|

HARRIS

& HARRIS GROUP, INC.®

|

||

|

(Exact

Name of Registrant as Specified in its Charter)

|

||

|

New

York

|

13-3119827

|

|

|

(State

or Other Jurisdiction of

|

(I.R.S.

Employer Identification No.)

|

|

|

Incorporation

or Organization)

|

||

|

111

West 57th

Street, New York, New York

|

10019

|

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

|

|

Title

of Each Class

|

Name

of Each Exchange on Which Registered

|

|

|

Common

Stock, $.01 par value

|

Nasdaq

Global Market

|

|

Large

accelerated filer ¨

|

Accelerated

filer þ

|

Non-accelerated

Filer ¨

|

|

DOCUMENTS

INCORPORATED BY REFERENCE

|

INCORPORATED

AT

|

|

|

Harris

& Harris Group, Inc. Proxy Statement for the

|

Part

III, Items 10, 11,

|

|

|

2007

Annual Meeting of Shareholders

|

12,

13 and 14

|

|

Page

|

|||

|

PART

I

|

|||

|

Item

1.

|

Business

|

1

|

|

|

Item

1A.

|

Risk

Factors

|

14

|

|

|

Item

1B.

|

Unresolved

Staff Comments

|

26

|

|

|

Item

2.

|

Properties

|

27

|

|

|

Item

3.

|

Legal

Proceedings

|

27

|

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

27

|

|

|

PART

II

|

|||

|

Item

5.

|

Market

For Registrant's Common Equity, Related

|

||

|

Stockholder

Matters and Issuer Purchase of

|

|||

|

Equity

Securities

|

28

|

||

|

Item

6.

|

Selected

Financial Data

|

31

|

|

|

Item

7.

|

Management's

Discussion and Analysis of Financial

|

||

|

Condition

and Results of Operations

|

32

|

||

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market

|

||

|

|

Risk

|

49

|

|

|

Item

8.

|

Consolidated

Financial Statements

|

||

|

and

Supplementary Data

|

51

|

||

|

Item

9.

|

Changes

in and Disagreements with Accountants on

|

||

|

Accounting

and Financial Disclosure

|

95

|

||

|

Item

9A.

|

Controls

and Procedures

|

95

|

|

|

Item

9B.

|

Other

Information

|

95

|

|

|

PART

III

|

|||

|

Item

10.

|

Directors

and Executive Officers of the Registrant

|

96

|

|

|

Item

11.

|

Executive

Compensation

|

96

|

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners

|

||

|

and

Management and Related Stockholder Matters

|

96

|

||

|

Item

13.

|

Certain

Relationships and Related Transactions,

|

||

|

and

Director Independence

|

96

|

||

|

Item

14.

|

Principal

Accountant Fees and Services

|

97

|

|

|

PART

IV

|

|||

|

Item

15.

|

Exhibits

and Financial Statements Schedules

|

98

|

|

|

Signatures

|

100

|

||

|

Exhibit

Index

|

102

|

||

| · |

Equity,

equity-related securities (including warrants) and debt with equity

features from either private or public

issuers.

|

| · |

Venture

capital investments, whether in corporate, partnership or other

form, including development stage or start-up entities.

|

| · |

Intellectual

property or patents or research and development in technology

or product development that may lead to patents or other marketable

technology.

|

| · |

Debt

obligations of all types having varying terms with respect to security

or credit support, subordination, purchase price, interest payments

and maturity.

|

| · |

Foreign

securities.

|

| · |

Miscellaneous

investments.

|

|

·

|

recruiting

management;

|

|

·

|

formulating

operating strategies;

|

|

·

|

formulating

intellectual property strategies;

|

|

·

|

assisting

in financial planning;

|

|

·

|

providing

management in the initial start-up stages; and

|

|

·

|

establishing

corporate goals.

|

|

·

|

funding

research and development in the development of a technology;

|

|

·

|

obtaining

licensing rights to intellectual property or patents;

|

|

·

|

acquiring

intellectual property or patents;

or

|

|

·

|

forming

and funding companies or joint ventures to commercialize further

intellectual property.

|

| • |

stock

market and capital markets

conditions;

|

| • |

internal

developments in our Company with respect to our personnel, financial

condition

and compliance with all applicable

regulations;

|

| • |

announcements

regarding any of our portfolio

companies;

|

| • |

announcements

regarding developments in the nanotechnology field in

general;

|

| • |

environmental

and health concerns regarding nanotechnology, whether real or perceptual;

|

| • |

announcements

regarding government funding and initiatives related to the development

of nanotechnology;

|

| • |

general

economic conditions and trends;

and/or

|

| • |

departures

of key personnel.

|

|

2006

Quarter Ending

|

Low

|

High

|

|||||

|

March

31

|

$

|

12.75

|

$

|

16.10

|

|||

|

June

30

|

$

|

9.57

|

$

|

14.26

|

|||

|

September

30

|

$

|

9.38

|

$

|

12.99

|

|||

|

December

31

|

$

|

11.80

|

$

|

15.16

|

|||

|

2005

Quarter Ending

|

Low

|

High

|

|||||

|

March

31

|

$

|

11.30

|

$

|

16.80

|

|||

|

June

30

|

$

|

10.01

|

$

|

13.38

|

|||

|

September

30

|

$

|

10.70

|

$

|

13.85

|

|||

|

December

31

|

$

|

10.15

|

$

|

14.95

|

|||

|

EQUITY

COMPENSATION PLAN INFORMATION

As

of December 31, 2006

|

|

|

Number

of securities to be issued upon exercise of outstanding options,

warrants

and rights

|

|

Weighted

average exercise price of outstanding options, warrants and

rights

|

|

Number

of securities remaining available for future

issuance

|

|||||

|

Plan

category

|

(a)

|

(b)

|

(c)

