UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-07074

| | |

| 180 DEGREE CAPITAL CORP. |

| (Exact Name of Registrant as Specified in Its Charter) |

| | | | | | | | |

| 7 N. Willow Street, Suite 4B, Montclair NJ | | 07042 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | |

Daniel B. Wolfe

President and Chief Financial Officer

180 Degree Capital Corp.

7 N. Willow Street, Suite 4B

Montclair, NJ 07042 |

| (Name and address of agent for service) |

|

Copy to:

John J. Mahon, Esq.

Schulte Roth & Zabel, LLP

1152 Fifteenth Street, NW

Suite 850

Washington, DC 20005

(202) 729-7477 |

Registrant's telephone number, including area code: (973) 746-4500

Date of fiscal year end: December 31

Date of reporting period: June 30, 2022

Item 1. Report to Shareholders.

Fellow Shareholders,

Imagine waking up to the realization that you are set to fight Mike Tyson and have him punch you in the face for 6.5 straight hours. Now imagine that happens every morning… Hello Q2 2022 (which was the actual twin of Q1 2022).

For a more detailed illustration of what I am referring to, here is a timeline of a typical day for any day during the last quarter:

12:00 AM to 6:00 AM: What should be my normal 6 hours of sleep turns into a toss and turn fest with my mind racing, thinking of markets, our holdings, Russia, and the Fed. In the minutes I actually fall asleep, I am awakened with nightmares of Disney World passes costing $7,890 per day per person, making a five-day trip for a family of five cost $197,250 (weirdly I can do the math in my sleep [Side note from Daniel: I confirm he really can do this and substantially more complex math in his head]), not including airfare and hotel rooms. “Inflation” has now replaced Jason Voorhees from “Friday the 13th” movies as the source of what feels like an everyday nightmare.

6:00 AM to 7:30 AM: A check of the daily news: Europe down, Asia down, Russia still bombing Ukraine, oil up, 79 stories on supply chain disruptions, incessant inflation chatter, futures down. ZeroHedge tweeting every negative data point imaginable for their 1.4 million followers to ponder. Spit my coffee out in frustration over listening to incessant yelling and screaming from pathetic politicians from both political parties’ extremes. Bad data points on the economy mean we are headed towards a depression. Good data points on the economy mean the Fed will raise the Fed Funds rate 75 basis every month for the next 5 years. Stellar, I see nothing changed from the morning before. Glad I woke up.

7:30 AM to 9:30 AM: I put aside the daily news and shift to optimism that today will be the day that the market will stop discounting the same news over and over and over again. I begin to believe that today our holdings, many of which trade at the lowest valuation levels in their history despite decent fundamentals, will stop going down at stairstep levels.

9:15 AM: Reality check for my optimism during the previous hour. Do you know those insane lines you see at Best Buy at midnight the morning of Black Friday; the ones where people shove each other to the ground the minute the store opens so they can get their 60-inch Samsung TVs? Think about 180’s stocks along the same line. It feels like every stock we own is chomping at the bit for the markets to open so they can all open down 4% on 329 shares (on no news). They are all excited to torture me and ruin my day starting in just a short 15 minutes from now.

9:31 AM: Indeed, optimism unwarranted and dream ends as every single one of our holdings opens up down 4% except for PBPB, which probably won't have its first trade cross for another hour and a half (even though it’s a NASDAQ listed company with over ~$400 million in revenue). Serenity now.

9:45 AM: “Daniel, can we get Ryan and Tony from ALTG on the phone? The stock is down 7% on 4,300 shares. I know they just reported better than expected earnings YESTERDAY and provided solid guidance for the upcoming quarter YESTERDAY, but maybe things changed in the middle of the night or maybe we are missing something.”

10:00 AM: Apologize to ALTG’s management for bothering them so soon after we talked to them 14 hours ago, but we are wondering if we are missing anything that came from its conference call (that we listened to) or follow-up calls like the one we just had with them: I REPEAT 14 HOURS AGO. No, nothing changed at 2:00 AM. We continue to believe our thesis is intact (for the 64th time in the last 90 days), so we buy more.

10:30 AM: Get a call that there is a block of 300,000 shares of SCOR for sale despite the stock getting cut in half the last quarter on the back of the company BEATING ESTIMATES (that were never cut to begin with). Spend the next hour or so calling around to see what we are missing. Find nothing of note, so we tell the broker we will buy stock at $1.75 with the bid/ask spread at $1.76/$1.80 as long as it’s a clean-up sale by the seller. We are told it’s a “clean up.” The broker says the seller is at $1.85. We tell the broker to tell the seller to have a nice day because we are not negotiating our price. By 2 pm, the seller has come back and asked if we would buy at $1.77. NO. We lower our price to $1.74 just to be obnoxious. At 3 pm the seller returns asking if we would buy at $1.76. Again, we say no and lower our bid to $1.73 (again for spite). At 3:59 pm we buy the block at our price. The good news is we cleaned up the seller. The bad news (for tomorrow) is the seller will miraculously be back with more stock from “another account”. By the way, as an aside, we never believe in so-called “clean-up” sales.

10:45 AM: PBPB finally opens with 765 shares traded and the stock is down 2.7%. Not bad as it usually opens down 4%. This feels like a win to me. This is the definition of being “glass half-filled” in a bear market.

11:00 AM: After closing yesterday at $9.50, AREN’s bid/ask spread is $8.80/$10.20. You think I am joking, but I am not. Someone sells 100 shares at 8.80 and the stock is down 7%. That costs us 96 bps of performance. I feel stupid, dumb, and that I am a washed-up portfolio manager. I get dejected, sad, and angry. I don’t know what to do with myself and lose my appetite so I decide to not eat lunch and just drink water.

11:30 AM: AREN trades at $10.20 after a 200 share “block” hits the tape. Stock is now up 7% for the day. Adds 96 bps to our daily performance. I feel rejuvenated, smart, elated, and relieved. I’m on top of Mt. Everest. My appetite has returned, so I order a turkey club and Diet Coke to celebrate.

12:15 PM: Despite the market rallying to barely unchanged from the 4% gap-down opening, PBPB, refuses to participate; in fact, Elizabeth Taylor (I could have gone Jenifer Lopez, but I am older) had more husbands than PBPB had trades through the first 3.5 hours of the market. Its second trade of the day is for 128 shares and it’s now down 3.6%. We spend the next hour combing through our model to make sure that we see the path for PBPB’s share price to triple as it grows its store base from 400 to over 2,000, primarily through its focus on franchising.

12:30 PM: Why I keep CNBC on all day is beyond me. I now listen to 30 minutes of experts telling me how bearish they are, how the only thing they want to own is energy (somehow, they try and convince everyone they were early on in that trade) and everything else is a sale. Amazing how all these long-only managers are doing quite well this year and last year. And every year for that matter. Based on how they describe their performance, none of them have ever done poorly! I mute the TV.

1:00 PM: I turn my attention to TURN stock, which I will gladly buy for the 100+ time while we are in open trading windows. Daniel and I approve pre-clearance requests from all of our employees, who then proceed to also purchase TURN stock. I know our stocks are down, but to think our share price should trade below 180’s cash and public and related securities ignoring the ~$3.00 of fair value we have for our legacy private holdings is, in our collective view, idiotic. Our ultimate goal is for 180 to have $200 million in assets and $20 stock. I try to buy 50,000 shares of TURN at a limit price in the middle of bid/ask spread. I got 1,200 shares. TURN’s stock never goes up anymore, but nobody is a seller and I can’t find stock to buy. How does that work?

1:10 PM: Get call from a TURN shareholder asking us why we aren’t buying back stock. Fair question.

1:20 PM: Get a call from a TURN shareholder asking us why we don’t initiate a dividend. Fair question.

1:30 PM: Get a call from a TURN shareholder telling us they would be very disappointed if we bought back stock or initiated a dividend. This shareholder wants us to continue doing what we have been doing since we started in 2017. Especially given the crash, this shareholder believes the best use and highest potential for generating returns on TURN’s permanent capital is investing in public companies that we believe have the potential for returns of at least 100%. Also, a fair opinion!

1:45 PM: PBPB is down 5.47% on 2,300 shares. Can’t call a sell-side analyst because nobody covers it. We look at our model and call Bob and Steve at PBPB to walk through it again with them for the 2,000th time (but only 5th time this quarter). We continue to believe our thesis is intact. We put in an order for 5,000 shares on the bid side. I tell Daniel for the 11th time today, “I can’t take it anymore,” which is a lie because I have been saying that since 1988, and I am still managing money with Max Scherzer intensity.

2:00 PM: That said, I scour the job listings site in the New Jersey Star Ledger newspaper and wonder if I would be a good door to door cutlery salesman. I’m probably underqualified for that job, so I go back to figuring out why SCOR is down 6%, reminding myself that this is the only job I have ever had, I love it, and running 180 is the only thing I want to do. I clearly “CAN” take it.

2:15 PM: After we scour the trading desks of the 20+ Wall Street firms we regularly communicate with and trade through, the only answer we get for why SCOR is down is, “All the selling is in the dark pools. We believe it’s all algo (short for computer algorithm) trading.” Great, a bunch of machines automatically put in sell orders because a stock is down, which creates more pressure on the stock and draws more selling from all the other momentum based algos. Fantastic. Selling begets selling. Reminds me of some of the momentum investors I used to work with over the years: 1. none of which I would ever have given a nickel of my money to manage, 2. none of which I ever saw consistently make money for their investors, and 3. none of which really had long careers. I start telling Daniel stories of the “salad days” back at Blackrock. Daniel feigns interest, but I can see the eyes rolling to the back of his head. Great, we just wasted an hour trying to find some fundamental reason for the stock to be down.

2:30 PM: I remind myself that no matter how brutal a period this is, I am grateful we sold AFI when we did. AFI had the single worst management team I have invested in since I have been at 180, but our investment approach minimized our losses on that investment. It gives me great pleasure to enunciate out loud just how pathetic that management team was. It is the only “win” of my day.

3:00 PM: We have been down roughly 2.5% the entire day. We were down 2.5% when the market was down 4%, and after it rallied back to unchanged for the day, we are still down 2.5%. The lack of trading volume for our holdings is astounding to me. I ask Daniel if his screen is working because mine hasn’t flashed and seems locked. Nope, our stocks haven’t had a traded in well over an hour! I check our PBPB model again. Yep, same story as an hour ago, except this time we don’t call the management team since we spoke with them a little over an hour ago and we’ll probably call them tomorrow.

3:15 PM: For some reason, I decide to unmute the TV. My blood pressure boils because an investor comes on the air and says he’s worried about inflation, so he’s going to “sit this out until he gets the ‘all clear’.” I am mortified at the comment and break out in hives thinking through a story I will share with you later in this letter about the last time I heard the “all clear” line. First off, investors don’t sit anything out. There is always something to do. Secondly, I can’t remember someone ringing the bell at the bottom of any of the historical market bottoms from 1987, 1990, 1998, 2003, 2008, 2018, or March 2020. It doesn’t work that way. I mute the TV again. I'd rather watch Dr. Phil at this point.

3:20 PM: I remind myself that as people are telling me the sky is falling (these are the same people that were buying every meme stock in the first quarter of 2021). The US just posted an increase of almost 400,000 jobs for the month of June. I’m not sure how the creation of that many jobs equates to eminent economic doom. Do I think a recession is coming? I believe we are in one now, and job growth like what we had in June 2022 makes me believe the US can manage through it without massive calamity.

3:30 PM: In the span of five minutes, I tell Daniel, “We shouldn’t buy anything anymore until this market calms down,” to “This market is so irrational that we should be buying everything.” I go through the five stages of grief at least twice a day, and I just wrapped up the acceptance stage with half an hour to go in today’s trading session.

3:45 PM: After thinking through what thoughts have been running through my head all day, I enunciate them out loud. “We are in a recession already, but the U.S. just posted almost 400,000 new jobs in June 2022. The market already is telling us that inflation is high, but there are signs inflation is peaking right now. Interest rates are going up, but the 10-year U.S. Treasury yield is 2.8%. COVID is “over” in some countries, but in others it seems like COVID will never end. I believe the market has bottomed out. I believe the market is going to collapse. I’m buying everything. I am not buying a thing.” I sound like a lunatic. Serenity now!

