UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-07074

| | |

| 180 DEGREE CAPITAL CORP. |

| (Exact Name of Registrant as Specified in Its Charter) |

| | | | | | | | |

| 7 N. Willow Street, Suite 4B, Montclair NJ | | 07042 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | |

Daniel B. Wolfe

President and Chief Financial Officer

180 Degree Capital Corp.

7 N. Willow Street, Suite 4B

Montclair, NJ 07042 |

| (Name and address of agent for service) |

|

Copy to:

John J. Mahon, Esq.

Schulte Roth & Zabel, LLP

1152 Fifteenth Street, NW

Suite 850

Washington, DC 20005

(202) 729-7477 |

Registrant's telephone number, including area code: (973) 746-4500

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Item 1. Report to Shareholders.

Fellow Shareholders,

I have learned so many valuable lessons over the years about investing, particularly from being around so many smart investors, all with markedly varying investment processes. From my very first days at Merrill Lynch Asset Management (“MLAM”), I had the luxury of having mentors who cared very deeply about my growth and my career. I am deeply indebted to people like Arthur Zeikel, Norm Harvey, Paul Hoffman, and Bob Martorelli for their guidance over the years. Arthur Zeikel was an icon in the investing world, and his recent passing got me thinking about all that he taught me. Arthur was a legendary value investor and headed up research and managed investments for Dreyfus Corporation. In the mid 1970’s, he was brought to Merrill Lynch to start and become President of MLAM. He eventually hired my former boss, Paul Hoffman, to run the first manufactured product from MLAM, the Merrill Lynch Basic Value Fund (“Basic Value”). Arthur built a business of portfolio managers and products that produced superior returns for its shareholders and MLAM became one of the more widely respected asset managers on Wall Street. He was a better person and leader than he was an investor; and he was a great investor. Managing money isn't easy and we all have challenging performance times. What I loved and respected the most about Arthur was his ability to support his portfolio managers when they would go through spotty performance periods, rather than pounce on them. Supporting folks through tough periods built loyalty and camaraderie throughout MLAM during those years. No portfolio manager can effectively manage money if he/she has a boss that is going to fire that person for one bad performance period. Part of any investor’s track record will encompass periods of underperformance no matter how good of an investor he/she is. We are all destined to have underperforming portfolios at one point or another. Arthur accepted those periods from his portfolio managers and always encouraged them to learn from their mistakes and to maintain the courage of their convictions and to think long term. He was the greatest, and I miss his leadership. Arthur once published a letter in the mid 1990’s he had written to his daughter about his advice for investing, and in memory of him, I am going to copy and paste it here. It’s gold. RIP Arthur.

From: Arthur Zeikel (Father)

To: Jill Anne Zeikel (Daughter)

Date: Oct. 17, 1994

Re: Managing Your Own Portfolio

Personal portfolio management is not a competitive sport. It is, instead, an important individualized effort to achieve some predetermined financial goal by balancing one's risk-tolerance level with the desire to enhance capital wealth. Good investment management practices are complex and time consuming, requiring discipline, patience, and consistency of application. Too many investors fail to follow some simple, time-tested tenets that improve the odds of achieving success and, at the same time, reduce the anxiety naturally associated with an uncertain undertaking.

I hope the following advice will help:

A fool and his money are soon parted. Investment capital becomes a perishable commodity if not handled properly. Be serious. Pay attention to your financial affairs. Take an active, intensive interest. If you don't, why should anyone else?

There is no free lunch. Risk and return are interrelated. Set reasonable objectives using history as a guide. All returns relate to inflation. Better to be safe than sorry. Never up, never in. Most investors underestimate the stress of a high-risk portfolio on the way down.

Don't put all your eggs in one basket. Diversify. Asset allocation determines the rate of return. Stocks beat bonds over time.

Never overreach for yield. Remember, leverage works both ways. More money has been lost searching for yield than at the point of a gun (Ray DeVoe).

Spend interest, never principal, If at all possible, take out less than comes in. Then a portfolio grows in value and lasts forever. The other way around, it can be diminished quite rapidly.

You cannot eat relative performance. Measure results on a total return, portfolio basis against your own objectives, not someone else's.

Don't be afraid to take a loss. Mistakes are part of the game. The cost price of a security is a matter of historical insignificance, of interest only to the IRS. Averaging down, which is different from dollar cost averaging, means the first

decision was a mistake. It is a technique used to avoid admitting a mistake or to recover a loss against the odds. When in doubt, get out. The first loss is not only the best but is also usually the smallest.

Watch out for fads. Hula hoops and bowling alleys (among others) didn't last. There are no permanent shortages (or oversupplies). Every trend creates its own countervailing force. Expect the unexpected.

Act. Make decisions. No amount of information can remove all uncertainty. Have confidence in your moves. Better to be approximately right than precisely wrong.

Take the long view. Don't panic under short-term transitory developments. Stick to your plan. Prevent emotion from overtaking reason. Market timing generally doesn't work. Recognize the rhythm of events.

Remember the value of common sense. No system works all of the time. History is a guide, not a template.

This is all you really need to know.

Love, Dad

There are so many things I have learned over the years, but I think the one thing that has helped me the most is that no matter what type of market environment you are in, be who you are, be true to yourself, and be true to your investment process. Focus on your own task at hand, the funds that you manage and don’t dwell on what others do. I started working at MLAM on July 1, 1990. On August 2, 1990, Saddam Hussein invaded Kuwait. From that day, a recession ensued in the US, the market swooned, and we faced a savings and loan (S&L)/banking collapse that was greater than at any time since the Great Depression. I was told to pack my bags, go to California and research all the S&L’s such as HomeFed and GlenFed. By the time I got home, hundreds of S&Ls had failed against the backdrop of over-leverage and non-performing loans. Over the course of the next couple years, 1/3 of all S&Ls went bankrupt. Many banks suffered as well for the same reasons as loans went sour and capital ratios declined at an alarming rate. Many banks were forced to sell to healthier banks with stronger capital positions. It was a disaster year for bank stocks, and thus a disaster year for value investors who committed a great portion of their portfolios to the sector. Up until that year, Basic Value had never had a down year, and low and behold, I showed up as an analyst on the eve of the Fund having its worst year in its recorded history. 1990 was a mini-version of the 2008 subprime mortgage crisis. It was also a period when growth stock investing significantly out-performed value stock investing, which is not too dissimilar from what we have seen in the markets over the last few years.

Coming back to 1990, my boss, Paul Hoffman was beside himself. He cared so deeply about the Basic Value shareholders and took Basic Value’s underperformance very personally. He had never experienced a year like 1990 when he underperformed the broad indices by a fairly healthy margin. From time to time, the MLAM portfolio managers would do panel discussions in front of distribution networks that sold our products to retail investors. It was the end of 1990, and Paul was in a foul mood. All anyone was talking about was the demise of banks and the damage they caused portfolio managers who owned them. Paul was on a panel with a few of our other portfolio managers; one managed a tech fund, one managed a growth fund, one managed a Japan-focused fund, and the last a global growth fund. On these panels, each portfolio manager would open up, talk about their process, what they owned and how they had performed in 1990. Paul went first and spoke of the financial crisis and how that negatively impacted Basic Value’s performance. He talked about Basic Value’s portfolio construction, what we were buying and selling, and his outlook for 1991. When the other portfolio managers started to talk, instead of talking about what they owned, they talked about what they didn’t own. The tech fund portfolio manager began his discussion by stating he didn’t own Citigroup or Nations Bank (as if a tech fund would ever own a bank). The next portfolio manager led by saying, “We don’t own banks and I don’t know why anyone would.” I watched the anger creep into Paul‘s face. It started to feel like a dog pile as each portfolio manager was patting himself on the back for not owning a group of stocks that THEY WOULD NEVER HAVE OWNED IN THE FIRST PLACE given their investment process and the asset classes they were focused on. I saw the steam coming off of Paul’s head, and finally he snapped and screamed, “For the Love of God. Would you shut your mouths and stop talking about things you don’t know and start talking about things you might know something about.” He then stormed off in anger. Perfect mic drop moment, and he was right. We were value investors that owned financials. That's who we were and we talked about what we owned, or didn’t own within our value universe. The fact that certain managers were trying to prop themselves up by talking about a group of stocks that were completely outside of their fund’s charters was irrational and irrelevant. It was so distasteful to listen to. Could you imagine me starting a shareholder letter and stating, “We didn’t own Facebook (Meta Platforms) this quarter and that helped our performance.” What? I learned from Paul, and what was clearly one of his investment commandments, that a portfolio manager should keep the blinders on and focus on your own business and not get involved in others. By the way, 1991 turned out to be one of the best years Basic Value ever had, and trust me, it wasn’t because we sold banks to buy the names that the rest of the portfolio managers were pitching during that panel discussion.

Fast forward to 2000, ten years removed from the Hoffman explosion. Paul had retired and I was given the opportunity to take over for him and add Basic Value to the six or seven other funds I was already managing. It was the dot.com bubble, if you will recall. It was a period where any company that ended with “.com” traded at what seemed like 200x revenue. We were in a new world order where, because of the advent of the internet, investors were speculating on any internet related company.

