UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-07074

| | |

| 180 DEGREE CAPITAL CORP. |

| (Exact Name of Registrant as Specified in Its Charter) |

| | | | | | | | |

| 7 N. Willow Street, Suite 4B, Montclair NJ | | 07042 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | |

Daniel B. Wolfe

President and Chief Financial Officer

180 Degree Capital Corp.

7 N. Willow Street, Suite 4B

Montclair, NJ 07042 |

| (Name and address of agent for service) |

|

Copy to:

John J. Mahon, Esq.

Schulte Roth & Zabel, LLP

1152 Fifteenth Street, NW

Suite 850

Washington, DC 20005

(202) 729-7477 |

Registrant's telephone number, including area code: (973) 746-4500

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Item 1. Report to Shareholders.

Fellow Shareholders,

"There are decades where nothing happens; and there are weeks where decades happen."

-- Vladimir Ilyich Lenin

It feels wrong somehow to be quoting Lenin given the destruction Putin’s Russia has caused in Ukraine, but destruction seems to be an appropriate word to sum up 2022. December of 2022 felt like a decade. The full year of 2022 felt like a century.

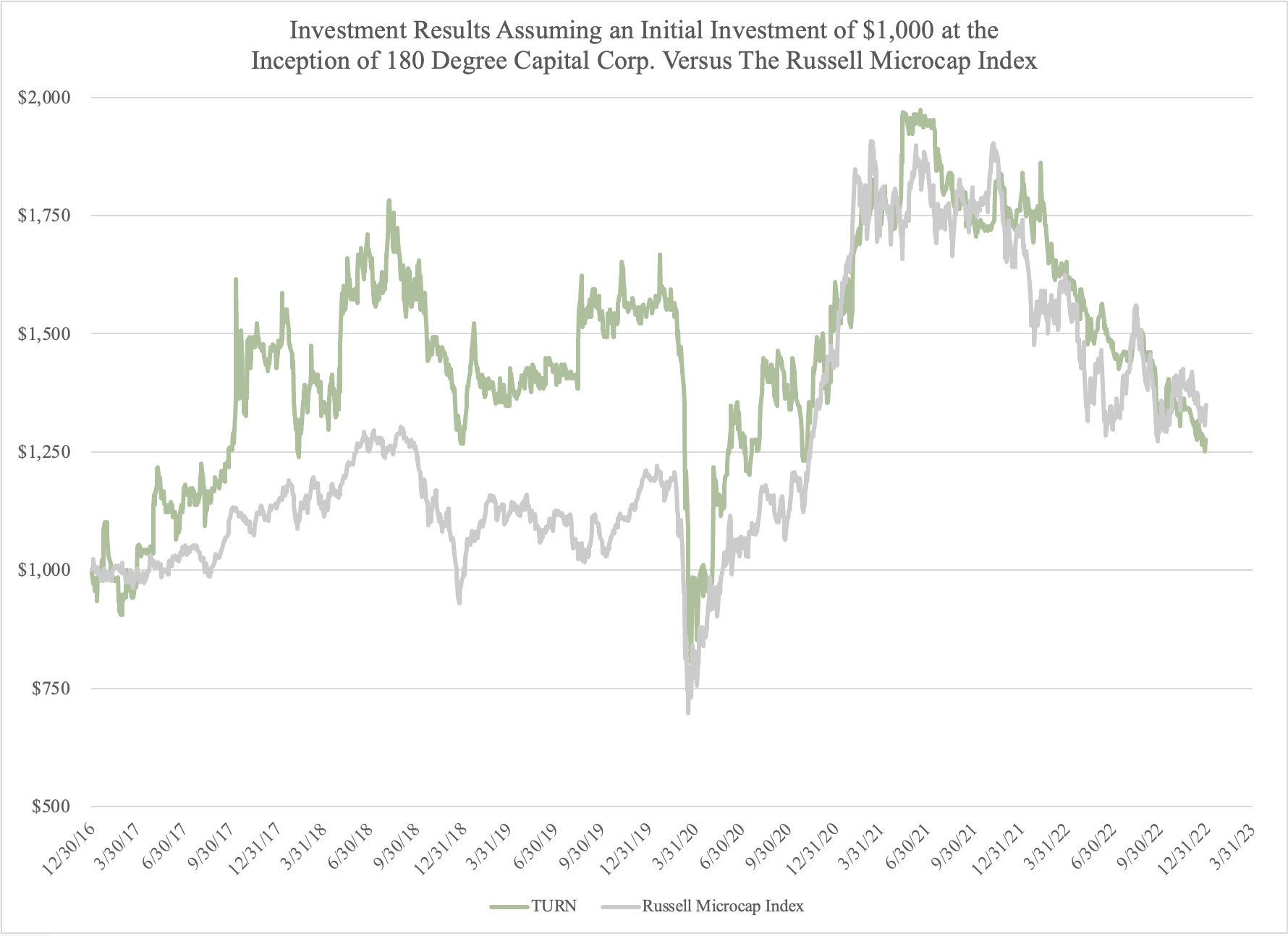

I thought it would be useful for me to sum up 180's year right at the beginning of this letter, rather than making you read seven pages (although I believe they will be an interesting read for you) before getting to the conclusion. After five years of exceptional performance, 2022 was anything but exceptional; put simply, we have a job to do, and we didn’t do it. While 2022 was a historically bad market, our performance during 2022 was disappointing, and we own that. The Russell Microcap Index was down 22%, and we were down more. Add it to the write-downs we took in the historical Harris & Harris Group portfolio, and 2022 couldn't end soon enough. We own a significant stake in TURN. Between Daniel and I, we own over 800,000 shares, or over 8% of TURN. When you include the other employees of TURN, who have all also purchased stock with after-tax dollars, this ownership percentage increases to almost 10% of TURN. We have had economic alignment with every shareholder of TURN from the day we arrived and that will never change for as long as I am in this seat. At the end of the day, the most important thing for us to achieve is a higher share price.

For the five years ending in 2021, our gross total return for our strategy in the public stock market including carried interest generated on our separately managed accounts (SMAs) was 405.5% versus 73.8% for the Russell Microcap Index. During that time and in many shareholder reports, I talked about the volatility that can occur when you run a concentrated portfolio of seven-to-ten names. Up until last year, we only experienced the “good” volatility. While losing money is never enjoyable, it should not be surprising that from time to time we are going to have periods where we come up well short of our expectations; 2022 was that year.

From the moment I arrived, I promised 100% transparency, both in good times and bad. In the down periods, the last thing I am ever going to do is sugar coat or make excuses. The reason for that is I have always believed that portfolio managers should be allowed to lose, though not every year and not often. If you have been in this business for a while and have never underperformed, then you have never managed money. I remember in one of my previous down years at a previous employer, I was out of town and my boss (a new one) was going to present our performance for a particular quarter to the mutual fund's Board; these presentations were fairly common and normal. Following the performance review with the Board, my boss called me during my travels, and instead of being direct with me, he was shifting his criticism of me on to the Board. I was miserable enough to begin with, so the last thing I needed was a non-supportive boss, especially considering the fact that my fund had rarely underperformed in the prior 11 years of managing money. I remember exactly where I was standing in Cincinnati, Ohio, while on my cell phone seething at the notion that after all these years, I wasn’t getting supported by my boss. To make matters worse, he had the audacity to make up fake criticism from the Board; as if that was meant to be some motivating or scare tactic. Trust me, I am no wallflower. I don’t need anyone telling me things will be fine when they aren't. I have a thick skin, and I don’t need validation from others. But I certainly had no time or patience for someone who was ready to pile on and use the Board as fake criticism. I knew damn well the Board, while not thrilled, would have completely understood that every PM struggles from time to time. So, after listening to my boss’s passive aggressive garbage for about ten minutes, I offered him the following response, “Do me a favor, either tell me to fly back to the office so you can fire me, or else I expect you to lend your full support of me and my team to the Board (who wasn’t even all that bothered to begin with). I am not going to listen to this. I feel badly enough not meeting the high expectations to which I hold myself accountable." Of course, the bully backed down.

After that conversation, I lost whatever respect I had for him. At the very next chance I could get, I made sure that the only way I would stay in the organization was if I didn’t have to report to him ever again. The point is, we take managing other people's money to heart, and when we fail, we suffer alongside every shareholder. By the way, you know how that story with my boss ends? Following that poor year, we had two of the best years we ever had. 2022 was a failing year. No way around that. We will give you the facts and offer commentary; but nary an excuse. In this letter, we will talk about our performance for what it was, and then move on to 2023. By the way, it’s worth noting that as of the close of business on February 23, 2023, our quarter-to-date gross total return for our public and public-related portfolio is up 14.8% vs 7.0% for the Russell Microcap Index.