3:58 PM: AREN which now has a bid/ask spread of $8.90/$10.10 (much tighter) trades 47 shares on the bid side ruining our day all over again. Serenity now. Serenity now. SERENITY NOW. I don’t know why I bought that turkey club sandwich. I am not eating tomorrow. While in my happy place I have decided this bid-side trade will be a positive for us because tomorrow it will trade up to the offer side and we will have a great day!

3:59 PM: PBPB also trades 43 shares on the close, except on the offer side of its $5.20/$5.61 bid/ask spread. That’s bad because tomorrow it will trade down to the bid side and will wreck our day.

4:00 PM: Today’s roller coaster is now over. I experienced emotions from laughter to optimism to depression to sea sickness. Total punches to face from Mike Tyson: 98. Let’s do it again as tomorrow will be different!

4:00 PM to 11:59 PM: The rest you don’t care about (that’s assuming you cared about any of this). Time to head off to my son’s baseball game, eat dinner with family, and perhaps take one hour to watch an episode of Yellowstone. The remainder of this time is spent combing through models, calling our companies, setting up conference calls, screening for new names, reading and convincing myself that this market could provide the opportunity that TURN needs to get to $200 million in net assets, which I believe could result in our stock trading close to $20. Optimism to pessimism back to optimism back to pessimism at least 7 or 8 times. Time to go pretend like I am going to sleep. Without nightmares, I hope.

While some of the descriptions and discussion above are tongue-in-cheek, the reality is that a significant portion of it is truly representative of a typical day during the first half of 2022. These six months have been challenging to say the least with a very confusing backdrop of economic data and frightening geopolitical events. Even though it has been a rollercoaster of emotions trying to navigate through these markets, we don’t manage money with emotion. We are deliberate and we are objective. We are focused on individual companies that we believe have the potential to generate a return of 100% over a three-year cycle. Despite mentioning how we toggle back and forth between a series of conflicting views on our macro and micro-economic

outlooks, we do indeed have a view. We believe we are already in a recession. We come to that conclusion based on the historical definition that has existed for a century, i.e., a recession is defined by two consecutive quarters of a decline in GDP. I’m not sure why this point is being continuously debated.

I was recently reading an article from Forbes that summarizes the current environment:

“Two quarters of negative growth, as we’ve seen so far in 2022, is a good rule of thumb for identifying recessions. However, the National Bureau of Economic Research (NBER) makes the final call. That can take some time as they look at all the data and the early estimates, such as we saw this morning, are refined over the coming months.

This is the NBER’s recession definition:

A significant decline in economic activity that is spread across the economy and that lasts more than a few months.

Let’s look at the elements of that in detail.

Three Considerations

Duration - The NBER fundamentally considers three things in calling recessions. These are depth, diffusion and duration of any economic decline. Given we’ve seen 6 months of negative growth for the U.S. economy the duration test is likely met.

Depth - Depth of the decline remains a key question. With declines in economic growth of around 1% to 2% so far in 2022, this is a pretty shallow decline. Calling the current dip in economic growth a “significant decline” may be a stretch. Often recessions can see the economy decline around 5% or more. So if this is a recession it’s a shallow one, at least so far. The lack of real depth to this decline may prevent the NBER from calling it a recession just yet. However, if this slump persists, the NBER may be forced to call it a recession regardless.

Diffusion - Then diffusion is the most complex of the three parts of the NBER’s definition. Clearly, some sectors of the economy such as travel and energy are doing relatively well today. On the other hand, we’ve seen big swings in trade, and now some slowing in the retail, automotive and housing sectors as well as slowing business investment in general. This mixed pattern is not unusual. The different parts of the economy seldom move together. Often recessions happen as some sectors boom. The 1970s and 1980s are good examples. The economy hit several recessions, but the energy industry did relatively well throughout.

What Will The NBER Do?

So we’ll have to wait some time to see if the NBER call this a recession. It’s not a simple call. If they name this a recession, it’s a shallow one, so far, compared to most examples in recent history. In a sense, that’s good news for markets, deep recessions are a bigger problem.

It May Not Matter For Markets

Nonetheless, while naming a recession is a debate, the economic situation in the U.S. for 2022 so far is pretty clear. We’re currently seeing a combination of declining growth and very high inflation. That’s essentially stagflation, especially if it persists. Whether or not it’s a recession is more of an academic debate. Since it’s clearly a proven toxic mix for financial markets, especially since we entered 2022 with relatively optimistic valuation levels. The question for the remainder of 2022 is whether inflation comes down significantly and if growth resumes, that, rather than the technical call on any historic or ongoing recession, is what will likely drive markets.”

Are we in a recession or not? Is it going to get worse or not? I am reminded of Saturday Night Live video of Dana Carvey playing George Bush back in the days of the 1990 recession. Here is a link to the video for a little lighthearted humor: https://youtu.be/yD8lIGqmHpE.

I was just 24 years old then but everyone was telling me it was the end of the world. War with Iraq. Banking and savings and loan collapse. Guess what? It wasn’t the end of the world. We recovered, and I suspect this isn’t going to be the end of the world either. One way or the other, I am not sure I care. The Russell Microcap Index has declined by 33% since it peaked in November 2021. Whether we are in recession, headed for a recession, or won’t have a recession, the market has already

discounted significant bad news. The market hasn’t just declined, it has experienced a slow methodical crash that has left many of TURN’s holdings (and countless others) to trade at all-time low valuations.

We recently wrote a white paper describing how markets perform going back to the depression during recessionary periods and I thought it would be useful to include this white paper in this letter:

It’s Always Darkest Before Dawn

War continues to rage in Ukraine. Inflation continues to run rampant. Gas prices are at record highs. Food prices are eating into consumers pocketbooks. Mortgage rates have skyrocketed. Gross Domestic Product fell in the first quarter of 2022. The Fed is in the midst of a major tightening cycle. When you add all of this together, it seems obvious why many believe that we are headed into a recession, defined as a drop in GDP for two successive quarters.

Given all of this, it’s no wonder that the stock market has been in the grips of a serious sell off thus far in 2022. From their peaks, the S&P is down 21% and the Russell Small Cap Index is down an even more significant 33%.

The question for investors though, is when to become optimistic on the market again and, as a result, begin adding risk to portfolios. Since nobody rings a bell to signify that the market has hit bottom, we decided to look back at previous recessions to see what history could tell us.

Dating back to the Great Depression there have officially been 15 recessions. They have obviously varied significantly in both length and severity. That said, the average recession has lasted a little over one year. This includes the aforementioned Great Depression as well as the more recent 2008 subprime mortgage triggered recession, both of which lasted significantly longer. No economist currently expects the current recession, if it even comes to pass (so far, we only have one negative quarter of GDP), to be anywhere near as bad as those two events. When we remove those two downturns from the data, the average term of the remaining 13 recessions drops to around 10.5 months.

The interesting aspect, foreshadowed by the title of the piece, is the point during a recessionary cycle when the market has historically bottomed out. On average, for the 15 recessions dating back to the Great Depression, the stock market has hit its lowest point when 40% of the recession still remains. In other words, if a recession ends up lasting 10 months, the market bottom would occur at approximately the six-month point.

This number goes to just under 50% when you take out the small recession (GDP only contracted 0.3%) back in the early 2000’s that was triggered by the dotcom bubble. That sell-off was clearly exacerbated by the unprecedented multiples that the market was trading at then. For reference, the S&P was trading at a multiple 47x price to earnings ratio on 1/1/2001 vs 23x on 1/1/2022.

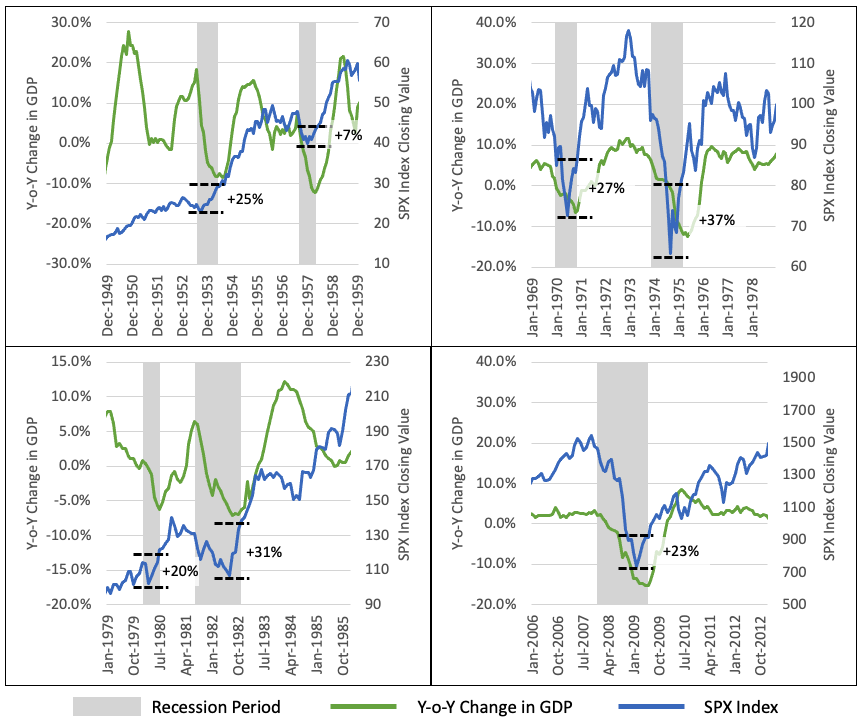

These trends are shown on the following charts for four periods in history that encompass seven recessionary periods.

Percent change is from the bottom of the SPX in a recessionary period to the end of that recessionary period.

What does this analysis tell us about the current market situation? Assuming we are in the midst of a recession, then when economists look back, they will likely peg its beginning to somewhere in the fourth quarter of 2021. If we use 12/21 as a starting point for the current downturn, then we would already be seven months into the current recession. If the current downturn ends up lasting an entire 12 months (the historic average for the length of recessions), then we are slightly over halfway through it. Further, we are inching up on the historic 60% point where the market has historically bottomed out before beginning a positive trajectory (often a significant one).

Clearly, timing the bottom is a very difficult exercise at best. That said, it seems reasonable that combining market history with some positive data (attractive valuations, improving supply chain, early signs of disinflation among others), presents an interesting case that we may, in fact, be near what will end up being the bottom of this bear market. One final historical point; there is a wide disparity for how long it has taken the market to return to its pre-bear market highs. For example, in the Great Depression in the early 1930’s, it took the market 258 months to recover to its previous high, and in the 2008 recession it took 45 months. In many other periods (e.g., the 1950’s, 1991, 2020) it took less than 5 months. Much depends on the severity of the recession and the amount of leverage in the system at the time. While the market has crashed to levels depicted in the Great Depression and the 2008 economic equivalent of Pearl Harbor, this doesn’t feel like an “end of the world” recession to us. For example, the US just created close to 400,000 jobs in the month of June! While we never know how long these recessions will last, the one thing we know from history is that when the newspapers and media outlets declare the recession to be over, the market is already well off its lows and real money has been made for investors.

"All Clear"

Back to the story I promised to share about waiting for the “all clear.” While the names shall remain nameless, I have told the story of a friend of mine who was having a normal performance review discussion with his “suit” boss (you know, the person that never managed a dollar of assets in his life, but thinks he knows everything). The discussion occurred during a rough patch for the market against the backdrop of a tough economy.

Boss: “Unless you are 100% certain about the market, why would you have any risk on?”

Portfolio Manager: "You mean I’m supposed to be 100% cash? I don’t ever recall any environment in my entire career when I was 100 % certain of the future."

Boss: “If I were you, I would just wait for the 'all clear' signal that it’s safe to invest again.”

Portfolio Manager (shaking his head in disbelief): “That doesn’t happen. EVER. Nobody rings a bell. It doesn’t work that way.”

The portfolio manager then proceeds to my office and we laugh out loud about how insane the conversation was. Portfolio manager bonding. It’s always easy for the people that don’t manage money to comment on how easy it is to actually manage money, except when you give them a $1.00 to manage. My friend stayed the course and was true to his discipline.