Multiples and valuations were discussed based on the number of Ph.D.s on staff or eyeballs looking at websites rather than traditional financial metrics like revenue, earnings or EBITDA. The Nasdaq Composite Index was in the midst of a 400% gain over a four-year period. It was tech, tech, tech at the expense of everything else. With Arthur retired, MLAM, known for being a value shop, set out to create its own growth/tech funds because at the time that was the flavor of the month, and we didn't have many applicable product offerings. We recruited several expensive portfolio managers from other firms and launched a series of internet and growth funds (yes, at the peak of the market). Have you ever met the “Masters of the Universe”? We were hiring them left and right. Pick any tech investor in January 2000 and you would be assured of being in the company of greatness. I remember walking into one of the “new geniuses” in the hallway and he was carrying 10 or so shirts that had been dry cleaned (our office was connected to a hotel). I attempted to make small talk, and, in the conversation, he alerted me to the fact that one of the conditions of his hire was housing in the hotel and free dry cleaning. What? I wanted to vomit. How does the topic of who pays for dry cleaning come up in an interview? I know you are going to pay me millions of dollars, but if you don't pay for my dry cleaning, it's a no go! Whatever. By the way, he lived an hour from the office. I lived an hour and 10 minutes away. He couldn’t drive home every night like I did? We were fast becoming a department of haves and have-nots and I was part of the latter group. These were the new sheriffs in town. The gold miners. Us “value” investors were old-school relic dinosaurs. Warren Buffett was a has been, and Julian Robertson, a sensible value investor, closed his fund in March 2000 due to redemptions. In his letter to investors that can be found at https://money.cnn.com/2000/03/30/mutualfunds/q_funds_tiger/sidebar.htm, Robertson spoke about the plunging prices of so-called "old economy" value stocks. While volatile technology stocks have soared, out-of-favor value stocks had been trading at bargain prices. “The result of the demise of value investing and investor withdrawals has been financial erosion, stressful to us all," Robertson wrote. “And there is no real indication that a quick end is in sight.”

We weren't immune to the redemptions either as I had to deal with $1 billion of redemptions in the first quarter of 2000. Each and every day I came to work, I needed to sell $15 million stocks to meet those redemptions. While at the same time, MLAM was launching a super charged growth fund and raised $1 billion overnight. It was an incredibly painful period for me as I attempted to justify to shareholders why our fund should continue to exist when tech/growth funds were rocketing to the moon. Thinking about working with people who demanded dry cleaning from their new employer made me angry. I literally had my boxes packed, as I was ready to get fired any day. Arthur was no longer around to provide his outstanding leadership and guidance. It was just a frustrating period for the “old guard.” We had our own versions of portfolio manager panels that Hoffman attended back in 1990, except for me, it was a portfolio manager lunch hosted by the new President of MLIM (we changed our name to Merrill Lynch Investment Mangers). We had all the new hot shots and a few of the old guard (hard to believe at 34 years old I was the old guard) at the lunch. It was a chance for the new President to get the team together and provide their views of their funds and the market. It was the worst lunch of my life. The dry-cleaning guy started off not talking about any of his momentum growth stocks but how the old economy was dead and buried. He said the internet would change how people work and expected a stay-at-home economy (he was sort of right 20 years too early and for the wrong reasons). Against that backdrop, he pitched Gillette (I owned it) as a short because we would all be at home, and nobody would shave. He ran a long only fund and couldn't short, so what was the point of his comments? Me saying to myself, “Serenity now, serenity now. Pass the butter please.” The next guy was our tech manager, who instead of pitching a bunch of dotcoms (that would eventually collapse), he started talking about why Caterpillar Tractor (as it was known at the time) was a screaming short because there would be no new construction of anything in the stay-at-home economy. Like the last portfolio manager, he also ran a long only fund and shorting Caterpillar was not something he could do. Caterpillar was a significant holding for Basic Value, and as I felt my blood boiling, I channeled my inner Paul Hoffman and went off, “I CAN'T TAKE IT ANYMORE. Shut up and start talking about what you own and not opining on my portfolio. What does Gillette and Caterpillar have to do with your Fund! You guys can't even short stocks in your fund so what’s the @#)(*#$)_@* point. Seriously, shut up!” In case it's not obvious, that was a very frustrating time for us value guys.

As a side note, the fund that was launched with a $10 net asset value per share (“NAV”) and $1 billion in assets, had a $1 NAV and $100 million assets a year later. Nice work guys. MLIM morphed itself into something it wasn't at the exact wrong time of the growth/tech craze; and as a result, hurt a lot of shareholders of those new funds along the way. We pretty much violated each and every one of Arthur’s points in his letter to his daughter. Most or all of all the hot shots brought in to “save” our company with their souped-up growth and tech funds weren't employed by us two years later. It was an institutional failure of our organization and shareholders suffered as a result. The good news for MLIM at least was we saved money on our income statement for no longer providing dry cleaning for the “superstars”!

The point of all of this for 180 is we love what we are doing and know who we are. We are laser focused on small cap/micro-cap activism with a Graham and Dodd value approach. Being true to yourself and your process is the number one lesson I have learned through my 30+ year career in investing. I know the FAANG stocks and growth stocks in general have outperformed value for years, and if investors have made money over the years by investing in those asset classes, good for them. I don't feel a need to pontificate on strategies unrelated to what we are trying to accomplish for our shareholders. We are confident that we will be able to provide above average returns over a market cycle, and we hope the last five years of 180 provides a strong indication that our investment process can be successful. That doesn’t mean that we will outperform every quarter, or for that matter every year. It also doesn’t mean that our way of investing is the only method that provides shareholders with an opportunity to outperform and create wealth. I do think that over our five years as a company we have demonstrated that the strategy we set forth when we began has served our shareholders quite well. I don’t think we should be the only fund in our

shareholders’ portfolios, but I do think we can be a very valuable piece because we provide low correlation to the rest of the market and have the ability to provide asymmetric returns.