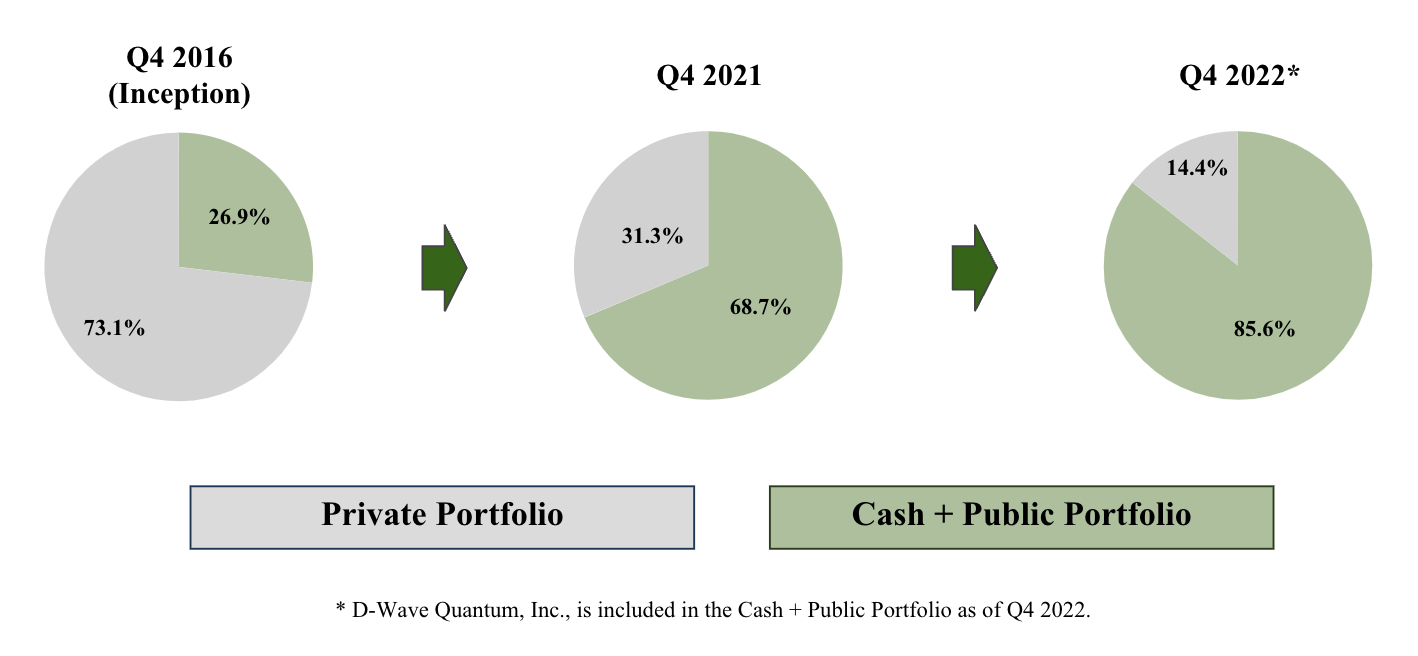

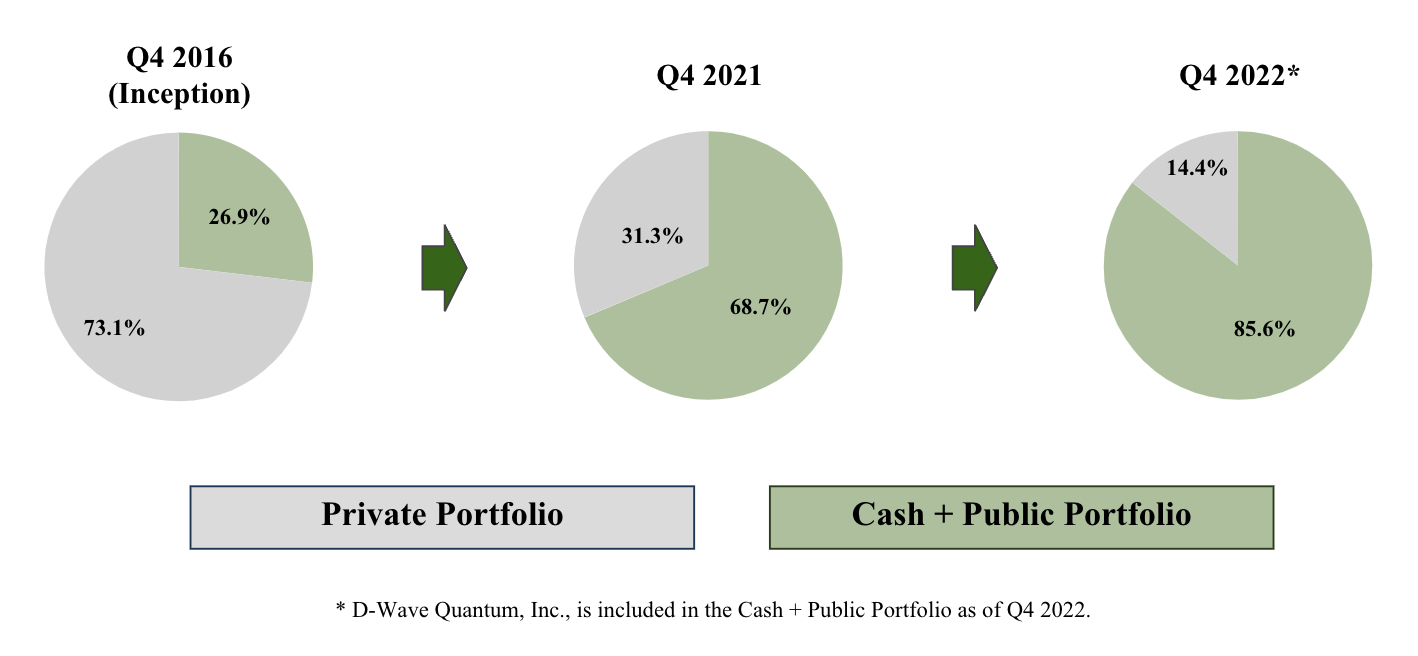

When we took over this business back in 2017, we inherited a balance sheet that had 73% of its invested assets and cash in illiquid securities of privately held companies, a completely failing business model because of bloated expenses, and a questionable track record for selecting VC investments. We have fought through the mistakes of the prior management team by achieving extraordinary performance in our public strategy from 2017-2021. Because of this strong performance in the public markets, the terrible performance of the legacy private portfolio was largely mitigated. In a bull market and for the five

years ended 2021, our legacy private portfolio generated net losses of approximately $7.4 million, or $0.71 per share.1 That’s quite the achievement, isn’t it? And, to make matters worse, in this past quarter we wrote down the value of several of our private holdings due to a number of factors including business-specific inputs and decreases in public market comparable companies, as applicable to each holding. Harris & Harris Group is truly the gift that keeps on giving as 65% of our Q4 2022 decline in net asset value per share (NAV) was generated from write downs in the value of AgBiome, LLC and D-Wave Quantum, Inc. The legacy Harris & Harris Group portfolio as a whole accounted for 71% of the decline in NAV.

Managing money is difficult and we take ownership of the things we can control; we will never ever hide from that. 2022 was made even more challenging due to the sins of Harris & Harris Group’s past; things over which we simply had little to no control. While that is infuriating to us, it is what it is and it's over. In this quarter alone, D-Wave cost us $5.5 million, or $0.53 per share, and AgBiome cost us $6.5 million, or $0.63 per share. Fortunately, the remaking of our company is for the most part over. As of December 31, 2022, we had over 86% of our total investment assets in our public markets-focused strategy and cash. The good news is our legacy private portfolio is now valued at less than 14% of our total NAV. Good riddance to 2022.

Many bubbles were popped in 2022, as the days of tripling your money in a matter of days or weeks in meme stocks evaporated once the Fed began raising rates, Russia waged war with Ukraine, and inflation began to rear its ugly head due to the unbalanced effect of COVID-19 impacting global supply chains. The Russell Microcap Index collapsed over 30% from its

November 2021 high, and the “don’t fight the Fed” folks forecasted a rather dire economic climate including the following scenarios that they and the markets were convinced with 100% certainty would occur:

1.This will be the worst recession we will have had in years.

2.Inflation will be with us forever.

3.This bear market will be with us for a very long time.

With 2022 in the rear view, and our sights on 2023, being Pollyannish isn’t part of our thinking as we acknowledge that rates are materially higher than where they were just 12 months ago, and this increase will no doubt have a dampening effect on global growth rates as well as equity valuations. Here is a nutshell of our views which will be supported by a number of charts and research we have come across in the last several months.

1.Our overall view is inflation peaked and the multitude of fed rate hikes have already had a significant effect in lowering inflation.

2.We believe we are already in some sort of a recession given real GDP has declined for more than 2 quarters in a row.

3.We do not believe we are headed for financial Armageddon like 2008 when we had $1.3 trillion of sub‑prime mortgage assets on the balance sheets of banks and insurance companies. The financial leverage simply doesn’t exist like it has in the past.

4.We believe stock price valuations have significantly discounted dire economic outlooks that are not occurring currently and may never occur.

5.We believe we are headed to a “normal” environment where the market can no longer rely on free money and the intravenous elixir of quantitative easing and 0% interest rates. Stocks will have competition from the bond market and we expect multiples as a whole to contract. Bubbles will continue to be popped, and slower growth rates will inevitably occur.

6.For the time being, and we believe rightly so, gone are the gold rush days where talking heads, financial thieves, and children pontificate endlessly on how “things have changed” and we are in “a new world order,” with these individuals arguing for an entirely new investment landscape.

In medieval Italy, people roamed throughout the land selling fake remedies and making false claims about their healing abilities. Many of these pretenders reputedly came from a village called Cerreto, and as a result, Cerretano (meaning “inhabitant of Cerreto”) became an epithet for a quack physician. In addition, these frauds used a practiced patter to attract customers, like the chatter of a circus barker. The Italian word for “to chatter” is ciarlare, and chattering was very much associated with the Cerretano, that the spelling of the word shifted to Ciarlatano. By the early 17th century, English speakers had anglicized the Italian word to charlatan and adopted it as their own.

Meet Sam Bankman-Fried, a modern day charlatan, and a first ballot hall of fame snake in the ground who is emblematic of the free money, valuations-don’t-matter bubble that was popped in 2022. I read the below quotes from a piece written by James Ferguson at MacroStrategy Partners:

---------------------------------

1. Net losses of the legacy private portfolio include the change in value of Mersana Therapeutics, Inc., (MRSN) from December 31, 2016, through the expiration of the lockup on December 26, 2017. Prior calculations of change in value of MRSN were included from December 31, 2016, through the date of MRSN’s IPO on June 27, 2017. The difference between these two measurement periods is +$0.07 per share.

“I don’t want to say no book is ever worth reading, but I actually do believe something pretty close to that.”

- Sam Bankman-Fried

Imagine that… nothing is worth reading! On the other side is Charlie Munger:

“In my whole life, I have known no wise people who didn’t read all the time. None. Zero.”

- Charlie Munger

No book is ever worth reading, Sam? I don’t think there has ever been a less intelligent statement said aloud. To think you have nothing to learn from reading is about as arrogant as it gets. Ok Sam, thanks for the insight. I wouldn't be surprised if you were in a jail cell for the next couple of decades. I'll take Charlie over Sam all day and every day.

So again, before I’m accused of having my head in the sand, I acknowledge risks exist in the market and the overall economy, but have chosen to balance those risks with the avalanche of selling that has already occurred in advance of what may or may not happen. I have always believed, and continue to believe, that stocks are a discounting mechanism and rise and fall well in advance of what happens down the road. Our Graham and Dodd value approach has always argued that the price you pay for the business you buy is the most important factor in determining investment success. One of the smartest people I have met in the small cap space recently sent me charts depicting just how inexpensive our investment universe is relative to other asset classes. Most of this value discrepancy came following years of investor obsession with FAANG stocks at the expense of everything else, and then followed up with significant underperformance of small caps in 2022. That environment has led to a collection of companies trading as cheaply as they have in a very long time.

A Case for Small Caps in 2023

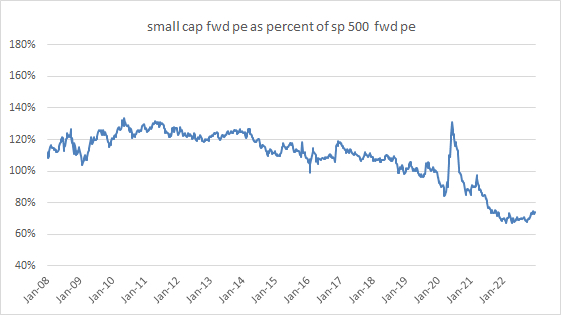

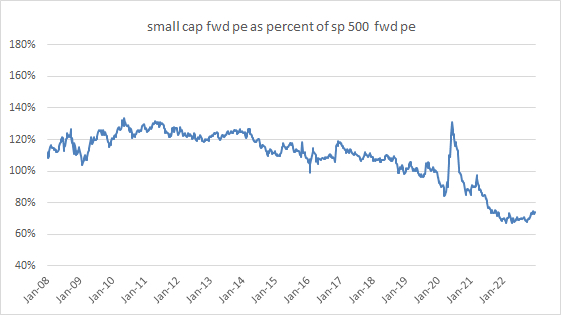

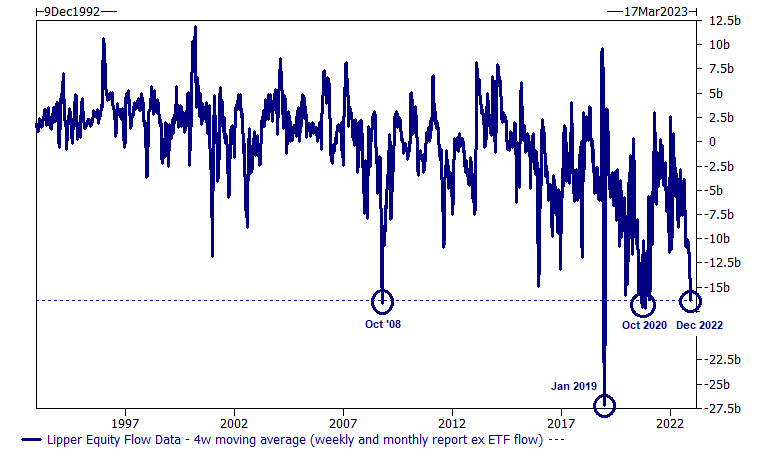

As a small/microcap manager, we spend a considerable amount of time examining where that market currently sits in comparison to the rest of the market. While small caps began the 2022 year undervalued relative to large caps, they actually managed to decline further in both relative and absolute value. As the charts below illustrate, small caps began 2023 at multi-decade lows in terms of relative valuations versus large caps.

Source: Bloomberg

Source: Bloomberg

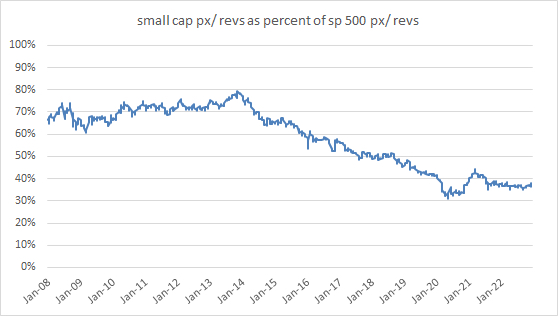

So, let’s talk about just how bearish the investing landscape became as we moved through 2022 and why we are constructive for the year 2023. Here is some data from Goldman Sachs from December 9, 2022:

1.Equity mutual funds have realized outflows for 26 consecutive weeks (-$254bn outflow) and 39 out of the last 40 weeks (-$333bn outflow) - Lipper Data excluding ETFs.