Of course, you know how this ends, right? A year later, the economy is humming, the market has recovered, my buddy has crushed it, and the market is up 30%. Performance review time comes:

Boss to the Portfolio Manager: “Seems to me now is the time to put on more leverage.”

Portfolio Manager: [Responding in his head] THANKS!

This environment for 180 reminds me of that conversation. By the time the smartest people in the world declare we are in recession, we will probably be out of it, and the market will be materially higher. Nobody ever comes around and rings a bell telling us that “the market bottoms today.” We will invest our capital in a handful of names because we believe: 1) their valuations already discount much of the negativity; and 2) they offer the potential for significant share price appreciation. While we currently believe we will generate meaningful returns on these investments and our shareholders will greatly benefit from this period, I don’t know when such returns will occur. All I know is we have NEVER been 100% certain of the future for the 34 years we have been managing money. I have lived in my own space of never thinking I was 100% certain I knew what the world would look like. That is in good times or bad. We make calculated educated decisions about the risk/reward to what valuations are and the potential opportunities that exist.

With that, let’s get into the nuts and bolts of our performance from this past quarter.

NET ASSET VALUE PER SHARE

Our net asset value per share (“NAV”) decreased this quarter from $9.81 to $8.35, a -14.9% decline. Our Fund has three principal components to the variance in our NAV: our public portfolio, our private portfolio, and our expenses. For the quarter, our public portfolio companies caused our NAV to decline by $1.27, while our private portfolio companies decreased our NAV by $0.12. Operating expenses, net of reversal of certain deferred bonus accruals decreased NAV by $0.07.

| | | | | | | | | | | | | | | | | | | | |

| Quarter | YTD | 1 Year | 3 Year | 5 Year | Inception to Date |

| Q2 2022 | Q4 2021- Q2 2022 | Q2 2021- Q2 2022 | Q2 2019- Q2 2022 | Q2 2017- Q2 2022 | Q4 2016- Q2 2022 |

| | | | | | |

| | | | | | |

| | | | | | |

| Change in NAV | (14.9%) | (21.7%) | (21.8%) | (1.3%) | 14.1% | 18.9% |

| | | | | | |

| Change in Stock Price | (10.4%) | (16.6%) | (23.9%) | 3.8% | 26.1% | 48.1% |

| | | | | | |

| Russell Microcap Index | (19.0%) | (25.1%) | (30.8%) | 15.8% | 24.9% | 30.2% |

| Russell Microcap Value Index | (15.3%) | (17.1%) | (17.9%) | 29.5% | 38.8% | 42.6% |

| Russell 2000 | (17.2%) | (23.4%) | (25.2%) | 13.1% | 28.5% | 34.9% |

| | | | | | |

| | | | | | |

| | | | | | |

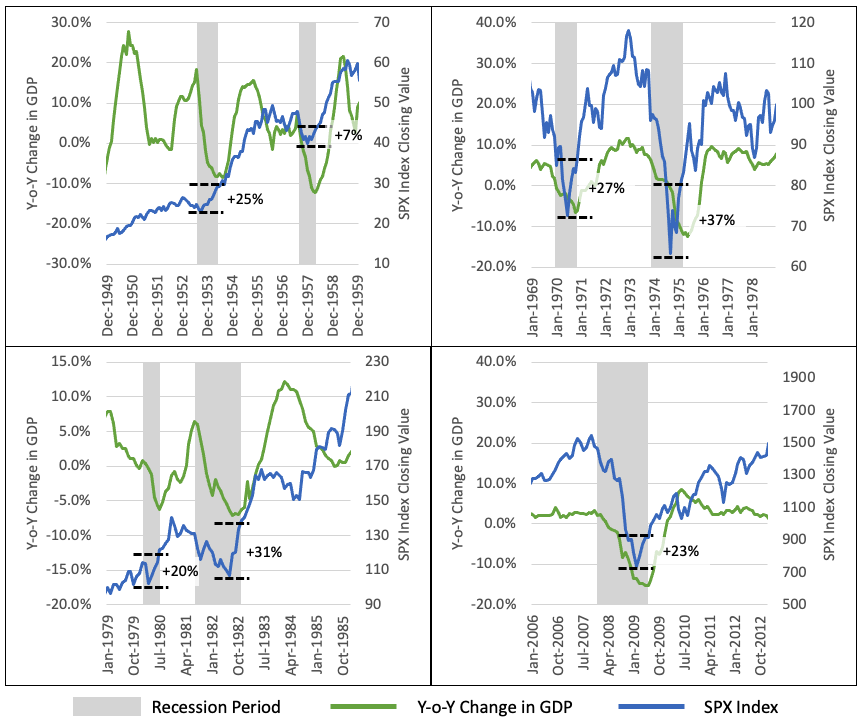

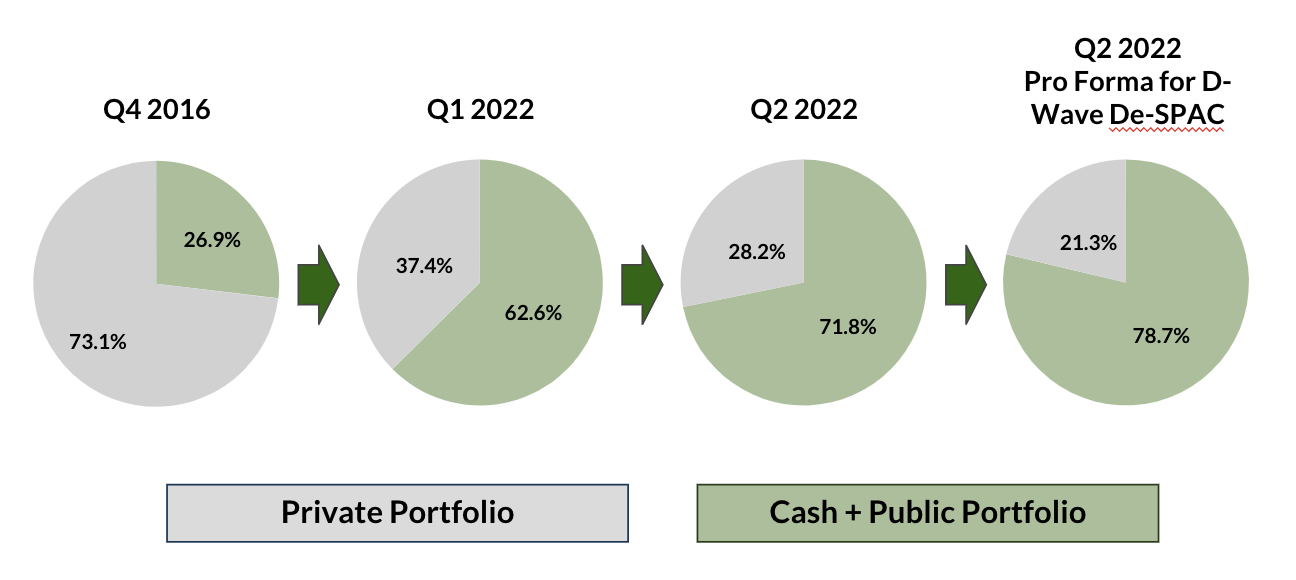

As bad a quarter as this has felt to us, I would offer the following chart to provide some perspective on our performance over a longer period of time. Despite a slight dip this quarter, we have grown our cash and liquid securities to a level greater than our share price, illustrating just how cheap we believe our stock is today, particularly if you include on a pro forma-basis the value of our holdings of D-Wave Systems, Inc., that completed its de-SPAC merger on August 5, 2022.

* Q2 2022 Pro forma for de-SPAC of D-Wave Systems, Inc. based on value as of June 30, 2022.

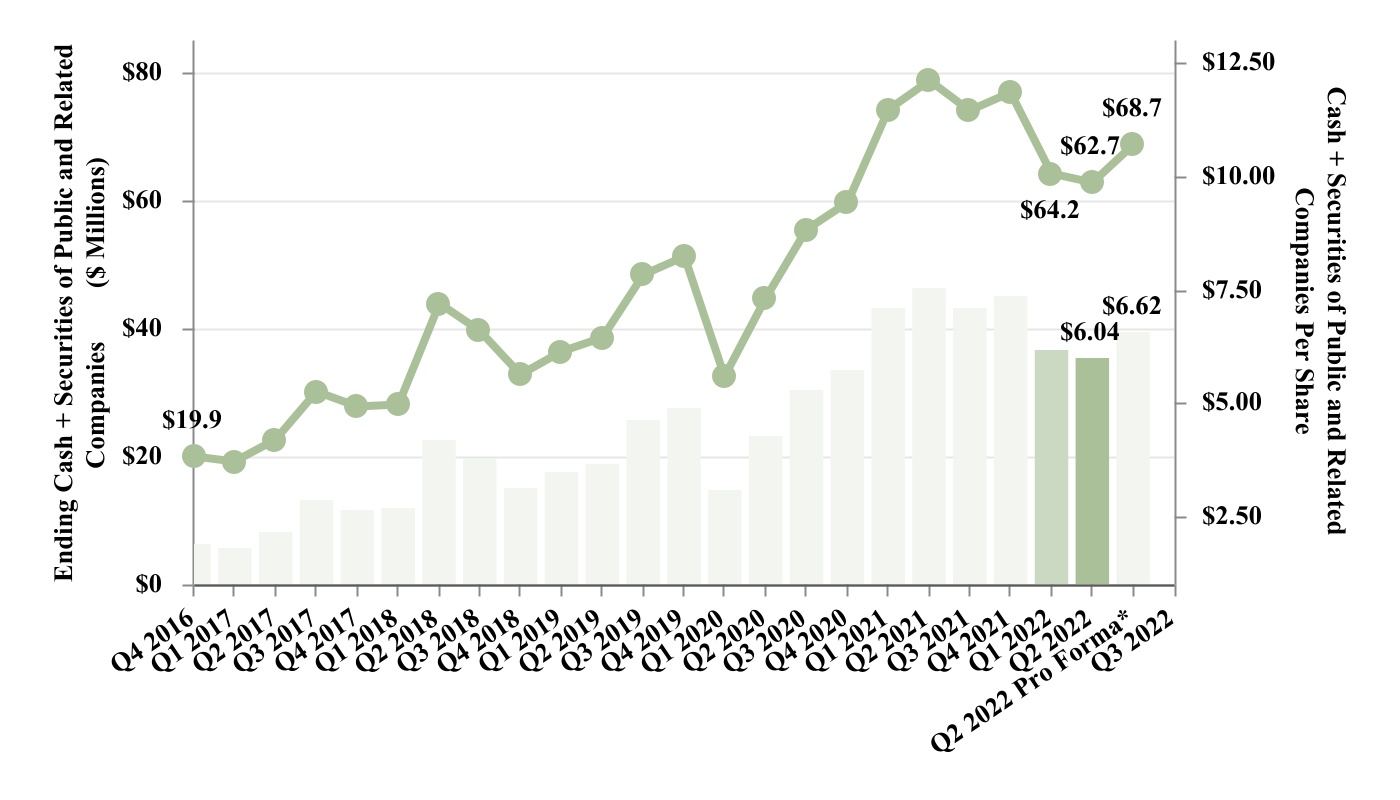

On a relative basis, TURN's stock price total return of +48.1% has also exceeded the Russell Microcap Index total return of +30.2% since our inception as is shown in the chart below:

PUBLIC AND RELATED PORTFOLIO

In the chart below, you see our quarter to date, one-year, three-year, and inception-to-date performance numbers. For Q2 2022, we showed a gross total return for our public portfolio of -19.0%, versus a gross total return for the Russell Microcap Index of -19.0% and a gross total return for the Russell Microcap Value Index of -15.3%. Year to date, our -31.0% gross total return compares negatively to the -25.1% return for the Russell Microcap Index. Despite this year’s performance, our three-year, five-year, and inception to date numbers show significant outperformance versus these benchmarks as seen in the chart below.

| | | | | | | | | | | | | | | | | | | | |

| Quarter | YTD | 1 Year | 3 Year | 5 Year | Inception to Date |

| Q2 2022 | Q4 2021- Q2 2022 | Q2 2021- Q2 2022 | Q2 2019- Q2 2022 | Q2 2017- Q2 2022 | Q4 2016- Q2 2022 |

TURN Public Portfolio

Gross Total Return (Excluding SMA Carried Interest) | (19.0%) | (31.0%) | (31.6%) | 45.2% | 172.8% | 227.5% |

TURN Public Portfolio

Gross Total Return (Including SMA Carried Interest) | (19.0%) | (31.0%) | (29.7%) | 55.0% | 190.8% | 249.0% |

| | | | | | |

| | | | | | |

| | | | | | |

| Change in Stock Price | (10.4%) | (16.6%) | (23.9%) | 3.8% | 26.1% | 48.1% |

| | | | | | |

| Russell Microcap Index | (19.0%) | (25.1%) | (30.8%) | 15.8% | 24.9% | 30.2% |

| Russell Microcap Value Index | (15.3%) | (17.1%) | (17.9%) | 29.5% | 38.8% | 42.6% |

| Russell 2000 | (17.2%) | (23.4%) | (25.2%) | 13.1% | 28.5% | 34.9% |

| | | | | | |

| | | | | | |

| | | | | | |

Let’s dig into the significant sources of the changes in value in our public portfolio in Q2 2022.