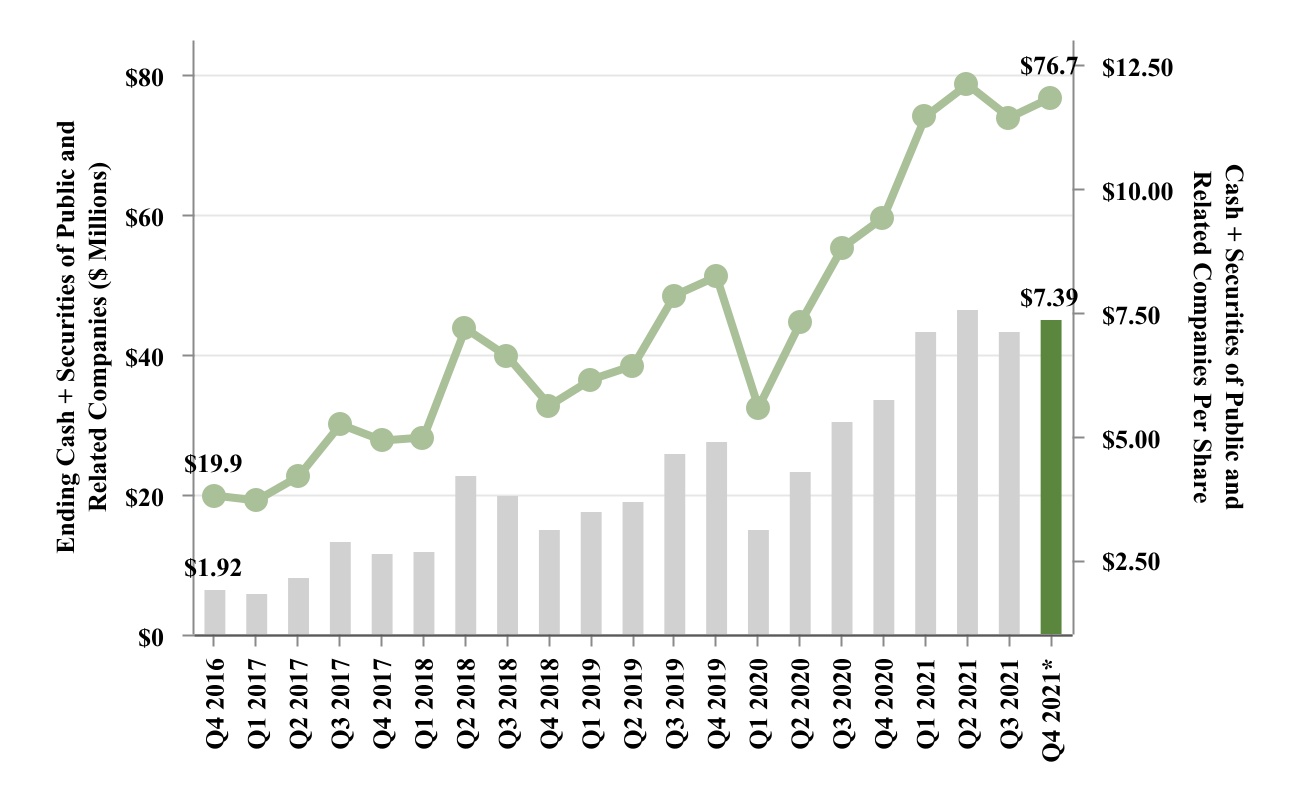

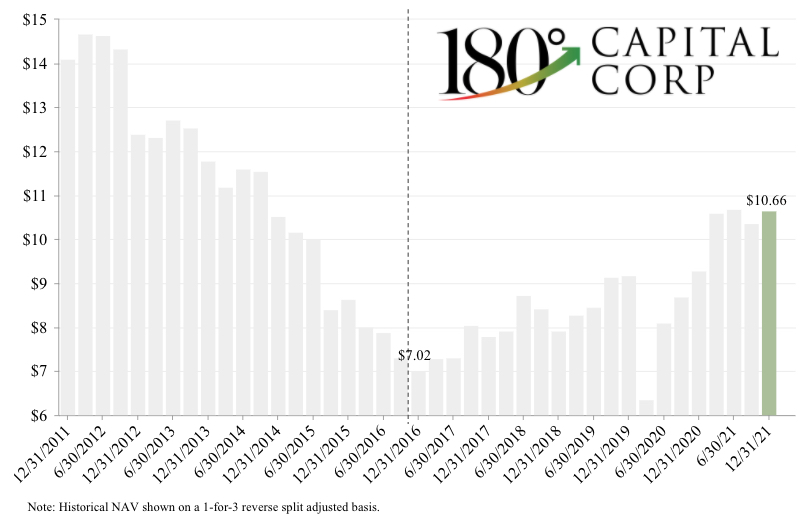

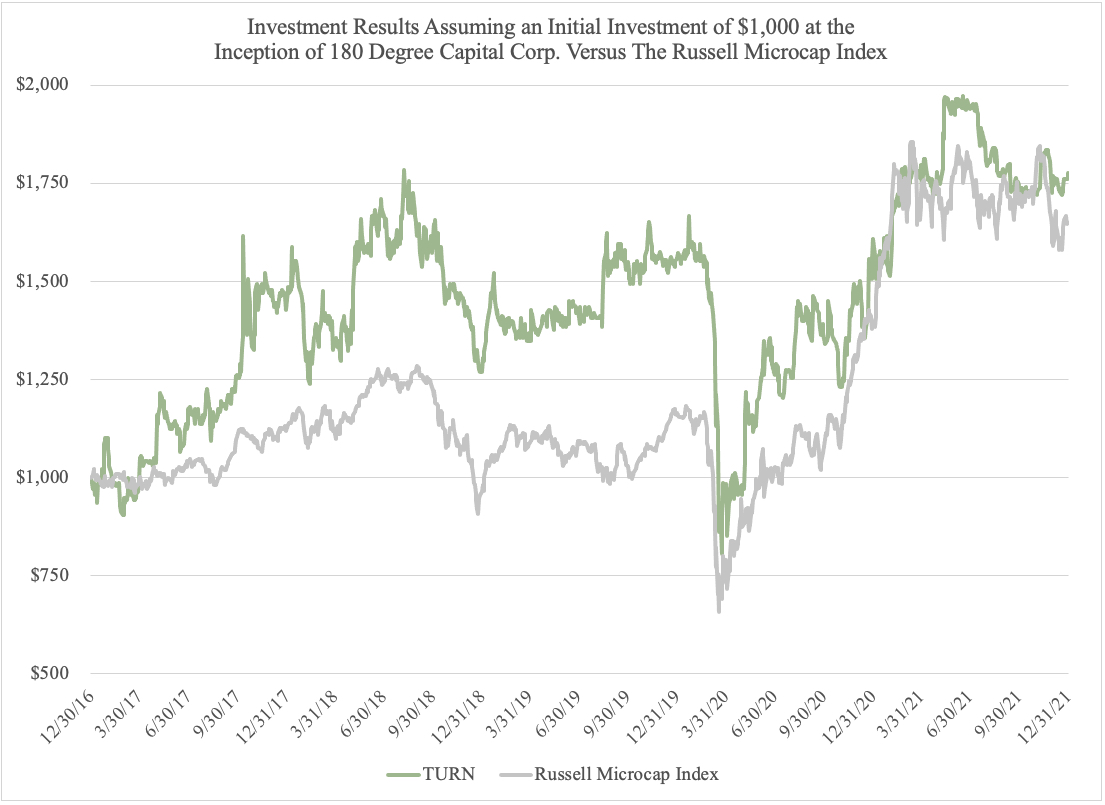

We had a nice quarter, and an even better year. For the quarter we grew our NAV 2.8% to $10.66 and our cash and securities of public and related companies represented $76.7 million, or $7.39 per share. In Q4 2021 we generated a +6.1% gross total return while the Russell Microcap Index declined, -2.7%. This quarter wasn’t without its challenges as our outperformance from our public assets was offset with a $1.6 million or $0.15 per share reduction in net assets and NAV respectively in our legacy private assets. For the year, we grew our NAV by +14.9% against the backdrop of a +34.7% (or +38.2% including carried interest from our separately managed account (“SMA”)) gross total return for our public market and related assets. The +34.7% gross total return in 2021 compares quite favorably to the +19.3% total return for the Russell Microcap Index. With 180 now completing our fifth full year of performance for our public market investing strategy, we are proud to report we achieved a +373.6% gross total return (or +405.5% including carried interest from our SMA) versus +73.8% total return for the Russell Microcap Index.

As we mentioned during the year, 180 was pursuing SPAC sponsorship opportunities with who we believe are value added partners or management teams and have demonstrated a core competency in sourcing merger candidates. The first of these efforts is Parabellum Acquisition Corp. (PRBM). We are thrilled the company had a successful IPO this past year, raising $143.75 million. 180 was the lead investor in the sponsor and Daniel Wolfe serves on PRBM’s Board of Directors on behalf of 180. We are excited to be working on this effort with the founders of PRBM, Narbeh Derhacobian and Ron Shelton, the former CEO and CFO of Adesto Technologies Corp. With the IPO behind us, PRBM is now on the hunt for target companies. 180’s holdings of PRBM are currently owned through the sponsor, Parabellum Acquisition Holdings, LLC. The fair value of our holdings of PRBM as of the end of Q4 2021 was approximately $6.7 million on a cost basis of approximately $2.7 million. In addition to PRBM, we continue to work with another partner in connection with exploring a SPAC sponsor group investment opportunity, although we cannot assure you when or if such investment will ultimately be consummated. We look forward to being able to discuss these continuing efforts in more detail in the future.

I think it's fair to say that I have tried to provide as much transparency as possible around our private holdings and relayed that we were becoming increasingly bullish on our ability to monetize some of them. It definitely has pained me at times that we were not at liberty to freely talk more specifically about which companies were exploring such opportunities. That said, we have been able to make two significant announcements subsequent to the end of 2021 from Petra Pharma Corporation (potential for a significant milestone payment from its acquisition by Eli Lilly and Company) and D-Wave Systems, Inc. (potential public listing through a merger with a SPAC, DPCM Capital, Inc. (XPOA)). If both come to fruition, we have the opportunity to convert a significant part of our private portfolio into cash in 2022.

Net Asset Value Per Share

Our NAV increased this quarter from $10.37 to $10.66, an increase of 2.8%. TURN has three principal components to the variance in our NAV: our public portfolio, our private portfolio, and our expenses. For the quarter, our public portfolio including carried interest generated from our SMA caused our NAV to increase by $0.64 per share, while our private portfolio companies decreased our NAV by $0.15. Operating expenses, ongoing expenses and the year-end bonus pool decreased NAV by $0.20.

