

|||

|

Net

cash used in operating activities

|

(2,659,976

|

)

|

(2,694,940

|

)

|

|||

|

Cash

flows from investing activities:

|

|||||||

|

Purchase

of U.S. government securities

|

(75,932,334

|

)

|

(60,744,292

|

)

|

|||

|

Sale

of U.S. government securities

|

79,326,692

|

56,454,594

|

|||||

|

Investment

in private placements and notes

|

(14,635,185

|

)

|

(17,480,885

|

)

|

|||

|

Proceeds

from sale of private placements and notes

|

140,257

|

51,669

|

|||||

|

Purchase

of fixed assets

|

(15,046

|

)

|

(36,367

|

)

|

|||

|

Net

cash used in investing activities

|

(11,115,616

|

)

|

(21,755,281

|

)

|

|||

|

Cash

flows from financing activities:

|

|||||||

|

Proceeds

from stock option exercises (Note 5)

|

0

|

9,673,662

|

|||||

|

Proceeds

from stock offering (Note 7)

|

14,383,497

|

12,993,168

|

|||||

|

Net

cash provided by financing activities

|

14,383,497

|

22,666,830

|

|||||

|

Net

increase (decrease) in cash and cash equivalents:

|

|||||||

|

Cash

and cash equivalents at beginning of the period

|

330,009

|

2,071,788

|

|||||

|

Cash

and cash equivalents at end of the period

|

937,914

|

288,397

|

|||||

|

Net

increase (decrease) in cash and cash equivalents

|

$

|

607,905

|

$

|

(1,783,391

|

)

|

||

|

Supplemental

disclosures of cash flow information:

|

|||||||

|

Income

taxes paid

|

$

|

48,427

|

$

|

87,920

|

|||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

STATEMENTS OF CHANGES IN NET ASSETS

|

|

Nine

Months Ended

September

30, 2008

|

Year

Ended

December

31, 2007

|

||||||

|

(Unaudited)

|

|||||||

|

Changes

in net assets from operations:

|

|||||||

|

Net

operating loss

|

$

|

(7,315,640

|

)

|

$

|

(11,827,543

|

)

|

|

|

Net

realized (loss) gain on investments

|

(9,433,050

|

)

|

30,162

|

||||

|

Net

decrease in unrealized depreciation on investments sold

|

9,293,153

|

0

|

|||||

|

Net

(increase) decrease in unrealized depreciation on investments

held

|

(28,511,536

|

)

|

5,080,936

|

||||

|

Net

decrease in net assets resulting from operations

|

(35,967,073

|

)

|

(6,716,445

|

)

|

|||

|

Changes

in net assets from capital stock transactions:

|

|||||||

|

Issuance

of common stock upon the exercise of stock options

|

0

|

9,996

|

|||||

|

Issuance

of common stock on offering

|

25,450

|

13,000

|

|||||

|

Additional

paid-in capital on common stock issued

|

14,358,047

|

23,075,683

|

|||||

|

Stock-based

compensation expense

|

4,333,892

|

8,050,807

|

|||||

|

Net

increase in net assets resulting from capital stock

transactions

|

18,717,389

|

31,149,486

|

|||||

|

Net

(decrease) increase in net assets

|

(17,249,684

|

)

|

24,433,041

|

||||

|

Net

assets:

|

|||||||

|

Beginning

of the period

|

138,363,344

|

113,930,303

|

|||||

|

End

of the period

|

$

|

121,113,660

|

$

|

138,363,344

|

|||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF SEPTEMBER

30, 2008

(Unaudited)

|

|

Method

of

|

Shares/

|

|||||||||

|

Valuation

(1)

|

Principal

|

Value

|

||||||||

|

Investments

in Unaffiliated Companies (2)(3) - 13.7% of net assets at

value

|

||||||||||

|

Private

Placement Portfolio (Illiquid) - 13.7% of net assets at

value

|

||||||||||

|

BioVex

Group, Inc. (4)(5)(6)(7) -- Developing novel biologics for treatment

of

cancer and infectious disease

|

||||||||||

|

Series

E Convertible Preferred Stock

|

(M

|

)

|

2,799,552

|

$

|

1,250,000

|

|||||

|

D-Wave

Systems, Inc. (4)(5)(6)(8) -- Developing high-performance quantum

computing systems

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(M

|

)

|

1,144,869

|

1,199,212

|

||||||

|

Series

C Convertible Preferred Stock

|

(M

|

)

|

450,450

|

471,831

|

||||||

|

Series

D Convertible Preferred Stock

|

(M

|

)

|

1,533,395

|

1,606,181

|

||||||

|

3,277,224

|

||||||||||

|

Exponential

Business Development Company (4)(5) - Venture capital partnership

focused

on early stage companies

|

||||||||||

|

Limited

Partnership Interest

|

(M

|

)

|

1

|

2,219

|

||||||

|

Molecular

Imprints, Inc. (4)(5) -- Manufacturing nanoimprint lithography capital

equipment

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(M

|

)

|

1,333,333

|

1,029,693

|

||||||

|

Series

C Convertible Preferred Stock

|

(M

|

)

|

1,250,000

|

965,337

|

||||||

|

Warrants

at $2.00 expiring 12/31/11

|

(I

|

)

|

125,000

|

36,875

|

||||||

|

2,031,905

|

||||||||||

|

Nanosys,

Inc. (4)(5) -- Developing zero and one-dimensional inorganic

nanometer-scale materials and devices

|

||||||||||

|

Series

C Convertible Preferred Stock

|

(M

|

)

|

803,428

|

2,370,113

|

||||||

|

Series

D Convertible Preferred Stock

|

(M

|

)

|

1,016,950

|

3,000,003

|

||||||

|

5,370,116

|

||||||||||

|

Nantero,

Inc. (4)(5)(6) -- Developing a high-density, nonvolatile, random

access

memory chip, enabled by carbon nanotubes

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(M

|

)

|

345,070

|

1,046,908

|

||||||

|

Series

B Convertible Preferred Stock

|

(M

|

)

|

207,051

|

628,172

|

||||||

|

Series

C Convertible Preferred Stock

|

(M

|

)

|

188,315

|

571,329

|

||||||

|

2,246,409

|

||||||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF SEPTEMBER

30, 2008

(Unaudited)

|

|

Method

of

Valuation

(1)

|

Shares/

Principal

|

Value

|

||||||||

|

Investments

in Unaffiliated Companies (2)(3) - 13.7% of net assets at value

(cont.)