Sources of material decreases in value:

•Synchronoss Technologies, Inc. (SNCR): Despite reporting better than expected revenue and EBITDA for Q1 2022 and the sale of a non-core asset for up to $14 million, the stock declined by 33.5% in the quarter. The positive operating performance was overshadowed by comments from management at conferences and in follow up calls that confused investors with regard to the ability of the company to generate unadjusted positive free cash flows and to substantially payoff its outstanding preferred stock. In our view, these are the equivalent of “unforced errors” by SNCR’s management and Board. While the last two points are perhaps attempting to justify a stock going down in a bear market, I will say we are considering ramping up our activism until we are convinced the management team and SNCR’s Board show a greater sense of urgency with regards to creating value for shareholders.

SNCR has been an outright disaster for an extended period of time. We believed when we helped the company recap its previously expensive and restrictive debt, that event would have been the catalyst for the company to create value. Its operating performance should have been enough to warrant stability in the equity, and certainly should not have been the cause of the share price plummeting 33.5% this quarter and 50% since the recap. While we need to hear about a clear plan to reduce the outstanding $75 million preferred security, we do believe a significant portion of SNCR’s poor stock performance is simply the result of a risk-off fearful market. For the quarter, SNCR decreased our NAV by $0.27 per share, or $2.8 million.

•Quantum Corporation (QMCO): While we have successfully traded in and out of QMCO a couple times over the last couple years, we got caught this time. We have often spoken about how legitimate supply chain issues have negatively impacted QMCO. What started out primarily as an inability to secure enough parts for tape drive products sold to major hyperscalers, has expanded to almost every part needed to build out their server and storage products. The margin pressure was so severe in Q4 2021, QMCO announced they would need to seek a waiver from its lenders to avoid tripping debt covenants. We were stunned. The fact that QMCO is tripping debt covenants three years removed from cutting their debt in half, restoring the company from its accounting scandal, and posting revenue at $90+ million per quarter is, in our humble view, obscene. QMCO’s Board fell asleep at the wheel and QMCO’s management built a cost structure (e.g., R&D +$20-million-year over--year) for revenues and a margin profile that doesn’t exist today. It is our view that the weakness in QMCO has nothing to do with the stock market and everything to do with poor planning and execution by QMCO’s Board and management team. The company fell victim to a “if we build it, they will come” mentality. And they have destroyed their shareholder base in the process. As a result of these missteps, the company was forced to do a rights offering at a price that, because of the resulting dilution, has killed off the upside to our price targets.

We spoke about all of these issues last quarter. This is old news by now. This quarter, the company reported results for calendar Q1 2022 that were above guidance and analyst estimates. QMCO also finally announced cost-cutting measures as well as price increases for its products. Given the destruction of value over the last six months, that operating performance, combined with a much stronger balance sheet following the rights offering, should have been enough to stop the stock from continuing to fall. But it didn’t. This is an example of the market discounting the same news over and over and over and over again. It just never ends. And this quarter, the stock declined a staggering additional 37.4%. This last decline was unwarranted in our view. We will hold QMCO’s Board and management team accountable for restoring value and will ramp up our activism, which may include a proxy contest if we don’t believe the company is being run for its shareholders. With the rights offering, the company has only $30 million of net debt versus $160 million just three years ago and a set of new covenants that should provide ample breathing room. The company’s balance sheet is de-risked, but still trades at substantially less than 1x of revenue. We continue to believe there is the opportunity for material improvement in QMCO’s stock price from where it ended the quarter as we did last quarter from the rights offering price of $2.25. For the quarter, QMCO decreased our NAV by $0.22 per share, or $2.3 million.

•Alta Equipment Group, Inc. (ALTG): ALTG reported strong results for Q1 2022 and maintained its EBITDA guidance for 2022. That said, if the market believes the US economy is headed to an end of the world scenario, do investors want to own a dealership of construction and material handling equipment? The answer this quarter was a resounding no, and the stock declined by 27.4% in the quarter. We believe ALTG is an incredibly well-run business. Ryan Greenawalt (CEO), Tony Colucci (CFO), and their entire management team continue to post impressive results. In a short period of time since listing publicly at the beginning of 2020, ALTG crossed over $1 billion in annual revenue and over $100 million in annual EBITDA in 2021. We believe in the management team and their roll-up strategy of a fragmented industry. It could be easily argued that the stock is inexpensive at 5.4x times EV/EBITDA (ex-operating

leases). The question for us is not whether the company can execute, but instead do we really want to own this type of business in which you are continuously acquiring or replacing fixed assets. Something for us to contemplate, although, I will say, if the management team of ALTG ran every business we own, I could go on permanent vacation knowing our investments were being run by an alpha generating management team. ALTG reduced our NAV by $0.19 per share, or $1.9 million.

•comScore, Inc. (SCOR): By now you have seen the public letters we have sent to SCOR's Board highlighting our criticism of how it is governing the company. In case you haven’t read them, you can find them at the following links: https://ir.180degreecapital.com/press-releases/detail/365/180-degree-capital-corp-issues-open-letter-to-the-board and https://ir.180degreecapital.com/press-releases/detail/367/180-degree-capital-corp-issues-second-open-letter-to-the. SCOR decreased 29.2% this quarter. We surmise that part of this decline resulted from two factors: First, SCOR was removed from the Russell indices due to the decline in the market cap of the company. Second, the company made no progress in the quarter with the hiring of a new CEO. To our disappointment, SCOR also refused to address many of our recommended steps towards creating value for all shareholders. While the announcement of a new CEO didn’t occur last quarter, on July 6, we were pleased to see the appointment of Jon Carpenter as CEO. We have been impressed with him since he joined SCOR and believe he has the right focus and sense of urgency required to turn this company around. We were also particularly pleased to see Nana Banjeree appointed as Chair of the Board. SCOR’s Board has long suffered from ineffective leadership and change was needed.

Given SCOR’s improving financial performance and clarity on management, we currently believe SCOR’s share price is beyond absurd. While SCOR’s biggest competitor, NLSN, has stumbled from a fundamental perspective over the last two years, NLSN was still sold for 4x revenue. SCOR trades at less than 1x. It is incumbent upon SCOR’s Board to create value for all stakeholders in the company, including its common shareholders, and actually do the work that board members are required to do under Delaware law. To date, SCOR's Board has failed to create value. The appointees of SCOR’s Preferred Shareholders have failed to represent any shareholder other than the Preferred Shareholders. If needed, we will pursue further action through the Delaware courts. We will continue to press the company until the rights of the common shareholders are properly reflected in the decisions of SCOR’s Board. For the quarter, SCOR reduced our NAV by $0.15 per share, or $1.6 million.

•Potbelly Corporation (PBPB): Following consistently dreadful performance in PBPB’s comparable same store sales under the prior two management teams, PBPB has seen a resurgence under its current leadership, Robert Wright (former COO of Wendy’s) and Steve Cirulis (former SVP of Strategy at Panera Bread). PBPB reported continued strong results in Q1 2022 as its average unit volume (AUV) continued to improve, particularly in its central business district stores that were particularly hard hit by COVID-related issues. Bob, Steve and their colleagues are executing on what we believe to be an exciting long-term plan to strategically grow PBPB from 400 shops to 2,000 shops with improved operating metrics and overall financial performance. Investors appear to be waiting for the company to complete a meaningful re-franchise and/or franchise deal to prove that management’s strategy is viable. We believe PBPB’s stock can reach the mid-to-high teens if the company can post 10% EBITDA margins over the next three years. In the short term, as people return “back to the office”, we think some of PBPB’s urban locations (e.g., Chicago Business District, New York City, and Washington DC) should catch up to the growth of its suburban locations. We are of course mindful of escalating food and labor costs and will monitor those as 2022 unfolds. This is our top holding by weight as of the end of Q2 2022, and we are firm believers we have the chance to triple our money from the current stock price. For the quarter, PBPB reduced our NAV by $0.15 per share, or $1.6 million.

•Arena Group Holdings, Inc. (AREN): AREN reported strong results for Q1 2022 and continued to build momentum in building its business. During the quarter, AREN's stock traded at a value that enabled it to be included in the Russell indices beginning with the rebalance in June 2022. While normally we would consider this inclusion to be a positive event, confusion around the actual number of shares outstanding led to issues in determining the number of shares that should be bought by index funds to reach the target weights. While we are not certain this was the source of the pressure on the stock, the number of shares to be purchased changed, which would have led to certain index funds potentially having an overweight position in AREN. The forced selling coupled with the relatively illiquid trading of the stock could have been a material source of pressure on its trading price. It is amazing and hard to fathom how SCOR’s removal from the Russell was a negative event; while at the same time the inclusion of AREN into the Russell was also a negative event! That is the definition of a bear market. Additional sources of pressure could have come from concerns regarding the impact of a recession on the company’s advertising revenue. The end result was that AREN declined 16.9% in the quarter.

Putting aside these factors, we believe AREN, under the leadership of Ross Levinson, is executing very well as traffic and advertising across its many websites has been increasing at an accelerating rate. AREN recently stated on its

earnings call that it is currently at an inflection point where both inorganic and organic growth can occur without adding any meaningful cost along the way. We expect material increases in revenue, EBITDA, and free cash flow over the ensuing years. We believe in AREN’s strategy of rolling up digital assets and integrating them across a single platform; this should allow for better traffic across each individual site. While we are never pleased with owning stocks that cause our performance to suffer, in the case of AREN, we haven't invested in the company for a 20-30% return. We believe that over time, AREN can be a $500+ million market cap company, which would equate to a $30+ stock price at its current shares outstanding. We believe it’s the right company, with the right management team and a great strategy. It’s just a bad stock market combined with a potentially rough advertising environment. Time will tell if we are right. For the quarter, AREN reduced NAV by $0.14 per share, or $1.4 million.

We had one name that materially increased in value this quarter:

•Envela, Inc. (ELA): ELA has historically been an undisclosed position. ELA operates two business units: retail services and commercial services. ELA’s retail segment buys and sells jewelry and bullion products to individual consumers, dealers, and institutions in the United States. ELA's commercial segment provides solutions to businesses from across all industries seeking sustainable ways to reduce waste and protect their intellectual property and brand value. ELA started as a relatively small position due primarily to the fact that the company is majority owned and controlled by its CEO, John Loftus. That said, John has a history of creating value in related businesses, so we established a starter position in the company in prior quarters. We then began discussions on potential opportunities to reduce John’s ownership and strengthen the balance sheet for acquisitions, but those discussions have yet to result in an opportunity for 180 to materially increase its position in the company. For the quarter, ELA increased NAV by $0.05 per share, or $0.5 million.

Last quarter we disclosed that we had initiated a position in Intevac, Inc. (IVAC) following its sale of its photonics business for $70 million and the hiring of a new CEO, Nigel Hunton. It is our belief that Nigel was brought in to rationalize the cost structure following the sale of the photonics business and reposition its current thin-film processing business for growth and then its inevitable sale. In its Q1 2022 earnings call, IVAC’s management reiterated its expectation to end 2022 with at least $115 million, or $4.58 per share, in cash, assuming no in-year distributions or other return of capital. With the stock declining to nearly the net cash on its balance sheet, we believe the risk/reward of the investment is compelling. During Q2 2022, we continued to build our position this quarter and it is now nearly a 5% holding.