| | | | | | | | | | | | | | | |

| Quarter | | 1 Year | 3 Year | Inception to Date

(5 Year) |

| Q4 2021 | | Q4 2020-

Q4 2021 | Q4 2018-

Q4 2021 | Q4 2016-Q4 2021 |

| | | | | |

| | | | | |

| | | | | |

| Change in NAV | 2.8% | | 14.9% | 34.6% | 51.9% |

| | | | | |

| Russell Microcap Index | (2.7%) | | 19.3% | 76.6% | 73.8% |

| Russell Microcap Value Index | 0.9% | | 33.6% | 74.9% | 72.0% |

| Russell 2000 | 2.1% | | 14.8% | 72.7% | 76.2% |

| | | | | |

| | | | | |

| | | | | |

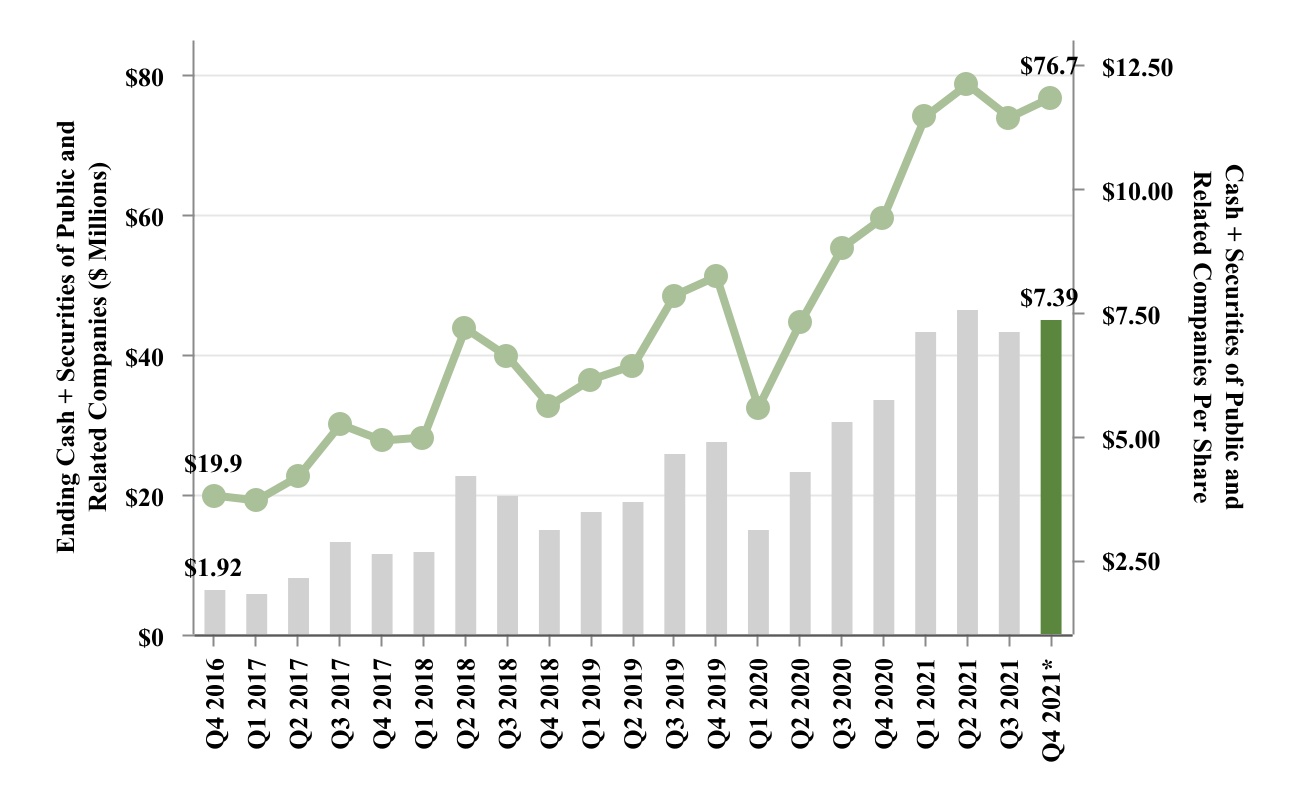

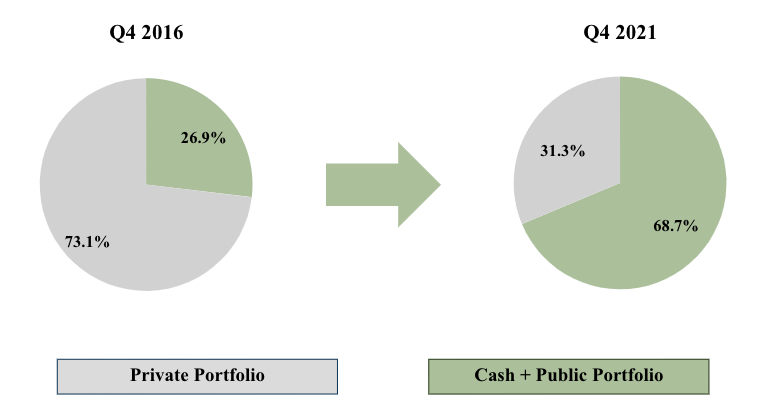

As I said above, we were able to grow our cash plus securities of public and related companies to $76.7 million and you can see the progress we have made in our five-year history to remake our business towards the ultimate goal of having 100% of our balance sheet in cash plus securities of public and related companies.

* Q4 2021 includes carried interest and net of cash to be paid for 2021 bonuses and 2019 and 2020 deferred bonuses.

And relative to our NAV, as you can see from the following chart before and after the beginning of 180, we have made considerable strides in growing our NAV.

On a relative basis, our stock price total return of +77.5% has also exceeded the Russell Microcap Index total return of +73.8% since our inception as is shown in the chart below:

Public Portfolio

In the chart below, you see our quarter-to-date, one-year, three-year, and now 5-year (since inception) gross total return performance from our public investment strategy. For Q4 2021, we showed a gross total return for our public portfolio of +6.1% (+9.0% including carried interest), versus a gross total return for the Russell Microcap Index of -2.7% and a gross total return for the Russell Microcap Value Index of +0.9%. For all of 2021, our +34.7% gross total return (+38.2% including carried interest) compares favorably to +19.3% total return for the Russell Microcap and +33.6% total return for the Russell Microcap Value Index. Since we have started, we have generated a +373.6 gross total return (+405.5% including carried interest) for our public assets versus the +73.8% total return for the Russell Microcap Index.1

| | | | | | | | | | | | | | | |

| Quarter | | 1 Year | 3 Year | Inception to Date

(5 Year) |

| Q4 2021 | | Q4 2020-

Q4 2021 | Q4 2018-

Q4 2021 | Q4 2016-Q4 2021 |

TURN Public Portfolio

Gross Total Return (Excluding SMA Carried Interest) | 6.1% | | 34.7% | 160.9% | 373.6% |

TURN Public Portfolio

Gross Total Return (Including SMA Carried Interest) | 9.0% | | 38.2% | 178.5% | 405.5% |

| | | | | |

| | | | | |

| | | | | |

| Russell Microcap Index | (2.7%) | | 19.3% | 76.6% | 73.8% |

| Russell Microcap Value Index | 0.9% | | 33.6% | 74.9% | 72.0% |

| Russell 2000 | 2.1% | | 14.8% | 72.7% | 76.2% |

| | | | | |

| | | | | |

| | | | | |

1 Past performance shown in the tables above and throughout this letter is not an indication or guarantee of future performance. Amounts gross unrealized and realized total returns compounded on a quarterly basis. 180 is an internally managed registered closed end fund and does not have an external manager that is paid fees based on assets and/or returns. 180 also has a material portion of its investment portfolio in legacy privately held investments. Please see 180's filings with the SEC, including its 2021 Annual Report filed on Form N-CSR for information on its expenses and expense ratios.

Let’s dig into the significant sources of the changes in value in our public portfolio in Q4 2021.

Sources of material increases in value:

•Synalloy Corporation (SYNL) – SYNL stock increased from $10.99 to $16.43 per share as the company reported blow-out Q3 2021 results that were above expectations for revenues, margins, and net earnings. The new management team, led by Chairman Ben Rosenzweig and CEO Chris Hutter have been exceptional in their efforts to turnaround the business inherited from the former inept management team. The company completed a rights offering at $12.75 raising $10 million. 180 purchased 50,168 shares in the rights offering, which included oversubscribing beyond our pro rata share of the offering. SYNL increased our NAV by $2.0 million, or +$0.19 per share.

•TheMaven, Inc. (MVEN) - In August 2021, MVEN regained compliance with SEC reporting requirements by filing its financial statements through Q2 2021. The volume weighted average price per share to reach 1% of outstanding tradable stock (VWAP) increased from $0.5550 to $0.6477 during the quarter. The company provided business updates that included showing better than expected 2021 revenue of $180 million and a less than expected negative impact to TheStreet.com's subscription business following the departure of Jim Cramer. MVEN increased our NAV by $1.5 million, or +$0.14 per share. We note that in February 2022, TheMaven changed its name to The Arena Group and now trades on the NYSE American exchange under the symbol AREN.

•Everspin Technologies, Inc. (MRAM) – MRAM announced much better than expected results for Q3 2021 including an IP license deal that added $5.3 million in cash to the balance sheet. The stock increased from $6.58 to a high of over $13.00. We sold our entire position in the quarter at an average price of $10.67 per share generating a $1.8 million, or approximately 59%, gain over the 10 months we owned the stock. For the quarter MRAM increased our NAV by $1.4 million, or +$0.13 per share.

•Lantronix, Inc. (LTRX) – LTRX reported strong results for Q3 2021 and provided better than expected guidance. The stock increased 34.5% in the quarter to $7.83. In the quarter, 180 sold 208,478 shares at an average price of $8.02 and then purchased 121,336 shares at an average price of $7.39. LTRX increased our NAV by $0.9 million, or +$0.09 per share.

Sources of material decrease in value:

•Potbelly Corporation (PBPB) – In Q4 2021, PBPB stock price declined 17.7% to $5.58. While the company announced Q3 2021 results that showed continued improvement in the business, the onset of the Omicron variant caused investors to worry about the impact it would have on PBPB business. 180 purchased 239,589 shares at an average price of $5.84, We believe this business under the leadership of Robert Wright and Steve Cirulis will show meaningful improvement over the ensuing years and deliver double-digit EBITDA margins. PBPB decreased our NAV by $1.6 million, or -$0.15 per share.

•comScore, Inc. (SCOR) – SCOR declined 14.4% to $3.34 during the quarter. While the company delivered better than expected results in Q3 2021, including revenues, EBITDA margins, and net income, the company continues to struggle to convince investors that it is on a sustained growth trajectory and can begin to generate meaningful positive cash flows. In our view, the catalyst for change will come from SCOR’s new CFO, Jon Carpenter, who came from Nielsen and Publishers Clearinghouse and has real operating experience. We believe he will simplify the SCOR story, change the reporting lines of the business which should highlight its digital revenues, and ensure the company will invest its assets in higher return revenue and margin opportunities. We purchased 505,731 shares of SCOR at an average price of $3.52, and it is now a 7.9% position. SCOR caused our NAV to decline $0.7 million, or -$0.07 per share.

We publicly announced one new position in the quarter: RF Industries, Ltd. (RFIL)

We closed out of two of our publicly announced positions in the quarter: Everspin Technologies, Inc. (MRAM) and Zymergen, Inc. (ZY; shares received from the sale of our legacy private company, Lodo Therapeutics Corporation)

Private Portfolio

For the quarter, our private portfolio decreased in value by $1.6 million, or -$0.15 per share. The largest decreases in value occurred in Nanosys, Inc., Seaport Diagnostics, Inc., and EchoPixel, Inc. In almost every shareholder letter, we state that while we desire to shepherd our existing private portfolio to exits or explore opportunities to sell our positions in those companies, we have the luxury of being able to sell our private holdings when we believe it makes sense for shareholders, rather than being forced to do so to survive. As stated above, we are pleased to report two events that we believe increase the likelihood we have

the opportunity to realize a cash payment from our rights to milestone payments from the acquisition of Petra Pharma Corporation by Eli Lilly and Company, and to monetize our position in D-Wave Systems, Inc.

In a presentation to investors in December 2021, Lilly noted that it expected to start human studies of the mutant-selective PI3Kα inhibitor developed by Petra in the first half of 2022. Although 180 cannot assure our investors when such an event may occur, if at all, such an event would trigger a contractual payment to former Petra shareholders, including 180. The $6.8 million payment, if received, would increase cash per share by $0.66.

D-Wave Systems announced its intent to become a publicly traded company through a merger with DPCM Capital, Inc., (“XPOA”), a special purpose acquisition company (“SPAC”). If the transaction is completed as currently agreed to by each party, 180 would hold approximately 900,000 shares of common stock of the merged company.

According to D-Wave and XPOA, the transaction is expected to enhance D-Wave’s leadership in commercial quantum computing and accelerate quantum use cases into significant customer segments, including manufacturing, logistics, pharmaceuticals, finance, and government. Upon closing of the transaction, shares of D-Wave Quantum Inc., a newly formed parent company of D-Wave and XPOA, are expected to trade on the NYSE under the symbol “QBTS.”

D-Wave and XPOA stated the transaction values D-Wave at an equity value of approximately $1.2 billion USD. The transaction also includes an innovative incentive structure, whereby a bonus pool of 5 million shares will be allocated pro rata to non-redeeming public stockholders of XPOA, effectively reducing their cost basis. A similar bonus pool of up to 1.8 million shares has been established for Private Investment in Public Equity ("PIPE”) investors to ensure the same effective cost basis for PIPE investors as for public stockholders of XPOA.

