UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Form 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

or

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _____________________ to ____________________

Commission File No. 0-11576

|

HARRIS & HARRIS GROUP, INC.®

|

|

(Exact Name of Registrant as Specified in Its Charter)

|

|

New York

|

|

13-3119827

|

|

(State or Other Jurisdiction

|

|

(I.R.S. Employer

|

|

of Incorporation or Organization)

|

|

Identification No.)

|

|

1450 Broadway, New York, New York

|

|

10018

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code (212) 582-0900

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

| |

|

|

|

Common Stock, $.01 par value

|

|

Nasdaq Global Market

|

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.¨Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.¨Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þYes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þYes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

|

Accelerated filer þ

|

|

Non-accelerated filer ¨

|

|

Smaller reporting company ¨

|

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).¨Yes þ No

The aggregate market value of the common stock held by non-affiliates of Registrant as of June 30, 2010 was $124,675,809 based on the last sale price as quoted by the Nasdaq Global Market on such date (only officers and directors are considered affiliates for this calculation).

As of March 15, 2011, the registrant had 30,941,139 shares of common stock, par value $.01 per share, outstanding.

|

DOCUMENTS INCORPORATED BY REFERENCE

|

INCORPORATED AT

|

| |

|

|

Harris & Harris Group, Inc. Proxy Statement for the

|

Part III, Items 10, 11,

|

|

2011 Annual Meeting of Shareholders

|

12, 13 and 14

|

TABLE OF CONTENTS

| |

|

Page

|

|

PART I

|

|

|

| |

|

|

|

Item 1.

|

Business

|

1

|

|

Item 1A.

|

Risk Factors

|

14

|

|

Item 1B.

|

Unresolved Staff Comments

|

29

|

|

Item 2.

|

Properties

|

30

|

|

Item 3.

|

Legal Proceedings

|

30

|

|

Item 4.

|

Removed and Reserved

|

30

|

| |

|

|

|

PART II

|

|

|

| |

|

|

|

Item 5.

|

Market For Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

31

|

|

Item 6.

|

Selected Financial Data

|

34

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

35

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

69

|

|

Item 8.

|

Consolidated Financial Statements and Supplementary Data

|

72

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

127

|

|

Item 9A.

|

Controls and Procedures

|

127

|

|

Item 9B.

|

Other Information

|

127

|

| |

|

|

|

PART III

|

|

|

| |

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

128

|

|

Item 11.

|

Executive Compensation

|

128

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

128

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

128

|

|

Item 14.

|

Principal Accountant Fees and Services

|

129

|

| |

|

|

|

PART IV

|

|

|

| |

|

|

|

Item 15.

|

Exhibits and Financial Statements Schedules

|

130

|

| |

|

|

|

Signatures

|

133

|

PART I

Item 1. Business.

Harris & Harris Group, Inc.® (the "Company," "us," "our," and "we"), is an internally managed venture capital company specializing in nanotechnology and microsystems that has elected to operate as a business development company ("BDC") under the Investment Company Act of 1940, which we refer to as the 1940 Act. For tax purposes, we have elected to be a regulated investment company ("RIC") under Subchapter M of the Internal Revenue Code of 1986. Our primary investment objective is to achieve long-term capital appreciation by making venture capital investments. Generation of current income is a secondary objective. We define venture capital investments as the money and resources made

available to privately held start-up firms and privately held and publicly traded small businesses with exceptional growth potential. We incorporated under the laws of the state of New York in August 1981. Our investment approach is comprised of a patient examination of available opportunities, thorough due diligence and close involvement with management. As a venture capital company, we invest in and provide managerial assistance to our portfolio companies, many of which, in our opinion, have significant potential for growth. We are overseen by our Board of Directors and managed by our officers and have no investment advisor.

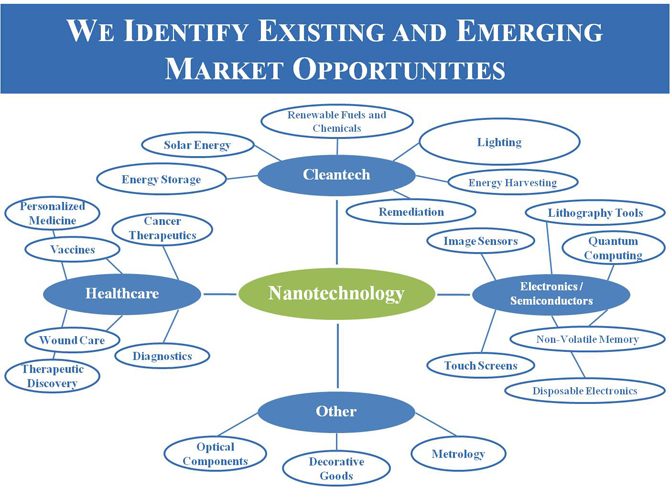

We make venture capital investments exclusively in companies commercializing or integrating products enabled by nanotechnology or microsystems. This investment focus is not a fundamental policy and accordingly may be changed without shareholder approval, although we intend to give shareholders at least 60 days' prior notice of any change in investment focus.

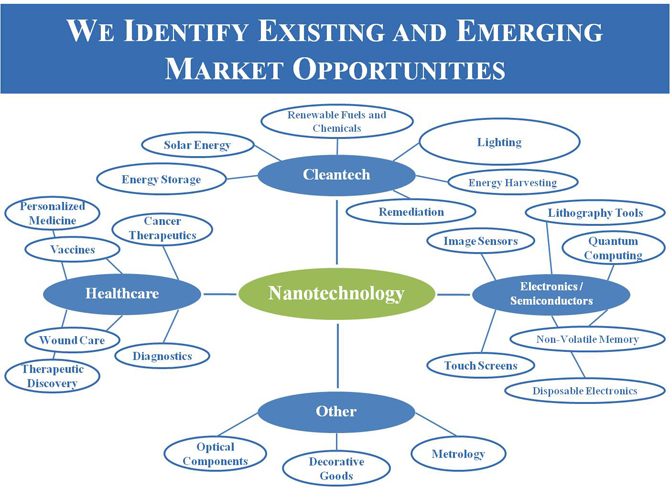

Nanotechnology is measured in nanometers, which are units of measurement in billionths of a meter. Microsystems are measured in micrometers, which are units of measurement in millionths of a meter. We sometimes use "tiny technology" to describe both of these disciplines. Nanotechnology and microsystems are multidisciplinary and widely applicable, and they incorporate technology that was not previously in widespread use. Products enabled by nanotechnology and microsystems are applicable to a large number of industries including pharmaceuticals, medical devices, telecommunications, electronics and semiconductors, and industries that seek to address global problems related to resource constraints (cleantech).

We consider a company to fit our investment thesis if the company employs or integrates or intends to employ or integrate technology that we consider to be at the microscale or smaller and if the employment of that technology is material to its business plan. Because it is in many respects a new field, tiny technology has significant scientific, engineering and commercialization risks.

As of December 31, 2010, our venture capital portfolio comprised 71 percent of our total assets, our U.S. Treasury obligations and cash comprised 28 percent of our total assets, and other assets comprised the remaining one percent of our total assets. As of December 31, 2010, we had no debt outstanding.