|

||||||||||

|

Private

Placement Portfolio (Illiquid) - 13.7% of net assets at value

(cont.)

|

||||||||||

|

NeoPhotonics

Corporation (4)(5) -- Developing and manufacturing optical devices

and

components

|

||||||||||

|

Common

Stock

|

(M

|

)

|

716,195

|

$

|

93,106

|

|||||

|

Series

1 Convertible Preferred Stock

|

(M

|

)

|

1,831,256

|

613,941

|

||||||

|

Series

2 Convertible Preferred Stock

|

(M

|

)

|

741,898

|

243,932

|

||||||

|

Series

3 Convertible Preferred Stock

|

(M

|

)

|

2,750,000

|

904,184

|

||||||

|

Series

X Convertible Preferred Stock

|

(M

|

)

|

2,000

|

400,000

|

||||||

|

Warrants

at $0.15 expiring 01/26/10

|

(I

|

)

|

16,364

|

884

|

||||||

|

Warrants

at $0.15 expiring 12/05/10

|

(I

|

)

|

14,063

|

760

|

||||||

|

2,256,807

|

||||||||||

|

Polatis,

Inc. (4)(5)(6)(9) -- Developing MEMS-based optical networking

components

|

||||||||||

|

Series

A-1 Convertible Preferred Stock

|

(M

|

)

|

16,775

|

0

|

||||||

|

Series

A-2 Convertible Preferred Stock

|

(M

|

)

|

71,611

|

0

|

||||||

|

Series

A-4 Convertible Preferred Stock

|

(M

|

)

|

4,774

|

0

|

||||||

|

Series

A-5 Convertible Preferred Stock

|

(M

|

)

|

16,438

|

0

|

||||||

|

0

|

||||||||||

|

PolyRemedy,

Inc. (4)(5)(6)(10) --Developing a robotic manufacturing platform

for wound

treatment patches

|

||||||||||

|

Series

B-1 Convertible Preferred Stock

|

(M

|

)

|

287,647

|

122,250

|

||||||

|

Starfire

Systems, Inc. (4)(5) -- Producing ceramic-forming polymers

|

||||||||||

|

Common

Stock

|

(M

|

)

|

375,000

|

0

|

||||||

|

Series

A-1 Convertible Preferred Stock

|

(M

|

)

|

600,000

|

0

|

||||||

|

0

|

||||||||||

|

Total

Unaffiliated Private Placement Portfolio (cost:

$24,854,430)

|

$

|

16,556,930

|

||||||||

|

Total

Investments in Unaffiliated Companies (cost:

$24,854,430)

|

$

|

16,556,930

|

||||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF SEPTEMBER

30, 2008

(Unaudited)

|

|

Method

of

Valuation

(1)

|

Shares/

Principal

|

Value

|

||||||||

|

Investments

in Non-Controlled Affiliated Companies (2)(11) -

|

||||||||||

|

33.9%

of net assets at value

|

||||||||||

|

Private

Placement Portfolio (Illiquid)

- 33.9% of net assets

|

||||||||||

|

at

value

|

||||||||||

|

Adesto

Technologies Corporation (4)(5)(6) -- Developing

|

||||||||||

|

semiconductor-related

products enabled at the nanoscale

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(M

|

)

|

6,547,619

|

$

|

1,100,000

|

|||||

|

Ancora

Pharmaceuticals, Inc. (4)(5)(6) -- Developing synthetic

|

||||||||||

|

carbohydrates

for pharmaceutical applications

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(M

|

)

|

1,663,808

|

1,200,000

|

||||||

|

BridgeLux,

Inc. (4)(5)(12) -- Manufacturing high-power light

|

||||||||||

|

emitting

diodes

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(M

|

)

|

1,861,504

|

2,792,256

|

||||||

|

Series

C Convertible Preferred Stock

|

(M

|

)

|

2,130,699

|

3,196,050

|

||||||

|

Series

D Convertible Preferred Stock

|

(M

|

)

|

666,667

|

1,000,001

|

||||||

|

Warrants

at $0.7136 expiring 02/02/17

|

(I

|

)

|

98,340

|

137,184

|

||||||

|

Warrants

at $0.7136 expiring 04/26/17

|

(I

|

)

|

65,560

|

91,784

|

||||||

|

7,217,275

|

||||||||||

|

Cambrios

Technologies Corporation (4)(5)(6) -- Developing

|

||||||||||

|

nanowire-enabled

electronic materials for the display industry

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(M

|

)

|

1,294,025

|

647,013

|

||||||

|

Series

C Convertible Preferred Stock

|

(M

|

)

|

1,300,000

|

650,000

|

||||||

|

1,297,013

|

||||||||||

|

CFX

Battery, Inc. (4)(5)(6)(13) -- Developing

batteries using

|

||||||||||

|

nanostructured

materials

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(M

|

)

|

1,208,262

|

946,528

|

||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF SEPTEMBER 30, 2008

(Unaudited)

|

|

Method

of

Valuation

(1)

|

Shares/

Principal

|

Value

|

||||||||

|

Investments

in Non-Controlled Affiliated Companies (2)(10) -

|

||||||||||

|

33.9%

of net assets at value (cont.)