D-Wave and XPOA further noted that the transaction, which has been unanimously approved by the Board of Directors of D-Wave as well as the Board of Directors of XPOA, is expected to close in the second quarter of 2022, subject to the satisfaction of customary closing conditions, including the approval of the stockholders of XPOA.

EXPENSES

As we have noted in previous letters, we have dramatically reduced our cost structure under our new strategy. In 2016, before our Fund’s change in investment focus and management team, our operating expenses, excluding stock-based compensation and interest on outstanding debt, averaged approximately $1.3 million per quarter. For Q4 2021, our regular operating expenses, excluding severance costs, equaled approximately $750,000. Given our persistent and outsized performance for the full year 2021, the Compensation Committee approved an additional accrual of approximately $1.3 million for the 2021 bonus pool. We will maintain a lean cost structure (outside of fixed expenses for being a public company) focusing our expenses on activities solely designed to enhance our investment performance or to increase our revenues from managing outside capital.

TURN/NAV: SUM OF THE PARTS

As of the end of Q4 2021, TURN traded at 69% of NAV. Our securities of publicly traded and related companies, cash, and other assets net of liabilities and including carried interest from our SMA were $7.28 per share. Our stock price was $7.35. If we received 100% credit for the value of these assets net of liabilities, the market is ascribing a value of approximately $0.07 per share or $726,000, to our private portfolio. Given our private assets are valued at approximately $35.0 million, the market is discounting the value of our private portfolio assets by approximately 98% as of the end of Q4 2021. As a reminder, if achieved, the first milestone payment from the acquisition of Petra to TURN is $6.8 million, or $0.66 per share.

At the end of the day, the private portfolio is becoming less and less important to our success. From the chart below, look at how dramatically different our balance sheet looks today versus almost five years ago.

CONCLUSION

As we kickoff 2022, we believe the small cap market has rarely, if ever, been as attractive as it currently is. While the small cap market underperformed when compared to large cap stocks during 2021, we believe there are multiple reasons for optimism and an improving landscape for investments in small cap equities as 2022 unfolds.

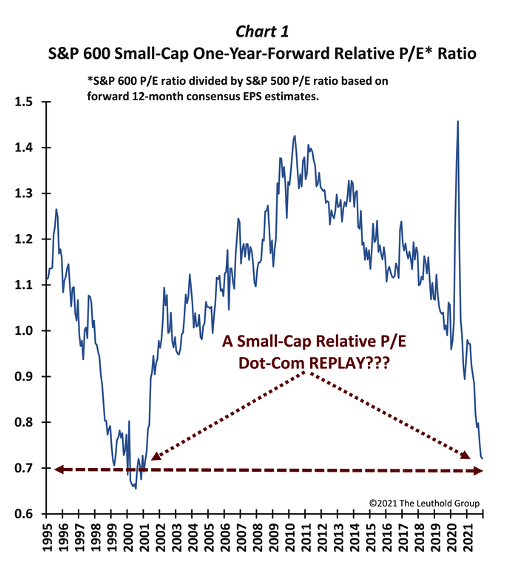

One traditional method of assigning relative value to companies is by comparing their price to earnings multiple (“P/E”). When viewed this way, and seen in the chart below, credited to The Leuthold Group, the relative value of small cap companies to large cap companies is nothing short of remarkable. Specifically, the ratio of P/E multiples for the small cap S&P 600 compared to that of the S&P 500 is at just north of 0.7, a level not seen since 2000 during the dot-com bubble.

A deeper dive into the numbers depicted on the chart above provides additional context. In 2000, the market was in the midst of the dot-com bubble, which burst not long after. Tech stocks at the time were trading at high P/E multiples that had never been seen before. This, of course, translated to an inflated P/E multiple for the S&P 500 as a whole. While small cap stocks were significantly undervalued to the S&P 500 on a relative basis, they weren't necessarily as undervalued in absolute terms.

One further point is that it wasn’t just small cap stocks that were undervalued relative to tech stocks and hence the S&P 500 P/E multiples across every market sector were significantly lower than those for tech stocks during this period. In other words, nearly the entire stock market was mispriced based on P/E multiples – not just the small and micro-cap markets.

This stands in sharp contrast to the current market. Whereas nearly every market was undervalued on a P/E multiple basis in 2000, in the current market, nearly every sector is overvalued compared to the small cap market on a P/E multiple basis.

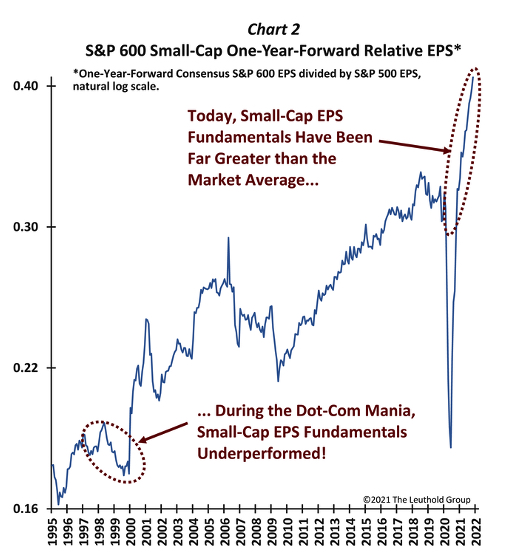

What makes this current opportunity in small caps even more compelling is that it is not just driven by attractive relative P/E multiples. Back in 2000, one argument and justification for lower P/E multiples for small caps was that the forward earnings per share (”EPS”) consensus was lower than that for the S&P 500. In the current market, however, the situation is the exact opposite. Currently, the consensus forward EPS estimates for the S&P 600 are the highest they have been relative to the S&P 500 going back to 1995. The chart below shows this relationship:

So unlike 2000 when small cap stocks traded at depressed P/E multiples due at least in part to underperforming earnings, the current small cap market is trading at these same depressed levels despite superior expected earnings.

180 is bullish on the investment opportunities in our microcap/small cap universe over the coming months, and we are excited to take advantage of what we currently think is indiscriminate selling. The Russell Microcap Index is down 21% in less than three months, which, when analyzed with the date presented above, we believe creates some exciting investment opportunities as we move through 2022.

Now to start the year, investors are fixated on the inflationary and disrupted supply chain environment that is likely to lead to higher interest rates. COVID-19 never seems to go away, and we have the potential for a Russian invasion of Ukraine which is causing concerns for risk assets. Put simply, it is a market filled with fear. The inflationary supply chain issues are real and are providing a serious headwind for the market and the economy. As you know, I love reading about some of the world's best investors. Warren Buffet once said, "Over time people get smarter but not wiser. They don't get emotionally stable. All the conditions for extreme overvaluation or undervaluation absolutely exist, the way they did 50 years ago. You can teach people

all you want, tell them to read Graham's book, you can send them to graduate school, but when they are scared, they really get scared." Well, the markets are presently experiencing extreme volatility and vicious selling. We are living though what appears to be a very “scared” market. While our investment results for the history of 180 have shown great outperformance, we are not immune from the sell-off that has occurred to start the year. We have had a number of large selloffs in our five-year history and yet through it all, our public and related asset gross total return is +373.6%. While it is never fun to live through nasty sell-offs, we need washouts like we are currently experiencing to find the stocks that offer enormous upside. While our Q4 2021 was very good relative to the indices, it is better to judge us on the totality of our long-term results.

With the conclusion of the first five-years of 180, we believe it is time to be more proactive about getting our name in front of potential new investors. We announced in November 2021, that we joined FLX Distribution’s platform toward increasing third-party assets under management. In conjunction with this effort, we have engaged Peaks Strategies to help us expand our public relations efforts. We have also launched a new website and updated our logo. We’re proud of what we have accomplished since 2017, and look forward to more actively getting in front of potential new shareholders and/or clients for management of third-party capital.

We have completely remade our business and created a real business with a real name in the microcap world. When I first joined the Board of Directors in mid-2016, we had just approximately $17 million in cash and securities of public companies net of outstanding debt. As the end of Q4 2021 we have approximately $76.7 million on our balance sheet and grew the net assets for our SMA client from $25 million to $38 million. The market for microcaps is ripe with inefficiencies and asymmetric risk/reward characteristics. If you get your stock picking right, you can achieve outsized returns. Based on our research, we believe some of the individual companies we own have upside of 100% over a three-year cycle. We have permanent capital and the opportunity to take advantage of the current dislocation is easier for us because we don’t have to sell to service redemptions. We are here for the long haul, we are going to make rational objective decisions, and we are going to use our activist approach when the situation calls for it. We look forward to reviewing our subsequent quarters as the year unfolds.

Thank you for your continued support.

Kevin Rendino

Chairman and Chief Executive Officer

Forward-Looking Statements

This shareholder letter may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company's current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this press release. Please see the Company's securities filings filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company's business and other significant factors that could affect the Company's actual results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The reference and link to any websites have been provided as a convenience, and the information contained on such website is not incorporated by reference into this shareholder letter. 180 Degree Capital Corp. is not responsible for the contents of third-party websites.