Neither our investments, nor an investment in us, is intended to constitute a balanced investment program. We expect to be risk seeking rather than risk averse in our investment approach. To such end, we reserve the fullest possible freedom of action, subject to our certificate of incorporation, applicable law and regulations, and policy statements contained herein. There is no assurance that our investment objective will be achieved.

We expect to invest a substantial portion of our assets in securities that we consider to be private venture capital equity investments. These private venture capital equity investments usually do not pay interest or dividends and usually are subject to legal or contractual restrictions on resale that may adversely affect the liquidity and marketability of such securities. We expect to invest a minority portion of our assets in debt securities issued to us by privately held and publicly traded small businesses. These investments usually pay interest and may include payment of fees and issuance of warrants for the purchase of equity securities at a future date.

We expect to make speculative venture capital investments with limited marketability and a greater risk of investment loss than less speculative investments. We make venture capital investments in companies commercializing and integrating products enabled by nanotechnology and microsystems. Such technology is enabling technology applicable to a wide range of industries and businesses. We do not limit our investments to any particular industries or categories of investments within this thesis. Our securities investments may consist of private, public or governmental issuers of any type. Subject to the diversification requirements applicable to a RIC, we may commit all of our assets to only a few

investments.

Achievement of our investment objective is basically dependent upon the judgment of a team of four professional, full-time members of management, three of whom are designated as Managing Directors: Douglas W. Jamison, Alexei A. Andreev and Daniel B. Wolfe, and a Vice President, Misti Ushio. One of our directors, Lori D. Pressman, is also a consultant to us. This team collectively has expertise in venture capital investing, intellectual property and nanotechnology. There can be no assurance that a suitable replacement could be found for any of our officers upon their retirement, resignation, inability to act on our behalf, or death.

Subject to continuing to meet the compliance tests applicable to BDCs, there are no limitations on the types of securities or other assets in which we may invest. Investments may include the following:

|

|

·

|

Venture capital investments, whether in corporate, partnership or other form, including development-stage or start-up entities;

|

|

|

·

|

Equity, equity-related securities (including warrants) and debt with equity features from either private or public issuers;

|

|

|

·

|

Debt obligations of all types having varying terms with respect to security or credit support, subordination, purchase price, interest payments and maturity;

|

|

|

·

|

Intellectual property or patents or research and development in technology or product development that may lead to patents or other marketable technology; and

|

|

|

·

|

Miscellaneous investments.

|

Investments and Strategies

The following is a summary description of the types of assets in which we may invest, the investment strategies we may use and the attendant risks associated with our investments and strategies.

Venture Capital Investments

We define venture capital as the money and resources made available to privately held start-up firms and privately held and publicly traded small businesses with exceptional growth potential. These businesses can range in stage from pre-revenue to generating positive cash flow. Substantially all of our long-term venture capital investments are in thinly capitalized, unproven, small companies focused on commercializing risky technologies. These businesses also tend to lack management depth, to have limited or no history of operations and to have not attained profitability. Because of the speculative nature of these investments, these securities have a significantly greater risk of loss than traditional investment

securities. Some of our venture capital investments will never realize their potential, and some will be unprofitable or result in complete loss of our investment.

We may own 100 percent of the securities of a start-up investment for a period of time and may control the company for a substantial period. Start-up companies are more vulnerable to adverse business or economic developments than better capitalized companies. Start-up businesses generally have limited product lines, markets and/or financial resources. Start-up companies are not well-known to the investing public and are subject to general movements in markets, to perceptions of potential growth and to potential bankruptcy.

In connection with our venture capital investments, we may participate in providing a variety of services to our portfolio companies, including the following:

|

|

·

|

formulating operating strategies;

|

|

|

·

|

formulating intellectual property strategies;

|

|

|

·

|

assisting in financial planning;

|

|

|

·

|

providing management in the initial start-up stages; and

|

|

|

·

|

establishing corporate goals.

|

We may assist in raising additional capital for these companies from other potential investors and may subordinate our own investment to that of other investors. We typically find it necessary or appropriate to provide additional capital of our own. We may introduce these companies to potential joint venture partners, suppliers and customers. In addition, we may assist in establishing relationships with investment bankers and other professionals. We may also assist with mergers and acquisitions ("M&As"). We do not currently derive income from these companies for the performance of any of the above services.

We may control, be represented on, or have observer rights on the Board of Directors of a portfolio company through one or more of our officers or directors, who may also serve as officers of the portfolio company. We indemnify our officers and directors for serving on the Boards of Directors or as officers of portfolio companies, which exposes us to additional risks. Particularly during the early stages of an investment, we may, in rare instances, in effect be conducting the operations of the portfolio company. As a venture capital-backed company emerges from the developmental stage with greater management depth and experience, we expect that our role in the portfolio company’s operations will diminish. Our goal is

to assist each company in establishing its own independent capitalization, management and Board of Directors. We expect to be able to reduce our involvement in those start-up companies that become successful, as well as in those start-up companies that fail.

Equity, Equity-Related Securities and Debt with Equity Features

We may invest in equity, equity-related securities and debt with equity features. These securities include common stock, preferred stock, debt instruments convertible into common or preferred stock, limited partnership interests, other beneficial ownership interests and warrants, options or other rights to acquire any of the foregoing.

We may make investments in companies with operating histories that are unprofitable or marginally profitable, that have negative net worth or that are involved in bankruptcy or reorganization proceedings. These investments would involve businesses that management believes have potential through the infusion of additional capital and management assistance. In addition, we may make investments in connection with the acquisition or divestiture of companies or divisions of companies. There is a significantly greater risk of loss with these types of securities than is the case with traditional investment securities.

Warrants, options and convertible or exchangeable securities generally give the investor the right to acquire specified equity securities of an issuer at a specified price during a specified period or on a specified date. Warrants and options fluctuate in value in relation to the value of the underlying security and the remaining life of the warrant or option, while convertible or exchangeable securities fluctuate in value both in relation to the intrinsic value of the security without the conversion or exchange feature and in relation to the value of the conversion or exchange feature, which is like a warrant or option. When we invest in these securities, we incur the risk that the option feature will expire worthless, thereby either

eliminating or diminishing the value of our investment.

Most of our current portfolio company investments are in the equity securities of private companies. Investments in equity securities of private companies often involve securities that are restricted as to sale and cannot be sold in the open market without registration under the Securities Act of 1933 or pursuant to a specific exemption from these registrations. Opportunities for sale are more limited than in the case of marketable securities, although these investments may be purchased at more advantageous prices and may offer attractive investment opportunities. Even if one of our portfolio companies completes an initial public offering ("IPO"), we are typically subject to a lock-up agreement for 180 days, and the stock price may

decline substantially before we are free to sell.

We may also invest in publicly traded securities of whatever nature, including relatively small, emerging growth companies that management believes have long-term growth potential. These investments may be through open-market transactions or through private placements in publicly traded companies ("PIPEs"). Securities purchased in PIPE transactions are typically subject to a lock-up agreement for 180 days, or are issued as unregistered securities that are not freely available for six months.