|

|||||||

|

Equity

compensation plans approved by security holders

|

3,699,611

|

$

|

10.11

|

192,986

|

||||||

|

Equity

compensation plans not approved by security holders

|

||||||||||

|

TOTAL

|

3,699,611

|

$

|

10.11

|

192,986

|

||||||

|

|

|

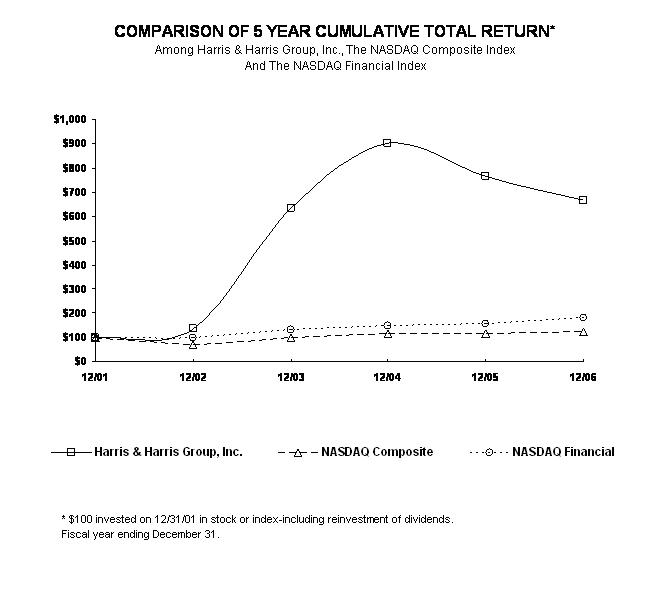

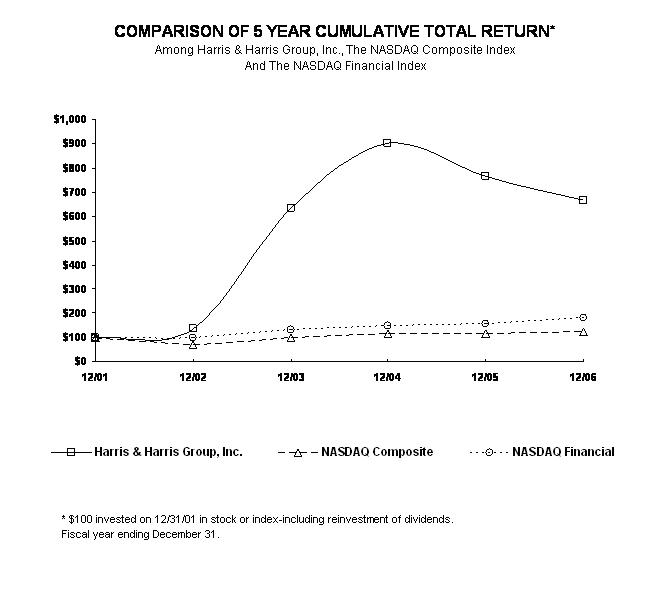

12/01

|

12/02

|

12/03

|

12/04

|

12/05

|

12/06

|

|

Harris

& Harris Group, Inc.

|

100.00

|

135.56

|

635.37

|

902.64

|

765.97

|

666.23

|

|

|

Nasdaq

Composite

|

100.00

|

69.66

|

99.71

|

113.79

|

114.47

|

124.20

|

|

|

Nasdaq

Financial

|

100.00

|

98.84

|

130.51

|

148.01

|

156.43

|

181.94

|

|

|

2006

|

|

2005

|

|

2004

|

|

2003

|

|

2002

|

|||||||

|

Total

assets

|

$

|

118,328,590

|

$

|

132,938,120

|

$

|

79,361,451

|

$

|

44,115,128

|

$

|

35,951,969

|

||||||

|

Total

liabilities

|

$

|

4,398,287

|

$

|

14,950,378

|

$

|

4,616,652

|

$

|

3,432,390

|

$

|

8,695,923

|

||||||

|

Net

assets

|

$

|

113,930,303

|

$

|

117,987,742

|

$

|

74,744,799

|

$

|

40,682,738

|

$

|

27,256,046

|

||||||

|

Net

asset value per outstanding share

|

$

|

5.42

|

$

|

5.68

|

$

|

4.33

|

$

|

2.95

|

$

|

2.37

|

||||||

|

Cash

dividends paid

|

$

|

0.00

|

$

|

0.00

|

$

|

0.00

|

$

|

0.00

|

$

|

0.00

|

||||||

|

Cash

dividends paid per outstanding share

|

$

|

0.00

|

$

|

0.00

|

$

|

0.00

|

$

|

0.00

|

$

|

0.00

|

||||||

|

Shares

outstanding, end of year

|

21,015,017

|

20,756,345

|

17,248,845

|

13,798,845

|

11,498,845

|

|||||||||||

|

|

2006

|

2005

|

2004

|

2003

|

2002

|

|||||||||||

|

Total

investment income

|

$

|

3,028,761

|

$

|

1,540,862

|

$

|

637,562

|

$

|

167,785

|

$

|

253,461

|

||||||

|

|

||||||||||||||||

|

Total

expenses1

|

$

|

10,641,696

|

$

|

7,006,623

|

$

|

4,046,341

|

$

|

2,731,527

|

$

|

2,124,549

|

||||||

|

Net

operating (loss) income

|

$

|

(7,612,935

|

)

|

$

|

(5,465,761

|

)

|

$

|

(3,408,779

|

)

|

$

|

(2,563,742

|

)

|

$

|

(1,871,088

|

)

|

|

|

Total

tax (benefit) expense2

|

$

|

(227,355

|

)

|

$

|

8,288,778

|

$

|

650,617

|

$

|

13,761

|

$

|

199,309

|

|||||

|

Net

realized income (loss) from

|

||||||||||||||||

|

investments

|

$

|

258,693

|

$

|

14,208,789

|

$

|

858,503

|

$

|

(984,925

|

)

|

$

|

2,390,302

|

|||||

|

Net

(increase) decrease in unrealized

|

||||||||||||||||

|

depreciation

on investments

|

$

|

(4,418,870

|

)

|

$

|

(2,026,652

|

)

|

$

|

484,162

|

$

|

343,397

|

$

|

(3,241,408

|

)

|

|||

|

Net

(decrease) increase in net assets

|

||||||||||||||||

|

resulting

from operations

|

$

|

(11,773,112

|

)

|

$

|

6,716,376

|

$

|

(2,066,114

|

)

|

$

|

(3,205,270

|

)

|

$

|

(2,722,194

|

)

|

||

|

(Decrease)

increase in net assets

|

||||||||||||||||

|

resulting

from operations per

|

||||||||||||||||

|

average

outstanding share

|

$

|

(0.57

|

)

|

$

|

0.36

|

$

|

(0.13

|

)

|

$

|

(0.28

|

)

|

$

|

(0.27

|

)