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES |

| | | | | |

| | December 31, 2021 |

| ASSETS | |

| Investments in securities and other financial instruments, at value: | |

| Unaffiliated publicly traded equity and equity-related securities (cost: $21,354,961) | $ | 29,078,904 | |

| Unaffiliated legacy privately held equity and equity-related securities (cost: $12,886,349) | 21,641,386 | |

| Non-controlled affiliated publicly traded equity and equity-related securities (cost: $31,949,232) | 36,359,588 | |

| Non-controlled affiliated legacy privately held equity and equity-related securities (cost: $11,942,463) | 5,275,293 | |

| Controlled affiliated equity and equity-related securities (cost: $2,830,646) | 6,832,700 | |

| Unaffiliated derivative securities (cost: $149,042) | 54,666 | |

| Non-controlled affiliated derivative securities (cost: $224,849) | 205,313 | |

| Unaffiliated rights to payments (cost: $6,869,436) | 8,012,759 | |

| Cash | 4,157,676 | |

| Receivable from managed funds | 2,319,258 | |

| Receivable from portfolio companies | 891,937 | |

| Receivable from securities sold | 73,159 | |

| Prepaid expenses | 352,665 | |

| Lease-asset | 109,680 | |

| Other receivables | 10,127 | |

| Other assets | 26,856 | |

| Total assets | $ | 115,401,967 | |

| LIABILITIES & NET ASSETS | |

| |

| Bonus payable (Note 7) | $ | 3,306,875 | |

| Post-retirement plan liabilities | 799,890 | |

| Accounts payable and accrued liabilities | 500,576 | |

| Lease obligation | 109,680 | |

| Payable for securities purchased | 74,970 | |

| Severance | 34,024 | |

| Total liabilities | $ | 4,826,015 | |

| Commitments and contingencies (Note 10) | |

| Net assets | $ | 110,575,952 | |

| Net assets are comprised of: | |

| Preferred stock, $0.10 par value, 2,000,000 shares authorized; none issued | $ | 0 | |

| Common stock, $0.03 par value, 15,000,000 shares authorized; 11,541,079 issued* | 334,594 | |

| Additional paid in capital | 118,997,664 | |

| Total accumulated distributable loss | (4,150,781) | |

| Treasury stock, at cost 1,167,259 shares* | (4,605,525) | |

| Net assets | $ | 110,575,952 | |

| Shares outstanding | 10,373,820 | |

| Net asset value per outstanding share | $ | 10.66 | |

*Reflects a 1-for-3 reverse stock split that became effective on January 4, 2021. Refer to Note 1. The Company, for further information.

The accompanying notes are an integral part of these consolidated financial statements.

13

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF OPERATIONS |

| | | | | |

| Year Ended

December 31, 2021 |

| Income: | |

| Carried interest | $ | 2,167,107 | |

| Interest from: | |

| Unaffiliated companies-PIK | 10,363 | |

| Non-controlled affiliated companies-cash | (8,154) | |

| Non-controlled affiliated companies-PIK | 301,431 | |

| Other income | 253,660 | |

| Board fees from portfolio companies-cash | 23,250 | |

| Board fees from portfolio companies-non-cash | 31,449 | |

| Management fee income | 6,083 | |

| Dividend income | 5,977 | |

| Total income | 2,791,166 | |

| Operating fees and expenses: | |

| Salaries, bonus and benefits | 4,621,152 | |

| Professional | 653,492 | |

| Insurance | 309,923 | |

| Directors | 285,000 | |

| Administration and operations | 275,662 | |

| Severance | 65,493 | |

| Custody | 31,032 | |

| Rent | 27,233 | |

| Other | 7,535 | |

| Total operating expenses | 6,276,522 | |

| Net investment loss before income tax expense | (3,485,356) | |

| Income tax expense | 1,272 | |

| Net investment loss | (3,486,628) | |

| Net realized gain (loss) from investments: | |

| Unaffiliated publicly traded equity and equity-related securities | 10,257,981 | |

| Unaffiliated legacy privately held equity and equity-related securities | (894,294) | |

| Non-controlled affiliated publicly traded equity and equity-related securities | 1,012,087 | |

| Non-controlled affiliated legacy privately held equity and equity-related securities | (8,447,220) | |

| Net realized gain from investments | 1,928,554 | |

| Realized gain from funds held in escrow | 163,043 | |

| Net realized gain | 2,091,597 | |

| Change in unrealized appreciation (depreciation) on investments: | |

| Unaffiliated publicly traded equity and equity-related securities | 270,245 | |

| Unaffiliated legacy privately held equity and equity-related securities | 2,659,811 | |

| Non-controlled affiliated publicly traded equity and equity-related securities | 4,598,704 | |

| Non-controlled affiliated legacy privately held equity and equity-related securities | 4,291,042 | |

| Controlled affiliated equity and equity-related securities | 4,002,054 | |

| Unaffiliated rights to payments | (168,667) | |

| Net change in unrealized appreciation on investments | 15,653,189 | |

| Net realized gain from investments and change in unrealized appreciation on investments | 17,744,786 | |

| Net increase in net assets resulting from operations | $ | 14,258,158 | |

The accompanying notes are an integral part of these consolidated financial statements.

14

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF CASH FLOWS |

| | | | | |

| Year Ended

December 31, 2021 |

| Cash flows used in operating activities: | |

| Net increase in net assets resulting from operations | $ | 14,258,158 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: |

| Net realized gain from investments | (2,091,597) | |

| Net change in unrealized appreciation on investments | (15,653,189) | |

| Depreciation of fixed assets | 7,532 | |

| Accretion of bridge note PIK interest income | (311,794) | |

| Board fees from portfolio companies-non-cash | (31,449) | |

| Purchase of unaffiliated publicly traded equity and equity-related securities | (26,608,470) | |

| Purchase of non-controlled affiliated publicly traded equity and equity-related securities | (19,680,825) | |

| Purchase of controlled affiliated equity and equity-related securities | (2,830,646) | |

| Proceeds from sale of unaffiliated publicly traded equity and equity-related securities | 36,559,597 | |

| Proceeds from sale of non-controlled affiliated publicly traded and equity-related securities | 5,833,019 | |

| Proceeds from sale of non-controlled affiliated legacy privately held equity and equity-related securities | 970,788 | |

| Proceeds from funds held in escrow from sales of investments | 323,683 | |

| Changes in assets and liabilities: | |

| Increase in receivable from sales of securities | (73,159) | |

| Decrease in receivable from managed funds | 319,122 | |

| Increase in receivable from portfolio securities | (96,944) | |

| Increase in prepaid expenses | (26,720) | |

| Decrease in interest receivable | 8,154 | |

| Increase in other receivables | (908) | |

| Decrease in other assets | 3,843 | |

| Increase in bonus payable | 1,948,953 | |

| Decrease in post-retirement plan liabilities | (42,476) | |

| Decrease in payable for securities purchased | (144,175) | |

| Decrease in accounts payable and accrued liabilities | (15,539) | |

| Increase in accrued severance | 34,024 | |

| Net cash used in operating activities | (7,341,018) | |

| Cash flows from investing activities: | |

| Purchase of fixed assets | (10,391) | |

| Net cash used in investing activities | (10,391) | |

| Net decrease in cash and restricted cash | (7,351,409) | |

| Cash and restricted cash at beginning of the year | 11,509,085 | |

| Cash at end of the year | $ | 4,157,676 | |

| Supplemental disclosures of cash flow information: | |

| Income taxes paid | $ | 1,272 | |

| |

The accompanying notes are an integral part of these consolidated financial statements.

15

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | | | | | | | |

| Year Ended

December 31, 2021 | | Year Ended December 31, 2020 |

| | | |

| Changes in net assets from operations: | | | |

| Net investment loss | $ | (3,486,628) | | | $ | (510,224) | |

| Net realized gain (loss) on investments | 2,091,597 | | | (1,071,992) | |

| Net change in unrealized appreciation on investments | 15,653,189 | | | 2,709,272 | |

| Share of loss on equity method investment | 0 | | | (22,901) | |

| Net increase in net assets resulting from operations | 14,258,158 | | | 1,104,155 | |

| Net increase in net assets | 14,258,158 | | | 1,104,155 | |

| Net Assets: | | | |

| Beginning of the year | 96,317,794 | | | 95,213,639 | |

| End of the year | $ | 110,575,952 | | | $ | 96,317,794 | |

| | | |

The accompanying notes are an integral part of these consolidated financial statements.

16

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED FINANCIAL HIGHLIGHTS |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended

Dec. 31, 2021 | | Year Ended Dec. 31 2020# | | Year Ended

Dec. 31, 2019# | | Year Ended

Dec. 31, 2018# | | Year Ended

Dec. 31, 2017# |

| | | | | | | | | |

| Per Share Operating Performance: | | | | | | | | | |

| Net asset value per share, beginning of the year | $ | 9.28 | | | $ | 9.18 | | | $ | 7.92 | | | $ | 7.80 | | | $ | 7.02 | |

Net investment loss* | (0.33) | | | (0.05) | | | (0.48) | | | (0.21) | | | (0.36) | |

Net realized gain (loss) from investments* | 0.20 | | | (0.11) | | | 0.93 | | | (0.75) | | | (1.14) | |

Net change in unrealized appreciation (depreciation) on investments and options*1 | 1.51 | | | 0.26 | | | 0.81 | | | 1.08 | | | 2.40 | |

Share of loss on equity method investment*2 | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | |

| Total* | 1.38 | | | 0.10 | | | 1.26 | | | 0.12 | | | 0.90 | |

Net (decrease) increase as a result of stock-based compensation expense*2 | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | (0.03) | |

Net decrease as a result of acquisition of vested restricted stock awards related to employee withholding2 | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | (0.06) | |

| Total (decrease) increase from capital stock transactions | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | (0.09) | |

Net (decrease) increase as a result of other comprehensive (loss) income*2 | 0.00 | | | 0.00 | | | 0.00 | | | 0.00 | | | (0.03) | |

| Net increase (decrease) in net asset value | 1.38 | | | 0.10 | | | 1.26 | | | 0.12 | | | 0.78 | |

| Net asset value per share, end of the year | $ | 10.66 | | | $ | 9.28 | | | $ | 9.18 | | | $ | 7.92 | | | $ | 7.80 | |

| | | | | | | | | |

| Stock price per share, end of the year | $ | 7.35 | | | $ | 6.66 | | | $ | 6.45 | | | $ | 5.25 | | | $ | 5.91 | |

| Total return based on stock price | 10.36 | % | | 3.26 | % | | 22.86 | % | | (11.17) | % | | 42.75 | % |

| Supplemental Data: | | | | | | | | | |

| Net assets, end of the year | $ | 110,575,952 | | | $ | 96,317,794 | | | $ | 95,213,639 | | | $ | 82,034,768 | | | $ | 81,042,989 | |

| Ratio of expenses, excluding taxes, to average net assets | 5.86 | % | ^ | 4.61 | % | ^ | 6.42 | % | ^ | 3.62 | % | ^ | 6.26 | % |

| Ratio of expenses, including taxes, to average net assets | 5.87 | % | ^ | 4.61 | % | ^ | 6.42 | % | ^ | 3.63 | % | ^ | 6.28 | % |

| Ratio of net investment loss to average net assets | (3.26) | % | | (0.59) | % | | (5.42) | % | | (2.82) | % | | (4.68) | % |

| Portfolio turnover | 44.46 | % | | 35.16 | % | | 30.17 | % | | 20.43 | % | | 8.83 | % |

| Number of shares outstanding, end of the year | 10,373,820 | | | 10,373,820 | | | 10,373,820 | | | 10,373,820 | | | 10,373,820 | |

# Reflect a 1-for-3 reverse stock split that became effective on January 4, 2021. Refer to Note 1. The Company, for further information.