2.The pace of outflows has increased into year-end, with the current 4 week moving average at levels seen only a handful of times in the last 30 years (chart below).

3.On average, -$16.5bn of equity outflows every week for the last month (-$65bn in total) … this pace is rivaled only by Oct 2008 (financial crisis), Dec 2018 (trade wars + fed hike into slowing economy leading to worst December since 1931), and Oct 2020 (Trump/Biden election).

4.Historically, stocks have traded higher in the months following outflows of this magnitude.

4 week rolling average // Equity Mutual fund flows (weekly and monthly, ex ETFs)

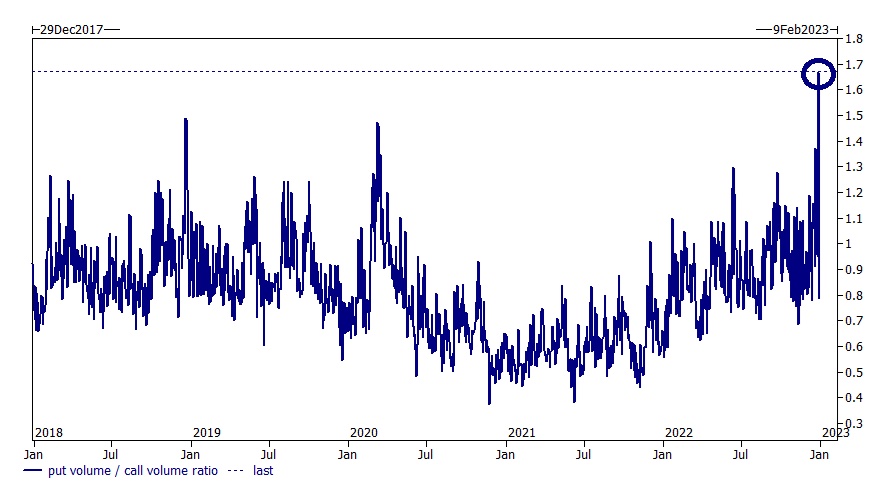

How about the next chart, also from Goldman Sachs on December 29, 2022, depicting recent put/call volume. If the world is ending as everyone says it is, we are all on the same side of that trade betting the end is near. For those who have been investors for some time like me, we know that the trend of everyone being on one side of a trade, for the most part, is almost always the greatest contrary indicator.

1.43 million listed options traded during yesterday’s session // this is slightly above the 1y rolling average of 39mm contracts.

2.16 million of these were call options // this is a 22% decrease vs the ytd avg of 20.8mm contracts.

3.27 million of these were put options // this is a 46% increase vs the ytd avg of 18.4mm contracts.

4.The ratio of puts to calls, yesterday, hit a 5y high at almost 1.7x to 1.

Daily Total Put / Call Volume Ratio – All US Listed Options

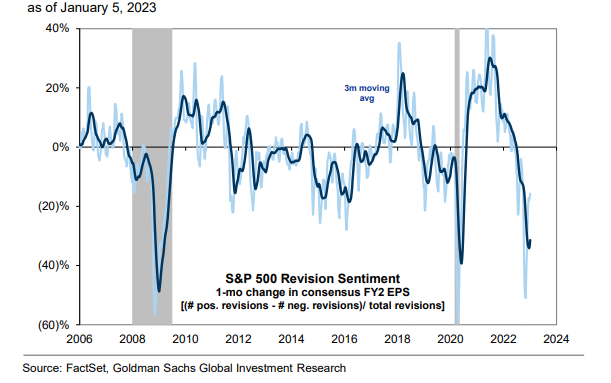

For those worried about corporate earnings given the backdrop we now face, so are we. The good news is based on information from Goldman Sachs, “More than 20% of S&P 500 market cap has pre-announced in 4Q 2022, the highest share since 1Q 2020. Similarly, the 3-month trend of S&P 500 FY2 EPS revision sentiment stands at -31%, the most negative reading outside of the 2008 and 2020 recessions...” The revisions have resulted in incredibly weak sentiment, usually representing a market bottom rather than a top.

S&P 500 EPS Revisions Sentiment is the Most Negative Since 2020 (as of January 5, 2023)

Clearly investors are worried that rising rates fueled by inflation will dampen corporate growth and earnings which leads to depressed stock prices. For TURN, while we are interested in the direction of the broader markets and global macroeconomic factors, we do so with a focus on how those factors impact the small/microcap markets where we invest.

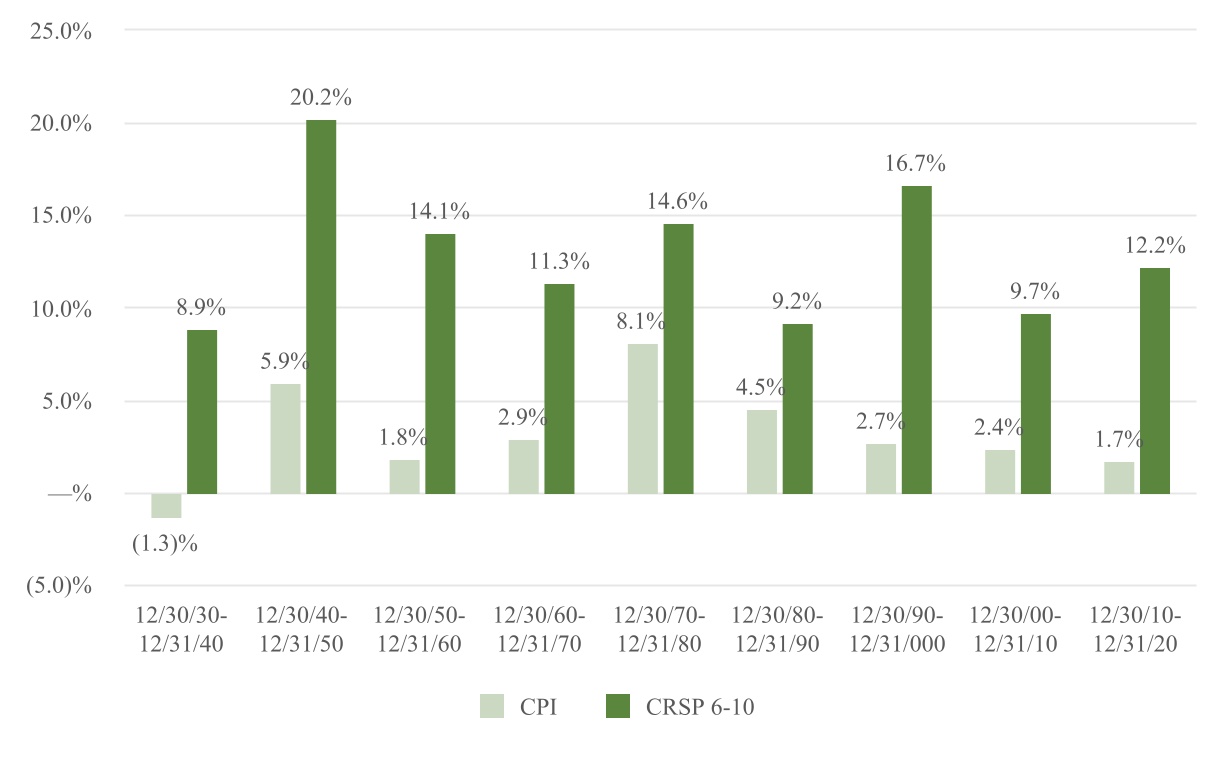

Interestingly, using history as a guide, we see the current sell-off as an opportunity as it relates to the small/microcap market. The following information is from an interview with Chuck Royce and Francis Gannon of Royce Investment Partners that I recently read and can be found at https://www.franklintempleton.com/articles/royce-investment-partners/why-better-days-for-small-cap-may-be-ahead.

“Small-cap has beaten inflation in every decade going back to the 1930s—and is the only equity class to have done so. We learned this by comparing the average annual U.S. consumer price index (CPI) to returns for the Center for Research in Security Prices (CRSP) 6-10 Index—which is a proxy that we use for small caps when we want to reach farther back in history than the Russell 2000 goes. Moreover, the CRSP 6-10 has posted positive annualized three-year returns 88% of the time on a rolling monthly basis since 1945, with an average return in the low double digits.”

Average Annual Consumer Price Index (CPI) vs.

Average Annual CRSP 6-10 Index Performance from 12/31/30- 12/31/20

Source: Russell Investments.

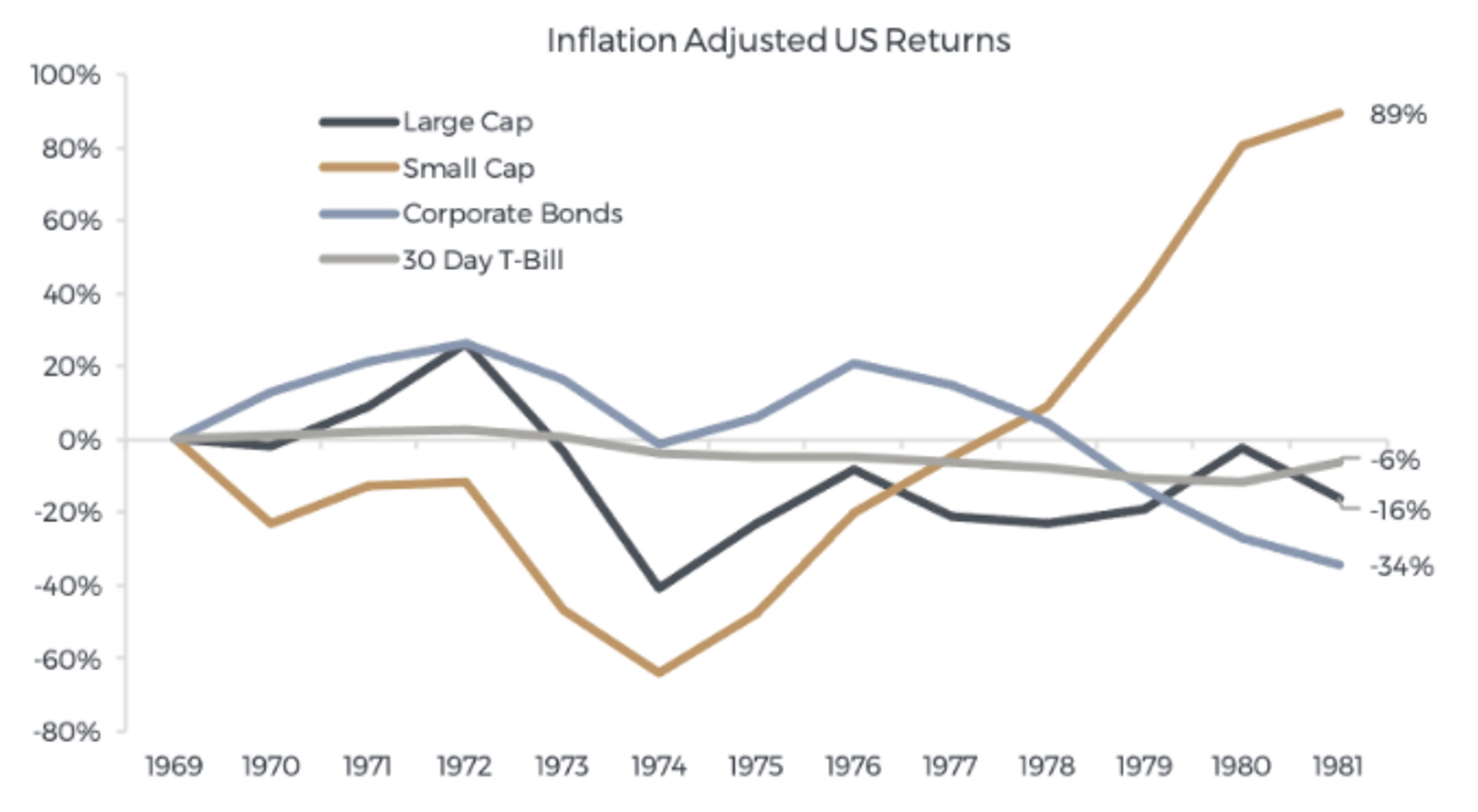

Here is some additional data from Ibboston that compares inflation adjusted returns amongst asset classes over time.