Even if we have registration rights to make our investments in privately held and publicly traded companies more marketable, a considerable amount of time may elapse between a decision to sell or register the securities for sale and the time when we are able to sell the securities. The prices obtainable upon sale may be adversely affected by market conditions or negative conditions affecting the issuer during the intervening time. We may elect to hold formerly restricted securities after they have become freely marketable, either because they remain relatively illiquid or because we believe that they may appreciate in value, during which holding period they may decline in value and be especially volatile as unseasoned securities. If

we need funds for investment or working capital purposes, we might need to sell marketable securities at disadvantageous times or prices.

Debt Obligations

We may hold debt securities, including in privately held and thinly traded public companies, for income and as a reserve pending more speculative investments. Debt obligations may include U.S. government and agency securities, commercial paper, bankers’ acceptances, receivables or other asset-based financing, notes, bonds, debentures, or other debt obligations of any nature and repurchase agreements related to these securities. These obligations may have varying terms with respect to security or credit support, subordination, purchase price, interest payments and maturity from private, public or governmental issuers of any type located anywhere in the world. We may invest in debt obligations of companies with operating

histories that are unprofitable or marginally profitable, that have negative net worth or are involved in bankruptcy or reorganization proceedings, or that are start-up or development-stage entities. In addition, we may participate in the acquisition or divestiture of companies or divisions of companies through issuance or receipt of debt obligations. As of December 31, 2010, the debt obligations held in our portfolio consisted of convertible bridge notes, senior secured non-convertible debt through a participation agreement and U.S. Treasury securities. The convertible bridge notes generally do not generate cash payments to us, nor are they held for that purpose. Our convertible bridge notes and the interest accrued thereon are held for the purpose of potential conversion into equity at a future date.

Our investments in debt obligations may be of varying quality, including non-rated, unsecured, highly speculative debt investments with limited marketability. Investments in lower-rated and non-rated securities, commonly referred to as "junk bonds," including our venture debt investments, are subject to special risks, including a greater risk of loss of principal and non-payment of interest. Generally, lower-rated securities offer a higher return potential than higher-rated securities, but involve greater volatility of price and greater risk of loss of income and principal, including the possibility of default or bankruptcy of the issuers of these securities. Lower-rated securities and comparable non-rated securities will likely

have large uncertainties or major risk exposure to adverse conditions and are predominantly speculative with respect to the issuer’s capacity to pay interest and repay principal in accordance with the terms of the obligation. The occurrence of adverse conditions and uncertainties to issuers of lower-rated securities would likely reduce the value of lower-rated securities held by us, with a commensurate effect on the value of our shares.

The markets in which lower-rated securities or comparable non-rated securities are traded generally are more limited than those in which higher-rated securities are traded. The existence of limited markets for these securities may restrict our ability to obtain accurate market quotations for the purposes of valuing lower-rated or non-rated securities and calculating net asset value or to sell securities at their fair value. Any economic downturn could adversely affect the ability of issuers’ lower-rated securities to repay principal and pay interest thereon. The market values of lower-rated and non-rated securities also tend to be more sensitive to individual corporate developments and changes in economic conditions than

higher-rated securities. In addition, lower-rated securities and comparable non-rated securities generally present a higher degree of credit risk. Issuers of lower-rated securities and comparable non-rated securities are often highly leveraged and may not have more traditional methods of financing available to them, so that their ability to service their debt obligations during an economic downturn or during sustained periods of rising interest rates may be impaired. The risk of loss owing to default by these issuers is significantly greater because lower-rated securities and comparable non-rated securities generally are unsecured and frequently are subordinated to the prior payment of senior indebtedness. We may incur additional expenses to the extent that we are required to seek recovery upon a default in the payment of principal or interest on our portfolio holdings.

The market value of investments in debt securities that carry no equity participation usually reflects yields generally available on securities of similar quality and type at the time purchased. When interest rates decline, the market value of a debt portfolio already invested at higher yields can be expected to rise if the securities are protected against early call. Similarly, when interest rates increase, the market value of a debt portfolio already invested at lower yields can be expected to decline. Deterioration in credit quality also generally causes a decline in market value of the security, while an improvement in credit quality generally leads to increased value.

Foreign Securities

We may make investments in securities of issuers whose principal operations are conducted outside the United States, and whose earnings and securities are stated in foreign currency. In order to maintain our status as a BDC, our investments in non-qualifying assets, including the securities of companies organized outside the U.S., would be limited to 30 percent of our assets, because we must invest at least 70 percent of our assets in "qualifying assets," and securities of foreign companies are not "qualifying assets."

Compared to otherwise comparable investments in securities of U.S. issuers, currency exchange risk of securities of foreign issuers is a significant variable. The value of these investments to us will vary with the relation of the currency in which they are denominated to the U.S. dollar, as well as with intrinsic elements of value such as credit risk, interest rates and performance of the issuer. Investments in foreign securities also involve risks relating to economic and political developments, including nationalization, expropriation of assets, currency exchange freezes and local recession. Securities of many foreign issuers are less liquid and more volatile than those of comparable U.S. issuers. Interest and dividend

income and capital gains on our foreign securities may be subject to withholding and other taxes that may not be recoverable by us. We may seek to hedge all or part of the currency risk of our investments in foreign securities through the use of futures, options and forward currency purchases or sales.

Intellectual Property

We believe there is a role for organizations that can assist in technology transfer. Scientists and institutions that develop and patent intellectual property perceive the need for and rewards of entrepreneurial commercialization of their inventions.

Our form of investment may be:

|

|

·

|

funding research and development in the development of a technology;

|

|

|

·

|

obtaining licensing rights to intellectual property or patents;

|

|

|

·

|

acquiring intellectual property or patents; or

|

|

|

·

|

forming and funding companies or joint ventures to commercialize further intellectual property.

|

Income from our investments in intellectual property or its development may take the form of participation in licensing or royalty income, fee income, or some other form of remuneration. In order to satisfy RIC requirements, these investments will normally be held in an entity taxable as a corporation. Investment in developmental intellectual property rights involves a high degree of risk that can result in the loss of our entire investment as well as additional risks, including uncertainties as to the valuation of an investment and potential difficulty in liquidating an investment. Further, investments in intellectual property generally require investor patience, as investment return may be realized only after or over a long

period. At some point during the commercialization of a technology, our investment may be transformed into ownership of securities of a development-stage or start-up company, as discussed under "Venture Capital Investments" above.

Borrowing and Margin Transactions

We may from time to time borrow money or obtain credit by any lawful means from banks, lending institutions, other entities or individuals, in negotiated transactions. We may issue, publicly or privately, bonds, debentures or notes, in series or otherwise, with interest rates and other terms and provisions, including conversion rights, on a secured or unsecured basis, for any purpose, up to the maximum amounts and percentages permitted for BDCs under the 1940 Act. The 1940 Act currently prohibits us from borrowing any money or issuing any other senior securities (including preferred stock but excluding temporary borrowings of up to five percent of our assets), if after giving effect to the borrowing or issuance, the value of our total assets

less liabilities not constituting senior securities would be less than 200 percent of our senior securities. We may pledge assets to secure any borrowings. As of December 31, 2010, we had no debt and have no current intention to issue preferred stock.