|

||||||||||

|

Private

Placement Portfolio (Illiquid)

- 33.9% of net assets

|

||||||||||

|

at

value (cont.)

|

||||||||||

|

Crystal

IS, Inc. (4)(5) -- Developing single-crystal

|

||||||||||

|

aluminum

nitride substrates for optoelectronic devices

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(M

|

)

|

391,571

|

$

|

76,357

|

|||||

|

Series

A-1 Convertible Preferred Stock

|

(M

|

)

|

1,300,376

|

253,574

|

||||||

|

Warrants

at $0.78 expiring 05/05/13

|

(

I

|

)

|

15,231

|

4,006

|

||||||

|

Warrants

at $0.78 expiring 05/12/13

|

(

I

|

)

|

2,350

|

618

|

||||||

|

Warrants

at $0.78 expiring 08/08/13

|

(

I

|

)

|

4,396

|

1,187

|

||||||

|

335,742

|

||||||||||

|

CSwitch

Corporation (4)(5)(6)(14) -- Developing next-generation,

system-

|

||||||||||

|

on-a-chip

solutions for communications-based platforms

|

||||||||||

|

Series

A-1 Convertible Preferred Stock

|

(M

|

)

|

6,863,118

|

0

|

||||||

|

Unsecured

Convertible Bridge Note (including interest)

|

(M

|

)

|

$

|

1,581,202

|

493,411

|

|||||

|

493,411

|

||||||||||

|

Ensemble

Discovery Corporation (4)(5)(6)(15) -- Developing

DNA

|

||||||||||

|

Programmed

Chemistry for the discovery of new classes of

|

||||||||||

|

therapeutics

and bioassays

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(M

|

)

|

1,449,275

|

1,000,000

|

||||||

|

Unsecured

Convertible Bridge Note (including interest)

|

(M

|

)

|

251,328

|

251,328

|

||||||

|

1,251,328

|

||||||||||

|

Innovalight,

Inc. (4)(5)(6) -- Developing solar power

|

||||||||||

|

products

enabled by silicon-based nanomaterials

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(M

|

)

|

16,666,666

|

4,288,662

|

||||||

|

Series

C Convertible Preferred Stock

|

(M

|

)

|

5,810,577

|

1,495,176

|

||||||

|

5,783,838

|

||||||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF SEPTEMBER 30, 2008

(Unaudited)

|

|

Method

of

Valuation

(1)

|

Shares/

Principal

|

Value

|

||||||||

|

Investments

in Non-Controlled Affiliated Companies (2)(10) -

|

||||||||||

|

33.9%

of net assets at value (cont.)

|

||||||||||

|

Private

Placement Portfolio (Illiquid)

- 33.9% of net assets

|

||||||||||

|

at

value (cont.)

|

||||||||||

|

Kereos,

Inc. (4)(5)(6) -- Developing emulsion-based imaging

|

||||||||||

|

agents

and targeted therapeutics to image and treat cancer

|

||||||||||

|

and

cardiovascular disease

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(M

|

)

|

545,456

|

$

|

0

|

|||||

|

Kovio,

Inc. (4)(5)(6) -- Developing semiconductor products

|

||||||||||

|

using

printed electronics and thin-film technologies

|

||||||||||

|

Series

C Convertible Preferred Stock

|

(M

|

)

|

2,500,000

|

3,125,000

|

||||||

|

Series

D Convertible Preferred Stock

|

(M

|

)

|

800,000

|

1,000,000

|

||||||

|

4,125,000

|

||||||||||

|

Mersana

Therapeutics, Inc. (4)(5)(6)(16) -- Developing advanced

|

||||||||||

|

polymers

for drug delivery

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(M

|

)

|

68,451

|

68,451

|

||||||

|

Series

B Convertible Preferred Stock

|

(M

|

)

|

866,500

|

866,500

|

||||||

|

Warrants

at $2.00 expiring 10/21/10

|

(

I

|

)

|

91,625

|

37,658

|

||||||

|

Unsecured

Convertible Bridge Note (including interest)

|

(M

|

)

|

203,068

|

203,068

|

||||||

|

1,175,677

|

||||||||||

|

Metabolon,

Inc. (4)(5) -- Discovering biomarkers through

|

||||||||||

|

the

use of metabolomics

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(M

|

)

|

2,173,913

|

882,768

|

||||||

|

Series

B-1 Convertible Preferred Stock

|

(M

|

)

|

869,565

|

353,107

|

||||||

|

Warrants

at $1.15 expiring 3/25/15

|

(

I

|

)

|

434,783

|

131,739

|

||||||

|

1,367,614

|

||||||||||

|

NanoGram

Corporation (4)(5) -- Developing solar power products

|

||||||||||

|

enabled

by silicon-based nanomaterials

|

||||||||||

|

Series

I Convertible Preferred Stock

|

(M

|

)

|

63,210

|

62,262

|

||||||

|

Series

II Convertible Preferred Stock

|

(M

|

)

|

1,250,904

|

1,232,141

|

||||||

|

Series

III Convertible Preferred Stock

|

(M

|

)

|

1,242,144

|

1,223,512

|

||||||

|

Series

IV Convertible Preferred Stock

|

(M

|

)

|

432,179

|

425,696

|

||||||

|

2,943,611

|

||||||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF SEPTEMBER 30, 2008

(Unaudited)

|

|

Method

of

Valuation

(1)

|

Shares/

Principal

|

Value

|

||||||||

|

Investments

in Non-Controlled Affiliated Companies (2)(10) -

|

||||||||||

|

33.9%

of net assets at value (cont.)

|

||||||||||

|

Private

Placement Portfolio (Illiquid)

- 33.9% of net assets

|

||||||||||

|

at

value (cont.)