Lastly, we closed out our positions in ENZ and AFI during Q2 2022. While we discussed AFI in detail in our last shareholder letter, we wanted to communicate one last time on the company given how deplorable the management team was in operating this business.

•Armstrong Flooring, Inc. (AFI): As it turns out, AFI’s management team was one of the worst we have come across in our five-year history. Our original investment thesis was: 1. We believed the company would sell an office location for meaningfully more than the expectations for what it was worth; and 2. The company under its new management team would fix the operations of the business and materially improve its gross margins, EBITDA and cash flows. We were dead right on 1 and dead wrong on 2. When the company announced the sale of its South Gate California facility in March 2021 for $76.7 million, the stock rose 50% and we sold half our position. From that moment on, the company burned through an inordinate amount of cash, had its head in the sand regarding supply chain inflationary pressures, and was ill prepared from a cost perspective to deal with the current environment. We pressed the company immediately following the South Gate sale to adjust the cost structure of the business to deal with deteriorating margins, but they failed to do so. I have never seen a less energetic management team in total denial of reality. Not only did we find the CEO arrogant and dismissive (at one point he suggested to us that “even the consultants didn’t see this coming”), he and management fell victim to shifting of blame to external “outside of their control” forces. As last year unfolded, we became convinced that the potential for bankruptcy was much higher than our risk tolerance could tolerate, and essentially sold our entire position. Behind the scenes, we sent a letter to AFI’s Board suggesting they seek alternative options for creating value for shareholders. The company announced they would do so at the end of 2021. We exited the remainder of our small position in early Q2 2022, well before AFI announced it was likely to, and ultimately did, file for Chapter 11 bankruptcy protection.

We will call AFI a bad investment. That said, because of our attention to paying “the right price” for the business from the outset and our sell discipline for exiting stories when the reasons for ownership are no longer valid, and we contained the loss to approximately 12%. Our average sale price of $3.63 per share versus our average cost basis of $3.97 per share looks a lot better than what ended up being a near zero for the common equity. We have talked about this many times in our letters. We aren’t “right” fighters with regards to our holdings; rather we are only interested in

preserving capital when our rationale for why we own individual companies changes for the negative. Going forward, we will use AFI as an example of how not to run a company.

All in all, it was a rough quarter for our public holdings. We believe we have gotten to the point where many names in our universe are overly discounted (based on their valuations) relative to the very bearish environment we are in. Our permanent capital allows us to make rational decisions on our investments, and we believe this is a distinct advantage in regard to our ability to generate returns greater than the indices. We are never forced to sell unless we believe we should for analytical and investment process reasons. We have seen the benefits of having permanent capital during other periods of market dislocation during our five-year history, and we expect this period will be no different. Like the other weak periods of performance during the last five years, we hope to look back at this one and reflect that while it was painful wading through it, we were presented with some interesting investment opportunities that we believe have at least 100% upside.

LEGACY PRIVATE PORTFOLIO

Despite the poor performance of our public holdings, in 2022 we finally received very important and positive news from a few of our private holdings. Since the end of 2021, we have made three announcements, with two in particular that we believe are very significant.

First, we sold our rights to potential future milestone payments that we had received from the acquisition of Petra Pharma Corporation by Eli Lilly and Company for $12.3 million in cash, or $1.19 per share. We received these funds on May 18, 2022. Finally, although not as meaningful as Petra Pharma, we noted that TARA Biosystems, Inc. has been acquired by Valo Health, LLC. Under the terms of the acquisition, 180 will receive approximately $2.7 million in cash over the next 24 months and has the potential to receive an additional $3.3 million upon achievement of certain milestones. We received our upfront payment in early April 2022 and the next payment of approximately $275,000 is expected in early December 2022.

Secondly, and importantly, D-Wave Systems announced its intent to become a publicly traded company through a merger with DPCM Capital, Inc., (XPOA), a special purpose acquisition company. During Q2 2022, D-Wave and XPOA made material progress toward completion of this merger including securing additional financing and waiving of certain closing conditions by each company. D-Wave and XPOA received clearance from the SEC in July 2022 and the merger closed on August 5, 2022. 180 holds approximately 900,000 shares of common stock of the merged company that now trades under the symbol QBTS. While this is clearly an important milestone for D-Wave and our efforts to monetize our legacy private portfolio, it is important to note that 180 cannot trade its shares of D-Wave immediately. The shares of newly public D-Wave owned by 180 are subject to restrictions from trading until a registration statement is filed and deemed effective by the SEC and the expiration of a lockup period that will last four-to-six months from the date of the business combination depending on trading of the stock post-merger.

We have already transformed our business over the last five years away from the historical venture capital model and towards public and public related securities. These three announcements have supercharged that transformation. 180’s remaining private portfolio has only one material position, AgBiome, LLC, following these monetizations, and approximately 83% of our pro forma cash and investment assets are in cash and public and related securities. We believe this progress should enable us to narrow the discount at which our stock trades to our NAV.

* D-Wave valuation based on 180’s carrying value as of June 30, 2022.

This milestone was a transformation that started in June 2016, when I first joined the Board of Directors. At that time, our predecessor company’s balance sheet was comprised of 79% private assets and 21% net cash and public securities. Today, following the events in Q2 2022 and the public listing of D-Wave Systems, we are in a completely different place. Because of the greater transparency in the value of our holdings, it would make sense to us that our stock should narrow the discount it trades to our NAV. When we first took over the management of 180, we were very clear about what we hoped to accomplish, and I am pleased to report we have executed that strategy to the benefit of our shareholders.

With regard to the remaining legacy private portfolio, it decreased NAV by $0.12 per share, or $1.3 million. The largest contributors to this decline in value changes came from Phylagen (business risk), Echopixel (business risk), and Nanosys (financing terms).

EXPENSES

As noted in previous letters, we have dramatically reduced our cost structure under our new strategy. In 2016, before our Fund’s change in investment focus and management team, our operating expenses, excluding stock-based compensation and interest on outstanding debt, averaged approximately $1.3 million per quarter. For Q2 2022 our regular operating expenses equaled approximately $741,000. Based on the performance during the quarter, this amount includes the reversal of an accrual for certain deferred bonus amounts from 2020 in the amount of approximately $80,000. This amount, or a portion of it, could be reinstated in future quarters depending on performance and at the discretion of the Compensation Committee of our Board. We will maintain a lean cost structure (outside of fixed expenses for being a public company) focusing our expenses on activities solely designed to enhance our investment performance or to increase our revenues from managing outside capital. As has been the case since my arrival, the management team will only participate in a bonus pool if our performance warrants it. Our performance for 2022 to date doesn’t warrant a bonus pool.

TURN/NAV: SUM OF THE PARTS

As of the end of Q2 2022, TURN traded at 73% of NAV. Our securities of publicly traded and related companies, cash, and other assets net of liabilities were $5.98 per share. Our stock price was $6.13. If we receive 100% credit for the value of these assets net of liabilities, the market is ascribing a value of approximately $0.15 per share, or $1.6 million, to our private portfolio. Given our private assets are valued at approximately $24.6 million, the market is discounting the value of our legacy private portfolio assets by approximately 94% as of the end of Q2 2022. Again, this analysis has D-Wave in the legacy private portfolio. If you include the carrying value of D-Wave as of June 30, 2022, in our public and related portfolio holdings, our remaining legacy private portfolio companies have negative implied value. This negative implied value includes approximately $2.6 million we are contractually due over the ensuing 1.75 years from the sale of TARA Biosystems to Valo.

At the end of the day, the legacy private portfolio, other than AgBiome, is currently irrelevant to our future success. Given how painful the market has been in 2022, we think the current construct of our balance sheet has provided a true floor for our share price. While none of 2022 has been fun, had 2017-2021 not occurred our share price would be nowhere near where it is trading today.

CONCLUSION

We had a very similar Q2 2022 versus Q1 2022, although this quarter our performance was in line with the Russell Benchmark (not that I care). It is important to remain focused, disciplined, agnostic, and emotionless during periods like we are living through. The good news for us, as I have said countless times, is that TURN has permanent capital. Nobody can take the money away from our shareholders. The second thing we have going for us is that we use activism as part of our Graham and Dodd value process to enhance our ability to improve our investment results. We will use our activism to ensure that the management teams and boards of the company’s we own are working for every constituent, not just themselves.

I read a lot, am a student of history, and always try to learn and make sense of where we are and where we are going. Remember one of the white papers we wrote this year reflected our views:

Reasons for Hope in a World of Bad News

It's extremely difficult to watch the news and not feel overwhelmed by the avalanche of negative headlines. Some of them, such as the war in Ukraine, are heartbreakingly negative, outright terrifying, and tragic. Others such as inflation, the corresponding looming Fed hikes and extreme volatility are clearly linked, but, at the same time, add to the sense of gloom that pervades the current US equity markets.

Despite this glut of negativity that we see playing out on television each day, are there reasons to be constructive on market performance for the remainder of 2022? Believe it or not, we believe there are.