|

||

|

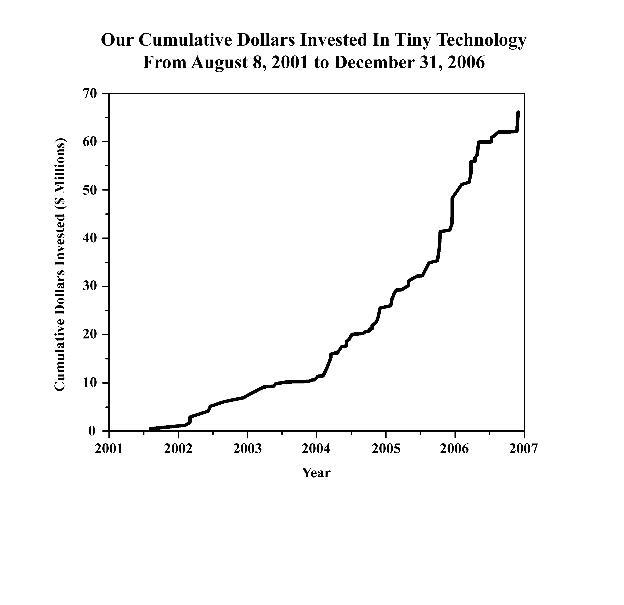

2001

|

2002

|

2003

|

2004

|

2005

|

2006

|

|

|

Total

Incremental Investments

|

$489,999

|

$6,240,118

|

$3,812,600

|

$14,837,846

|

$16,251,339

|

$24,408,187

|

|

No.

of New Investments

|

1

|

7

|

5

|

8

|

4

|

6

|

|

No.

of Follow-On Investment Rounds

|

0

|

1

|

5

|

21

|

13

|

14

|

|

No.

of Rounds Led

|

0

|

1

|

0

|

2

|

0

|

7

|

|

Average

Dollar Amount - Initial

|

$489,999

|

$784,303

|

$437,156

|

$911,625

|

$1,575,000

|

$2,383,424

|

|

Average

Dollar Amount - Follow-On

|

N/A

|

$750,000

|

$325,364

|

$359,278

|

$765,488

|

$721,974

|

|

2001

|

2002

|

2003

|

2004

|

2005

|

2006

|

||||||||||||||

|

Net

Asset Value, Beginning of Year

|

31,833,475

|

24,334,770

|

27,256,046

|

40,682,738

|

74,744,799

|

117,987,742

|

|||||||||||||

|

Gross

Write-Downs During Year

|

(2,532,730

|

)

|

(5,400,005

|

)

|

(1,256,102

|

)

|

(5,711,229

|

)

|

(3,450,236

|

)

|

(4,211,323

|

)

|

|||||||

|

Gross

Write-Downs as a Percentage of Net Asset Value

|

-7.96

|

%

|

-22.19

|

%

|

-4.61

|

%

|

-14.04

|

%

|

-4.62

|

%

|

-3.57

|

%

|

|||||||

|

31-Dec-00

|

31-Mar-01

|

30-June-01

|

30-Sep-01

|

31-Dec-01

|

||||||||||||

|

NAV

per Share

|

3.51

|

3.09

|

3.29

|

2.92

|

2.75

|

|||||||||||

|

$

Change

|

(0.42

|

)

|

0.20

|

(0.37

|

)

|

(0.17

|

)

|

|||||||||

|

%

Change

|

-11.97

|

%

|

6.47

|

%

|

-11.25

|

%

|

-5.82

|

%

|

||||||||

|

|

31-Mar-02

|

30-June-02

|

30-Sep-02(1

|

)

|

31-Dec-02

|

|||||||||||

|

NAV

per Share

|

2.63

|

2.68

|

2.61

|

2.37

|

||||||||||||

|

$

Change

|

(0.12

|

)

|

0.05

|

(0.07

|

)

|

(0.24

|

)

|

|||||||||

|

%

Change

|

-4.36

|

%

|

1.90

|

%

|

-2.61

|

%

|

-9.20

|

%

|

||||||||

|

|

31-Mar-03

|

30-June-03

|

30-Sep-03

|

31-Dec-03(1

|

)

|

|||||||||||

|

NAV

per Share

|

2.26

|

2.22

|

2.11

|

2.95

|

||||||||||||

|

$

Change

|

(0.11

|

)

|

(0.04

|

)

|

(0.11

|

)

|

0.84

|

|||||||||

|

%

Change

|

-4.64

|

%

|

-1.77

|

%

|

-4.95

|

%

|

39.81

|

%

|

||||||||

|

|

31-Mar-04

|

30-June-04

|

30-Sep-04(1

|

)

|

31-Dec-04

|

|||||||||||

|

NAV

per Share

|

3.01

|

2.85

|

4.44

|

4.33

|

||||||||||||

|

$

Change

|

0.06

|

(0.16

|

)

|

1.59

|

(0.11

|

)

|

||||||||||

|

%

Change

|

2.03

|

%

|

-5.32

|

%

|

55.79

|

%

|

-2.48

|

%

|

||||||||

|

|

31-Mar-05

|

30-June-05

|

30-Sep-05(1

|

)

|

31-Dec-05

|

|||||||||||

|

NAV

per Share

|

4.20

|

4.61

|

5.94

|

5.68

|

||||||||||||

|

$

Change

|

(0.13

|

)

|

0.41

|

1.33

|

(0.26

|

)

|

||||||||||

|

%

Change

|

-3.00

|

%

|

9.76

|

%

|

28.85

|

%

|

-4.38

|

%

|

||||||||

|

|

31-Mar-06

|

30-June-06

|

30-Sep-06

|

31-Dec-06

|

||||||||||||

|

NAV

per Share

|

5.6

|

5.54

|

5.54

|

5.42

|

||||||||||||

|

$

Change

|

(0.08

|

)

|

(0.06

|

)

|

0.00

|

(0.12

|

)

|

|||||||||

|

%

Change

|

-1.41

|

%

|

-1.07

|

%

|

0.00

|

%

|

-2.17

|

%

|

||||||||

|

New

Investments

|

Amount

|

|||

|

D-Wave

Systems, Inc.

|

$

|

1,750,547

|

||

|

Evolved

Nanomaterial Sciences, Inc.

|

2,800,000

|

|||

|

Innovalight,

Inc.

|

2,500,000

|

|||

|

Metabolon,

Inc.

|

2,500,000

|

|||

|

SiOnyx,

Inc.