Source: Ibboston @ Harrington, SBBI (2020)

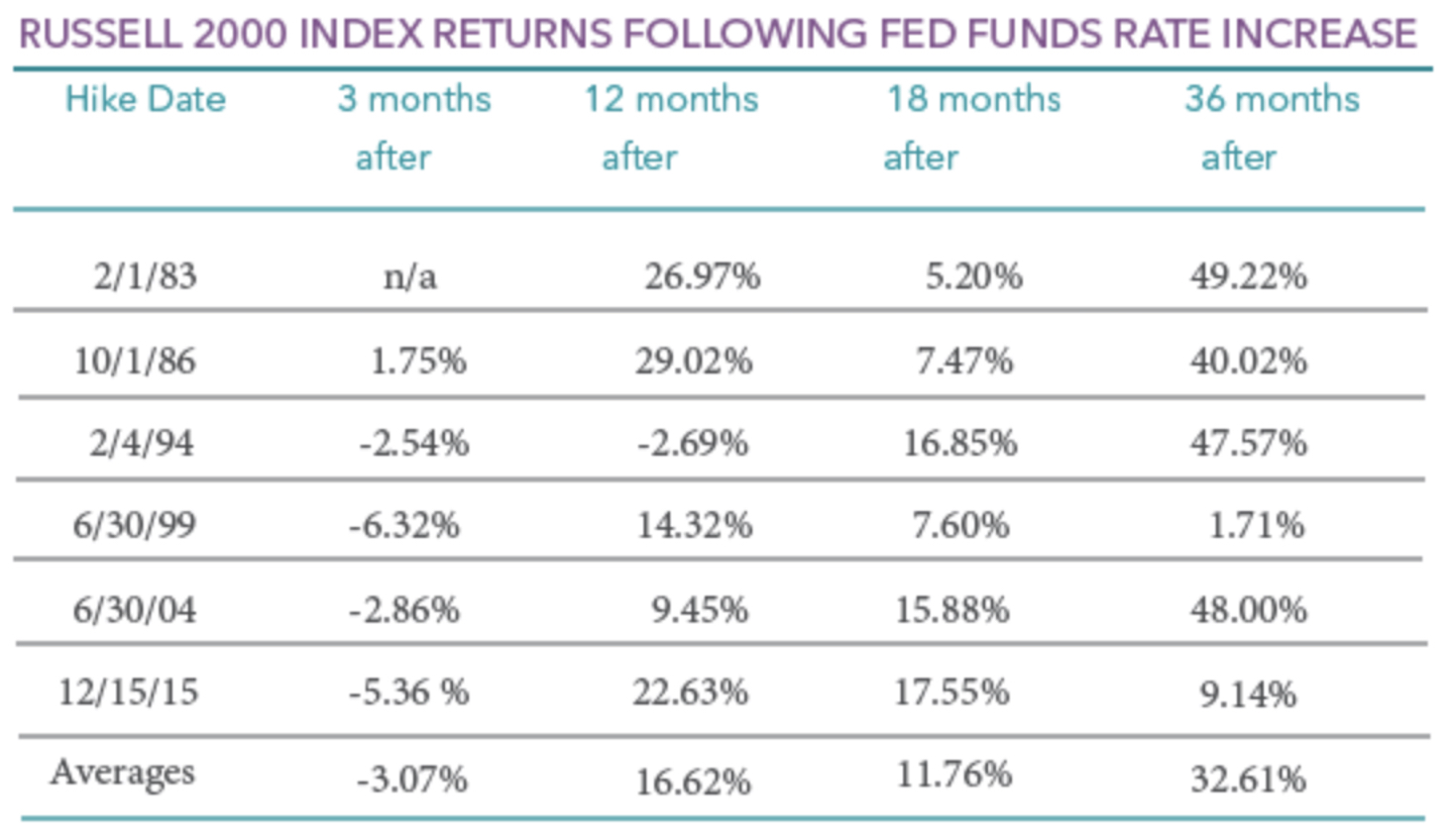

If we drill down further and examine the six most recent cycles of fed funds rate hikes, we see that following an initial selloff, the small cap market consistently produced attractive rates of return for the 12-36 month period following an initial rate increase.

Source: Perritt Capital Management

So, our conclusion is not that the investing landscape hasn’t changed, it has changed. It’s just that with companies like Synchronoss, having already been cut in half, and then cut in half again in the last two months of the year; we believe equities like SNCR have overshot to the downside. Stocks are trading at all time low valuations and are discounting a lot of the weakening economies that potentially will be here. And no, this isn’t 2008. It almost bastardizes just how bad 2008 was by weakly comparing this period to that period. 2008 was truly "the end of the world," or as Warren Buffet said, "Economic Pearl Harbor." This is just a return to more normal markets; albeit ones that will not necessarily be easy to navigate; and will indeed have their pitfalls. With this backdrop, let’s dive into the specifics related to the results from Q4 2022.

NET ASSET VALUE PER SHARE

Our NAV decreased this quarter from $8.10 to $6.32, or a decline of 22.0%. Our Fund has three principal components to the variance in our NAV: our public and public-related portfolio, our legacy private portfolio, and our expenses. For the quarter, our public and public related portfolio companies excluding D-Wave Quantum, Inc., which is a legacy portfolio company, decreased our NAV by $0.44. As stated above, the decrease in the value of the legacy Harris & Harris Group portfolio which existed before 180, reduced NAV by $1.27. AgBiome and D-Wave Quantum accounted for $0.63 and $0.53 of that decline, respectively. The rest of the legacy private portfolio decreased NAV by $0.11. Operating expenses decreased NAV by $0.07.

The only good news regarding the latest write-offs and write-downs we have had to take on the legacy Harris & Harris Group portfolio is that it’s basically over. As of December 31, 2022, approximately 86% of our invested assets and cash are now in

public or public-related investments, while approximately 14%, or just $9.5 million is in our legacy portfolio. To understand the magnitude of the headwinds we have faced since our arrival at the beginning of 2017, our public and public-related market strategy has increased our NAV by $3.52 per share by while at the same time, the private holdings have decreased our NAV by a $1.80 per share.