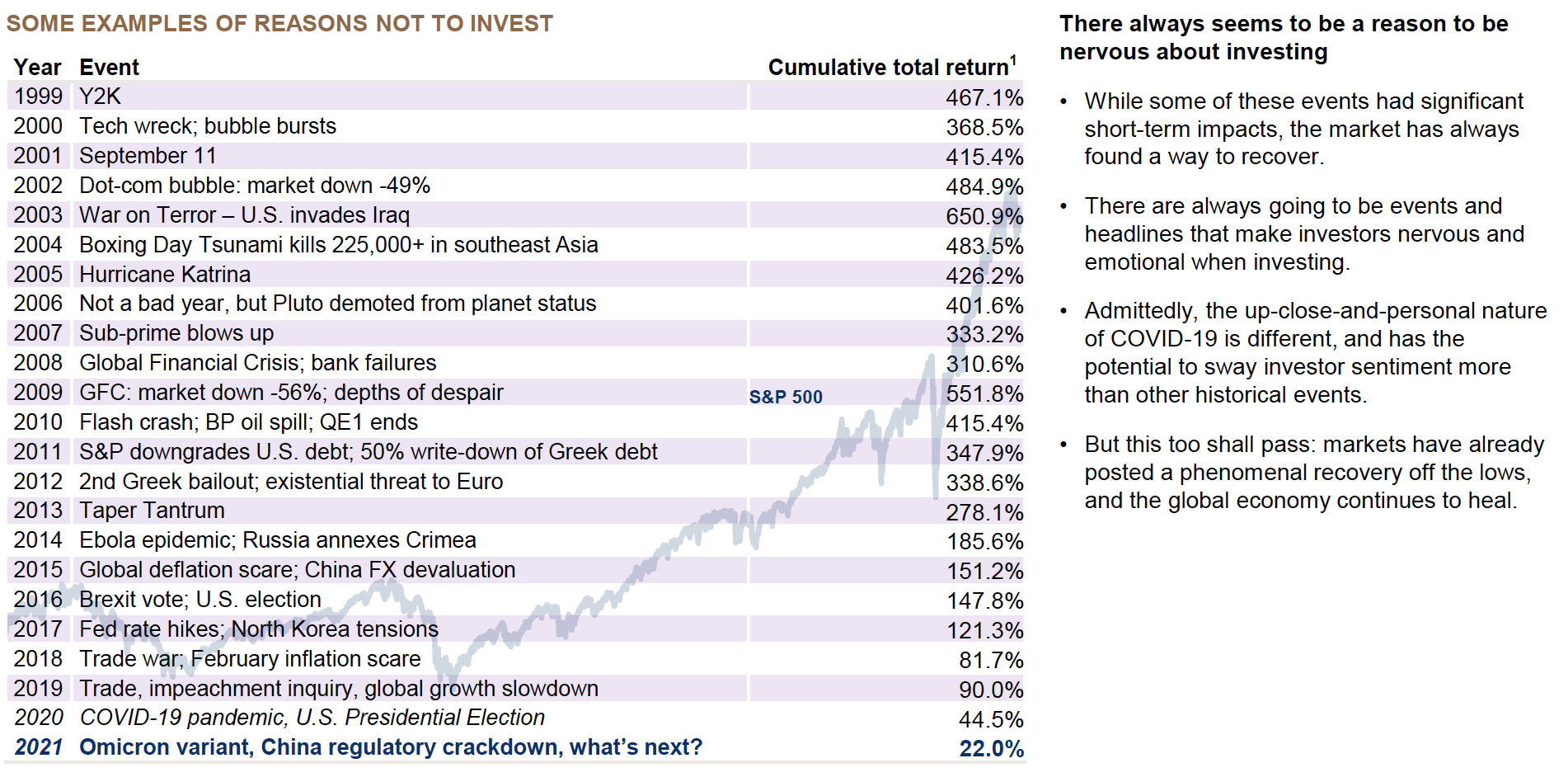

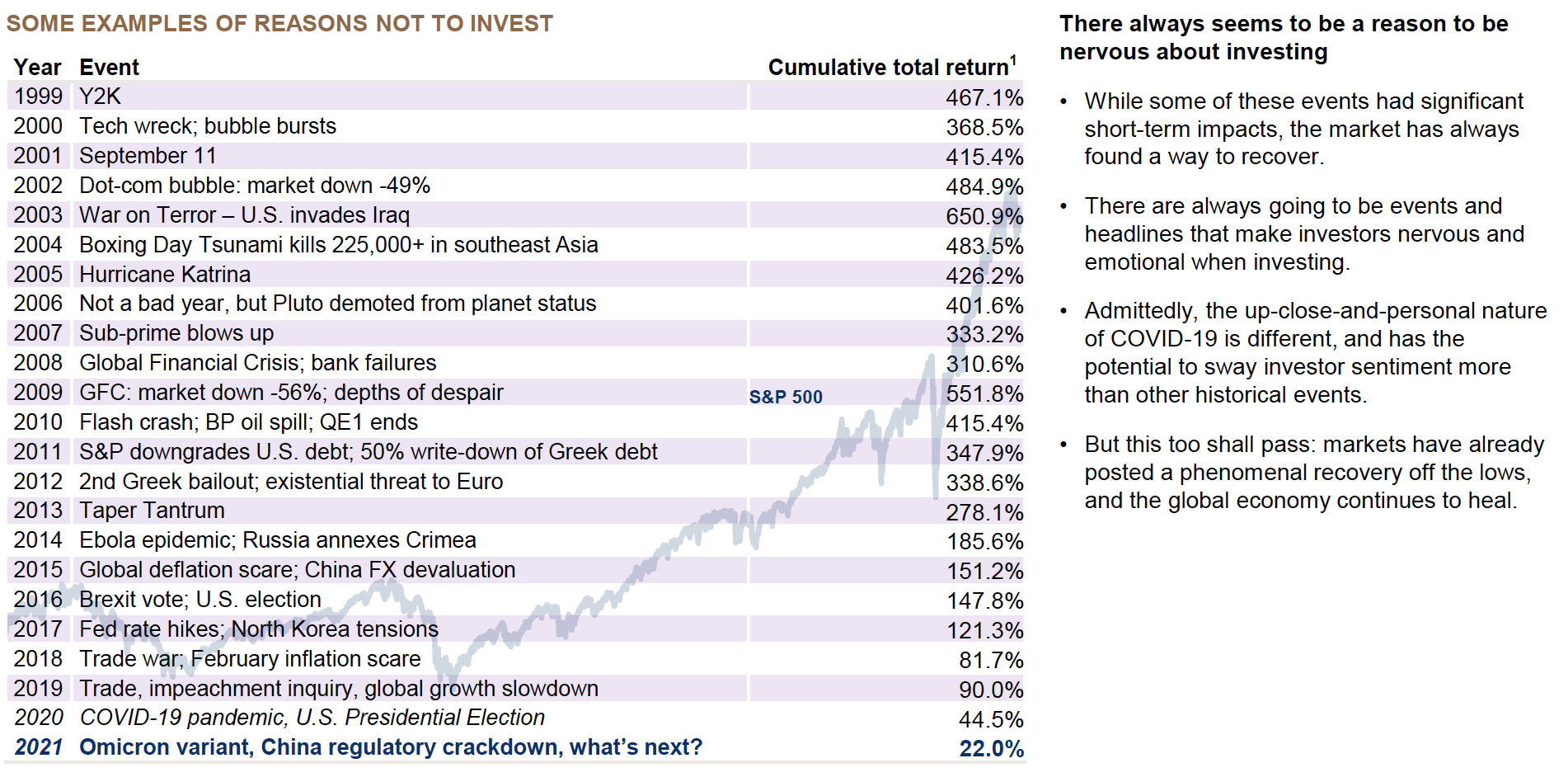

Let’s start with the on-going war in Ukraine. Clearly what is happening there is a human tragedy on a level that is hard to find adequate words for. Further, it’s clear that it has had a negative effect on the market for a litany of reasons. Setting aside the incredible human cost, what effects are likely to impact the market for the remainder of 2022? We will not pontificate on how we see this ending other than to say it feels like a poorly planned miscalculation on the part of Putin. We would feel arrogant attempting to claim we know how this will end, particularly when Putin seems to be relying less on calculated precise strategy and more on pure emotion. While this event is casting a scary pall over the market, it is not the first nor the last “bad news” event that in the moment feels like a headwind that can never be overcome. We aren’t suggesting any of the below events carry the same magnitude as today's current events, but, for example, if you flashback to March of 2020 at the onset of the Pandemic, was the market convinced at that time that the market would be materially higher over the next 18 months? No. Circumstances change and markets evolve.

Sources: J.P. Morgan Private Bank. FactSet. [1] Cumulative total returns for S&P 500 are calculated from December 31 of the year prior until January 31, 2022.

Clearly, each of these headwinds were unique, but the point is that it seems reasonable that the current war alone should not be enough to keep the market negative. We have priced in quite a bearish scenario as we look at individual companies from a valuation perspective.

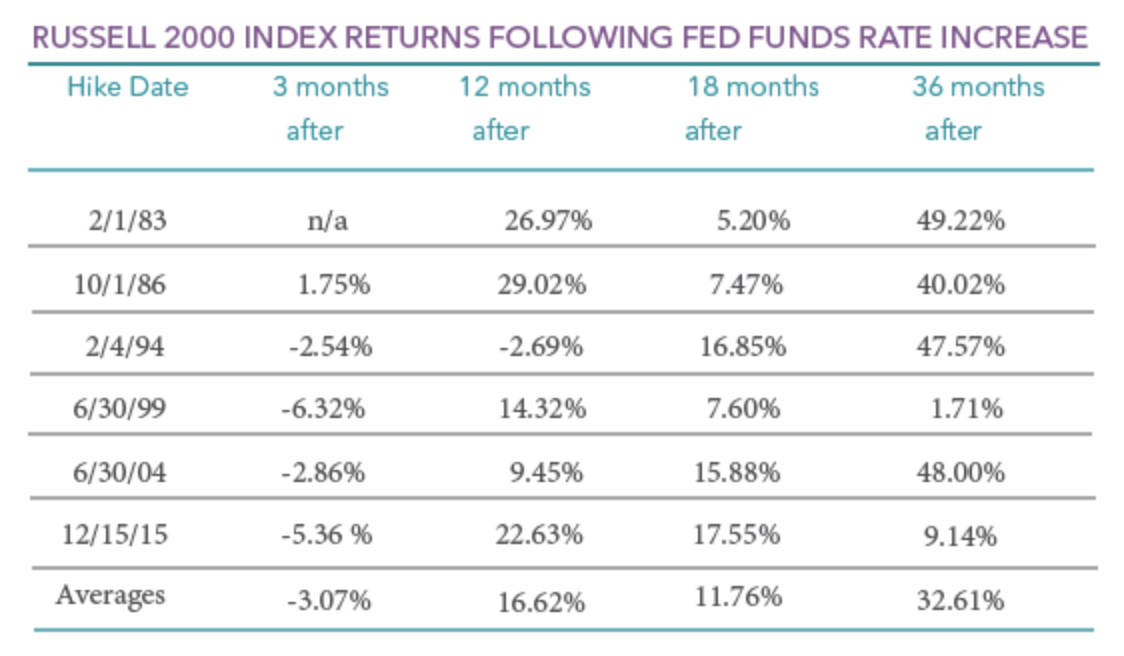

What about inflation and the corresponding rate hikes? The CPI release on March 10, 2022, was just the most recent data point reflecting high inflation and the necessity for rate hikes (with the first 25 basis points of tightening occurring on 3/16). Our last piece from February 2022 that can be found at https://secureservercdn.net/198.71.233.29/h7s.91a.myftpupload.com/wp-content/uploads/2022/02/Inflation-impact-on-small-caps-Feb-2022.pdf made the strong case that small cap equities had historically experienced strong performance following the first Fed rate hike in a cycle. The chart below, which we included in that piece makes a strong case for the potential for positive market performance of small cap stocks over the rest of 2022 despite the looming rate hikes.

Source: Perritt Capital Management

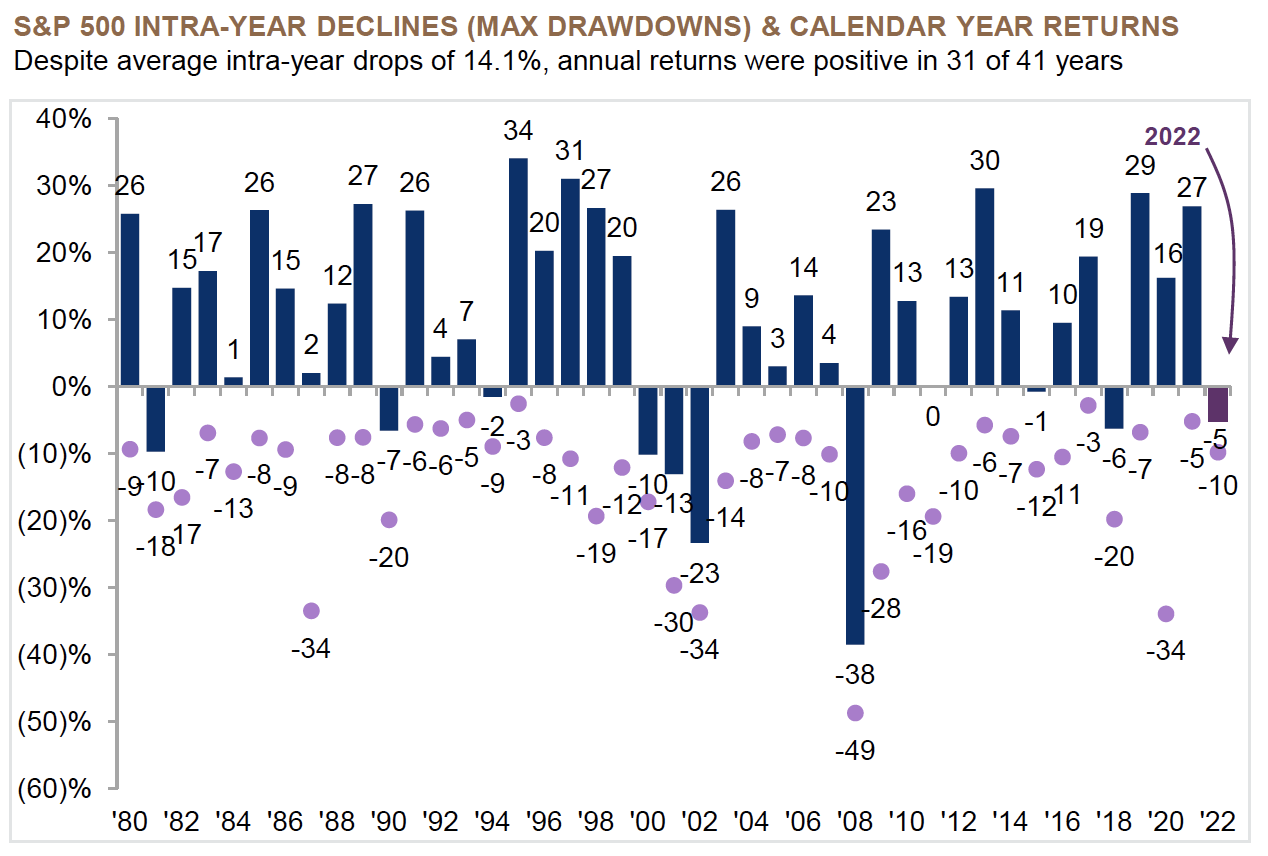

Not surprisingly, war and inflation lead to high volatility. This is to be expected. However, historically this kind of volatility has both presented buying opportunities and has not normally resulted in negative annual returns for the US equity markets. As the chart below shows, despite average peak to trough drops of 14.1%, the market has had a positive annual return in 31 of 41 years.