|

750,000

|

|||

|

Xradia,

Inc.

|

4,000,000

|

|||

|

Follow-on

Investments

|

||||

|

Chlorogen,

Inc.

|

$

|

221,438

|

||

|

Crystal

IS, Inc.

|

1,098,240

|

|||

|

CSwitch

Corporation

|

2,850,000

|

|||

|

NanoGram

Corporation

|

1,262,764

|

|||

|

NanoOpto

Corporation

|

433,138

|

|||

|

NeoPhotonics

Corporation

|

2,750,000

|

|||

|

Nextreme

|

500,000

|

|||

|

Polatis,

Inc.

|

89,310

|

|||

|

Questech

Corporation

|

12,750

|

|||

|

SiOnyx,

Inc.

|

890,000

|

|||

|

Total

|

$

|

24,408,187

|

||

|

December

31,

|

|

||||||

|

|

|

2006

|

|

2005

|

|||

|

Venture

capital investments,

|

|||||||

|

at

cost

|

$

|

62,118,800

|

$

|

37,706,342

|

|||

|

Net

unrealized depreciation

|

8,450,969

|

4,519,009

|

|||||

|

Venture

capital investments,

|

|||||||

|

at

fair value

|

$

|

53,667,831

|

$

|

33,187,333

|

|||

|

|

December

31,

|

||||||

|

2006

|

2005

|

||||||

|

U.S.

government and agency

|

|||||||

|

securities,

at cost

|

$

|

59,212,598

|

$

|

96,320,405

|

|||

|

Net

unrealized depreciation

|

556,451

|

69,541

|

|||||

|

U.S.

government and agency

|

|||||||

|

securities,

at fair value

|

$

|

58,656,147

|

$

|

96,250,864

|

|||

|

December

31,

|

|||||||

|

Category

|

2006

|

2005

|

|||||

|

Tiny

Technology

|

99.9

|

%

|

99.9

|

%

|

|||

|

Other

Venture Capital Investments

|

0.1

|

%

|

0.1

|

%

|

|||

|

Total

Venture Capital Investments

|

100.0

|

%

|

100.0

|

%

|

|||

|

New

Investment

|

Amount

|

|||

|

eLite

Optoelectronics, Inc.

|

$

|

1,000,000

|

||

|

Kereos,

Inc.

|

800,000

|

|||

|

Kovio,

Inc.

|

3,000,000

|

|||

|

Zia

Laser, Inc.

|

1,500,000

|

|||

|

Follow-on

Investments

|

||||

|

Cambrios

Technologies Corporation

|

$

|

511,006

|

||

|

Chlorogen,

Inc.

|

364,261

|

|||

|

Kereos,

Inc.

|

160,000

|

|||

|

Molecular

Imprints, Inc.

|

2,500,000

|

|||

|

Nanomix,

Inc.

|

250,000

|

|||

|

NanoOpto

Corporation

|

411,741

|

|||

|

Mersana

Therapeutics, Inc.

|

683,000

|

|||

|

Nanosys,

Inc.

|

3,000,003

|

|||

|

Nantero,

Inc.

|

571,329

|

|||

|

NeoPhotonics

Corporation

|

999,999

|

|||

|

Starfire

Systems, Inc.

|

500,000

|

|||

|

Total

|

$

|

16,251,339

|

||

| Documents |

Page

|

|

|

Management's

Report on Internal Control Over

|

||

|

Financial

Reporting

|

52

|

|

|

Report

of Independent Registered Public Accounting Firm

|

53

|

|

| Consolidated Financial Statements | ||

|

Consolidated

Statements of Assets and Liabilities

|

||

|

as of December 31, 2006, and 2005

|

55

|

|

|

|

||

|

Consolidated

Statements of Operations for the

|

||

|

years ended December 31, 2006, 2005, 2004

|

56

|

|

|

Consolidated

Statements of Cash Flows for the

|

||

|

years

ended December 31, 2006, 2005, and 2004

|

57

|

|

|

Consolidated

Statements of Changes in Net Assets for the

|

||

|

years

ended December 31, 2006, 2005, and 2004

|

58

|

|

|

Consolidated

Schedule of Investments as of December 31, 2006

|

59-66

|

|

|

Consolidated

Schedule of Investments as of December 31, 2005

|

67-72

|

|

|

Footnote

to Consolidated Schedule of Investments

|

73-76

|

|

|

Notes

to Consolidated Financial Statements

|

77-93

|

|

|

Financial

Highlights for the years ended December 31, 2006,

|

||

|

2005 and 2004

|

94

|

|

|

•

|

pertain

to the maintenance of records that in reasonable detail accurately

and

fairly reflect the transactions and dispositions of the assets of

the

Company;

|

|

•

|

provide

reasonable assurance that transactions are recorded as necessary

to permit

preparation of financial statements in accordance with generally

accepted

accounting principles, and that receipts and expenditures of the

company

are being made only in accordance with authorizations of management

and

directors of the Company; and

|

|

•

|

provide

reasonable assurance regarding prevention or timely detection of

unauthorized acquisition, use or disposition of the Company's assets

that

could have a material effect on the financial

statements.

|

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

STATEMENTS OF ASSETS AND

LIABILITIES

|

|

ASSETS

|

|||||||

|

December

31, 2006

|

|

December

31, 2005

|

|||||

|

Investments,

at value (Cost: $121,331,398 at 12/31/06,

|

|||||||

|

$134,026,747

at 12/31/05

|

$

|

112,323,978

|

$

|

129,438,197

|

|||

|

Cash

and cash equivalents

|

2,071,788

|

1,213,289

|

|||||

|

Restricted

funds (Note 6)

|

2,149,785

|

1,730,434

|

|||||

|

Receivable

from portfolio company

|

0

|

75,000

|

|||||

|

Receivable

from broker (Note 3)

|

819,905

|

0

|

|||||

|

Interest

receivable

|

625,372

|

248,563

|

|||||

|

Prepaid

expenses

|

10,945

|

2,993

|

|||||

|

Other

assets

|

326,817

|

229,644

|

|||||

|

Total

assets

|

$

|

118,328,590

|

$

|

132,938,120

|

|||

|

LIABILITIES

& NET ASSETS

|

|||||||

|

Accounts

payable and accrued liabilities (Note 6)

|

$

|

4,115,300

|

$

|

3,174,183

|

|||

|

Accrued

profit sharing (Note 4)