| | | | | | | | | | | | | | | | | | |

| Quarter | | 1 Year | 3 Year | 5 Year | Inception to Date |

| Q4 2022 | | Q4 2021- Q4 2022 | Q4 2019- Q4 2022 | Q4 2017- Q4 2022 | Q4 2016- Q4 2022 |

| | | | | | |

| | | | | | |

| | | | | | |

| Change in NAV | (22.0%) | | (40.7%) | (31.2%) | (19.0%) | (10.0%) |

| | | | | | |

| Change in Stock Price | (3.8%) | | (28.2%) | (18.1%) | (10.7%) | 27.5% |

| | | | | | |

| Russell Microcap Index | 4.7% | | (22.0%) | 12.6% | 19.9% | 35.6% |

| Russell Microcap Value Index | 6.0% | | (13.9%) | 24.4% | 32.3% | 48.1% |

| Russell 2000 | 6.2% | | (20.5%) | 9.5% | 22.3% | 40.1% |

| | | | | | |

| | | | | | |

| | | | | | |

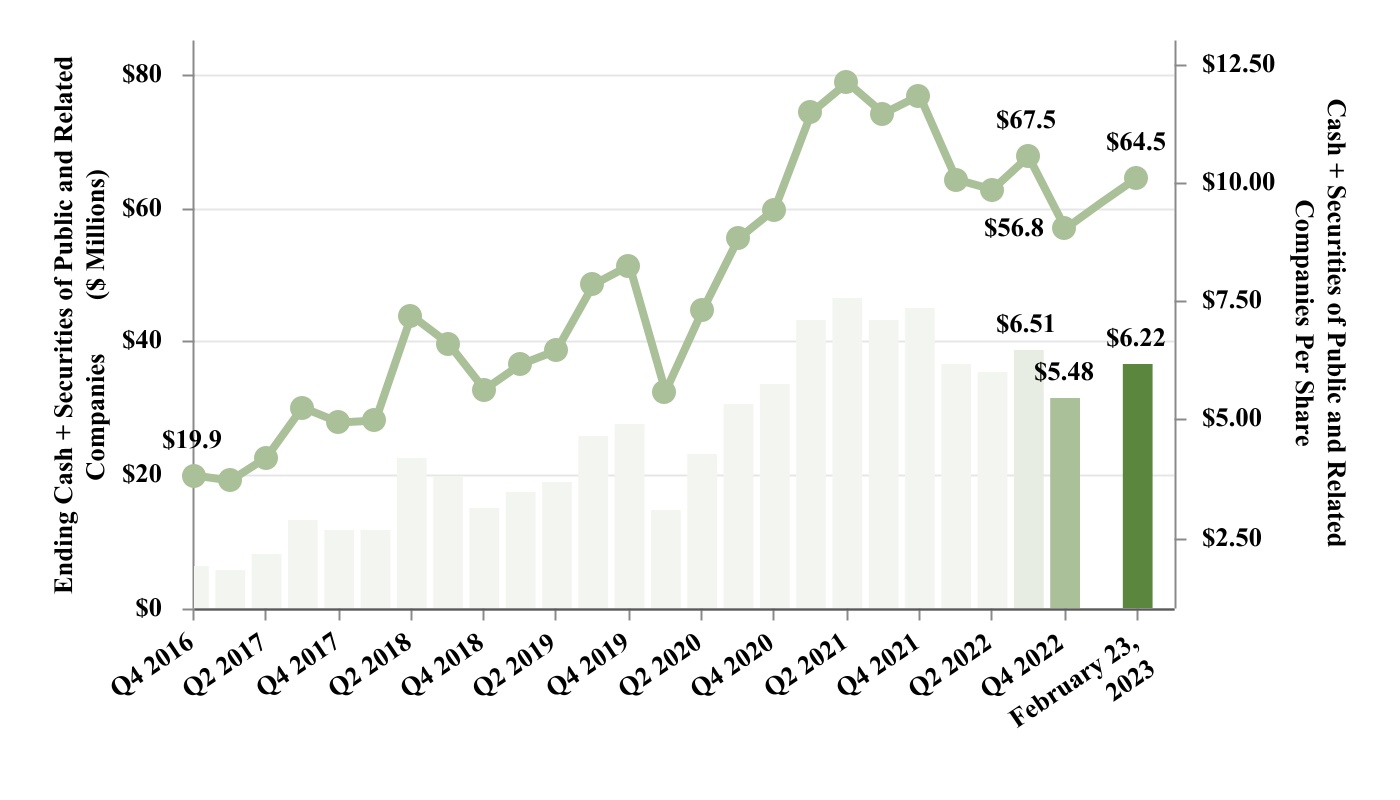

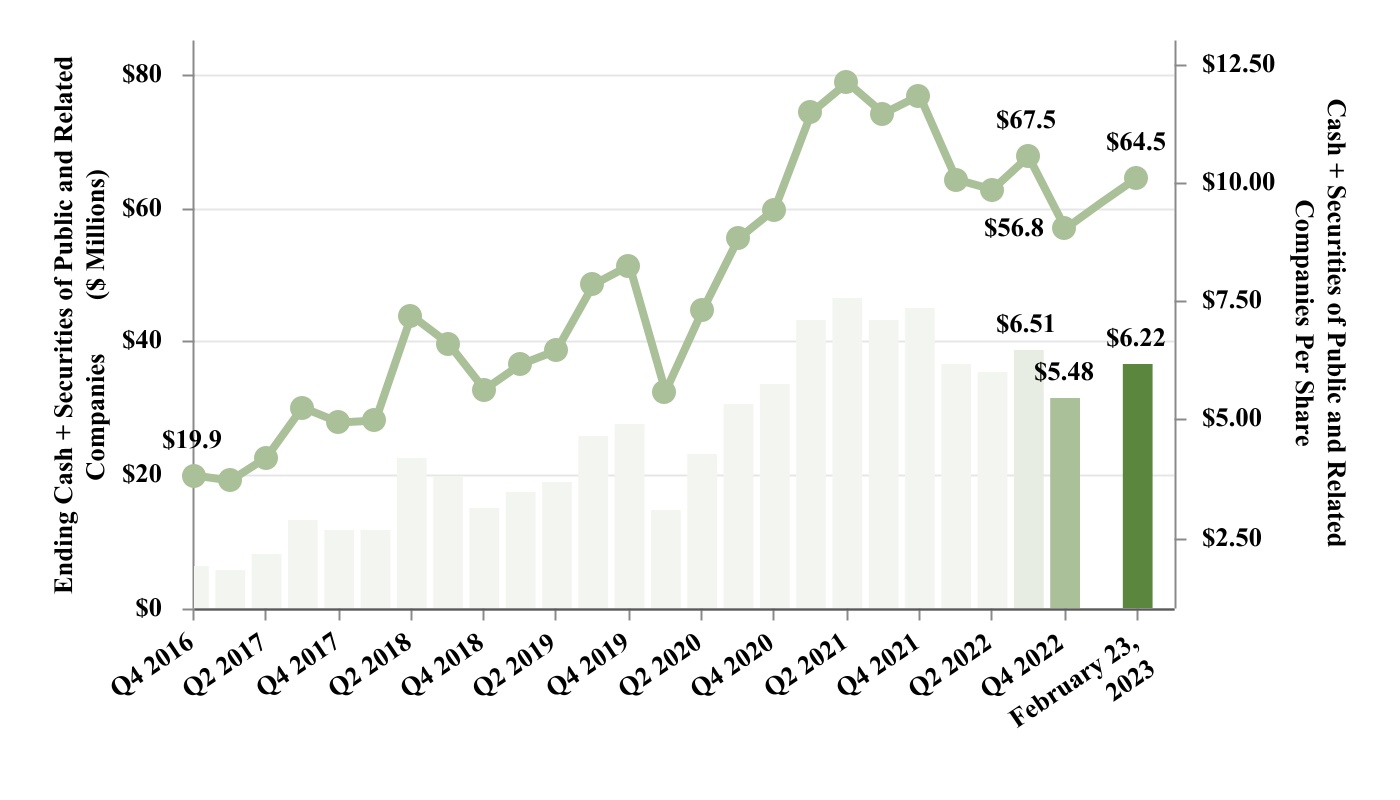

That said, you are fully aware that our primary goal since we started was to ensure that the bulk of our balance sheet be comprised of cash and public and public related securities, which would allow our shareholders to value TURN’s holdings more easily. It also will allow for a discussion of opportunities to return capital back to shareholders at some point. As a whole, this past quarter and 2022 were disappointing. That said, I would offer the following chart to provide some perspective on our performance over a longer period of time. I would also encourage you to focus your attention on our book value for where we already are in 2023 rather than on the year end numbers. You can see a strong increase in the value of our cash and securities of public and related companies since TURN began. And after a dismal 2022, we have bounced back to start the year.

On a relative basis, TURN's stock price total return of +27.5% trailed the Russell Microcap Index total return of +35.6% since our inception as is shown in the chart below:

PUBLIC AND RELATED PORTFOLIO

In the chart below, you see our one-year, three-year, and inception-to-date performance. It wasn’t a good year either from an absolute or relative return basis.

| | | | | | | | | | | | | | | | | | |

| Quarter | | 1 Year | 3 Year | 5 Year | Inception to Date |

| Q4 2022 | | Q4 2021- Q4 2022 | Q4 2019- Q4 2022 | Q4 2017- Q4 2022 | Q4 2016- Q4 2022 |

TURN Public Portfolio

Gross Total Return (Excluding SMA Carried Interest) | (7.6%) | | (37.6%) | (4.8%) | 92.3% | 205.0% |

TURN Public Portfolio

Gross Total Return (Including SMA Carried Interest) | (7.6%) | | (37.6%) | 1.6% | 104.9% | 225.0% |

| | | | | | |

| | | | | | |

| | | | | | |

| Change in Stock Price | (3.8%) | | (28.2%) | (18.1%) | (10.7%) | 27.5% |

| | | | | | |

| Russell Microcap Index | 4.7% | | (22.0%) | 12.6% | 19.9% | 35.6% |

| Russell Microcap Value Index | 6.0% | | (13.9%) | 24.4% | 32.3% | 48.1% |

| Russell 2000 | 6.2% | | (20.5%) | 9.5% | 22.3% | 40.1% |

| | | | | | |

| | | | | | |

| | | | | | |

I have repeatedly said, when you run a concentrated portfolio with seven to ten names, there are going to be periods where we look like we have never managed money a day in our lives. If you have done this long enough, you will have developed scar tissue from years like 2022; but as Babe Ruth said, “Never let the fear of striking out keep you from playing the game.” We have achieved a 225% gross total return since the inception of 180 versus 35% total return for the Russell Microcap Index because we stepped up to the batter’s box and had conviction about investing in particular companies. Investors miss 100 percent of the shots they never take.

For Q4 2022, we generated a gross total return for our public and public related portfolio of -7.6%, versus a total return for the Russell Microcap Index of 4.7 % and a gross total return for the Russell Microcap Value Index of 6.0%. For 2022 as a whole, our -37.6% gross total return compares negatively to the -22.0 % return for the Russell Microcap Index. Despite this year’s performance, as seen in the chart above, our five-year, and inception-to-date numbers including the carried interest from our SMAs show significant outperformance versus these benchmarks. While we have certainly hit a rough patch in performance in 2022, we are excited that we are potentially starting the next bull cycle with a bear market NAV of $6.32, the vast majority of which are in assets that we actually control both from when we made the investment and, as importantly, when we want to sell the position. We had neither control or the capability to act with regard to the legacy holdings we inherited that have negatively impacted our NAV for 6 years, including 180’s position in D-Wave Quantum, that was unable to be sold due to lockup provisions associated with its de-SPAC. If you wanted to understand the history of what we inherited, the strategy of the past has left 180 with approximately $80.6 million in operating loss carryforwards and $16 million in capital losses; these losses were created, by the way, in a bull market! Not an exceptional track record. We have finally cleansed ourselves of the drag the legacy private portfolio has had on 180's NAV. We believe many of our public investments have the ability to at least double from where they ended in 2022, and, if that occurs, we believe that should propel our NAV and share price higher.

Let’s dig into the significant sources of the changes in value in our public portfolio in Q4 2022. What you will see a lot of is the following story: Company A reported better than expected results and the stock was down anyway, and because the stock was down YTD, it was subject to extreme tax loss selling, particularly in December 2022.

Largest Decreases in Value

•D-Wave Quantum, Inc. (QBTS) – In early October 2022, QBTS share price began to freefall from approximately $8.00 per share to $2.50 per share in less than one month. While there was no specific news that could be traced to this collapse, it was well known that QBTS needed to use its equity line of credit to raise capital for operations since the de-SPAC process left the company with less than $15 million on its balance sheet. This equity line could be tapped once the registration statement was deemed effective by the SEC in October 2022. While the Q3 2022 report was in-line with expectations, the management of QBTS did not provide any clarity on how it planned to fund the operations of the company beyond using the equity line facility and the stock continued to decline into the end of the year. For the quarter, QBTS reduced our NAV by $0.53 per share, or $5.5 million.

180's shares of QBTS were subject to a lockup agreement as of the end of 2022, so we were not able to trade or hedge this position. Because of our inability to be anything other than a bystander, while included in this section as a public company, the performance was calculated as if it was a private company. Our shares are now registered, and as of February 5, 2023, the lockup has expired and we are free to trade our holdings of QBTS. Going forward, the performance of QBTS will therefore be included in our calculations of gross total return for our public and public-related holdings.

•Synchronoss Technologies, Inc. (SNCR) – SNCR reported better than expected results for Q3 2022, but was not able to make progress cleaning up its balance sheet with regard to paying off its preferred stock. Investors continue to be concerned with the ability of the company to reach the point where it will begin to generate positive unadjusted free cash flow even though SNCR's management communicated its expectation that such point will be reached in 2023. That said, we are trying to rationalize SNCR’s 41% plunge in the quarter and are left making up reasons. We believe the truth is instead that the stock was cut in half this quarter because of tax loss selling. Full stop. This is a business that is mostly cloud based recurring revenue and worth multiples of the share price that existed at the end of the year. It is incumbent upon management and the Board of SNCR to realize that value in 2023 and beyond. For the quarter, SNCR reduced our NAV by $0.24 per share, or $2.5 million.

•Arena Group Holdings, Inc. (AREN) – AREN reported strong results for Q3 2022, and the stock responded positively through most of the quarter. On December 13, 2022, AREN announced the acquisition of Men's Journal using a new debt facility from B. Riley to fund the acquisition. This facility was meant as a bridge to more permanent financing as it includes terms that call for increases in the interest rate quarterly starting in March 2023. AREN's stock subsequently collapsed from approximately $16.00 per share to $10.61 as of the end of the quarter. We like the transaction, believe AREN is performing quite well, and it is a standout in what has become a challenging advertising environment. We believe what is holding the stock back is its capital structure and management simply needs to address and solve for it in the first few months of 2023. For the quarter, AREN reduced our NAV by $0.18 per share, or $1.9 million.

•Comscore, Inc. (SCOR) – SCOR reported continued improving financial results for Q3 2022, and announced the renegotiation of its data deal with Charter to provide lower costs, increased data access and a longer term of exclusivity to certain data sets. That said, SCOR's stock was unable to recover from the collapse that started in early September 2022, due primarily to continued ambiguity around the potential for the special dividend to be called by the Preferred Stockholders and certain corporate governance matters. Cerberus continued purchasing SCOR's common stock in open-market purchases, with its largest purchase of 1.5 million shares at approximately $1.10 per share. Simply put, the performance of the business would justify a meaningfully higher share price. We believe SCOR is woefully undervalued due to investors’ obsession with the special dividend and conspiracy theories for what the three preferred holder’s intentions are with regards to oversight of the business. It is patently clear to us that SCOR’s Board has its head in the sand with regards to why the stock is here and we will ramp up our activism to shine a light on the egregious board compensation and the lack of transparency with regards to the special dividend. The board’s purpose is to represent common shareholders, not just serve the interests of the preferred holders. For the quarter, SCOR reduced our NAV by $0.15 per share, or $1.5 million.

Largest Increase in Value

•Potbelly Corporation (PBPB) – PBPB reported continued strong results for Q3 2022, across all financial and shop-level metrics. PBPB also provided a strong guide for Q4 2022 that included continued increases in shop-level margins. In December 2022, PBPB announced the signing of four additional shop development agreements with existing franchisees. Under the agreements, 25 new shops will be developed in their respective territories over the next six years. For the quarter, PBPB increased our NAV by $0.16 per share, or $1.7 million.

•Commercial Vehicle Group, Inc. (CVGI) – CVGI reported results that continued to show the improvements made by management through renegotiation of contracts and streamlining of the business. CVGI reported new business wins and continued strong free cash flow that allowed the company to pay down debt near the top end of its guidance. CVGI also noted that it has begun to renegotiate the remaining low-margin contracts in Q4 2022, with the goal to complete these renegotiations by the end of the year which would enable the company to realize the benefits of such improvements much earlier than originally communicated to investors. For the quarter, CVGI increased our NAV by $0.12 per share, or $1.3 million.

•Alta Equipment Group, Inc. (ALTG) – ALTG reported results that exceeded all analyst expectations and guidance with continued strong performance across all of its businesses. ALTG also noted that it continues to be capacity constrained on its rental fleet and has not seen any weakness in demand. For the quarter, ALTG increased our NAV by $0.10 per share, or $1.1 million.