A primary purpose of our borrowing power is for leverage, to increase our ability to acquire venture debt investments both by acquiring larger positions and by acquiring more positions while maintaining a substantial balance of cash on our balance sheet. As discussed in more detail below in Management's Discussion and Analysis of Financial Condition and Results of Operations, we believe we need a strong balance sheet to have access to the best deal flow. Borrowings for leverage accentuate any increase or decrease in the market value of our investments and thus our net asset value. Because any decline in the net asset value of our investments will be borne first by holders of common stock, the effect of leverage in a declining market

would be a greater decrease in net asset value applicable to the common stock than if we were not leveraged. Any decrease would likely be reflected in a decline in the market price of our common stock. To the extent the income derived from assets acquired with borrowed funds exceeds the interest and other expenses associated with borrowing, our total income will be greater than if borrowings were not used. Conversely, if the income from assets is not sufficient to cover the borrowing costs, our total income will be less than if borrowings were not used. If our current income is not sufficient to meet our borrowing costs (repayment of principal and interest), we might have to liquidate some or all of our investments when it may be disadvantageous to do so. Our borrowings for the purpose of buying most liquid equity securities will be subject to the margin rules, which require excess liquid collateral marked to market daily. If we

are unable to post sufficient collateral, we will be required to sell securities to remain in compliance with the margin rules. These sales might be at disadvantageous times or prices.

Repurchase of Shares

Our shareholders do not have the right to compel us to redeem our shares. We may, however, purchase outstanding shares of our common stock from time to time, subject to approval of our Board of Directors and compliance with applicable corporate and securities laws. The Board of Directors may authorize purchases from time to time when they are deemed to be in the best interests of our shareholders, but could do so only after notification to shareholders. The Board of Directors may or may not decide to undertake any purchases of our common stock.

Our repurchases of our common shares would decrease our total assets and would therefore likely have the effect of increasing our expense ratio. Subject to our investment restrictions, we may borrow money to finance the repurchase of our common stock in the open market pursuant to any tender offer. Interest on any borrowings to finance share repurchase transactions will reduce our net assets. If, because of market fluctuations or other reasons, the value of our assets falls below the required 1940 Act coverage requirements, we may have to reduce our borrowed debt to the extent necessary to comply with the requirement. To achieve a reduction, it is possible that we may be required to sell portfolio securities at

inopportune times when it may be disadvantageous to do so.

Portfolio Company Turnover

Changes with respect to portfolio companies will be made as our management considers necessary in seeking to achieve our investment objective. The rate of portfolio turnover will not be treated as a limiting or relevant factor when circumstances exist, which are considered by management to make portfolio changes advisable.

Although we expect that many of our investments will be relatively long term in nature, we may make changes in our particular portfolio holdings whenever it is considered that an investment no longer has substantial growth potential or has reached its anticipated level of performance, or (especially when cash is not otherwise available) that another investment appears to have a relatively greater opportunity for capital appreciation. We may also make general portfolio changes to increase our cash to position us in a defensive posture. We may make portfolio changes without regard to the length of time we have held an investment, or whether a sale results in profit or loss, or whether a purchase results in the reacquisition of an investment that

we may have only recently sold. Our investments in privately held companies are illiquid, which limits portfolio turnover. The portfolio turnover rate may vary greatly during a year as well as from year to year and may also be affected by cash requirements.

Competition

Numerous companies and individuals are engaged in the venture capital business, and such business is intensely competitive. We believe the perpetual nature of our corporate structure enables us to be a better long-term partner for our portfolio companies than if we were organized as a traditional private equity fund that typically has a limited life. We believe that we have invested in more nanotechnology-enabled companies than any venture capital firm and that we have assembled a team of investment professionals that have scientific and intellectual property expertise that is relevant to investing in nanotechnology. Nevertheless, many of our competitors have significantly greater financial and other resources than we do and are,

therefore, in certain respects, in a better position than we are to obtain access to attractive venture capital investments. There can be no assurance that we will be able to compete against these venture capital businesses for attractive investments, particularly in capital-intensive companies.

Regulation

The Small Business Investment Incentive Act of 1980 added the provisions of the 1940 Act applicable only to BDCs. BDCs are a special type of investment company. After a company files its election to be treated as a BDC, it may not withdraw its election without first obtaining the approval of holders of a majority of its outstanding voting securities. The following is a brief description of the 1940 Act provisions applicable to BDCs, qualified in its entirety by reference to the full text of the 1940 Act and the rules issued thereunder by the Securities and Exchange Commission ("SEC").

Generally, to be eligible to elect BDC status, a company must primarily engage in the business of furnishing capital and making significant managerial assistance available to companies that do not have ready access to capital through conventional financial channels. Such companies that satisfy certain additional criteria described below are termed "eligible portfolio companies." In general, in order to qualify as a BDC, a company must: (i) be a domestic company; (ii) have registered a class of its securities pursuant to Section 12 of the Securities Exchange Act of 1934 (the "Exchange Act"); (iii) operate for the purpose of investing in the securities of certain types of portfolio companies, including early-stage or emerging companies and

businesses suffering or just recovering from financial distress (see following paragraph); (iv) make available significant managerial assistance to such portfolio companies; and (v) file a proper notice of election with the SEC.

An eligible portfolio company generally is a domestic company that is not an investment company or a company excluded from investment company status pursuant to exclusions for certain types of financial companies (such as brokerage firms, banks, insurance companies and investment banking firms) and that: (i) has a fully diluted market capitalization of less than $250 million and has a class of equity securities listed on a national securities exchange, (ii) does not have a class of securities listed on a national securities exchange, or (iii) is controlled by the BDC by itself or together with others (control under the 1940 Act is presumed to exist where a person owns at least 25 percent of the outstanding voting securities of the portfolio company) and has a

representative on the Board of Directors of such company.

We may be periodically examined by the SEC for compliance with the 1940 Act.

As with other companies regulated by the 1940 Act, a BDC must adhere to certain substantive regulatory requirements. A majority of the directors must be persons who are not interested persons, as that term is defined in the 1940 Act. Additionally, we are required to provide and maintain a bond issued by a reputable fidelity insurance company to protect the BDC. Furthermore, as a BDC, we are prohibited from protecting any director or officer against any liability to us or our shareholders arising from willful malfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such person's office.

The 1940 Act provides that we may not make an investment in non-qualifying assets unless at the time at least 70 percent of the value of our total assets (measured as of the date of our most recently filed financial statements) consists of qualifying assets. Qualifying assets include: (i) securities of eligible portfolio companies; (ii) securities of certain companies that were eligible portfolio companies at the time we initially acquired their securities and in which we retain a substantial interest; (iii) securities of certain controlled companies; (iv) securities of certain bankrupt, insolvent or distressed companies; (v) securities received in exchange for or distributed in or with respect to any of the foregoing; and (vi) cash items, U.S. government securities and high quality short-term

debt. The SEC has adopted a rule permitting a BDC to invest its cash in certain money market funds. The 1940 Act also places restrictions on the nature of the transactions in which, and the persons from whom, securities can be purchased in some instances in order for the securities to be considered qualifying assets.