|

261,661

|

2,107,858

|

|||||

|

Deferred

rent

|

21,326

|

31,003

|

|||||

|

Current

taxes payable

|

0

|

1,514,967

|

|||||

|

Taxes

payable on behalf of shareholders (Note 7)

|

0

|

8,122,367

|

|||||

|

Total

liabilities

|

4,398,287

|

14,950,378

|

|||||

|

Net

assets

|

$

|

113,930,303

|

$

|

117,987,742

|

|||

|

Net

assets are comprised of:

|

|||||||

|

Preferred

stock, $0.10 par value,

|

|||||||

|

2,000,000

shares authorized; none issued

|

$

|

0

|

$ | 0 | |||

|

Common

stock, $0.01 par value, 45,000,000 shares authorized at

|

|||||||

|

12/31/06

and 30,000,000 at 12/31/05; 22,843,757 issued at

|

|||||||

|

12/31/06

and 22,585,085 issued at 12/31/05

|

228,438

|

225,851

|

|||||

|

Additional

paid in capital (Note 9)

|

129,801,201

|

122,149,642

|

|||||

|

Accumulated

net realized income (loss)

|

(3,747,912

|

)

|

3,781,905

|

||||

|

Accumulated

unrealized depreciation of investments

|

(9,007,420

|

)

|

(4,764,125

|

)

|

|||

|

Unrecognized

net gain on retirement benefit plans (Note 6)

|

61,527

|

||||||

|

Treasury

stock, at cost (1,828,740 shares at 12/31/06 and

|

|||||||

|

12/31/05)

|

(3,405,531

|

)

|

(3,405,531

|

)

|

|||

|

Net

assets

|

$

|

113,930,303

|

$

|

117,987,742

|

|||

|

Shares

outstanding

|

21,015,017

|

20,756,345

|

|||||

|

Net

asset value per outstanding share

|

$

|

5.42

|

$

|

5.68

|

|||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS

|

|

|

Year

Ended

|

|

Year

Ended

|

|

Year

Ended

|

|

||||

|

|

|

December

31, 2006

|

|

December

31, 2005

|

|

December

31, 2004

|

||||

|

Investment

income:

|

||||||||||

|

Interest

from:

|

||||||||||

|

Fixed-income

securities

|

$

|

2,991,261

|

$

|

1,409,273

|

$

|

614,728

|

||||

|

Portfolio

companies

|

0

|

65,620

|

22,834

|

|||||||

|

Miscellaneous

income

|

37,500

|

65,969

|

0

|

|||||||

|

Total

investment income

|

3,028,761

|

1,540,862

|

637,562

|

|||||||

|

Expenses:

|

||||||||||

|

Salaries,

benefits and stock-based

|

||||||||||

|

compensation

(Note 3)

|

7,933,276

|

2,459,033

|

1,928,088

|

|||||||

|

Administration

and operations

|

1,250,080

|

1,319,354

|

718,530

|

|||||||

|

Profit-sharing

provision (Note 4)

|

50,875

|

1,796,264

|

311,594

|

|||||||

|

Professional

fees

|

737,828

|

830,062

|

667,311

|

|||||||

|

Rent

|

239,846

|

211,582

|

151,434

|

|||||||

|

Directors'

fees and expenses

|

340,750

|

308,874

|

209,210

|

|||||||

|

Depreciation

|

64,916

|

64,713

|

43,151

|

|||||||

|

Custodian

fees

|

24,125

|

16,741

|

17,023

|

|||||||

|

Total

expenses

|

10,641,696

|

7,006,623

|

4,046,341

|

|||||||

|

Net

operating loss

|

(7,612,935

|

)

|

(5,465,761

|

)

|

(3,408,779

|

)

|

||||

|

Net

realized gain from investments:

|

||||||||||

|

Realized

gain from investments

|

31,338

|

23,862,037

|

813,994

|

|||||||

|

Income

tax (benefit) expense (Note 7)

|

(227,355

|

)

|

9,653,248

|

(44,509

|

)

|

|||||

|

Net

realized gain from investments

|

258,693

|

14,208,789

|

858,503

|

|||||||

|

Net

(increase) decrease in unrealized

|

||||||||||

|

depreciation

on investments:

|

||||||||||

|

Change

as a result of investment sales

|

0

|

|

(23,181,420

|

)

|

915,118

|

|||||

|

Change

on investments held

|

(4,418,870

|

)

|

19,790,298

|

264,170

|

||||||

|

Change

in unrealized depreciation

|

||||||||||

|

on

investments

|

(4,418,870

|

)

|

(3,391,122

|

)

|

1,179,288

|

|||||

|

Income

tax (benefit) expense (Note 7)

|

0

|

(1,364,470

|

)

|

695,126

|

||||||

|

Net

decrease (increase) in unrealized

|

||||||||||

|

depreciation

on investments

|

(4,418,870

|

)

|

(2,026,652

|

)

|

484,162

|

|||||

|

Net

(decrease) increase in net assets

|

||||||||||

|

resulting

from operations:

|

||||||||||

|

Total

|

$

|

(11,773,112

|

)

|

$

|

6,716,376

|

$

|

(2,066,114

|

)

|

||

|

Per

average basic and diluted outstanding share

|

$

|

(0.57

|

)

|

$

|

0.36

|

$

|

(0.

13

|

)

|

||

|

Average

outstanding shares

|

20,759,547

|

18,471,770

|

15,476,714

|

|||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

|

|

Year

Ended

|

|

Year

Ended

|

|

Year

Ended

|

|

|||||

|

|

|

December

31, 2006

|

|

December

31, 2005

|

|

December

31, 2004

|

||||

|

Cash

flows used in operating activities:

|

||||||||||

|

Net

(decrease) increase in net assets

|

||||||||||

|

resulting

from operations

|

$

|

(11,773,112

|

)

|

$

|

6,716,376

|

$

|

(2,066,114

|

)

|

||

|

Adjustments

to reconcile net increase (decrease) in net assets

|

||||||||||

|

resulting

from operations to net cash used in operating activities:

|

||||||||||

|

Net

realized and unrealized loss (gain) on investments

|

4,420,619

|

(20,470,915

|

)

|

(1,993,282

|

)

|

|||||

|

Deferred

income taxes

|

0

|

(1,364,470

|

)

|

695,126

|

||||||

|

Depreciation

and amortization

|

(426,168

|

)