|

||||||||||

|

Nanomix,

Inc. (4)(5) -- Producing nanoelectronic sensors that

|

||||||||||

|

integrate

carbon nanotube electronics with silicon microstructures

|

||||||||||

|

Series

C Convertible Preferred Stock

|

(M

|

)

|

977,917

|

$

|

23,622

|

|||||

|

Series

D Convertible Preferred Stock

|

(M

|

)

|

6,802,397

|

6,428

|

||||||

|

30,050

|

||||||||||

|

Nextreme

Thermal Solutions, Inc. (4)(5) -- Developing thin-film

|

||||||||||

|

thermoelectric

devices for cooling and energy conversion

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(M

|

)

|

1,750,000

|

875,000

|

||||||

|

Series

B Convertible Preferred Stock

|

(M

|

)

|

4,870,244

|

1,327,629

|

||||||

|

2,202,629

|

||||||||||

|

Questech

Corporation (4)(5) -- Manufacturing and marketing

|

||||||||||

|

proprietary

metal and stone decorative tiles

|

||||||||||

|

Common

Stock

|

(M

|

)

|

655,454

|

193,846

|

||||||

|

Warrants

at $1.50 expiring 11/19/08

|

(

I

|

)

|

5,000

|

0

|

||||||

|

Warrants

at $1.50 expiring 11/19/09

|

(

I

|

)

|

5,000

|

125

|

||||||

|

193,971

|

||||||||||

|

Siluria

Technologies, Inc. (4)(5)(6) -- Developing next-generation

|

||||||||||

|

nanomaterials

|

||||||||||

|

Series

S-2 Convertible Preferred Stock

|

(M

|

)

|

482,218

|

40,181

|

||||||

|

Solazyme,

Inc. (4)(5)(6) -- Developing algal biodiesel, industrial

|

||||||||||

|

chemicals

and special ingredients based on synthetic biology

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(M

|

)

|

988,204

|

2,489,088

|

||||||

|

Series

B Convertible Preferred Stock

|

(M

|

)

|

495,246

|

1,247,426

|

||||||

|

Series

C Convertible Preferred Stock

|

(M

|

)

|

651,309

|

1,640,517

|

||||||

|

5,377,031

|

||||||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF SEPTEMBER

30, 2008

(Unaudited)

|

|

Method

of

Valuation (1)

|

Shares/

Principal

|

Value

|

||||||||

|

Investments

in Non-Controlled Affiliated Companies (2)(10) -

|

||||||||||

|

33.9%

of net assets at value (cont.)

|

||||||||||

|

Private

Placement Portfolio (Illiquid)

- 33.9% of net assets

|

||||||||||

|

at

value (cont.)

|

||||||||||

|

Xradia,

Inc. (4)(5) -- Designing, manufacturing and selling

ultra-high

|

||||||||||

|

resolution

3D x-ray microscopes and fluorescence imaging systems

|

||||||||||

|

Series

D Convertible Preferred Stock

|

(M

|

)

|

3,121,099

|

$

|

4,000,000

|

|||||

|

Total

Non-Controlled Private Placement Portfolio (cost:

$56,974,432)

|

$

|

41,080,899

|

||

|

Total

Investments in Non-Controlled Affiliated Companies (cost:

$56,974,432)

|

$

|

41,080,899

|

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF SEPTEMBER 30, 2008

(Unaudited)

|

|

Method

of

Valuation

(1)

|

Shares/

Principal

|

Value

|

||||||||

|

Investments

in Controlled Affiliated Companies (2)(17) -

|

||||||||||

|

5.2%

of net assets at value

|

||||||||||

|

Private

Placement Portfolio (Illiquid)

- 5.2% of

|

||||||||||

|

net

assets at value

|

||||||||||

|

Laser

Light Engines, Inc. (4)(5)(6)(10) -- Manufacturing solid-state

light

|

||||||||||

|

sources

for digital cinema and large-venue projection displays

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(M

|

)

|

7,499,062

|

2,000,000

|

||||||

|

SiOnyx,

Inc. (4)(5)(6) -- Developing silicon-based optoelectronic

|

||||||||||

|

products

enabled by its proprietary "Black Silicon"

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(M

|

)

|

233,499

|

135,686

|

||||||

|

Series

A-1 Convertible Preferred Stock

|

(M

|

)

|

2,966,667

|

1,723,930

|

||||||

|

Series

A-2 Convertible Preferred Stock

|

(M

|

)

|

4,207,537

|

2,445,000

|

||||||

|

4,304,616

|

||||||||||

|

Total

Controlled Private Placement Portfolio (cost:

$6,085,000)

|

$

|

6,304,616

|

||||||||

|

Total

Investments in Controlled Affiliated Companies (cost:

$6,085,000)

|

$

|

6,304,616

|

||||||||

|

Total

Private Placement Portfolio (cost: $87,913,862)

|

$

|

63,942,445

|

||||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF SEPTEMBER 30, 2008

(Unaudited)

|

|

Method

of

|

Shares/

|

|

||||||||

|

Valuation

(1)

|

Principal

|

Value

|

||||||||

|

U.S.

Government and Agency Securities (18) - 47.1% of net assets at

value

|

||||||||||

|

U.S.

Treasury Bill -- due date 02/12/09

|

(M

|

)

|

$

|

4,495,000

|

$

|

4,477,200

|

||||

|

U.S.

Treasury Notes -- due date 01/15/09, coupon 3.25%

|

(M

|

)

|

3,000,000

|

3,020,640

|

||||||

|

U.S.

Treasury Notes -- due date 02/15/09, coupon 4.50%

|

(M

|

)

|

5,100,000

|

5,158,956

|

||||||

|

U.S.

Treasury Notes -- due date 04/15/09, coupon 3.125%

|

(M

|

)

|

3,000,000

|

3,024,840

|

||||||

|

U.S.

Treasury Notes -- due date 07/15/09, coupon 3.625%

|

(M

|

)

|

3,000,000

|

3,041,940

|

||||||

|

U.S.