We are permitted by the 1940 Act, under specified conditions, to issue multiple classes of debt and a single class of preferred stock if our asset coverage, as defined in the 1940 Act, is at least 200 percent after the issuance of the debt or the preferred stock (i.e., such senior securities may not be in excess of our net assets). Under specific conditions, we are also permitted by the 1940 Act to issue warrants.

Except under certain conditions, we may sell our securities at a price that is below the prevailing net asset value per share only during the 12-month period after (i) a majority of our directors and our disinterested directors have determined that such sale would be in the best interest of us and our stockholders and (ii) the holders of a majority of our outstanding voting securities and the holders of a majority of our voting securities held by persons who are not affiliated persons of ours approve our ability to make such issuances. A majority of the disinterested directors must determine in good faith that the price of the securities being sold is not less than a price which closely approximates the market value of the securities, less any distribution discount or commission.

Certain transactions involving certain closely related persons of the Company, including its directors, officers and employees, may require the prior approval of the SEC. However, the 1940 Act ordinarily does not restrict transactions between us and our portfolio companies.

Subchapter M Status

We elected to be treated as a RIC, taxable under Subchapter M of the Internal Revenue Code of 1986 (the "Code"), for federal income tax purposes. In general, a RIC is not taxable on its income or gains to the extent it distributes such income or gains to its shareholders. In order to qualify as a RIC, we must, in general, (1) annually derive at least 90 percent of our gross income from dividends, interest and gains from the sale of securities and similar sources (the "Income Source Rule"); (2) quarterly meet certain investment asset diversification requirements; and (3) annually distribute at least 90 percent of our investment company taxable income as a dividend (the "Income Distribution Rule"). Any taxable investment company income not distributed will be subject to

corporate level tax. Any taxable investment company income distributed generally will be taxable to shareholders as dividend income.

In addition to the requirement that we must annually distribute at least 90 percent of our investment company taxable income, we may either distribute or retain our realized net capital gains from investments, but any net capital gains not distributed may be subject to corporate level tax. It is our current intention not to distribute net capital gains. Any net capital gains distributed generally will be taxable to shareholders as long-term capital gains.

In lieu of actually distributing our realized net capital gains, we as a RIC may retain all or part of our net capital gains and elect to be deemed to have made a distribution of the retained portion to our shareholders under the "designated undistributed capital gain" rules of the Code. We currently intend to retain and so designate all of our net capital gains. In this case, the "deemed dividend" generally is taxable to our shareholders as long-term capital gains. Although we pay tax at the corporate rate on the amount deemed to have been distributed, our shareholders receive a tax credit equal to their proportionate share of the tax paid and an increase in the tax basis of their shares by the amount per share retained by us.

To the extent that we declare a deemed dividend, each shareholder will receive an IRS Form 2439 that will reflect each shareholder's receipt of the deemed dividend income and a tax credit equal to each shareholder's proportionate share of the tax paid by us. This tax credit, which is paid at the corporate rate, is often credited at a higher rate than the actual tax due by a shareholder on the deemed dividend income. The "residual" credit can be used by the shareholder to offset other taxes due in that year or to generate a tax refund to the shareholder. Tax exempt investors may file for a refund.

The following simplified examples illustrate the tax treatment under Subchapter M of the Code for us and our individual shareholders with regard to three possible distribution alternatives, assuming a net capital gain of $1.00 per share, consisting entirely of sales of non-real property assets held for more than 12 months.

Under Alternative A: 100 percent of net capital gain declared as a cash dividend and distributed to shareholders:

1. No federal taxation at the Company level.

2. Taxable shareholders receive a $1.00 per share dividend and pay federal tax at a rate not in excess of 15 percent* or $.15 per share, retaining $.85 per share.

3. Non-taxable shareholders that file a federal tax return receive a $1.00 per share dividend and pay no federal tax, retaining $1.00 per share.

Under Alternative B (Current Tax Structure Employed): 100 percent of net capital gain retained by the Company and designated as "undistributed capital gain" or deemed dividend:

1. The Company pays a corporate-level federal income tax of 35 percent on the undistributed gain or $.35 per share and retains 65 percent of the gain or $.65 per share.

2. Taxable shareholders increase their cost basis in their stock by $.65 per share. They pay federal capital gains tax at a rate not in excess of 15 percent* on 100 percent of the undistributed gain of $1.00 per share or $.15 per share in tax. Offsetting this tax, shareholders receive a tax credit equal to 35 percent of the undistributed gain or $.35 per share.

3. Non-taxable shareholders that file a federal tax return receive a tax refund equal to $.35 per share.

*Assumes all capital gains qualify for long-term rates of 15 percent, which may increase for gains realized after December 31, 2010.

Under Alternative C: 100 percent of net capital gain retained by the Company, with no designated undistributed capital gain or deemed dividend:

1. The Company pays a corporate-level federal income tax of 35 percent on the retained gain or $.35 per share plus an excise tax of four percent of $.98 per share, or about $.04 per share.

2. There is no tax consequence at the shareholder level.

Although we may retain income and gains subject to the limitations described above (including paying corporate level tax on such amounts), we could be subject to an additional four percent excise tax if we fail to distribute 98 percent of our aggregate annual taxable income.

As noted above, in order to qualify as a RIC, we must meet certain investment asset diversification requirements each quarter. Because of the specialized nature of our investment portfolio, in some years we have been able to satisfy the diversification requirements under Subchapter M of the Code primarily as a result of receiving certifications from the SEC under the Code with respect to each taxable year beginning after 1998 that we were "principally engaged in the furnishing of capital to other corporations which are principally engaged in the development or exploitation of inventions, technological improvements, new processes, or products not previously generally available" for such year.

Although we received SEC certifications for 1999-2009, there can be no assurance that we will receive such certification for subsequent years (to the extent we need additional certifications as a result of changes in our portfolio). In 2010, we qualified for RIC treatment even without certification. If we require, but fail to obtain, the SEC certification for a taxable year, we may fail to qualify as a RIC for such year. We will also fail to qualify as a RIC for a taxable year if we do not satisfy the Income Source Rule or Income Distribution Rule for such year. In the event we do not qualify as a RIC for any taxable year, we will be subject to federal tax with respect to all of our taxable income, whether or not

distributed. In addition, all our distributions to shareholders in that situation generally will be taxable as ordinary dividends.

Although we generally intend to qualify as a RIC for each taxable year, under certain circumstances we may choose to take action with respect to one or more taxable years to ensure that we would be taxed under Subchapter C of the Code (rather than Subchapter M) for such year or years. We will choose to take such action only if we determine that the result of the action will benefit us and our shareholders.

Subsidiaries

Harris & Harris Enterprises, Inc.SM ("Enterprises"), is a 100 percent wholly owned subsidiary of the Company and is consolidated in our financial statements. Enterprises holds the lease for our office space in Palo Alto, California, is a partner in Harris Partners I, L.P. SM, and is taxed as a C Corporation. Harris Partners I, L.P., is a limited partnership. The partners of Harris Partners I, L.P., are Enterprises (sole general partner) and the Company (sole limited partner). Enterprises, as the sole general partner, consolidates Harris Partners I, L.P.