|

346,019

|

43,151

|

||||||

|

Taxes

payable on behalf of shareholders on deemed dividend

|

0

|

8,122,367

|

0

|

|||||||

|

Stock-based

compensation expense

|

5,038,956

|

0

|

0

|

|||||||

|

Changes

in assets and liabilities:

|

||||||||||

|

Restricted

funds

|

(419,351

|

)

|

(138,463

|

)

|

(379,893

|

)

|

||||

|

Receivable

from portfolio company

|

75,000

|

(65,000

|

)

|

(10,000

|

)

|

|||||

|

Interest

receivable

|

(376,808

|

)

|

(189,603

|

)

|

(58,510

|

)

|

||||

|

Income

tax receivable

|

0

|

(7,023

|

)

|

14,895

|

||||||

|

Prepaid

expenses

|

(7,951

|

)

|

539,496

|

(535,648

|

)

|

|||||

|

Other

receivables

|

(819,905

|

)

|

0

|

0

|

||||||

|

Other

assets

|

(176,325

|

)

|

11,599

|

(8,666

|

)

|

|||||

|

Accounts

payable and accrued liabilities

|

1,002,643

|

268,525

|

182,260

|

|||||||

|

Accrued

profit sharing

|

(1,846,197

|

)

|

1,796,264

|

311,594

|

||||||

|

Deferred

rent

|

(9,677

|

)

|

(3,927

|

)

|

(4,718

|

)

|

||||

|

Current

income tax liability

|

(9,637,026

|

)

|

1,524,470

|

0

|

||||||

|

|

||||||||||

|

Net

cash used

in operating

activities

|

(14,955,302

|

)

|

(2,914,285

|

)

|

(3,809,805

|

)

|

||||

|

Cash

flows from investing activities:

|

||||||||||

|

Net

(purchase) sale of short-term investments

|

||||||||||

|

and

marketable securities

|

37,593,589

|

(52,144,482

|

)

|

(17,823,606

|

)

|

|||||

|

Investment

in private placements and loans

|

(24,408,187

|

)

|

(16,251,339

|

)

|

(16,731,216

|

)

|

||||

|

Proceeds

from sale of investments

|

28,295

|

35,392,200

|

2,530,483

|

|||||||

|

Purchase

of fixed assets

|

(15,086

|

)

|

(45,704

|

)

|

(69,273

|

)

|

||||

|

Net

cash provided by (used in) investing activities

|

13,198,611

|

(33,049,325

|

)

|

(32,093,612

|

)

|

|||||

|

Cash

flows from financing activities:

|

||||||||||

|

Proceeds

from public offering, net (Note 9)

|

0

|

36,526,567

|

36,128,175

|

|||||||

|

Proceeds

from stock option exercises (Note 3)

|

2,615,190

|

0

|

0

|

|||||||

|

Net

cash provided by financing activities

|

2,615,190

|

36,526,567

|

36,128,175

|

|||||||

|

Net

increase in cash and cash equivalents:

|

||||||||||

|

Cash

and cash equivalents at beginning of the year

|

1,213,289

|

650,332

|

425,574

|

|||||||

|

Cash

and cash equivalents at end of the year

|

2,071,788

|

1,213,289

|

650,332

|

|||||||

|

Net

increase in cash and cash equivalents

|

$

|

858,499

|

$

|

562,957

|

$

|

224,758

|

||||

|

Supplemental

disclosures of cash flow information:

|

||||||||||

|

Income

taxes paid

|

$

|

9,425,922

|

$

|

0

|

$

|

0

|

||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

STATEMENTS OF CHANGES IN NET ASSETS

|

|

Year

Ended

|

|

Year

Ended

|

|

Year

Ended

|

|

|||||

|

|

|

December

31, 2006

|

|

December

31, 2005

|

|

December

31, 2004

|

||||

|

Changes

in net assets from operations:

|

||||||||||

|

Net

operating loss

|

$

|

(7,612,935

|

)

|

$

|

(5,465,761

|

)

|

$

|

(3,408,779

|

)

|

|

|

Net

realized income (loss) on investments

|

258,693

|

14,208,789

|

858,503

|

|||||||

|

Net

increase (decrease) in unrealized

|

||||||||||

|

depreciation

on investments as a

|

||||||||||

|

result

of sales

|

0

|

(23,181,420

|

)

|

915,118

|

||||||

|

Net

(increase) decrease in unrealized

|

||||||||||

|

depreciation

on investments held

|

(4,418,870

|

)

|

19,790,298

|

264,170

|

||||||

|

Net

change in deferred taxes

|

0

|

1,364,470

|

(695,126

|

)

|

||||||

|

Net

increase (decrease) in net assets resulting

|

||||||||||

|

from

operations

|

(11,773,112

|

)

|

6,716,376

|

(2,066,114

|

)

|

|||||

|

Changes

in net assets from

|

||||||||||

|

capital

stock transactions:

|

||||||||||

|

Issuance

of common stock upon the

|

||||||||||

|

exercise

of stock options

|

2,587

|

0

|

0

|

|||||||

|

Proceeds

from sale of stock

|

0

|

35,075

|

34,500

|

|||||||

|

Additional

paid in capital on common

|

||||||||||

|

stock

issued

|

2,612,603

|

36,491,492

|

36,093,675

|

|||||||

|

Stock

based compensation expense

|

5,038,956

|

0

|

0

|

|||||||

|

Net

increase in net assets resulting

|

||||||||||

|

from

capital stock

transactions

|

7,654,146

|

36,526,567

|

36,128,175

|

|||||||

|

Changes

in net assets from adoption

|

||||||||||

|

of

SFAS No. 158

|

61,527

|

0

|

0

|

|||||||

|

Net

(decrease) increase in net assets

|

(4,057,439

|

)

|

43,242,943

|

34,062,061

|

||||||

|

Net

Assets:

|

||||||||||

|

Beginning

of the year

|

117,987,742

|

74,744,799

|

40,682,738

|

|||||||

|

End

of the year

|

$

|

113,930,303

|

$

|

117,987,742

|

$

|

74,744,799

|

||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF DECEMBER 31,

2006

|

|

Method

of

|

|

Shares/

|

|

|

|

|||||

|

|

|

Valuation

(3)

|

|

Principal

|

|

Value

|

||||

|

Investments

in Unaffiliated Companies (6)(7) - 15.61% of net

assets

|

||||||||||

|

Private

Placement Portfolio (Illiquid) - 15.61% of net

assets

|

||||||||||

|

AlphaSimplex

Group, LLC (2) -- Investment management company headed by

|

||||||||||

|

Dr.