Other Notes

The valuation committee of our Board of Directors fair valued our holdings of Parabellum Acquisition Partners, LLC., the entity that sponsored the SPAC, Parabellum Acquisition Corp. (PRBM) at approximately $2.7 million, a decrease of $3.2 million, or $0.30/share. Given we hold a seat on the board of PRBM, we are limited in what we can say publicly regarding the inputs used by our Valuation Committee to set the valuation of these holdings as of the end of the quarter beyond a reduction in the probability of completing a transaction from 75% as of the end of Q3 2022 to 33% as of the end of Q4 2022. We can note that a transaction with EnOcean GmbH was announced during the quarter, but the deal contains a provision that PRBM needs to secure $30 million of capital under terms acceptable to EnOcean by the end of February 2023 or EnOcean has the ability to terminate the transaction. We will provide updates on this effort as they become available and are able to be shared publicly.

It is our view that many names in our universe have been overly discounted (based on their valuations) as a result of the very bearish environment we are in. Our permanent capital allows us to make rational decisions on our investments, and we believe this is a distinct advantage in regard to our ability to generate returns greater than the indices over an investment cycle. We are never forced to sell unless we believe we should for analytical and investment process reasons. We have seen the benefits of having permanent capital during other periods of market dislocation during our six-year history, and we expect this period will be no different. Like the other weak periods of performance during the last six years, we hope to look back at this one and reflect that while it was painful wading through it, we were presented with some interesting investment opportunities that we believe have at least 100% upside. I have seen a number of washouts over the last 35 years, and 2022, Q4 and December in particular, were amongst the most vicious I have ever seen. We have intentionally created a concentrated portfolio that has very low correlation to the broad indices. We are aware of the potential for episodic returns for our holdings, i.e., we believe we will get paid for most of our investments, we just can't say when. But I can say 2023 is off to a great start with our year-to-date gross total return through February 23, 2023, of 14.8% more than doubling the Russell Microcap Index total return of 7.0%.

LEGACY PRIVATE PORTFOLIO

We have already transformed our business over the last five years away from the historical venture capital model and towards public and public related securities and this past quarter. While beyond painful, this past quarter got us closer to the ultimate goal of having 100 percent of our assets in public companies. We have already discussed why QBTS hurt us this quarter. This quarter we also wrote down the value of our holdings in AgBiome due primarily to declines in the value of comparable public companies. HALE.life has been written down to zero following its management's continued and endless failure to raise capital. Following these write-downs, 180’s remaining private portfolio has only one material position, AgBiome. The total assets of our remaining legacy private portfolio is approximately $9.5 million, and of that amount, $2.4 million are payments that we expect to receive from the sale of TARA Biosystems, Inc., to Valo Health, LLC, with $1.1 million to be paid in April 2023, and $1.3 million in April 2024.

Our transformation started in June 2016, when I first joined the Board of Directors. At that time, our predecessor company’s balance sheet was comprised of 73% private assets and 27% net cash and public and related securities. Today, following the events in Q4 2022, those percentages have flipped. Because of the greater transparency in the value of our holdings, it would make sense to us that our stock should narrow the discount it trades to our NAV. When we first took over the management of 180, we were very clear about what we hoped to accomplish with regard to the mix of assets on our balance sheet, and I am pleased to report we have executed that strategy. I would have liked the last increase in terms of the mix of public versus private assets to have come from strength in the public holdings rather than write-downs in our private holdings, but as I have said, we simply have had no control over the legacy holdings we inherited from the Harris & Harris Group. We have cleared our decks as we head toward the future, and finally have the balance sheet mix we can utilize to create real value for our shareholders.

EXPENSES

As noted in previous letters, we have dramatically reduced our cost structure under our new strategy. In 2016, before our Fund’s change in investment focus and management team, our operating expenses, excluding stock-based compensation and interest on outstanding debt, averaged approximately $1.3 million per quarter. For Q4 2022 our regular operating expenses equaled approximately $800,000 versus approximately $750,000 in Q4 2021. We will maintain a lean cost structure (outside of fixed expenses for being a public company) focusing our expenses on activities solely designed to enhance our investment performance or to increase our revenues from managing outside capital. As has been the case since my arrival, we have been consistent in saying that the management team will only participate in a bonus pool if our performance warrants it. Needless to say, our performance for 2022 didn’t warrant a bonus pool, and thus no performance based bonuses are accrued as of the end of Q4 2022. In addition, no new bonus pools will be accrued until we overcome the high-water mark set by our public holdings and payment of the historically deferred portion of prior bonus pools with require the same with respect to each year they were established. Our management team and Board are acutely aware that we are in business to serve our shareholders.

TURN/NAV: SUM OF THE PARTS

As of the end of Q4 2022, TURN traded at 84% of NAV. Our securities of publicly traded and related companies, cash, and other assets net of liabilities were $5.41 per share. Our stock price was $5.28. If we receive 100% credit for the value of these assets net of liabilities, the market is ascribing a negative value of approximately $0.13 per share, or -$1.35 million, to our legacy private portfolio.

We thought it appropriate to provide an update on this analysis through February 23, 2023, given the discussion earlier in this letter. As of that date, using solely changes in value of Level 1, or publicly traded holdings, TURN traded at 75% of estimated NAV. Our securities of publicly traded and related companies, cash, and other assets net of liabilities were $6.16 per share. Our stock price was $5.2756. If we receive 100% credit for the value of these assets net of liabilities, the market is ascribing a value of approximately -$0.89 per share, or -$9.2, million to our legacy private portfolio. I'll remind you that approximately $2.3 million of the legacy private portfolio are payments from the sale of TARA to Valo Health, and that we expect to receive $1.1 million in April 2023 and the remaining $1.3 million in April 2024.

Given how painful the market has been in 2022, we think the current construct of our balance sheet has provided a true floor for our share price. While none of 2022 has been fun, had 2017-2021 not occurred our share price would be nowhere near where it is trading today.

CONCLUSION

A return to a normal environment of higher interest rates is here. It is our view, the market adjustment to that environment has been vicious, indiscriminating, and, in some cases, overdone. I think the mistake we made last year was thinking, to some extent, because of their own execution of our portfolio company’s businesses, and because valuations were modest to begin with, the performance of the stocks would supersede the downdraft of the macro economy and the market as a whole. We were dead wrong. Microcap companies were amongst the worst performing asset class last year, and much of that underperformance was due to a lack of liquidity and end of the year tax loss selling. Selling begets selling in a risk off market and that’s what fed on itself as we ended the year. This trend reversed itself thus far in 2023 as the overzealous tax loss selling and doomsday predictions abate.

180 suffered through as poor a year as I had running the Basic Value Fund at BlackRock in 2008; that was a period that was actually the economic equivalent of Pearl Harbor. This isn’t that. An unemployment rate of 3.4% is not an end of the world scenario, and as the COVID-19 pandemic becomes a thing of the past, especially with China exiting its COVID-zero policy, inflation and supply chain inefficiencies should moderate. Will demand slow? Yes. Are bonds more competition for stocks? Yes. Will multiples contract as a reflection of higher rates? Yes. But that doesn’t mean SNCR deserved to be cut in half in December 2022 after being cut in half in one month prior. Markets, always overshoot in both directions and we have seen both ends in the last two years. Do you remember the period when Bitcoin was $60,000, the movie theater chain meme stock AMC went from $2 to $60 per share in a month, and every cannabis stock went to valuations that reflected an investment community that was truly “high” from smoking their investments? That was a bubble. 2022 ended with the seemingly unanimous view that we are headed for a nasty recession, stocks have no place in client portfolios given the attractiveness of bonds, so sell everything I own at any price. That is peak pessimism.

We own a number of companies that we believe are mis-valued. We believe that these mis-valuations are our opportunity as we look out a number of years. When we started, we told you we were going to construct a concentrated group of companies and use a Graham and Dodd process for selecting those companies, supplemented with an activist approach. In doing so, we knew that we would have less correlation with the indices (intentional) and have a portfolio that had a higher risk/reward profile than the average diversified small cap fund. For the first five years, we showed the benefit of our strategy, both in terms of our absolute and relative performance. And then last year happened. Every time I hear someone say, “It’s different this time,” I want to scratch my eyes out. You know why “we haven’t seen this before?” It’s because many market participants have only known a Fed that kept rates at zero (for far too long but that’s a different story), 14 years of quantitative easing, free money for all, and next to nothing inflation. THAT’S NOT NORMAL! I truly don’t want to come across as some old stodgy value guy preaching to the world, but the truth is there are so many market participants who haven’t lived through a normal Fed cycle of rate increases, or who haven’t experienced not making AMC like returns in short time frames. So, as one would expect (although way worse than we thought), the market began to adjust to the new world, but in our estimation, overcorrected and overly punished equities as the year ended.

We intentionally run a concentrated portfolio of small cap companies. Way more often than not, our shareholders have seen the benefit of that strategy by benefiting when we get our stock picking right. Of course, with the upside potential comes periods like we are in where you see the risk of managing a concentrated portfolio.

The market for microcaps is filled with inefficiencies and asymmetric risk/reward characteristics. If you get your stock picking right, you can achieve outsized returns. Based on our research, we believe many of the individual companies we own have

upside of 100% over a three-year period. We have permanent capital and the opportunity to take advantage of the current dislocation is easier for us because we don’t have to sell to service redemptions.

It was breathtaking (and not in a good way) to watch the destruction of many of our holdings in Q4 2022. We have seen periods of indiscriminate selling before, but last year and specifically the fourth quarter was at another level. In last quarter’s shareholder letter, I wrote the following: “We have always subscribed to the “you reap what you sow” school of hard work. Well, at TURN, we are sowing. That’s what we do each and every day. Sow. Sow. Sow. I anticipate looking back three years from now and laughing at the investor who sold PBPB stock to us at $4.60.”

PBPB is now $7.39, some 60% higher, but at the moment it was $4.60, with the market telling me just how dumb I was, I wasn’t feeling too good. We insist on knowing what we own and why we own it, and we hold a deeply-held belief that intelligent contrarianism works over time. The PBPB selloff had the potential to cause us to not only second guess our views, but perhaps, ultimately, alter our investment thesis. We thought we knew how absurd the selloff was given the fundamentals, but it's often hard to retain conviction when the rest of the world seemingly has a totally different view. Fortunately, we stayed with PBPB and the gains year-to-date are reflected in our interim estimated NAV. In recent weeks, SNCR traded to $0.51, AREN to $7.43, SCOR to $1.00, CVGI to $4.03, ACNT to $8.12, LTRX to $3.79, and QMCO to $1.00. Are those really the right prices for these businesses over the next couple of years? I doubt it. And just like with PBPB, we really hope we can look back with laughter at the “gifts” we were offered in what was an avalanche of risk-off selling. If we are more right than wrong on the above holdings and new positions we establish, our NAV will be meaningfully higher and so should our stock price.

The only reason I agreed to become CEO of TURN was to see if we could stop Harris & Harris from ending at $0, and see if we could build a different business that would reward shareholders, not destroy them as had been the case through 2016. The only thing we truly care about is the return of TURN stock. And while last year was disappointing, it’s over and we are seeing the benefit of our permanent capital in the meaningful appreciation in the value of our holdings thus far in 2023. We believe our strategy will once again reward shareholders as it did from 2016-2021, and as we start 2023 we have a balance sheet that resides predominantly in the positions we can control. We think many of our holdings are discounting for an environment that is not going to exist. We are bullish on our ability to use this environment to create significant value over the next few years. There won’t be any free lunches and it will take a lot of good stock picking, but I’m convinced we have the opportunities in front of us that can lead to a much higher stock price than the one we have today.

Thank you for your continued support.

Kevin Rendino

Chairman and Chief Executive Officer

Forward-Looking Statements and Disclaimers

This shareholder letter may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company's current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this press release. Please see the Company's securities filings filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company's business and other significant factors that could affect the Company's actual results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The reference and link to any websites have been provided as a convenience, and the information contained on such website is not incorporated by reference into this shareholder letter. 180 Degree Capital Corp. is not responsible for the contents of third-party websites. The information discussed above is solely the opinion of 180 Degree Capital Corp. Any discussion of past performance is not an indication of future results. Investing in financial markets involves a substantial degree of risk. Investors must be able to withstand a total loss of their investment. The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions.