Treasury Notes -- due date 10/15/09, coupon 3.375%

|

(M

|

)

|

3,000,000

|

3,046,410

|

||||||

|

U.S.

Treasury Notes -- due date 01/15/10, coupon 3.625%

|

(M

|

)

|

3,000,000

|

3,068,430

|

||||||

|

U.S.

Treasury Notes -- due date 04/15/10, coupon 4.00%

|

(M

|

)

|

3,000,000

|

3,097,980

|

||||||

|

U.S.

Treasury Notes -- due date 06/30/10, coupon 2.875%

|

(M

|

)

|

1,250,000

|

1,270,600

|

||||||

|

U.S.

Treasury Notes -- due date 07/15/10, coupon 3.875%

|

(M

|

)

|

3,000,000

|

3,108,060

|

||||||

|

U.S.

Treasury Notes -- due date 09/15/10, coupon 3.875%

|

(M

|

)

|

2,000,000

|

2,077,500

|

||||||

|

U.S.

Treasury Notes -- due date 10/15/10, coupon 4.25%

|

(M

|

)

|

2,000,000

|

2,092,660

|

||||||

|

U.S.

Treasury Notes -- due date 12/15/10, coupon 4.375%

|

(M

|

)

|

2,000,000

|

2,102,040

|

||||||

|

U.S.

Treasury Notes -- due date 03/31/11, coupon 4.750%

|

(M

|

)

|

2,000,000

|

2,131,560

|

||||||

|

U.S.

Treasury Notes -- due date 06/30/11, coupon 5.125%

|

(M

|

)

|

2,000,000

|

2,157,960

|

||||||

|

U.S.

Treasury Notes -- due date 09/30/11, coupon 4.500%

|

(M

|

)

|

2,000,000

|

2,126,400

|

||||||

|

U.S.

Treasury Notes -- due date 12/31/11, coupon 4.625%

|

(M

|

)

|

2,000,000

|

2,133,600

|

||||||

|

U.S.

Treasury Notes -- due date 10/31/12, coupon 3.875%

|

(M

|

)

|

2,000,000

|

2,091,880

|

||||||

|

U.S.

Treasury Notes -- due date 02/15/13, coupon 3.875%

|

(M

|

)

|

7,500,000

|

7,804,125

|

||||||

|

Total

Investments in U.S. Government and Agency Securities (cost:

$56,206,231)

|

$

|

57,032,781

|

||||||||

|

Total

Investments (cost: $144,120,093)

|

$

|

120,975,226

|

||||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF SEPTEMBER

30, 2008

(Unaudited)

|

|

(1)

|

See

Footnote to Consolidated Schedule of Investments on page 17 for a

description of the Valuation

Procedures.

|

|

(2)

|

Investments

in unaffiliated companies consist of investments in which we own

less than

five percent of the voting shares of the portfolio company. Investments

in

non-controlled affiliated companies consist of investments in which

we own

five percent or more, but less than 25 percent, of the voting shares

of

the portfolio company, or where we hold one or more seats on the

portfolio

company’s Board of Directors but do not control the company. Investments

in controlled affiliated companies consist of investments in which

we own

25 percent or more of the voting shares of the portfolio company

or

otherwise control the company.

|

|

(3)

|

The

aggregate cost for federal income tax purposes of investments in

unaffiliated companies is $24,854,430. The gross unrealized appreciation

based on the tax cost for these securities is $2,035,048. The gross

unrealized depreciation based on the tax cost for these securities

is

$10,332,548.

|

|

(4)

|

Legal

restrictions on sale of investment.

|

|

(5)

|

Represents

a non-income producing security. Equity investments that have not

paid

dividends within the last 12 months are considered to be non-income

producing.

|

|

(6)

|

These

investments are development stage companies. A development stage

company

is defined as a company that is devoting substantially all of its

efforts

to establishing a new business, and either it has not yet commenced

its

planned principal operations, or it has commenced such operations

but has

not realized significant revenue from

them.

|

|

(7)

|

With

our purchase of Series E Convertible Preferred Stock of BioVex, we

received a warrant to purchase a number of shares of common stock

of

BioVex as determined by dividing 624,999.99 by the price per share

at

which the common stock is offered and sold to the public in connection

with the initial public offering. The ability to exercise this

warrant is therefore contingent on BioVex completing successfully

an

initial public offering before the expiration date of the warrant

on

September 27, 2012. The exercise price of this warrant shall be 110

percent of the initial public offering

price.

|

|

(8)

|

D-Wave

Systems, Inc., is located and is doing business primarily in Canada.

We

invested in D-Wave Systems, Inc., through D-Wave USA, a Delaware

company.

Our investment is denominated in Canadian dollars and is subject

to

foreign currency translation. See "Note 3. Summary of Significant

Accounting Policies."

|

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF SEPTEMBER

30, 2008

(Unaudited)

|

|

(9)

|

Continuum

Photonics, Inc., merged with Polatis, Ltd., to form Polatis,

Inc.

|

|

(10)

|

Initial

investment was made during 2008.

|

|

(11)

|

The

aggregate cost for federal income tax purposes of investments in

non-controlled affiliated companies is $56,974,432. The gross unrealized

appreciation based on the tax cost for these securities is $6,545,710.

The

gross unrealized depreciation based on the tax cost for these securities

is $22,439,243.

|

|

(12)

|

BridgeLux,

Inc., was previously named eLite Optoelectronics,

Inc.

|

|

(14)

|

With

our investments in secured convertible bridge notes issued by CSwitch,

we

received two warrants to purchase a number of shares of the class

of stock

sold in the next financing of CSwitch equal to $529,322 and $985,835,

respectively, the principal of the notes, divided by the lowest price

per

share of the class of stock sold in the next financing of CSwitch.