Available Information

Additional information about us, including our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, are available free of charge on our website at www.HHVC.com. Information on our website is not part of this Annual Report on Form 10-K.

Employees

We currently employ directly 10 permanent, full-time employees.

Item 1A. Risk Factors.

Investing in our common stock involves significant risks relating to our business and investment objective. You should carefully consider the risks and uncertainties described below before you purchase any shares of our common stock. These risks and uncertainties are not the only ones we face. Unknown additional risks and uncertainties, or ones that we currently consider immaterial, may also impair our business. If any of these risks or uncertainties materialize, our business, financial condition or results of operations could be materially adversely affected. In this event, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks related to the companies in our portfolio.

The difficult venture capital investment and capital market climates could increase the non-performance risk for our portfolio companies.

While the public markets have rebounded from the lows of March 2009 and corporate profits and growth are improving, unemployment remains high, and there are global instabilities, including sovereign debt issues and the potential for inflation. Even with signs of economic improvement, the availability of capital for venture capital firms and venture-backed companies continues to be limited. Currently, financing for capital-intensive companies remains difficult. Historically, difficult venture environments have resulted in a higher than normal number of companies not receiving financing and being subsequently closed down with a loss to venture investors, and other companies receiving financing but at significantly lower valuations than the preceding financing

rounds. This issue is compounded by the fact that many existing venture capital firms have few remaining years of investment and available capital owing to the finite lifetime of the funds managed by these firms. Additionally, even if a firm was able to raise a new fund, commonly new funds are not permitted to invest with old funds in existing investments. As such, the currently improving exit environment for venture-backed companies through IPOs and M&A transactions and the currently improving public markets in general may not translate to an increase in the available capital to venture-backed companies, particularly those that have investments from funds that are in the latter stage of life unless it continues for some time into the future.

We believe that these factors continue to introduce significant non-performance risk for venture-backed companies that need to raise additional capital or that require substantial amounts of capital to execute on their business plans. We define non-performance risk as the risk that a portfolio company will be: (a) unable to raise capital, will need to be shut down and will not return our invested capital; or (b) able to raise capital, but at a valuation significantly lower than the implied post-money valuation. In these circumstances, the portfolio company could be recapitalized at a valuation significantly lower than the post-money valuation implied by our valuation method, sold at a loss to our investment or shut down. In addition, significant changes in the capital markets,

including the recent extreme volatility and disruption, have had, and may in the future have, a negative effect on the valuations of our investments and on the potential for liquidity events involving our investments. We believe further that the long-term effects of the difficult venture capital investment and difficult, but improving, exit environments will continue to affect negatively the fundraising ability of some companies regardless of near-term improvements in the overall global economy and public markets.

The average length of time from founding to a liquidity event is at historical highs, which could result in companies remaining in our portfolio longer, leading to lower returns, write-downs and write-offs.

Beginning in about 2001, many fewer venture capital-backed companies per annum have been able to complete IPOs than in the years of the previous decade. The IPO and M&A markets improved in 2010 from those in 2009. On average, however, more capital and more time than in previous decades are required for companies to reach these liquidity events. This trend could lead to companies staying longer in our portfolio as private entities that may require additional funding. In the best case, such stagnation would dampen returns, and in the worst case, could lead to write-downs and write-offs as some companies run short of cash and have to accept lower valuations in private financings or are not able to access additional capital at all. The difficult venture capital climate is

also causing some venture capital firms to change their investment strategies. Accordingly, some venture capital firms are reducing funding of their portfolio companies, making it more difficult for such companies to access capital and to fulfill their potential. In some cases this leads to write-downs and write-offs of such companies by other venture capital firms, such as ourselves, who are co-investors in such companies.

Investing in small, privately held and publicly traded companies involves a high degree of risk and is highly speculative.

We have invested a substantial portion of our assets in privately held companies, the securities of which are inherently illiquid. We also seek to invest in small publicly traded companies that we believe have exceptional growth potential. Although these companies are publicly traded, their stock may not trade at high volumes and prices can be volatile, which may restrict our ability to sell our positions. These privately held and publicly traded businesses tend to lack management depth, to have limited or no history of operations and to have not attained profitability. Companies commercializing products enabled by nanotechnology or microsystems are especially risky, involving scientific, technological and commercialization risks. Because of the speculative

nature of these investments, these securities have a significantly greater risk of loss than traditional investment securities. Some of our venture capital investments are likely to be complete losses or unprofitable, and some will never realize their potential. We have been and will continue to be risk seeking rather than risk averse in our approach to venture capital and other investments. Neither our investments nor an investment in our common stock is intended to constitute a balanced investment program.

We may invest in companies working with technologies or intellectual property that currently have few or no proven commercial applications.

Nanotechnology, in particular, is a developing area of technology, of which much of the future commercial value is difficult to estimate and subject to widely varying interpretations. It is a general purpose technology that is applicable to a diverse set of industries. As such, nanotechnology-enabled products must compete against existing products or enable a completely new product in an emerging or existing industry. The timing of additional future commercially available nanotechnology-enabled products and the industries on which nanotechnology will have the most significant impact are highly uncertain. To date, some of our portfolio companies have not developed any commercially available products. In addition, our portfolio companies may not be able to

manufacture successfully or to market their products in order to achieve commercial success. Further, the products may never gain commercial acceptance.

Our portfolio companies working with nanotechnology and microsystems may be particularly susceptible to intellectual property litigation.

Research and commercialization efforts in nanotechnology and microsystems are being undertaken by a wide variety of government, academic and private corporate entities. As additional commercially viable applications of nanotechnology emerge, ownership of intellectual property on which these products are based may be contested. From time to time, our portfolio companies are or have been involved in intellectual property disputes and litigation. Any litigation over the ownership of, or rights to, any of our portfolio companies’ technologies or products could have a material adverse effect on those companies’ values.

The value of our portfolio could be adversely affected if the technologies utilized by our portfolio companies are found, or even rumored or feared, to cause health or environmental risks, or if legislation is passed that limits the commercialization of any of these technologies.

Nanotechnology has received both positive and negative publicity and is the subject increasingly of public discussion and debate. For example, debate regarding the production of materials that could cause harm to the environment or the health of individuals could raise concerns in the public’s perception of nanotechnology, not all of which might be rational or scientifically based. Nanotechnology in particular is currently the subject of health and environmental impact research. If health or environmental concerns about nanotechnology or microsystems were to arise, whether or not they had any basis in fact, our portfolio companies might incur additional research, legal and

regulatory expenses, and might have difficulty raising capital or marketing their products. Government authorities could, for social or other purposes, prohibit or regulate the use of nanotechnology. Legislation could be passed that could circumscribe the commercialization of any of these technologies.