* Based on average shares outstanding.

^ The Company has entered into an expense offsetting arrangement with one of its unaffiliated brokers relating to broker fees paid. The total broker fee charged to the Company was applied as a credit to fees charged by an affiliate of the unaffiliated broker who the Company subscribes to for data services billed during the year. The Company received an offset to expense totaling approximately $31,900, $15,700, $17,500 and $5,700 with that broker for the years ended December 31, 2020, December 31, 2019, December 31, 2018 and December 31, 2017, respectively. The Company received an offset to expense totaling approximately $84,800 with that broker for the year ended December 31, 2021.

1 Net unrealized losses include rounding adjustments to reconcile change in net asset value per share.

2 Amounts listed as zero are amounts calculated as less than $0.005.

3 Ratio of expenses, including taxes and excluding expenses related to restructuring, to quarterly average net assets for the year ended December 31, 2017 was 5.19%.

The accompanying notes are an integral part of these consolidated financial statements.

17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2021 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 45.9% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Publicly Traded Equity and Equity-Related Securities - | | | | | | | | | |

| 26.3% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Alta Equipment Group, Inc. (3) | | | Trading Companies & Distributors | | | | | | |

| Operates as an industrial and construction equipment company | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 433,321 | | $ | 3,332,135 | | | $ | 6,343,819 | |

| | | | | | | | | |

| comScore, Inc. (3) | | | Advertising | | | | | | |

| Provides technology and services that measure audiences, brands and consumer behavior | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 1,562,156 | | 5,417,532 | | | 5,217,601 | |

| | | | | | | | | |

| Enzo Biochem, Inc. (3) | | | Health Care Services | | | | | | |

| Develops health care products and provides diagnostic services | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 241,182 | | 726,727 | | | 774,194 | |

| | | | | | | | | |

| Lantronix, Inc. (3) | | | Communications Equipment | | | | | | |

| Provides secure data access and management solutions | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 331,101 | | 1,752,737 | | | 2,592,521 | |

| | | | | | | | | |

| PFSweb, Inc. (3) | | | IT Consulting & Other Services | | | | | | |

| Provides management services for ecommerce | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 162,016 | | 1,198,424 | | | 2,086,766 | |

| | | | | | | | | |

| Quantum Corporation (3) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Provides high-density data storage and high-speed data processing solutions | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 1,532,053 | | 5,376,566 | | | 8,456,933 | |

| | | | | | | | | |

| RF Industries, Ltd. (3) | | | Electronic Manufacturing Services | | | | | | |

| Provides products that enable wired and wireless communications | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 213,480 | | 1,509,057 | | | 1,707,840 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

18

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2021 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 45.9% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Publicly Traded Equity and Equity-Related Securities - | | | | | | | | | |

| 26.3% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Miscellaneous Common Stocks (4) | (M) (L1) | | | | | | $ | 2,041,783 | | | $ | 1,899,230 | |

| | | | | | | | | |

| Total Unaffiliated Publicly Traded Equity and Equity-Related Securities (cost: $21,354,961) | | | | | | | | | $ | 29,078,904 | |

| | | | | | | | | |

| Legacy Privately Held Equity and Equity-Related Securities - | | | | | | | | | |

| 19.6% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| AgBiome, LLC (3)(5) | | | Fertilizers & Agricultural Chemicals | | | | | | |

| Develops agricultural products that reduce risk and improve yield | | | | | | | | | |

| Series A-1 Convertible Preferred Units (acquired 1/30/13) | (H) (L3) | | | | 2,000,000 | | $ | 2,000,000 | | | $ | 9,615,057 | |

| Series A-2 Convertible Preferred Units (acquired 4/9/13-10/15/13) | (H) (L3) | | | | 417,392 | | 521,740 | | | 2,007,843 | |

| Series B Convertible Preferred Units (acquired 8/7/15) | (H) (L3) | | | | 160,526 | | 500,006 | | | 784,916 | |

| | | | | | | 3,021,746 | | | 12,407,816 | |

| | | | | | | | | |

| AutoTech Ventures Management I, LLC (3)(5)(6) | | | Asset Management & Custody Banks | | | | | | |

| Venture capital investing in automotive-related companies | | | | | | | | | |

| LLC Interests (acquired 12/1/17) | (M) (L3) | | | | 0 | | 0 | | | 225,000 | |

| | | | | | | | | |

| D-Wave Systems, Inc. (3)(5)(7)(8) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Develops high-performance quantum computing systems | | | | | | | | | |

| Class A Convertible Preferred Stock (acquired 4/14/20) | (M) (L3) | | | | 1,025,045.6 | | 1,238,050 | | | 5,731,450 | |

| | | | | | | | | |

| Fleet Health Alliance, LLC (3)(5)(8) | | | Health Care Technology | | | | | | |

| Develops software for information transfer amongst healthcare providers and consumers | | | | | | | | | |

| Unsecured Convertible Bridge Note, 0%, (acquired 4/22/16, no maturity date) | (I) (L3) | | | | $ | 225,000 | | | 225,000 | | | 0 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

19

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2021 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 45.9% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Legacy Privately Held Equity and Equity-Related Securities - | | | | | | | | | |

| 19.6% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Magnolia Neurosciences Corporation (3)(5)(8) | | | Pharmaceuticals | | | | | | |

| Develops novel therapeutics for treatment of neurodegeneration | | | | | | | | | |

| Series A Convertible Preferred Stock (acquired 8/3/18) | (I) (L3) | | | | 862,872 | | $ | 862,872 | | | $ | 547,474 | |

| | | | | | | | | |

| Nanosys, Inc. (3)(5)(8)(9) | | | Specialty Chemicals | | | | | | |

| Develops inorganic nanowires and quantum dots for use in LED-backlit devices | | | | | | | | | |

| Series A-1 Convertible Preferred Stock (acquired 5/22/21) | (M) (L3) | | | | 496,572 | | 496,573 | | | 410,044 | |

| Series A-2 Convertible Preferred Stock (acquired 5/22/21) | (M) (L3) | | | | 2,232,001 | | 4,500,003 | | | 1,624,177 | |

| | | | | | | 4,996,576 | | | 2,034,221 | |

| | | | | | | | | |

| Phylagen, Inc. (3)(5)(8) | | | Research & Consulting Services | | | | | | |

| Develops technology to improve human health and business productivity | | | | | | | | | |

| Series A Convertible Preferred Stock (acquired 11/14/18) | (M) (L3) | | | | 548,031 | | 233,845 | | | 679,011 | |

| | | | | | | | | |

| Ravenna Pharmaceuticals, Inc. (3)(5)(8)(10)(11) | | | Pharmaceuticals | | | | | | |

| Holding company for intellectual property in oncology therapeutics | | | | | | | | | |

| Common Stock (acquired 5/14/20-8/26/21) | (M) (L3) | | | | 2,785,274 | | 108,258 | | | 16,414 | |

| | | | | | | | | |

| Seaport Diagnostics, Inc. (3)(5)(8)(11)(12) | | | Health Care Technology | | | | | | |

| Develops consumer focused genetic tests | | | | | | | | | |

| Series 1 Convertible Preferred Stock (acquired 2/5/15-8/5/15) | (I) (L3) | | | | 1,195,315 | | 500,000 | | | 0 | |

| Series A Convertible Preferred Stock (acquired 11/25/15-9/7/16) | (I) (L3) | | | | 1,364,666 | | 1,500,000 | | | 0 | |

| Series A-2 Convertible Preferred Stock (acquired 5/11/17-2/8/18) | (I) (L3) | | | | 176,386 | | 200,002 | | | 0 | |

| | | | | | | 2,200,002 | | | 0 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