The ability to exercise these warrants is, therefore, contingent

on

CSwitch completing successfully a subsequent round of financing. The

warrants will expire five years from the date of the close of the

next

round of financing. The cost basis of these warrants is $529 and

$986, respectively.

|

|

(15)

|

With

our investment in a convertible bridge note issued by Ensemble Discovery,

we received a warrant to purchase a number of shares of the class

of stock

sold in the next financing of Ensemble Discovery equal to $125,105.40

divided by the price per share of the class of stock sold in the

next

financing of Ensemble Discovery. The ability to exercise this warrant

is,

therefore, contingent on Ensemble Discovery completing successfully

a

subsequent round of financing. This warrant shall expire and no longer

be

exercisable on September 10, 2015. The cost basis of this warrant

is

$75.20.

|

|

(16)

|

Mersana

Therapeutics, Inc., was previously named Nanopharma

Corp.

|

|

(17)

|

The

aggregate cost for federal income tax purposes of investments in

controlled affiliated companies is $6,085,000. The gross unrealized

appreciation based on the tax cost for these securities is $219,616.

The

gross unrealized depreciation based on the tax cost for these securities

is $0.

|

|

(18)

|

The

aggregate cost for federal income tax purposes of our U.S. government

securities is $56,206,231. The gross unrealized appreciation on the

tax

cost for these securities is $941,828. The gross unrealized depreciation

on the tax cost of these securities is

$115,278.

|

|

HARRIS

& HARRIS GROUP, INC.

FOOTNOTE

TO CONSOLIDATED SCHEDULE OF INVESTMENTS

(Unaudited)

|

|

·

|

Market

Approach (M):

The market approach uses prices and other relevant information generated

by market transactions involving identical or comparable assets or

liabilities. For example, the market approach often uses market multiples

derived from a set of comparables. Multiples might lie in ranges

with a

different multiple for each comparable. The selection of where within

the

range each appropriate multiple falls requires judgment considering

factors specific to the measurement (qualitative and quantitative).

|

|

·

|

Income

Approach (I):

The income approach uses valuation techniques to convert future amounts

(for example, cash flows or earnings) to a single present value amount

(discounted). The measurement is based on the value indicated by

current

market expectations about those future amounts. Those valuation techniques

include present value techniques; option-pricing models, such as

the

Black-Scholes-Merton formula (a closed-form model) and a binomial

model (a

lattice model), which incorporate present value techniques; and the

multi-period excess earnings method, which is used to measure the

fair

value of certain assets.

|

|

·

|

Level

1:

Unadjusted quoted prices in active markets for identical assets or

liabilities.

|

|

·

|

Level

2:

Quoted prices in active markets for similar assets or liabilities,

or

quoted prices for identical or similar assets or liabilities in markets

that are not active, or inputs other than quoted prices that are

observable for the asset or

liability.

|

|

·

|

Level

3:

Unobservable inputs for the asset or

liability.

|

|

·

|

Equity-related

securities;

|

|

·

|

Long-term

fixed-income securities;

|

|

·

|

Short-term

fixed-income securities;

|

|

·

|

Investments

in intellectual property, patents, research and development in technology

or product development; and

|

|

·

|

All

other securities.

|

|

§

|

Readily

available public market quotations;

|

|

§

|

The

cost of the Company’s investment;

|

|

§

|

Transactions

in a company's securities or unconditional firm offers by responsible

parties as a factor in determining

valuation;

|

|

§

|

The

financial condition and operating results of the

company;

|

|

§

|

The

company's progress towards milestones.

|

|

§

|

The

long-term potential of the business and technology of the

company;

|

|

§

|

The

values of similar securities issued by companies in similar businesses;

|

|

§

|

Multiples

to revenue, net income or EBITDA that similar securities issued by

companies in similar businesses receive;

|

|

§

|

The

proportion of the company's securities we own and the nature of any

rights

to require the company to register restricted securities under applicable

securities laws; and

|

|

§

|

The

rights and preferences of the class of securities we own as compared

to

other classes of securities the portfolio company has issued.

|

|

When

the income approach is used to value warrants, the Company uses the

Black-Scholes-Merton formula.

|

|

·

|

Credit

quality;

|

|

·

|

Interest

rate analysis;

|

|

·

|

Quotations

from broker-dealers;

|

|

·

|

Prices

from independent pricing services that the Board believes are reasonably

reliable; and

|

|

·

|

Reasonable

price discovery procedures and data from other

sources.

|

|

D.

|

INVESTMENTS

IN INTELLECTUAL PROPERTY, PATENTS, RESEARCH AND DEVELOPMENT IN TECHNOLOGY

OR PRODUCT DEVELOPMENT

|

|

·

|

Investments

in the same or substantially similar intellectual property or patents

or

research and development in technology or product development or

offers by

responsible third parties;

|

|

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

|

|

Fair

Value Measurement at

Reporting Date Using:

|

|||||||||||||

|

Description

|

September

30, 2008

|

Quoted

Prices in Active Markets for Identical Assets (Level

1)

|

Significant

Other Observable Inputs (Level

2)

|

Significant

Unobservable Inputs

(Level 3)

|

|||||||||

|

U.S.