Sources: FactSet, Standard & Poor’s, J.P. Morgan Asset Management - Guide to the Markets. Returns are based on price index only and do not include dividends. Intra-year drops refer to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to present year. Data is as of January 31, 2022. It is not possible to invest directly in an index. Analysis is based on the J.P. Morgan Guide to the Markets – Principles for Successful Long-term Investing.

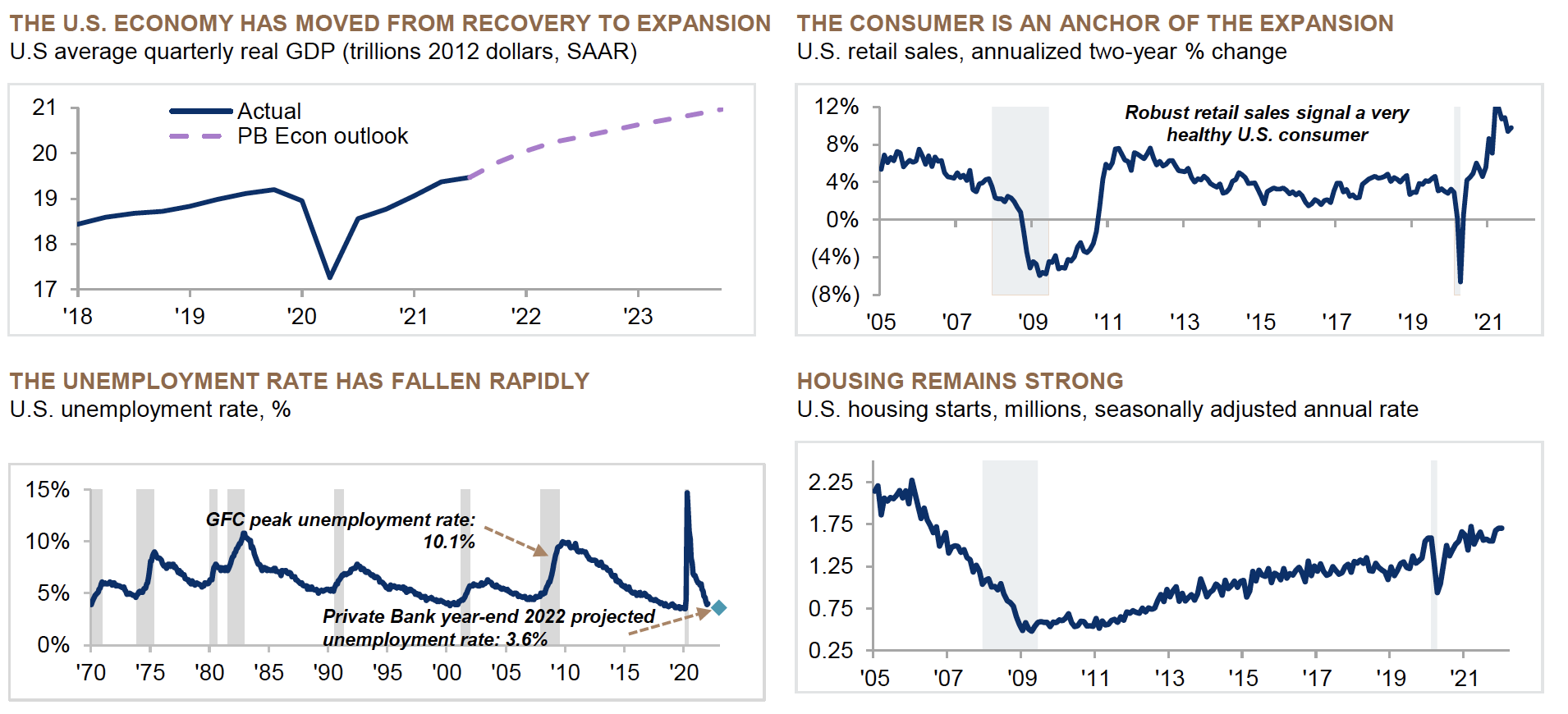

By far, the most fundamental reason to maintain a positive outlook on US equities for the remainder of 2022 is that the US economy remains strong and is expected to grow, and a strong US economy means continued earnings growth.

Sources: (Top left) Macroeconomic Advisers, Bloomberg Finance L.P, J.P. Morgan Private Bank. Data is as of November 30, 2021. Note: Actual GDP extended through September using Fed Weekly Economic Index. (Bottom left) Bureau of Labor Statistics, NBER, Haver Analytics. Data is as of January 31, 2022. (Top right) U.S. Census Bureau, NBER, Haver Analytics.

Data is as of January 31, 2022. (Bottom right) U.S. Census Bureau, NBER, Bloomberg Finance L.P. Data is as of January 31, 2022.

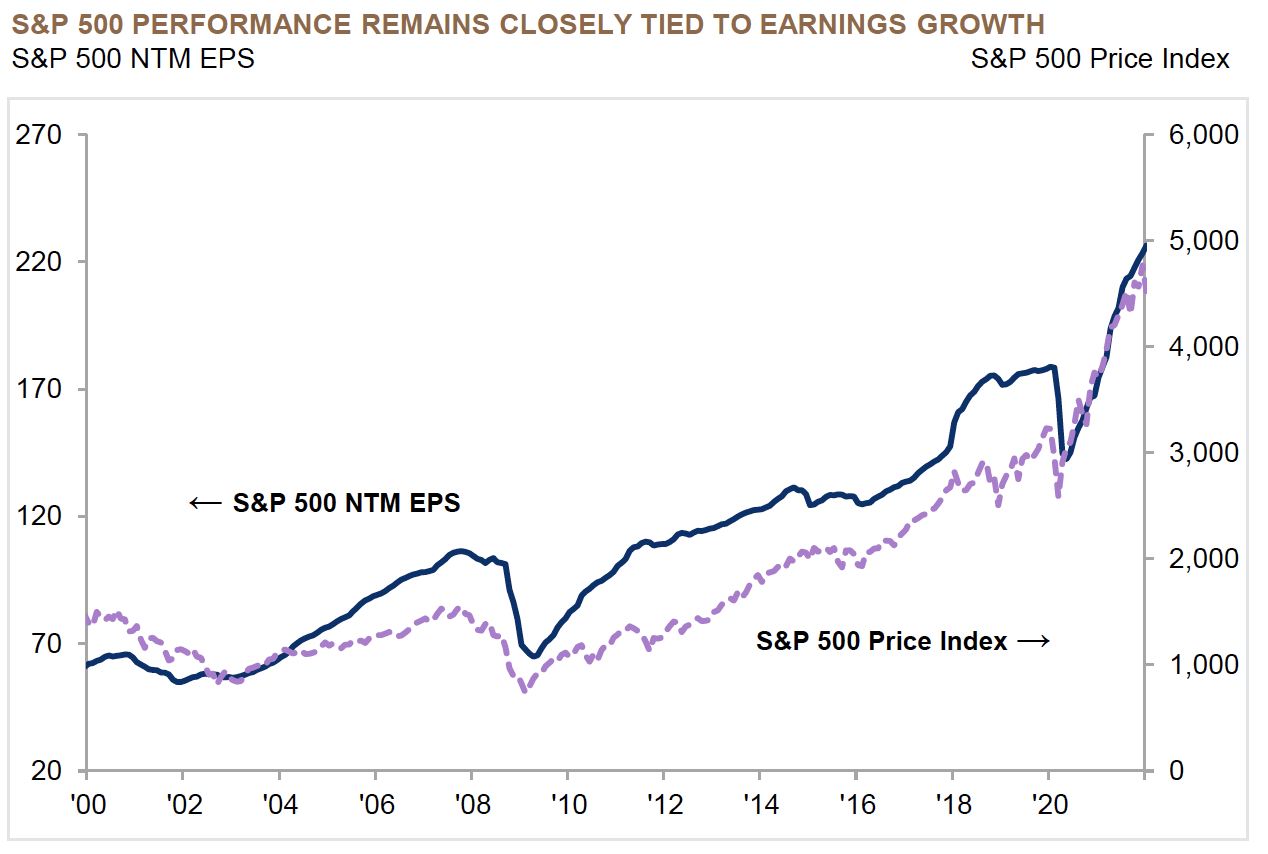

Further, all of the above negative factors should ultimately be overwhelmed by strong earnings growth, which currently most analysts believe that we will continue to see. Investing in companies that are able to navigate through these myriad issues and grow their earnings has historically been a winning formula.

Sources: Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Data as of January 31, 2022. S&P 500 NTM EPS refers to analyst estimates for S&P 500 earnings over the next 12 months.

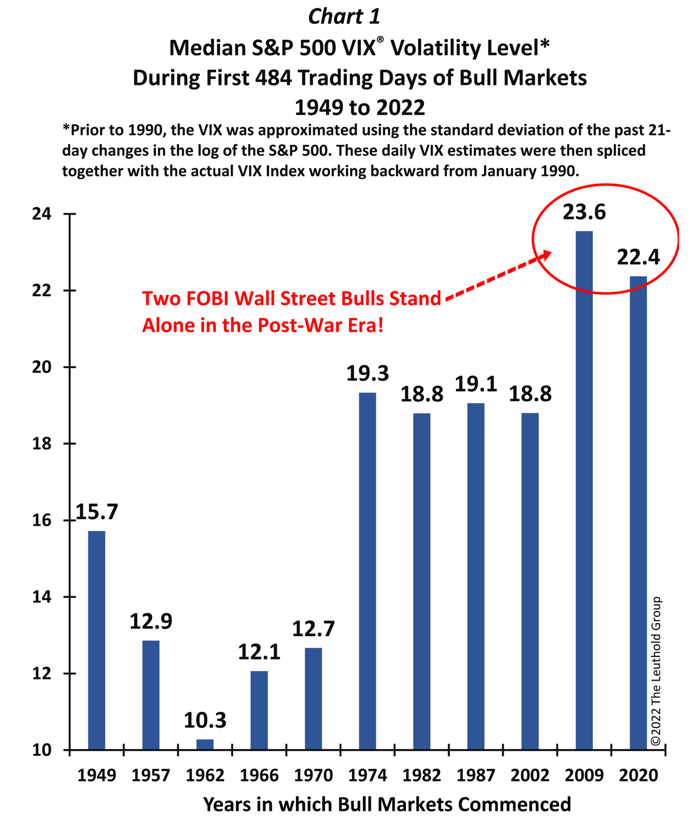

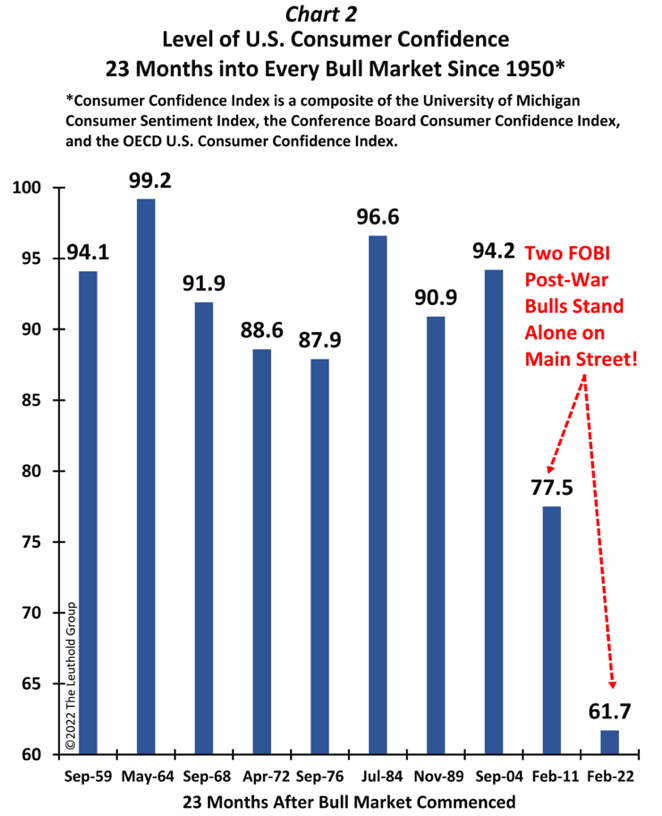

One final reason that we see for optimism around the US equity market is actually somewhat counterintuitive. The two charts below show the VIX and consumer confidence during various bull markets over the years. As you can see, volatility, as measured by the VIX, is extremely high despite the bull market that US equity markets have been experiencing. This suggests that despite the run up in the market, many investors have trepidations. Further, consumer confidence is as low as it has been during a bull market—another indication of underlying concern. This suggests to us that despite the strong upward move in the market since 2020, there has remained a constant fear amongst investors. We believe this fear has caused the market to sell very quickly on any hint of bad news, but further, and importantly, it has likely provided a floor to market sell offs as nervous investors have likely already taken steps to manage downside risk given the jitters that the charts below imply they are experiencing.