20

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2021 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Unaffiliated Legacy Privately Held Equity and Equity-Related Securities (cost: $12,886,349) | | | | | | | | | $ | 21,641,386 | |

| | | | | | | | | |

| Total Investments in Unaffiliated Equity and Equity-Related Securities (cost: $34,241,310) | | | | | | | | | $ | 50,720,290 | |

| | | | | | | | | |

| Investments in Non-Controlled Affiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 37.7% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Non-Controlled Affiliated Publicly Traded Equity and Equity-Related Securities - | | | | | | | | | |

| 32.9% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Armstrong Flooring, Inc. (3)(13) | | | Building Products | | | | | | |

| Produces flooring products | | | | | | | | | |

| Common Stock | (M) (L2) | | | | 723,550 | | $ | 2,973,630 | | | $ | 1,816,111 | |

| | | | | | | | | |

| Potbelly Corporation (3)(13) | | | Restaurants | | | | | | |

| Operates a chain of sandwich shops | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 1,515,163 | | 6,702,539 | | | 8,454,610 | |

| | | | | | | | | |

| Synalloy Corporation (3)(13) | | | Steel | | | | | | |

| Manufactures metals and chemicals | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 373,306 | | 3,425,139 | | | 6,133,418 | |

| | | | | | | | | |

| Synchronoss Technologies, Inc. (3)(13) | | | Application Software | | | | | | |

| Provides white-label cloud storage, messaging and other digital analytic services | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 4,082,578 | | 10,847,924 | | | 9,961,490 | |

| | | | | | | | | |

| TheMaven, Inc. (3)(13)(14) | | | Interactive Media & Services | | | | | | |

| Provides a shared digital publishing, advertising and distribution platform | | | | | | | | | |

| Common Stock | (M) (L2) | | | | 15,429,920 | | 8,000,000 | | | 9,993,959 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Publicly Traded Equity and Equity-Related Securities (cost: $31,949,232) | | | | | | | | | $ | 36,359,588 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

21

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2021 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 37.7% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Legacy Privately Held Equity and Equity-Related Securities - | | | | | | | | | |

| 4.8% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| EchoPixel, Inc. (3)(5)(8) | | | Health Care Equipment | | | | | | |

| Develops virtual reality 3-D visualization software for life sciences and health care applications | | | | | | | | | |

| Series Seed Convertible Preferred Stock (acquired 6/21/13-6/30/14) | (I) (L3) | | | | 4,194,630 | | $ | 1,250,000 | | | $ | 520,097 | |

| Series Seed-2 Convertible Preferred Stock (acquired 1/22/16) | (I) (L3) | | | | 1,476,668 | | 500,000 | | | 186,084 | |

| Series A-2 Convertible Preferred Stock (acquired 3/23/17) | (I) (L3) | | | | 1,471,577 | | 350,000 | | | 238,390 | |

| | | | | | | 2,100,000 | | | 944,571 | |

| | | | | | | | | |

| Essential Health Solutions, Inc. (3)(8)(11) | | | Health Care Technology | | | | | | |

| Develops software for information transfer amongst healthcare providers and consumers | | | | | | | | | |

| Common Stock (acquired 11/18/16) | (I) (L3) | | | | 200,000 | | 20 | | | 0 | |

| Series A Convertible Preferred Stock (acquired 11/18/16) | (I) (L3) | | | | 2,750,000 | | 2,750,000 | | | 0 | |

| Unsecured Convertible Bridge Note, 8%, (acquired 12/19/18, matured 12/19/21) | (I) (L3) | | | | $ | 50,000 | | | 50,000 | | | 0 | |

| | | | | | | 2,800,020 | | | 0 | |

| | | | | | | | | |

| HALE.life Corporation (3)(5)(8) | | | Health Care Technology | | | | | | |

| Develops a platform to facilitate precision health and medicine | | | | | | | | | |

| Common Stock (acquired 3/1/16) | (I) (L3) | | | | 1,000,000 | | 10 | | | 31,155 | |

| Series Seed-1 Convertible Preferred Stock (acquired 3/28/17) | (I) (L3) | | | | 11,000,000 | | 1,896,920 | | | 561,053 | |

| Series Seed-2 Convertible Preferred Stock (acquired 12/28/18) | (I) (L3) | | | | 12,083,132 | | 2,500,000 | | | 668,023 | |

| | | | | | | 4,396,930 | | | 1,260,231 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

22

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2021 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 37.7% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Legacy Privately Held Equity and Equity-Related Securities - | | | | | | | | | |

| 4.8% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| TARA Biosystems, Inc. (3)(5)(8) | | | Life Sciences Tools & Services | | | | | | |

| Develops human tissue models for toxicology and drug discovery applications | | | | | | | | | |

| Common Stock (acquired 8/20/14) | (M) (L3) | | | | 2,000,000 | | $ | 20 | | | $ | 319,446 | |

| Series A Convertible Preferred Stock (acquired 3/31/17) | (M) (L3) | | | | 6,878,572 | | 2,545,493 | | | 2,670,081 | |

| Series A-2 Convertible Preferred Stock (acquired 4/18/19) | (M) (L3) | | | | 208,577 | | 100,000 | | | 80,964 | |

| | | | | | | 2,645,513 | | | 3,070,491 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Legacy Privately Held Equity and Equity-Related Securities (cost: $11,942,463) | | | | | | | | | $ | 5,275,293 | |

| | | | | | | | | |

| Total Investments in Non-Controlled Affiliated Equity and Equity-Related Securities (cost: $43,891,695) | | | | | | | | | $ | 41,634,881 | |

| | | | | | | | | |

| Controlled Affiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 6.2% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| LS180 Acquisition Holdings, LLC (3)(5) | | | Specialized Finance | | | | | | |

| Holding company for Special Purpose Acquisition Company (SPAC) interests | | | | | | | | | |

| Membership Units (acquired 4/13/21) | (M) (L3) | | | | 1,300,000 | | $ | 13,000 | | | $ | 13,000 | |

| Unsecured Promissory Note, 0% (acquired 5/10/2021, maturing 12/31/22) | (M) (L3) | | | | $ | 50,000 | | | 50,000 | | | 50,000 | |

| Unsecured Promissory Note, 0% (acquired 9/7/21, maturing 12/31/22) | (M) (L3) | | | | $ | 50,000 | | | 50,000 | | | 50,000 | |

| | | | | | | 113,000 | | | 113,000 | |

| | | | | | | | | |

| Parabellum Acquisition Holdings, LLC (3)(5) | | | Specialized Finance | | | | | | |

| Holding company for Special Purpose Acquisition Company (SPAC) interests | | | | | | | | | |

| Membership Units (acquired 4/22/21) | (M) (L3) | | | | 693,151 | | 2,717,646 | | | 6,719,700 | |

| | | | | | | | | |

| Total Controlled Affiliated Equity and Equity-Related Securities (cost: $2,830,646) | | | | | | | | | $ | 6,832,700 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

23

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2021 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Investments in Publicly Traded Equity and Equity-Related Securities and Legacy Privately Held Equity and Equity-Related Securities (cost: $80,963,651) | | | | | | | | | $ | 99,187,871 | |

| | | | | | | | | |

| Derivative Securities - | | | | | | | | | |

| 0.2% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Derivative Securities (2) - | | | | | | | | | |

| 0.0% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Magnolia Neurosciences Corporation (3)(5)(8) | | | Pharmaceuticals | | | | | | |

| Develops novel therapeutics for treatment of neurodegeneration | | | | | | | | | |

| Warrants for the Purchase of Common Stock expiring 8/3/28 (acquired 8/26/21) | (I) (L3) | | | | 138,059 | | $ | 112,854 | | | $ | 54,666 | |

| | | | | | | | | |

| NanoTerra, Inc. (3)(5)(11) | | | Research & Consulting Services | | | | | | |

| Develops surface chemistry and nano-manufacturing solutions | | | | | | | | | |

| Warrants for Series A-3 Preferred Stock expiring on 11/15/22 (acquired 11/15/12) | (I) (L3) | | | | 47,508 | | 35,403 | | | 0 | |

| | | | | | | | | |

| OpGen, Inc. (3) | | | Biotechnology | | | | | | |

| Developing tools for genomic sequence assembly and analysis | | | | | | | | | |

| Warrants for the Purchase of Common Stock expiring 2/17/25 | (I) (L3) | | | | 62 | | 785 | | | 0 | |

| | | | | | | | | |

| Total Unaffiliated Derivative Securities (cost: $149,042) | | | | | | | | | $ | 54,666 | |

| | | | | | | | | |

| Non-Controlled Affiliated Derivative Securities (2) - | | | | | | | | | |

| 0.2% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Potbelly Corporation (3)(13) | | | Restaurants | | | | | | |

| Operates a chain of sandwich shops | | | | | | | | | |

| Warrants for the Purchase of Common Stock expiring 2/12/26 | (I) (L3) | | | | 80,605 | | $ | 224,849 | | | $ | 205,313 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Derivative Securities (cost: $224,849) | | | | | | | | | $ | 205,313 | |

| | | | | | | | | |

| Total Derivative Securities (cost: $373,891) | | | | | | | | | $ | 259,979 | |

| | | | | | | | | |

| Total Investments (cost: $81,337,542) | | | | | | | | | $ | 99,447,850 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

24

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2021 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Principal | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Financial Instruments (15) - | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Rights to Payments (Illiquid) (2) - | | | | | | | | | |

| 7.2% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| | | Biotechnology | | | | | | |

| Rights to Milestone Payments from Acquisition of BioVex Group, Inc. (acquired 3/4/11) (3)(5)(8)(16) | (I) (L3) | | | | $ | 548,998 | | | $ | 548,998 | | | $ | 400,420 | |

| | | | | | | | | |

| | | Pharmaceuticals | | | | | | |

| Rights to Milestone Payments from Acquisition of Petra Pharma Corporation (acquired 5/14/20-8/26/21) (3)(5)(8)(17) | (I) (L3) | | | | $ | 6,320,438 | | | 6,320,438 | | | 7,612,339 | |

| | | | | | | | | |

| | | | | | | | | |

| Total Unaffiliated Rights to Payments (cost: $6,869,436) | | | | | | | | | $ | 8,012,759 | |

| | | | | | | | | |

| Total Investments in Publicly Traded and Privately Held Equity and Equity-Related Securities, Derivative Securities and Other Financial Instruments (cost: $88,206,978) | | | | | | | | | $ | 107,460,609 | |

The accompanying notes are an integral part of these consolidated financial statements.

25

180 DEGREE CAPITAL CORP.

NOTES TO CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2021

Notes to Consolidated Schedule of Investments

(1)See Note 2. Summary of Significant Accounting Policies: Portfolio Investment Valuations.