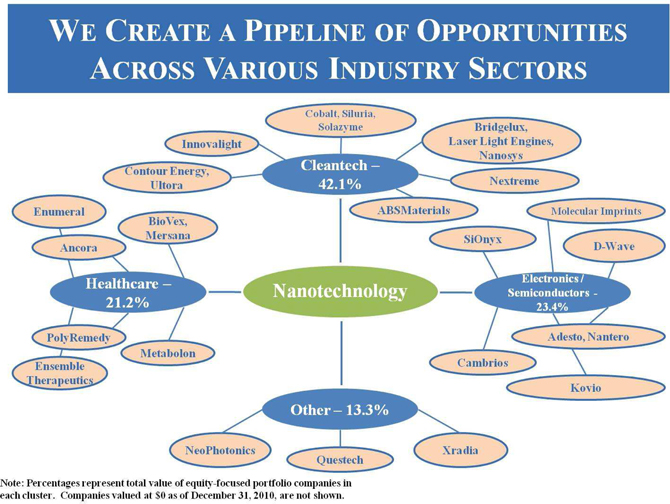

Our Nanotech for CleantechSM, Nanotech for ElectronicsSM and Nanotech for HealthcareSM portfolios are currently the largest portion of our venture capital portfolio, and, therefore, fluctuations in the value of the companies in these portfolios may

adversely affect our net asset value per share to a greater degree than other sectors of our portfolio.

The three largest portions of our portfolio are our Nanotech for CleantechSM, Nanotech for ElectronicsSM and Nanotech for HealthcareSM portfolios. Our Nanotech for CleantechSM portfolio consists of companies commercializing nanotechnology-enabled products targeted at cleantech-related markets. There are risks in investing in companies that target cleantech-related markets, including the rapid and sometimes dramatic price fluctuations of commodities, particularly oil and sugar, and of

public equities, the reliance on the capital and debt markets to finance large capital outlays, change in climate, including climate-related regulations, and the dependence on government subsidies to be cost-competitive with non-cleantech solutions. For example, the attractiveness of alternative methods for the production of biobutanol and biodiesel can be adversely affected by a decrease in the demand or price of oil. The demand for solar cells is driven partly by government subsidies and the availability of credit to finance the purchase and installation of the system. Adverse developments in any of these sectors may significantly affect the value of our Nanotech for CleantechSM portfolio, and thus our venture capital portfolio as a whole. Additionally, companies with cleantech platforms are currently in favor with the media and investors. Cleantech

companies in general may have a harder time accessing capital in the future if this level of interest subsides.

Our Nanotech for ElectronicsSM portfolio consists of companies commercializing and integrating nanotechnology-enabled products targeted at electronics-related markets. There are risks in investing in companies that target electronics-related markets, including rapid and sometimes dramatic price erosion of products, the reliance on capital and debt markets to finance large capital outlays, including fabrication facilities, the reliance on partners outside of the United States, particularly in Asia, and inherent cyclicality of the electronics market in general. Additionally, electronics-related companies are currently out of favor with many venture capital firms. Therefore, access to capital may be

difficult or impossible for companies in our portfolio that are pursuing these markets.

Our Nanotech for HealthcareSM portfolio consists of companies that commercialize and integrate products enabled by nanotechnology and microsystems in healthcare-related industries, including biotechnology, pharmaceuticals, diagnostics and medical devices. There are risks in investing in companies that target healthcare-related industries, including but not limited to the uncertainty of timing and results of clinical trials to demonstrate the safety and efficacy of products; failure to obtain any required regulatory approval of products; failure to develop manufacturing processes that meet regulatory standards; competition, in particular from companies that develop rival products; and the ability to protect proprietary

technology. Adverse developments in any of these areas may adversely affect the value of our Nanotech for HealthcareSM portfolio.

The three main industry clusters around which our nanotechnology investments have developed are all capital intensive.

The industry clusters where nanotechnology and microsystems are gaining the greatest traction, cleantech, electronics and healthcare, are all capital intensive. Currently, financing for capital-intensive companies remains difficult. In some successful companies, we believe we may need to invest more than we currently have planned to invest in these companies. There can be no assurance that we will have the capital necessary to make such investments. In addition, investing greater than planned amounts in our portfolio companies could limit our ability to pursue new investments and fund follow-on investments. Both of these situations could cause us to miss investment opportunities or limit our ability to protect existing investments from dilution or other

actions or events that would decrease the value and potential return from these investments.

Our portfolio companies may generate revenues from the sale of products that are not enabled by nanotechnology.

We consider a company to be enabled by nanotechnology or microsystems if a product or products, or intellectual property covering a product or products, that we consider to be at the microscale or smaller is material to its business plan. The core business of some of these companies may not be nanotechnology-enabled products, and, therefore, their success or failure may not be dependent upon the nanotechnology aspects of their business. In addition to developing products that we consider nanotechnology, some of these companies may also develop products that we do not consider enabled by nanotechnology. Some of these companies will generate revenues from the sale of non-nanotechnology-enabled products. Additionally, it is possible that a portfolio company may decide to change its business

focus after our initial investment and decide to develop and commercialize non-nanotechnology-enabled products.

Our venture debt investments may be extremely risky, and we could lose all or part of our investments.

A portfolio company’s failure to satisfy financial or operating covenants imposed by us or other lenders could lead to defaults and, potentially, termination of its loans and foreclosure on its assets, which could trigger cross-defaults under other agreements and jeopardize our portfolio company’s ability to meet its obligations under the debt securities that we hold. We may incur expenses to the extent necessary to seek recovery upon default or to negotiate new terms with a defaulting portfolio company. In addition, if a portfolio company goes bankrupt, even though we may have structured our interest as senior debt, depending on the facts and circumstances, including the extent to which we actually provided significant "managerial assistance" to that portfolio company, a

bankruptcy court might recharacterize our debt holding and subordinate all or a portion of our claim to that of another creditor.

When we make a senior secured term loan investment in a portfolio company, we generally take a security interest in the available assets of the portfolio company, including the equity interests of its subsidiaries, which we expect to help mitigate the risk that we will not be repaid. However, there is a risk that the collateral securing our loans may decrease in value over time, may be difficult to sell in a timely manner, may be difficult to appraise and may fluctuate in value based upon the success of the business and market conditions, including as a result of the inability of the portfolio company to raise additional capital, and, in some circumstances, our lien could be subordinated to claims of other creditors. In addition, deterioration in a portfolio company’s financial

condition and prospects, including its inability to raise additional capital, may be accompanied by deterioration in the value of the collateral for the loan. Consequently, the fact that a loan is secured does not guarantee that we will receive principal and interest payments according to the loan’s terms, or at all, or that we will be able to collect on the loan should we be forced to enforce our remedies.

To the extent we use debt to finance our venture debt investments, changes in interest rates will affect our cost of capital and net investment income.

To the extent we borrow money to make venture debt investments, our net investment income will depend, in part, upon the difference between the rate at which we borrow funds and the rate at which we invest those funds. As a result, we can offer no assurance that a significant change in market interest rates will not have a material adverse effect on our net investment income in the event we use debt to finance our venture debt investments. In periods of rising interest rates, our cost of funds could increase, which could reduce our net investment income. Currently, our one venture debt investment is at a fixed rate. Some of our future debt investments may bear interest at variable rates and the interest income from these investments could be negatively affected

by decreases in market interest rates. In addition, an increase in interest rates would make it more expensive to use debt to finance our investments. As a result, a significant increase in market interest rates could increase our cost of capital, which would reduce our net investment income. A decrease in interest rates may have an adverse impact on our returns by requiring us to seek lower yields on our debt investments and by increasing the risk that our portfolio companies will prepay our debt investments, resulting in the need to redeploy capital at potentially lower rates. A decrease in market interest rates may also adversely impact our returns on our cash invested in treasury securities, which would reduce our net investment income.