Source: The Leuthold Group

We will agnostically and objectively analyze our performance and report on it to you. Fortunately, at 180, we have had significantly more outperforming quarters versus underperforming ones, and, as a result, our funds have had great runs of performance. One of the many lessons I learned along the way is that a quarter’s return doesn’t matter. Good or bad. Go back and read our shareholder letter from a quarter when we significantly outperformed. What relevance did that letter have to this quarter’s performance? None. What does this past quarter’s performance say about how we are going to perform over the next year? Nothing. You have to have the right temperament to be a money manager and the appropriate amount of perspective.

Now don’t take that the wrong way. For anyone that knows us, they know we care about every last tick of every stock we own every day of the week. We have an intensity for getting it right every day and not being blinded by “only focusing on the long term.” I personally own 500,000 shares of TURN bought with after-tax dollars of my own money. I care. Daniel owns over 200,000 shares, most of which he purchased with after-tax dollars of his own money. He cares. We and other members of our team continue to buy TURN stock each and every quarter. But, if you ask me the relevance of performance in any one quarter, I will tell you it isn’t that relevant to the big picture because we have permanent capital. The big story for us is we took $16 million of cash and public assets in the middle of 2016 and turned that into $68.7 million on a pro forma basis. This environment might ultimately be the catalyst that will allow us to go from where we are to $200 million over the next four years.

In 2022, investors are fixated on the inflationary and disrupted supply chain environment that is likely to lead to higher interest rates and the potential for slower growth, stagflation and a recession. COVID-19 never seems to go away, and now we have Russia’s ongoing invasion of Ukraine. All of these factors have caused dislocations in the markets and dramatic declines in equity indices. Put simply, it is a market filled with fear. The inflationary supply chain issues are real and are providing a serious headwind for the market and the economy. The Russian invasion of Ukraine has been a depressing humanitarian tragedy coupled with the potential for supply chain issues of food and energy. The markets are presently experiencing extreme volatility and vicious selling. Despite this glut of negativity that we see playing out on television each day, are there reasons to be constructive on market performance for the remainder of 2022? Believe it or not, we believe there are.

Let’s start with the on-going war in Ukraine. Clearly what is happening there is a human tragedy on a level that is hard to find adequate words for. Further, it’s clear that it has had a negative effect on the market for a litany of reasons. Setting aside the incredible human cost, what effects are likely to impact the market for the remainder of 2022? We will not pontificate on how we see this ending other than to say it feels like a poorly planned miscalculation on the part of Putin. We would feel arrogant attempting to claim we know how this will end, particularly when Putin seems to be relying less on calculated precise strategy and more on pure emotion. While this event is casting a scary pall over the market, it is not the first nor the last “bad news” event that in the moment feels like a headwind that can never be overcome. We aren’t suggesting any of the below events carry

the same magnitude as today's current events, but, for example, if you flashback to March of 2020 at the onset of the pandemic, was the market convinced at that time that the market would be materially higher over the next 18 months? No. Circumstances change and markets evolve.

Clearly, each of these headwinds were unique, but the point is that it seems reasonable that the current war alone should not be enough to keep the market negative. We have priced in quite a bearish scenario as we look at individual companies from a valuation perspective.

While it is never fun to live through nasty selloffs, we need washouts like the one we are currently experiencing to find the stocks that offer enormous upside. We intentionally run a concentrated portfolio of small cap companies. Way more often than not, our shareholders have seen the benefit of that strategy by benefiting when we get our stock picking right. Of course, with the upside potential comes periods like we are in where you see the risk of managing a concentrated portfolio. The market for microcaps is filled with inefficiencies and asymmetric risk/reward characteristics. If you get your stock picking right, you can achieve outsized returns. Based on our research, we believe many of the individual companies we own have upside of 100% over a three-year period. We have permanent capital and the opportunity to take advantage of the current dislocation is easier for us because we don’t have to sell to service redemptions. We are here for the long haul, we are going to make rational objective decisions, and we are going to use our activist approach when the situation calls for it. One thing I know is, it isn't easy and this hasn’t been fun. But don’t look for someone to tell you “It's ok to invest again, you have the all clear” as they are ringing a bell declaring today to be the bottom. I also have never run away from a challenge and despite getting repeatedly punched in the face by Mike Tyson, I can promise you we will be back for more tomorrow. And the day after. And the day after that. We look forward to reviewing our subsequent quarters as the year unfolds. It's time to get back on the roller coaster.

Thank you for your continued support.

Kevin Rendino

Chairman and Chief Executive Officer

Forward-Looking Statements and Disclaimers

This shareholder letter may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company's current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this press release. Please see the Company's securities filings filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company's business and other significant factors that could affect the Company's actual results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The reference and link to any websites have been provided as a convenience, and the information contained on such website is not incorporated by reference into this shareholder letter. 180 Degree Capital Corp. is not responsible for the contents of third-party websites. The information discussed above is solely the opinion of 180 Degree Capital Corp. Any discussion of past performance is not an indication of future results. Investing in financial markets involves a substantial degree of risk. Investors must be able to withstand a total loss of their investment. The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions.

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES (UNAUDITED) |

| | | | | |

| | June 30, 2022 |

| ASSETS | |

| Investments in securities and other financial instruments, at value: | |

| Unaffiliated publicly traded equity and equity-related securities (cost: $33,433,748) | $ | 27,175,207 | |

| Unaffiliated legacy privately held equity and equity-related securities (cost: $12,886,349) | 20,290,917 | |

| Non-controlled affiliated publicly traded equity and equity-related securities (cost: $28,119,487) | 21,443,194 | |

| Non-controlled affiliated legacy privately held equity and equity-related securities (cost: $6,496,930) | 1,046,648 | |

| Controlled affiliated equity and equity-related securities (cost: $2,880,646) | 5,970,633 | |

| Unaffiliated derivative securities (cost: $149,042) | 0 | |

| Non-controlled affiliated derivative securities (cost: $224,849) | 232,632 | |

| Unaffiliated rights to payments (cost: $3,561,459) | 3,290,766 | |

| Cash | 8,004,055 | |

| Prepaid expenses | 183,743 | |

| Receivable from managed funds | 152,151 | |

| Receivable from securities sold | 78 | |

| Lease-asset | 91,094 | |

| Other receivables | 10,367 | |

| Other assets | 22,259 | |

| Total assets | $ | 87,913,744 | |

| LIABILITIES & NET ASSETS | |

| |

| Post-retirement plan liabilities | $ | 807,166 | |

| Accounts payable and accrued liabilities | 293,004 | |

| Lease obligation | 91,094 | |

| Payable for securities purchased | 77,964 | |

| Total liabilities | $ | 1,269,228 | |

| Commitments and contingencies (Note 10) | |

| Net assets | $ | 86,644,516 | |

| Net assets are comprised of: | |

| Preferred stock, $0.10 par value, 2,000,000 shares authorized; none issued | $ | 0 | |

| Common stock, $0.03 par value, 15,000,000 shares authorized; 11,541,079 issued | 334,594 | |

| Additional paid in capital | 118,997,664 | |

| Total accumulated distributable loss | (28,082,217) | |

| Treasury stock, at cost 1,167,259 shares | (4,605,525) | |

| Net assets | $ | 86,644,516 | |

| Shares outstanding | 10,373,820 | |

| Net asset value per outstanding share | $ | 8.35 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

21

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF OPERATIONS (UNAUDITED) |

| | | | | |

| Six Months Ended

June 30, 2022 |

| Income: | |

| Other (Note 2) | $ | 202,077 | |

| Dividend | 11,579 | |

| Total income | 213,656 | |

| Operating fees and expenses: | |

| Professional | 304,585 | |

| Administration and operations | 246,727 | |

| Salaries, bonus and benefits | 236,219 | |

| Insurance | 169,984 | |

| Directors | 143,750 | |

| Custody | 16,400 | |

| Rent | 14,872 | |

| Other | 4,591 | |

| Total operating expenses | 1,137,128 | |

| Net investment loss before income tax expense | (923,472) | |

| Income tax expense | 3,163 | |

| Net investment loss | (926,635) | |

| Net realized gain (loss) from investments: | |

| Unaffiliated publicly traded equity and equity-related securities | 1,096,833 | |

| Unaffiliated legacy privately held equity and equity-related securities | 5,990,170 | |

| Non-controlled affiliated publicly traded equity and equity-related securities | (9,846) | |

| Non-controlled affiliated legacy privately held equity and equity-related securities | (2,365,432) | |

| Call options | 35,909 | |

| Net realized gain from investments | 4,747,634 | |

| Transferred shares-value | (196,290) | |

| Net realized gain | 4,551,344 | |

| Change in unrealized (depreciation) appreciation on investments: | |

| Unaffiliated publicly traded equity and equity-related securities | (15,533,242) | |

| Unaffiliated legacy privately held equity and equity-related securities | (1,405,139) | |

| Non-controlled affiliated publicly traded equity and equity-related securities | (9,508,569) | |

| Non-controlled affiliated legacy privately held equity and equity-related securities | 1,216,889 | |

| Controlled affiliated equity and equity-related securities | (912,067) | |

| Unaffiliated rights to payments | (1,414,017) | |

| Net change in unrealized depreciation on investments | (27,556,145) | |

| Net realized gain and change in unrealized depreciation on investments | (23,004,801) | |

| Net decrease in net assets resulting from operations | $ | (23,931,436) | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

22

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED) |

| | | | | |

| Six Months Ended

June 30, 2022 |

| Cash flows provided by operating activities: | |

| Net decrease in net assets resulting from operations | $ | (23,931,436) | |

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash provided by operating activities: |

| Net realized gain from investments | (4,551,344) | |

| Net change in unrealized depreciation on investments | 27,556,145 | |

| Depreciation of fixed assets | 4,483 | |

| Other income-non-cash | (1,094,014) | |

| Call options purchased | (174,765) | |

| Call options written | 210,674 | |

| Purchase of unaffiliated publicly traded equity and equity-related securities | (13,331,218) | |

| Purchase of non-controlled affiliated publicly traded equity and equity-related securities | (1,697,908) | |

| Purchase of controlled affiliated equity and equity-related securities | (50,000) | |

| Proceeds from sale of unaffiliated publicly traded equity and equity-related securities | 8,748,031 | |

| Proceeds from sale of non-controlled affiliated publicly traded and equity-related securities | 16,763 | |

| Proceeds from sale of non-controlled affiliated legacy privately held equity and equity-related securities | 67,641 | |

| Distribution from sale of unaffiliated rights to payments | 12,310,608 | |

| Changes in assets and liabilities: | |

| Decrease in receivable from managed funds | 2,167,107 | |

| Decrease in receivable from portfolio securities | 891,937 | |

| Decrease in prepaid expenses | 168,922 | |

| Decrease in receivable from sales of securities | 73,081 | |

| Increase in other receivables | (240) | |

| Decrease in other assets | 113 | |

| Decrease in bonus payable | (3,281,875) | |

| Decrease in post-retirement plan liabilities | (17,724) | |