Government Securities

|

$

|

57,032,781

|

$

|

0

|

$

|

57,032,781

|

$

|

0

|

|||||

|

Portfolio

Companies

|

$

|

63,942,445

|

$

|

0

|

$

|

0

|

$

|

63,942,445

|

|||||

|

Total

|

$

|

120,975,226

|

$

|

0

|

$

|

57,032,781

|

$

|

63,942,445

|

|||||

|

Fair

Value Measurements Using Significant

Unobservable

Inputs

(Level 3)

|

||||

|

Portfolio

Companies

|

||||

|

Beginning

Balance, July 1, 2008

|

$

|

92,335,524

|

||

|

Total

realized losses included in changes in net assets

|

(4,371,987

|

)

|

||

|

Total

unrealized losses included in changes in net assets

|

(27,847,181

|

)

|

||

|

Purchases

and interest on bridge notes

|

3,832,612

|

|||

|

Disposals

|

(6,523

|

)

|

||

|

Ending

Balance, September 30, 2008

|

$

|

63,942,445

|

||

|

The

amount of total losses for the period

|

||||

|

included

in changes in net assets attributable to the

|

||||

|

change

in unrealized gains or losses relating to

|

||||

|

assets

still held at the reporting date

|

$

|

(32,125,681

|

)

|

|

|

Fair

Value Measurements Using Significant

UnobservableInputs

(Level 3)

|

||||

|

Portfolio

Companies

|

||||

|

Beginning

Balance, January 1, 2008

|

$

|

78,110,384

|

||

|

Total

realized losses included in changes in net assets

|

(9,386,640

|

)

|

||

|

Total

unrealized losses included in changes in net assets

|

(19,404,273

|

)

|

||

|

Purchases

and interest on bridge notes

|

14,756,711

|

|||

|

Disposals

|

(133,737

|

)

|

||

|

Ending

Balance, September 30, 2008

|

$

|

63,942,445

|

||

|

The

amount of total losses for the period

|

||||

|

included

in changes in net assets attributable to the

|

||||

|

change

in unrealized gains or losses relating to

|

||||

|

assets

still held at the reporting date

|

$

|

(28,697,427

|

)

|

|

|

Weighted

|

|||||||||||||||||||||||

|

Average

|

|||||||||||||||||||||||

|

Number

|

Expected

|

Expected

|

Expected

|

Risk-free

|

Fair

|

||||||||||||||||||

|

of

Options

|

Term

|

Volatility

|

Dividend

|

Interest

|

Value

|

||||||||||||||||||

|

Type

of Award

|

Term

|

Granted

|

in

Yrs

|

Factor

|

Yield

|

Rates

|

Per

Share

|

||||||||||||||||

|

Non-qualified

stock options

|

9.78

Years

|

348,032

|

6.14

|

57.1%

|

0%

|

2.62%

|

$

|

3.45

|

|||||||||||||||

|

Total

|

348,032

|

$

|

3.45

|

||||||||||||||||||||

|

Weighted

|

|||||||||||||||||||||||

|

Average

|

|||||||||||||||||||||||

|

Number

|

Expected

|

Expected

|

Expected

|

Risk-free

|

Fair

|

||||||||||||||||||

|

of

Options

|

Term

|

Volatility

|

Dividend

|

Interest

|

Value

|

||||||||||||||||||

|

Type

of Award

|

Term

|

Granted

|

in

Yrs

|

Factor

|

Yield

|

Rates

|

Per

Share

|

||||||||||||||||

|

Non-qualified

stock options

|

9.38

Years

|

976,685

|

5.94%

|

55.1%

|

|

0%

|

3.40%

|

|

$

|

3.79

|

|||||||||||||

|

Non-qualified

stock options

|

9.38

Years

|

187,039

|

4.88%

|

50.6%

|

0%

|

3.24%

|

|

$

|

3.25

|

||||||||||||||

|

|

|||||||||||||||||||||||

|

Total

|

1,163,724

|

||||||||||||||||||||||

|

Weighted

|

||||||||||||||||

|

Weighted

|

Weighted

|

Average

|

||||||||||||||

|

Average

|

Average

|

Remaining

|

Aggregate

|

|||||||||||||

|

Exercise

|

Grant

Date

|

Contractual

|

Intrinsic

|

|||||||||||||

|

Shares

|

Price

|

Fair

Value

|

Term

(Yrs)

|

Value

|

||||||||||||

|

Options

Outstanding at

January

1, 2008

|

3,967,744

|

$

|

10.54

|

$

|

4.77

|

|||||||||||

|

Granted

|

1,511,756

|

$

|

6.75

|

$

|

3.64

|

9.25

|

||||||||||

|

Exercised

|

0

|

$

|

0

|

$

|

0

|

|||||||||||

|

Forfeited

or Expired

|

(465,087

|

)

|

$

|

10.15

|

$

|

2.70

|

||||||||||

|

Options

Outstanding at

September

30, 2008

|

5,014,413

|

$

|

9.43

|

$

|

4.62

|

5.82

|

$

|

69,357

|

||||||||

|

Options

Exercisable at

September

30, 2008

|

1,760,544

|

$

|

10.42

|

$

|

5.34

|

4.89

|

$

|

0

|

||||||||

|

Options

Exercisable and Expected to be

Exercisable

at September 30, 2008

|

4,943,565

|

$

|

9.42

|

$

|

4.59

|

5.80

|

$

|

69,357

|

||||||||

|

For

the Three Months

Ended

September 30

|

For

the Nine Months

Ended

September 30

|

||||||||||||

|

2008

|

2007

|

2008

|

2007

|

||||||||||

|

Numerator

for (decrease) increase in net assets per share

|

$

|

(34,032,747

|

)

|

$

|

604,237

|

$

|

(35,967,073

|

)

|

$

|

(9,879,567

|

)

|

||

|

Denominator

for basic and diluted weighted average shares

|

25,859,573

|

23,235,023

|

24,271,270

|

22,084,893

|

|||||||||

|

Basic

and diluted net (decrease) increase in net assets per share resulting

from

operations

|

$

|

(1.32

|

)

|

$

|

0.03

|

$

|

(1.48

|

)

|

$

|

(0.45

|

)

|

||

|

HARRIS

& HARRIS GROUP, INC.