On February 24, 2011, the Company established a new $10 million three-year revolving credit facility with TD Bank, N.A., to be used in conjunction with its investments in venture debt. As of March 15, 2011, we had $1,250,000 outstanding from our $10 million credit facility.

Our portfolio companies may incur debt that ranks senior to our investments in such companies.

We may make investments in our portfolio companies in the form of bridge notes that typically convert into preferred stock issued in the next round of financing of that portfolio company or other forms of convertible and non-convertible debt securities. The portfolio companies usually have, or may be permitted to incur, other debt that ranks senior to the debt securities in which we invest. By their terms, debt instruments may provide that the holders are entitled to receive payment of interest and principal on or before the dates on which we are entitled to receive payments in respect of the debt securities in which we invest. Also, in the case of insolvency, liquidation, dissolution, reorganization or bankruptcy of a portfolio company, holders of debt instruments ranking senior

to our investment in that portfolio company would typically be entitled to receive payment in full before we receive any distribution in respect of our investment. After repaying such senior creditors, such portfolio company may not have any remaining assets to use for repaying its obligations to us. In addition, in companies where we have made investments in the form of bridge notes or other debt securities, we may also have investments in equity in the form of preferred shares. In such a case, a bankruptcy court may subordinate our bridge notes and/or other debt securities to debt holders that do not have equity in the portfolio company.

Our portfolio companies face risks associated with international sales.

We anticipate that certain of our portfolio companies could generate revenue from international sales. Risks associated with these potential future sales include:

| |

·

|

Political and economic instability;

|

| |

·

|

Export controls and other trade restrictions;

|

| |

·

|

Changes in legal and regulatory requirements;

|

| |

·

|

U.S. and foreign government policy changes affecting the markets for the technologies;

|

| |

·

|

Changes in tax laws and tariffs;

|

| |

·

|

Convertibility and transferability of international currencies; and

|

| |

·

|

International currency exchange rate fluctuations.

|

The effect of global climate change may impact the operations of our portfolio companies.

There may be evidence of global climate change. Climate change creates physical and financial risk, and some of our portfolio companies may be adversely affected by climate change. For example, the needs of customers of energy companies vary with weather conditions, primarily temperature and humidity. To the extent weather conditions are affected by climate change, energy use could increase or decrease depending on the duration and magnitude of any changes. Increases in the cost of energy could adversely affect the cost of operations of our portfolio companies if the use of energy products or services is material to their business. A decrease in energy use due to weather changes may affect some of our portfolio companies’ financial condition through

decreased revenues. Extreme weather conditions in general require more system backup, adding to costs, and can contribute to increased system stresses, including service interruptions.

Risks related to the illiquidity of our investments.

We invest in illiquid securities and may not be able to dispose of them when it is advantageous to do so, or ever.

Most of our investments are or will be equity, equity-linked, or debt securities acquired directly from small companies. These securities are generally subject to restrictions on resale or otherwise have no established trading market. The illiquidity of most of our portfolio of securities may adversely affect our ability to dispose of these securities at times when it may be advantageous for us to liquidate these investments. We may never be able to dispose of these securities.

Unfavorable regulatory changes could impair our ability to engage in liquidity events.

Recent government reforms affecting publicly traded companies, stock markets, investment banks and securities research practices have made it more difficult for privately held companies to complete successful IPOs of their equity securities, and such reforms have increased the expense and legal exposure of being a public company. Public equity market response to companies offering nanotechnology-enabled products is uncertain. An inability to exit investments in our portfolio could negatively affect our liquidity, our reinvestment rate in new and follow-on investments and the value of our portfolio.

Even if some of our portfolio companies complete IPOs, the returns on our investments in those companies would be uncertain.

When companies in which we have invested as private entities complete IPOs of their securities, these newly issued securities are by definition unseasoned issues. Unseasoned issues tend to be highly volatile and have uncertain liquidity, which may negatively affect their price. In addition, we are typically subject to lock-up provisions that prohibit us from selling our investments into the public market for specified periods of time after IPOs. The market price of securities that we hold may decline substantially before we are able to sell these securities. Government reforms that affect the trading of securities in the United States have made market-making by broker-dealers less profitable, which has caused broker-dealers to reduce their market-making activities, thereby making the market for unseasoned stocks

less liquid than they might be otherwise.

Risks related to our Company.

Our business may be adversely affected by the state of the venture capital market and capital markets in general.

The economies of the United States and many other countries are just emerging from recession. While the public markets have rebounded from the lows of March 2009 and corporate profits and growth are improving, unemployment remains high, and there are global instabilities, including sovereign debt issues, popular revolts against established governments and the potential for inflation. These issues may persist for a substantial period and may slow or reverse the recovery of the global economy, which could be detrimental to the recovery of the venture capital industry.

Our business and results of operations could be impacted adversely by a number of follow-on effects of the difficult venture capital market that resulted from the recent financial crisis, including the inability of our portfolio companies to obtain sufficient financing to continue to operate as a going concern, an increase in our funding costs or the limitation on our access to the capital markets. A prolonged period of market illiquidity may have an adverse effect on our business, financial condition, and results of operations. Our nonperforming assets may increase, and the value of our portfolio may decrease if this period of market illiquidity persists. These events could limit our investment activity, limit our ability to grow and negatively impact our operating results.

Changes in regulations of the financial industry have adversely affected coverage of us by financial analysts. A number of analysts that have covered us in the past are no longer able to continue to do so owing to changes in employment, to restrictions on the size of companies they are allowed to cover and/or their firms have shut down operations. An inability to attract analyst coverage may adversely affect our ability to raise capital from investors, particularly institutional investors. Our inability to access the capital markets on favorable terms, or at all, may adversely affect our future financial performance. The inability to obtain adequate financing capital sources could force us to seek debt financing, self-fund strategic initiatives or even forgo certain opportunities, which in turn could potentially

harm our current and future performance.

Because there is generally no established market in which to value our investments, our Valuation Committee’s value determinations may differ materially from the values that a ready market or third party would attribute to these investments.

There is generally no public market for the private equity securities in which we invest. Pursuant to the requirements of the 1940 Act, we value all of the privately held equity and debt securities in our portfolio at fair value as determined in good faith by the Valuation Committee, a committee made up of all of the independent members of our Board of Directors, pursuant to Valuation Procedures established by the Board of Directors. Determining fair value requires that judgment be applied to the specific facts and circumstances of each portfolio investment pursuant to specified valuation principles and processes. We are required by the 1940 Act to value specifically each individual investment on a quarterly basis and record unrealized depreciation for an investment that we believe has become impaired.

Conversely, we must record unrealized appreciation if we believe that a security has appreciated in value. Our valuations, although stated as a precise number, are necessarily within a range of values that vary depending on the significance attributed to the various factors being considered.