Andrew W. Lo, holder of the Harris & Harris Group Chair at

MIT

|

||||||||||

|

Limited

Liability Company Interest

|

(B

|

)

|

--

|

$

|

10,521

|

|||||

|

Exponential

Business Development Company (1)(2) --

|

||||||||||

|

Venture

capital partnership focused on early stage companies

|

||||||||||

|

Limited

Partnership Interest

|

(B

|

)

|

--

|

0

|

||||||

|

Molecular

Imprints, Inc. (1)(2) -- Manufacturing nanoimprint lithography

|

||||||||||

|

capital

equipment

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(A

|

)

|

1,333,333

|

2,000,000

|

||||||

|

Series

C Convertible Preferred Stock

|

(A

|

)

|

1,250,000

|

2,500,000

|

||||||

|

Warrants

at $2.00 expiring12/31/11

|

(B

|

)

|

125,000

|

0

|

||||||

|

4,500,000

|

||||||||||

|

Nanosys,

Inc. (1)(2)(5) -- Developing zero and one-dimensional

|

||||||||||

|

inorganic

nanometer-scale materials for use in nanotechnology-

|

||||||||||

|

enabled

systems

|

||||||||||

|

Series

C Convertible Preferred Stock

|

(C

|

)

|

803,428

|

2,370,113

|

||||||

|

Series

D Convertible Preferred Stock

|

(C

|

)

|

1,016,950

|

3,000,003

|

||||||

|

5,370,116

|

||||||||||

|

Nantero,

Inc. (1)(2)(5) -- Developing a high-density, nonvolatile, random

|

||||||||||

|

access

memory chip, enabled by carbon nanotubes

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(C

|

)

|

345,070

|

1,046,908

|

||||||

|

Series

B Convertible Preferred Stock

|

(C

|

)

|

207,051

|

628,172

|

||||||

|

Series

C Convertible Preferred Stock

|

(C

|

)

|

188,315

|

571,329

|

||||||

|

2,246,409

|

||||||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF DECEMBER

31, 2006

|

|

Method

of

|

Shares/

|

|

||||||||

|

|

Valuation

(3)

|

Principal

|

Value

|

|||||||

|

Investments

in Unaffiliated Companies (6)(7) - 15.61% of net assets

(cont.)

|

||||||||||

|

Private

Placement Portfolio (Illiquid) - 15.61% of net assets

(cont.)

|

||||||||||

|

NeoPhotonics

Corporation (1)(2) -- Developing and manufacturing

|

||||||||||

|

planar

optical devices and components

|

||||||||||

|

Common

Stock

|

(C

|

)

|

716,195

|

$

|

133,141

|

|||||

|

Series

1 Convertible Preferred Stock

|

(C

|

)

|

1,831,256

|

1,831,256

|

||||||

|

Series

2 Convertible Preferred Stock

|

(C

|

)

|

741,898

|

741,898

|

||||||

|

Series

3 Convertible Preferred Stock

|

(C

|

)

|

2,750,000

|

2,750,000

|

||||||

|

Warrants

at $0.15 expiring 01/26/10

|

(C

|

)

|

16,364

|

164

|

||||||

|

Warrants

at $0.15 expiring 12/05/10

|

(C

|

)

|

14,063

|

140

|

||||||

|

5,456,599

|

||||||||||

|

Polatis,

Inc. (1)(2)(5)(10) -- Developing optical networking

components

|

||||||||||

|

by

merging materials, MEMS and electronics technologies

|

||||||||||

|

Series

A-1 Convertible Preferred Stock

|

(B

|

)

|

16,775

|

0

|

||||||

|

Series

A-2 Convertible Preferred Stock

|

(B

|

)

|

71,611

|

141,520

|

||||||

|

Series

A-4 Convertible Preferred Stock

|

(B

|

)

|

4,774

|

9,435

|

||||||

|

Series

A-5 Convertible Preferred Stock

|

(B

|

)

|

5,491

|

45,127

|

||||||

|

196,082

|

||||||||||

|

Total

Unaffiliated Private Placement Portfolio (cost:

$18,107,124)

|

$

|

17,779,727

|

||||||||

|

Total

Investments in Unaffiliated Companies (cost:

$18,107,124)

|

$

|

17,779,727

|

||||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF DECEMBER

31, 2006

|

|

Method

of

|

Shares/

|

|

||||||||

|

|

Valuation

(3)

|

Principal

|

Value

|

|||||||

|

Investments

in Non-Controlled Affiliated Companies (6)(8) -28.20% of net

assets

|

||||||||||

|

Private

Placement Portfolio (Illiquid)

- 28.20% of net assets

|

||||||||||

|

BridgeLux,

Inc. (1)(2)(11) -- Manufacturing high-power light

|

||||||||||

|

emitting

diodes

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(A

|

)

|

1,861,504

|

$

|

1,000,000

|

|||||

|

Cambrios

Technologies Corporation (1)(2)(5) -- Developing nanowire-

|

||||||||||

|

enabled

electronic materials for the display industry

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(A

|

)

|

1,294,025

|

1,294,025

|

||||||

|

Chlorogen,

Inc. (1)(2)(5) -- Developing patented chloroplast technology

|

||||||||||

|

to

produce plant-made proteins

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(C

|

)

|

4,478,038

|

785,000

|

||||||

|

Series

B Convertible Preferred Stock

|

(C

|

)

|

2,077,930

|

364,261

|

||||||

|

Secured

Convertible Bridge Note (including interest)

|

(A

|

)

|

$

|

221,438

|

225,697

|

|||||

|

1,374,958

|

||||||||||

|

Crystal

IS, Inc. (1)(2)(5) -- Developing single-crystal

|

||||||||||

|

aluminum

nitride substrates for optoelectronic devices

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(C

|

)

|

391,571

|

305,425

|

||||||

|

Series

A-1 Convertible Preferred Stock

|

(C

|

)

|

1,300,376

|

1,014,294

|

||||||

|

Warrants

at $0.78 expiring 05/05/2013

|

(B

|

)

|

15,231

|

0

|

||||||

|

Warrants

at $0.78 expiring 05/12/2013

|

(B

|

)

|

2,350

|

0

|

||||||

|

Warrants

at $0.78 expiring 08/08/2013

|

(B

|

)

|

4,396

|

0

|

||||||

|

1,319,719

|

||||||||||

|

CSwitch,

Inc. (1)(2)(5) -- Developing next-generation,

system-on-a-chip

|

||||||||||

|

solutions

for communications-based platforms

|

||||||||||

|

Series

A-1 Convertible Preferred Stock

|

(C

|

)

|

6,700,000

|

3,350,000

|

||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF DECEMBER

31, 2006

|

|

Method

of

|

Shares/

|

|||||||||

|

Valuation

(3)

|

Principal

|

Value

|

||||||||

|

Investments

in Non-Controlled Affiliated Companies (6)(8) - 28.20% of net assets

(cont.)