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES |

| | | | | |

| | December 31, 2022 |

| ASSETS | |

| Investments in securities and other financial instruments, at value: | |

| Unaffiliated publicly traded equity and equity-related securities (cost: $31,887,534) | $ | 28,348,665 | |

| Unaffiliated legacy privately held equity and equity-related securities (cost: $9,108,961) | 6,511,987 | |

| Non-controlled affiliated publicly traded equity and equity-related securities (cost: $37,012,880) | 24,905,157 | |

| Non-controlled affiliated legacy privately held equity and equity-related securities (cost: $6,496,930) | 158,886 | |

| Controlled affiliated equity and equity-related securities (cost: $2,923,003) | 2,706,572 | |

| Unaffiliated derivative securities (cost: $113,639) | 0 | |

| Non-controlled affiliated derivative securities (cost: $224,849) | 215,631 | |

| Unaffiliated rights to payments (cost: $3,320,538) | 2,842,814 | |

| Cash | 655,459 | |

| Prepaid expenses | 250,439 | |

| Receivable from managed funds | 152,151 | |

| Receivable from securities sold | 108,512 | |

| Lease asset | 72,634 | |

| Other assets | 21,423 | |

| Other receivables | 2,278 | |

| Total assets | $ | 66,952,608 | |

| LIABILITIES & NET ASSETS | |

| |

| Post-retirement plan liabilities | $ | 645,637 | |

| Accounts payable and accrued liabilities | 508,217 | |

| Payable for securities purchased | 180,971 | |

| Lease obligation | 72,634 | |

| Total liabilities | $ | 1,407,459 | |

| Commitments and contingencies (Note 10) | |

| Net assets | $ | 65,545,149 | |

| Net assets are comprised of: | |

| Preferred stock, $0.10 par value, 2,000,000 shares authorized; none issued | $ | 0 | |

| Common stock, $0.03 par value, 15,000,000 shares authorized; 11,541,079 issued | 334,594 | |

| Additional paid in capital | 115,687,138 | |

| Total accumulated distributable loss | (45,871,058) | |

| Treasury stock, at cost 1,167,259 shares | (4,605,525) | |

| Net assets | $ | 65,545,149 | |

| Shares outstanding | 10,373,820 | |

| Net asset value per outstanding share | $ | 6.32 | |

The accompanying notes are an integral part of these consolidated financial statements.

16

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF OPERATIONS |

| | | | | |

| Year Ended

December 31, 2022 |

| Income: | |

| Dividend | $ | 83,942 | |

| Other (Note 2) | 202,077 | |

| Total income | 286,019 | |

| Operating fees and expenses: | |

| Salaries, bonus and benefits | 1,019,877 | |

| Professional | 696,620 | |

| Administration and operations | 454,649 | |

| Insurance | 336,845 | |

| Directors | 288,750 | |

| Custody | 32,204 | |

| Rent | 29,744 | |

| Other | 9,659 | |

| Total operating expenses | 2,868,348 | |

| Net investment loss before income tax expense | (2,582,329) | |

| Income tax expense | 874 | |

| Net investment loss | (2,583,203) | |

| Net realized gain (loss) from investments: | |

| Unaffiliated publicly traded equity and equity-related securities | 2,007,977 | |

| Unaffiliated legacy privately held equity and equity-related securities | (2,453,941) | |

| Non-controlled affiliated publicly traded equity and equity-related securities | (694,257) | |

| Non-controlled affiliated legacy privately held equity and equity-related securities | (2,365,432) | |

| Controlled affiliated equity and equity-related securities | (143,490) | |

| Unaffiliated rights to payments | 6,014,178 | |

| Call options | 35,909 | |

| Net realized gain from investments | 2,400,944 | |

| Transferred shares-value (Note 2) | (196,290) | |

| Net realized gain | 2,204,654 | |

| Change in unrealized (depreciation) appreciation on investments: | |

| Unaffiliated publicly traded equity and equity-related securities | (19,114,100) | |

| Unaffiliated legacy privately held equity and equity-related securities | (5,270,680) | |

| Non-controlled affiliated publicly traded equity and equity-related securities | (14,757,068) | |

| Non-controlled affiliated legacy privately held equity and equity-related securities | 329,127 | |

| Controlled affiliated equity and equity-related securities | (4,218,485) | |

| Unaffiliated rights to payments | (1,621,048) | |

| Net change in unrealized depreciation on investments | (44,652,254) | |

| Net realized gain and change in unrealized depreciation on investments | (42,447,600) | |

| Net decrease in net assets resulting from operations | $ | (45,030,803) | |

The accompanying notes are an integral part of these consolidated financial statements.

17

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENT OF CASH FLOWS |

| | | | | |

| Year Ended

December 31, 2022 |

| Cash flows used in operating activities: | |

| Net decrease in net assets resulting from operations | $ | (45,030,803) | |

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash used in operating activities: |

| Net realized gain from investments | (2,400,944) | |

| Net change in unrealized depreciation on investments | 44,652,254 | |

| Depreciation of fixed assets | 9,547 | |

| Call options purchased | (174,765) | |

| Call options written | 210,674 | |

| Purchase of unaffiliated publicly traded equity and equity-related securities | (23,783,007) | |

| Purchase of non-controlled affiliated publicly traded equity and equity-related securities | (2,817,196) | |

| Purchase of controlled affiliated equity and equity-related securities | (255,357) | |

| Proceeds from sale of unaffiliated publicly traded equity and equity-related securities | 13,274,916 | |

| Proceeds from sale of unaffiliated legacy privately held equity and equity-related securities | 120,802 | |

| Proceeds from sale of non-controlled affiliated publicly traded and equity-related securities | 1,172,773 | |

| Proceeds from sale of non-controlled affiliated legacy privately held equity and equity-related securities | 67,641 | |

| Proceeds from controlled affiliated equity and equity-related securities | 19,510 | |

| Distribution from sale of unaffiliated rights to payments | 12,575,536 | |

| Changes in assets and liabilities: | |

| Decrease in receivable from managed funds | 2,167,107 | |

| Decrease in prepaid expenses | 102,226 | |

| Increase in receivable from sales of securities | (35,353) | |

| Decrease in other receivables | 7,849 | |

| Decrease in other assets | 109 | |

| Decrease in bonus payable | (3,256,875) | |

| Decrease in post-retirement plan liabilities | (154,253) | |

| Decrease in accounts payable and accrued liabilities | (42,359) | |

| Decrease in accrued severance | (34,024) | |

| Increase in payable for securities purchased | 106,001 | |

| Net cash used in operating activities | (3,497,991) | |

| Cash flows from investing activities | |

| Purchase of fixed assets | (4,226) | |

| Net cash used in investing activities | (4,226) | |

| Net decrease in cash | (3,502,217) | |

| Cash at beginning of the year | 4,157,676 | |

| Cash at end of the year | $ | 655,459 | |

| Supplemental disclosures of cash flow information: | |

| Income taxes paid | $ | 874 | |

| |

The accompanying notes are an integral part of these consolidated financial statements.

18

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | | | | | | | |

| Year Ended

December 31, 2022 | | Year Ended December 31, 2021 |

| | | |

| Changes in net assets from operations: | | | |

| Net investment loss | $ | (2,583,203) | | | $ | (3,486,628) | |

| Net realized gain | 2,204,654 | | | 2,091,597 | |

| Net change in unrealized (depreciation) appreciation on investments | (44,652,254) | | | 15,653,189 | |

| Net (decrease) increase in net assets resulting from operations | (45,030,803) | | | 14,258,158 | |

| Net (decrease) increase in net assets | (45,030,803) | | | 14,258,158 | |

| Net Assets: | | | |

| Beginning of the year | 110,575,952 | | | 96,317,794 | |

| End of the year | $ | 65,545,149 | | | $ | 110,575,952 | |

| | | |

The accompanying notes are an integral part of these consolidated financial statements.

19

| | |

180 DEGREE CAPITAL CORP.

CONSOLIDATED FINANCIAL HIGHLIGHTS |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended Dec. 31, 2022 | | Year Ended Dec. 31, 2021 | | Year Ended Dec. 31 2020# | | Year Ended Dec. 31 2019# | | Year Ended Dec. 31, 2018# | | | | |

| | | | | | | | | | | | | |

| Per Share Operating Performance: | | | | | | | | | | | | | |

| Net asset value per share, beginning of the year | $ | 10.66 | | | $ | 9.28 | | | $ | 9.18 | | | $ | 7.92 | | | $ | 7.80 | | | | | |

Net investment loss* | (0.25) | | | (0.33) | | | (0.05) | | | (0.48) | | | (0.21) | | | | | |

Net realized gain (loss) from investments* | 0.21 | | | 0.20 | | | (0.11) | | | 0.93 | | | (0.75) | | | | | |

Net change in unrealized (depreciation) appreciation on investments and options*1 | (4.30) | | | 1.51 | | | 0.26 | | | 0.81 | | | 1.08 | | | | | |

| Total* | (4.34) | | | 1.38 | | | 0.10 | | | 1.26 | | | 0.12 | | | | | |

| Net (decrease) increase in net asset value | (4.34) | | | 1.38 | | | 0.10 | | | 1.26 | | | 0.12 | | | | | |

| Net asset value per share, end of the year | $ | 6.32 | | | $ | 10.66 | | | $ | 9.28 | | | $ | 9.18 | | | $ | 7.92 | | | | | |

| | | | | | | | | | | | | |

| Stock price per share, end of the year | $ | 5.28 | | | $ | 7.35 | | | $ | 6.66 | | | $ | 6.45 | | | $ | 5.25 | | | | | |

| Total return based on stock price | (28.16) | % | | 10.36 | % | | 3.26 | % | | 22.86 | % | | (11.17) | % | | | | |

| Supplemental Data: | | | | | | | | | | | | | |

| Net assets, end of the year | $ | 65,545,149 | | | $ | 110,575,952 | | | $ | 96,317,794 | | | $ | 95,213,639 | | | $ | 82,034,768 | | | | | |

| Ratio of expenses to average net assets | 3.20 | % | ^ | 5.87 | % | ^ | 4.61 | % | ^ | 6.42 | % | ^ | 3.63 | % | ^ | | | |

| Ratio of net investment loss to average net assets | (2.88) | % | | (3.26) | % | | (0.59) | % | | (5.42) | % | | (2.82) | % | | | | |

| Portfolio turnover | 30.95 | % | | 44.46 | % | | 35.16 | % | | 30.17 | % | | 20.43 | % | | | | |

| Number of shares outstanding, end of the year | 10,373,820 | | | 10,373,820 | | | 10,373,820 | | | 10,373,820 | | | 10,373,820 | | | | | |

# Reflect a 1-for-3 reverse stock split that became effective on January 4, 2021.

* Based on average shares outstanding.

^ The Company has entered into an expense offsetting arrangement with one of its unaffiliated brokers relating to broker fees paid. The total broker fee charged to the Company was applied as a credit to fees charged by an affiliate of the unaffiliated broker who the Company subscribes to for data services billed during the year. The Company received an offset to expense totaling approximately $20,600, $84,800, $31,900, $15,700, and $17,500 with that broker for the years ended December 31, 2022-2018, respectively.

1 Net unrealized losses include rounding adjustments to reconcile change in net asset value per share.

The accompanying notes are an integral part of these consolidated financial statements.