FINANCIAL

HIGHLIGHTS

(Unaudited)

|

|

Three

Months Ended Sept. 30

|

Nine

Months Ended Sept. 30

|

||||||||||||

|

2008

|

2007

|

2008

|

2007

|

||||||||||

|

Per

Share Operating Performance

|

|||||||||||||

|

Net

asset value per share, beginning

|

|||||||||||||

|

of

period

|

$

|

5.95

|

$

|

5.54

|

$

|

5.93

|

$

|

5.42

|

|||||

|

Net

operating (loss)*

|

(0.09

|

)

|

(0.13

|

)

|

(0.30

|

)

|

(0.39

|

)

|

|||||

|

Net

realized income (loss)

|

|||||||||||||

|

on

investments*(1)

|

(0.17

|

)

|

0.00

|

(0.36

|

)

|

(0.01

|

)

|

||||||

|

Net

(increase) decrease in unrealized

|

|||||||||||||

|

depreciation

as a result of sales*(1)

|

0.17

|

0.00

|

0.41

|

(0.00

|

)

|

||||||||

|

Net

decrease (increase) in unrealized

|

|||||||||||||

|

depreciation

on investments held*

|

(1.23

|

)

|

0.16

|

(1.17

|

)

|

(0.05

|

)

|

||||||

|

Total

from investment operations*

|

(1.32

|

)

|

0.03

|

(1.42

|

)

|

(0.45

|

)

|

||||||

|

Net

increase as a result of stock-

|

|||||||||||||

|

based

compensation*

|

0.05

|

0.10

|

0.18

|

0.26

|

|||||||||

|

(Decrease)

Increase as a result of stock-

|

|||||||||||||

|

offering,

net of offering expenses

|

0.00

|

0.00

|

(0.01

|

)

|

0.26

|

||||||||

|

Net

increase as a result of proceeds

|

|||||||||||||

|

from

exercise of options

|

0.00

|

0.02

|

0.00

|

0.20

|

|||||||||

|

Total

increase from capital

|

|||||||||||||

|

stock transactions

|

0.05

|

0.12

|

0.17

|

0.72

|

|||||||||

|

Net

asset value per share, end

|

|||||||||||||

|

of

period

|

$

|

4.68

|

$

|

5.69

|

$

|

4.68

|

$

|

5.69

|

|||||

|

Stock

price per share, end

|

|||||||||||||

|

of

period

|

$

|

6.38

|

$

|

10.64

|

$

|

6.38

|

$

|

10.64

|

|||||

|

Total

return based on stock price (2)

|

6.33

|

%

|

(5.00

|

)%

|

(27.42

|

)%

|

(11.99

|

)%

|

|||||

|

Supplemental

Data:

|

|||||||||||||

|

Net

assets, end of period

|

$

|

121,113,660

|

$

|

132,442,597

|

$

|

121,113,660

|

$

|

132,442,597

|

|||||

|

Ratio

of expenses to average

|

|||||||||||||

|

net

assets (2)

|

2.0

|

%

|

3.0

|

%

|

6.5

|

%

|

8.8

|

%

|

|||||

|

Ratio

of net operating income (loss) to

|

|||||||||||||

|

average

net assets (2)

|

(1.6

|

)%

|

(2.4

|

)%

|

(5.3

|

)%

|

(7.1

|

)%

|

|||||

|

Cash

dividend paid per share

|

$

|

0.00

|

$

|

0.00

|

$

|

0.00

|

$

|

0.00

|

|||||

|

Deemed

dividend per share

|

$

|

0.00

|

$

|

0.00

|

$

|

0.00

|

$

|

0.00

|

|||||

|

Number

of shares outstanding,

|

|||||||||||||

|

end

of period

|

25,859,573

|

23,271,858

|

25,859,573

|

23,271,858

|

|||||||||

|

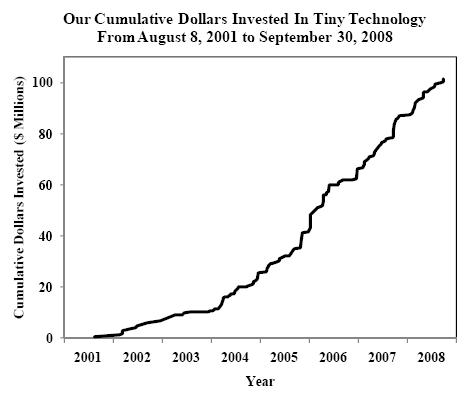

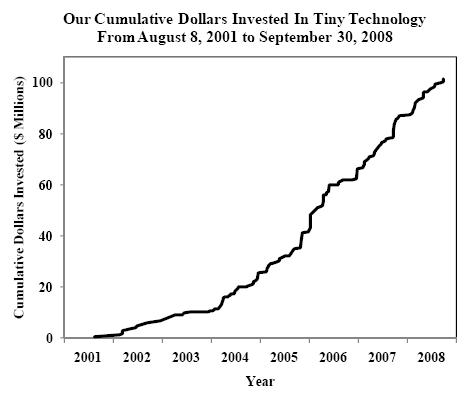

2001

|

2002

|

2003

|

2004

|

2005

|

2006

|

2007

|

YTD

9/30/08

|

||||||||||||||||||

|

Total

Incremental Investments

|

$

|

489,999

|

$

|

6,240,118

|

$

|

3,812,600

|

$

|

14,837,846

|

$

|

16,251,339

|

$

|

24,408,187

|

$

|

20,595,161

|

$

|

14,635,185

|

|||||||||

|

No.

of New Investments

|

1

|

7

|

5

|

8

|

4

|

6

|

7

|

2

|

|||||||||||||||||

|

No.

of Follow-On Investment Rounds

|

0

|

1

|

5

|

21

|

13

|

14

|

20

|

19

|

|||||||||||||||||

|

No.

of Rounds Led

|

0

|

1

|

0

|

2

|

0

|

7

|

3

|

3

|

|||||||||||||||||

|

Average

Dollar Amount - Initial

|

$

|

489,999

|

$

|

784,303

|

$

|

437,156

|

$

|

911,625

|

$

|

1,575,000

|

$

|

2,383,424

|

$

|