20

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2022 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 53.3% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Publicly Traded Equity and Equity-Related Securities - | | | | | | | | | |

| 43.3% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Alta Equipment Group, Inc. | | | Trading Companies & Distributors | | | | | | |

| Operates as an industrial and construction equipment company | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 445,064 | | $ | 3,714,065 | | | $ | 5,870,394 | |

| | | | | | | | | |

| Ascent Industries Co. (3) | | | Steel | | | | | | |

| Manufactures metals and chemicals | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 278,057 | | 2,990,139 | | | 2,410,754 | |

| | | | | | | | | |

| Commercial Vehicle Group, Inc. (3) | | | Construction Machinery & Heavy Trucks | | | | | | |

| Supplier of vehicle components | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 553,629 | | 3,520,855 | | | 3,770,213 | |

| | | | | | | | | |

| D-Wave Quantum, Inc. (3)(4)(5) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Develops high-performance quantum computing systems | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 911,938 | | 1,238,050 | | | 1,313,191 | |

| | | | | | | | | |

| Intevac, Inc. (3) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Develops solutions for the application and engineering of thin-films | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 1,100,572 | | 5,484,766 | | | 7,120,701 | |

| | | | | | | | | |

| Jerash Holdings US, Inc. | | | Apparel, Accessories & Luxury Goods | | | | | | |

| Manufactures ready-made sport and outerwear in Jordan | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 135,617 | | 862,705 | | | 527,550 | |

| | | | | | | | | |

| Lantronix, Inc. (3) | | | Communications Equipment | | | | | | |

| Provides secure data access and management solutions | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 514,132 | | 2,896,688 | | | 2,221,050 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

21

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2022 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 53.3% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Publicly Traded Equity and Equity-Related Securities - | | | | | | | | | |

| 43.3% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Quantum Corporation (3) | | | Technology Hardware, Storage & Peripherals | | | | | | |

| Provides high-density data storage and high-speed data processing solutions | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 3,102,812 | | $ | 8,843,263 | | | $ | 3,382,065 | |

| | | | | | | | | |

| RF Industries, Ltd. (3) | | | Electronic Manufacturing Services | | | | | | |

| Provides products that enable wired and wireless communications | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 336,470 | | 2,333,739 | | | 1,729,456 | |

| | | | | | | | | |

| Miscellaneous Common Stock (6) | (M) (L1) | | | | | | 3,264 | | | 3,291 | |

| | | | | | | | | |

| Total Unaffiliated Publicly Traded Equity and Equity-Related Securities (cost: $31,887,534) | | | | | | | | | $ | 28,348,665 | |

| | | | | | | | | |

| Unaffiliated Legacy Privately Held Equity and Equity-Related Securities - | | | | | | | | | |

| 10.0% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| AgBiome, LLC (3)(7) | | | Fertilizers & Agricultural Chemicals | | | | | | |

| Develops agricultural products that reduce risk and improve yield | | | | | | | | | |

| Series A-1 Convertible Preferred Units (acquired 1/30/13) | (H) (L3) | | | | 2,000,000 | | $ | 2,000,000 | | | $ | 4,372,191 | |

| Series A-2 Convertible Preferred Units (acquired 4/9/13-10/15/13) | (H) (L3) | | | | 417,392 | | 521,740 | | | 913,762 | |

| Series B Convertible Preferred Units (acquired 8/7/15) | (H) (L3) | | | | 160,526 | | 500,006 | | | 364,581 | |

| | | | | | | | 3,021,746 | | | 5,650,534 | |

| | | | | | | | | |

| AutoTech Ventures Management I, LLC (7)(8) | | | Asset Management & Custody Banks | | | | | | |

| Venture capital investing in automotive-related companies | | | | | | | | | |

| LLC Interests (acquired 12/1/17) | (M) (L3) | | | | 0 | | 0 | | | 218,534 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

22

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2022 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Unaffiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 53.3% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Legacy Privately Held Equity and Equity-Related Securities - | | | | | | | | | |

| 10.0% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Magnolia Neurosciences Corporation (5)(7)(9) | | | Pharmaceuticals | | | | | | |

| Develops novel therapeutics for treatment of neurodegeneration | | | | | | | | | |

| Series A Convertible Preferred Stock (acquired 8/3/18) | (I) (L3) | | | | 862,872 | | $ | 748,536 | | | $ | 121,576 | |

| | | | | | | | | |

| Nanosys, Inc. (3)(5)(7)(10) | | | Specialty Chemicals | | | | | | |

| Develops inorganic nanowires and quantum dots for use in LED-backlit devices | | | | | | | | | |

| Series A-1 Convertible Preferred Stock (acquired 5/22/21) | (I) (L3) | | | | 496,572 | | 496,573 | | | 110,708 | |

| Series A-2 Convertible Preferred Stock (acquired 5/22/21) | (I) (L3) | | | | 2,232,001 | | 4,500,003 | | | 394,221 | |

| | | | | | | | 4,996,576 | | | 504,929 | |

| | | | | | | | | |

| Phylagen, Inc. (3)(5)(7)(9) | | | Research & Consulting Services | | | | | | |

| Develops technology to improve human health and business productivity | | | | | | | | | |

| Series A Convertible Preferred Stock (acquired 11/14/18) | (I) (L3) | | | | 548,031 | | 233,845 | | | 0 | |

| | | | | | | | | |

| Ravenna Pharmaceuticals, Inc. (3)(5)(9)(11) | | | Pharmaceuticals | | | | | | |

| Holding company for intellectual property in oncology therapeutics | | | | | | | | | |

| Common Stock (acquired 5/14/20-8/26/21) | (M) (L3) | | | | 2,785,274 | | 108,258 | | | 16,414 | |

| Total Unaffiliated Legacy Privately Held Equity and Equity-Related Securities (cost: $9,108,961) | | | | | | | | | $ | 6,511,987 | |

| | | | | | | | | |

| Total Investments in Unaffiliated Equity and Equity-Related Securities (cost: $40,996,495) | | | | | | | | | $ | 34,860,652 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

23

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2022 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 38.2% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Non-Controlled Affiliated Publicly Traded Equity and Equity-Related Securities - | | | | | | | | | |

| 38.0% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Arena Group Holdings, Inc. (3)(12) | | | Interactive Media & Services | | | | | | |

| Provides a shared digital publishing, advertising and distribution platform | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 767,869 | | $ | 8,836,074 | | | $ | 8,147,090 | |

| | | | | | | | | |

| Comscore, Inc. (3)(12) | | | Advertising | | | | | | |

| Provides technology and services that measure audiences, brands and consumer behavior | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 3,909,475 | | 9,577,898 | | | 4,534,991 | |

| | | | | | | | | |

| Potbelly Corporation (3)(12) | | | Restaurants | | | | | | |

| Operates a chain of sandwich shops | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 1,587,769 | | 7,070,549 | | | 8,843,873 | |

| | | | | | | | | |

| Synchronoss Technologies, Inc. (3)(12) | | | Application Software | | | | | | |

| Provides white-label cloud storage, messaging and other digital analytic services | | | | | | | | | |

| Common Stock | (M) (L1) | | | | 5,467,081 | | 11,528,359 | | | 3,379,203 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Publicly Traded Equity and Equity-Related Securities (cost: $37,012,880) | | | | | | | | | $ | 24,905,157 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

24

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2022 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in Non-Controlled Affiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 38.2% of net assets at value (cont.) | | | | | | | | | |

| | | | | | | | | |

| Non-Controlled Affiliated Legacy Privately Held Equity and Equity-Related Securities - | | | | | | | | | |

| 0.2% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| EchoPixel, Inc. (3)(5)(7) | | | Health Care Equipment | | | | | | |

| Develops virtual reality 3-D visualization software for life sciences and health care applications | | | | | | | | | |

| Series Seed Convertible Preferred Stock (acquired 6/21/13-6/30/14) | (I) (L3) | | | | 4,194,630 | | $ | 1,250,000 | | | $ | 78,993 | |

| Series Seed-2 Convertible Preferred Stock (acquired 1/22/16) | (I) (L3) | | | | 1,476,668 | | 500,000 | | | 28,553 | |

| Series A-2 Convertible Preferred Stock (acquired 3/23/17) | (I) (L3) | | | | 1,471,577 | | 350,000 | | | 51,340 | |

| | | | | | | | 2,100,000 | | | 158,886 | |

| | | | | | | | | |

| HALE.life Corporation (3)(5)(7) | | | Health Care Technology | | | | | | |

| Develops a platform to facilitate precision health and medicine | | | | | | | | | |

| Common Stock (acquired 3/1/16) | (I) (L3) | | | | 1,000,000 | | 10 | | | 0 | |

| Series Seed-1 Convertible Preferred Stock (acquired 3/28/17) | (I) (L3) | | | | 11,000,000 | | 1,896,920 | | | 0 | |

| Series Seed-2 Convertible Preferred Stock (acquired 12/28/18) | (I) (L3) | | | | 12,083,132 | | 2,500,000 | | | 0 | |

| | | | | | | | 4,396,930 | | | 0 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Legacy Privately Held Equity and Equity-Related Securities (cost: $6,496,930) | | | | | | | | | $ | 158,886 | |

| | | | | | | | | |

| Total Investments in Non-Controlled Affiliated Equity and Equity-Related Securities (cost: $43,509,810) | | | | | | | | | $ | 25,064,043 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

25

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2022 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Controlled Affiliated Equity and Equity-Related Securities (2) - | | | | | | | | | |

| 4.1% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Parabellum Acquisition Partners, LLC (3)(7) | | | Specialized Finance | | | | | | |

| Holding company for Special Purpose Acquisition Company (SPAC) interests | | | | | | | | | |

| Membership Units (acquired 4/22/21) | (M) (L3) | | | | 693,151 | | $ | 2,923,003 | | | $ | 2,706,572 | |

| | | | | | | | | |

| Total Controlled Affiliated Equity and Equity-Related Securities (cost: $2,923,003) | | | | | | | | | $ | 2,706,572 | |

| | | | | | | | | |

| Total Investments in Publicly Traded Equity and Equity-Related Securities and Legacy Privately Held Equity and Equity-Related Securities (cost: $87,429,308) | | | | | | | | | $ | 62,631,267 | |

| | | | | | | | | |

| Derivative Securities - | | | | | | | | | |

| 0.3% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Derivative Securities (2) - | | | | | | | | | |

| 0.0% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Magnolia Neurosciences Corporation (5)(7)(9) | | | Pharmaceuticals | | | | | | |

| Developed neurodegeration therapeutics | | | | | | | | | |

| Warrants for the Purchase of Common Stock expiring 8/3/28 (acquired 8/26/21) | (I) (L3) | | | | 138,059 | | | $ | 112,854 | | | $ | 0 | |

| | | | | | | | | |

| OpGen, Inc. (3) | | | Biotechnology | | | | | | |

| Developing genomic analysis tools | | | | | | | | | |

| Warrants for the Purchase of Common Stock expiring 2/17/25 | (I) (L3) | | | | 62 | | 785 | | | 0 | |

| | | | | | | | | |

| Total Unaffiliated Derivative Securities (cost: $113,639) | | | | | | | | | $ | 0 | |

| | | | | | | | | |

| Non-Controlled Affiliated Derivative Securities (2) - | | | | | | | | | |

| 0.3% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Potbelly Corporation (3)(12) | | | Restaurants | | | | | | |

| Operates a chain of sandwich shops | | | | | | | | | |

| Warrants for the Purchase of Common Stock expiring 2/12/26 | (I) (L3) | | | | 80,605 | | $ | 224,849 | | | $ | 215,631 | |

| | | | | | | | | |

| Total Non-Controlled Affiliated Derivative Securities (cost: $224,849) | | | | | | | | | $ | 215,631 | |

| | | | | | | | | |

| Total Derivative Securities (cost: $338,488) | | | | | | | | | $ | 215,631 | |

| | | | | | | | | |

| Total Investments (cost: $87,767,796) | | | | | | | | | $ | 62,846,898 | |

| | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

26

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 180 DEGREE CAPITAL CORP. CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2022 |

| | | | | | | | | |

| Method of

Valuation (1) | | Industry | | Shares/Units | | Cost | | Value |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Financial Instruments (13) - | | | | | | | | | |

| | | | | | | | | |

| Unaffiliated Rights to Payments (Illiquid) (2) - | | | | | | | | | |

| 4.3% of net assets at value | | | | | | | | | |

| | | | | | | | | |

| Rights to Milestone Payments from Acquisition of BioVex Group, Inc. (acquired 3/4/11) (3)(5)(7)(14) | (I) (L3) | | Biotechnology | | $ | 548,998 | | | $ | 548,998 | | | $ | 0 | |

| | | | | | | | | |

| Rights to Milestone Payments from Acquisition of TARA Biosystems, Inc. (acquired 4/1/22) (3)(5)(7)(15) | (I) (L3) | | Pharmaceuticals | | $ | 2,771,540 | | | 2,771,540 | | | 2,842,814 | |

| | | | | | | | | |

| Total Unaffiliated Rights to Payments (cost: $3,320,538) | | | | | | | | | $ | 2,842,814 | |

| | | | | | | | | |