|

||||||||||

|

Private

Placement Portfolio (Illiquid)

- 28.20% of net assets (cont.)

|

||||||||||

|

D-Wave

Systems, Inc. (1)(2)(4)(5)(13) -- Developing

high-performance

|

||||||||||

|

quantum

computing systems

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(A

|

)

|

2,000,000

|

$

|

1,716,444

|

|||||

|

Warrants

at $0.85 expiring 10/19/07

|

(B

|

)

|

1,800,000

|

0

|

||||||

|

1,716,444

|

||||||||||

|

Innovalight,

Inc. (1)(2)(4)(5) - Developing renewable energy products

|

||||||||||

|

enabled

by silicon-based nanomaterials

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(A

|

)

|

16,666,666

|

2,500,000

|

||||||

|

Kereos,

Inc. (1)(2)(5) -- Developing emulsion-based imaging

|

||||||||||

|

agents

and targeted therapeutics to image and treat cancer

|

||||||||||

|

and

cardiovascular disease

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(A

|

)

|

349,092

|

960,000

|

||||||

|

Kovio,

Inc. (1)(2)(5) -- Developing semiconductor products

|

||||||||||

|

using

printed electronics and thin-film technologies

|

||||||||||

|

Series

C Convertible Preferred Stock

|

(A

|

)

|

2,500,000

|

3,000,000

|

||||||

|

Mersana

Therapeutics, Inc. (1)(2)(5)(12) -- Developing advanced

|

||||||||||

|

polymers

for drug delivery

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(C

|

)

|

68,452

|

136,904

|

||||||

|

Series

B Convertible Preferred Stock

|

(C

|

)

|

616,500

|

1,233,000

|

||||||

|

Warrants

at $2.00 expiring 10/21/10

|

(B

|

)

|

91,625

|

0

|

||||||

|

1,369,904

|

||||||||||

|

Metabolon,

Inc. (1)(2)(4)(5) - Discovering biomarkers through

|

||||||||||

|

the

use of metabolomics

|

||||||||||

|

Series

B Convertible Preferred Stock

|

(A

|

)

|

2,173,913

|

2,500,000

|

||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF DECEMBER

31, 2006

|

|

Method

of

|

Shares/

|

|

||||||||

|

|

Valuation

(3)

|

Principal

|

Value

|

|||||||

|

Investments

in Non-Controlled Affiliated Companies (6)(8) - 28.20% of net assets

(cont.)

|

||||||||||

|

Private

Placement Portfolio (Illiquid)

- 28.20% of net assets (cont.)

|

||||||||||

|

NanoGram

Corporation (1)(2)(5) -- Developing a broad suite of intellectual

|

||||||||||

|

property

utilizing nanotechnology

|

||||||||||

|

Series

I Convertible Preferred Stock

|

(C

|

)

|

63,210

|

$

|

64,259

|

|||||

|

Series

II Convertible Preferred Stock

|

(C

|

)

|

1,250,904

|

1,271,670

|

||||||

|

Series

III Convertible Preferred Stock

|

(C

|

)

|

1,242,144

|

1,262,764

|

||||||

|

2,598,693

|

||||||||||

|

Nanomix,

Inc. (1)(2)(5) -- Producing nanoelectronic sensors that

|

||||||||||

|

integrate

carbon nanotube electronics with silicon microstructures

|

||||||||||

|

Series

C Convertible Preferred Stock

|

(B

|

)

|

9,779,181

|

790,000

|

||||||

|

NanoOpto

Corporation (1)(2)(5) -- Manufacturing discrete and

integrated

|

||||||||||

|

optical

communications sub-components on a chip by utilizing

|

||||||||||

|

nano

manufacturing and nano coating technology

|

||||||||||

|

Series

A-1 Convertible Preferred Stock

|

(B

|

)

|

267,857

|

16,400

|

||||||

|

Series

B Convertible Preferred Stock

|

(B

|

)

|

3,819,935

|

560,328

|

||||||

|

Series

C Convertible Preferred Stock

|

(B

|

)

|

1,932,789

|

425,266

|

||||||

|

Series

D Convertible Preferred Stock

|

(B

|

)

|

1,397,218

|

204,951

|

||||||

|

Warrants

at $0.4359 expiring 03/15/10

|

(B

|

)

|

193,279

|

0

|

||||||

|

1,206,945

|

||||||||||

|

Nextreme

Thermal Solutions, Inc. (1)(2)(5) -- Developing thin-film

|

||||||||||

|

thermoelectric

devices

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(A

|

)

|

1,000,000

|

1,000,000

|

||||||

|

Questech

Corporation (1)(2) -- Manufacturing and marketing

|

||||||||||

|

proprietary

metal and stone decorative tiles

|

||||||||||

|

Common

Stock

|

(B

|

)

|

655,454

|

996,683

|

||||||

|

Warrants

at $1.50 expiring 11/21/07

|

(B

|

)

|

3,750

|

77

|

||||||

|

Warrants

at $1.50 expiring 11/19/08

|

(B

|

)

|

5,000

|

103

|

||||||

|

Warrants

at $1.50 expiring 11/19/09

|

(B

|

)

|

5,000

|

103

|

||||||

|

996,966

|

||||||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF DECEMBER

31, 2006

|

|

Method

of

|

Shares/

|

|

||||||||

|

|

Valuation

(3)

|

Principal

|

Value

|

|||||||

|

Investments

in Non-Controlled Affiliated Companies (6)(8) - 28.20% of net assets

(cont.)

|

||||||||||

|

Private

Placement Portfolio (Illiquid)

- 28.20% of net assets (cont.)

|

||||||||||

|

Solazyme,

Inc. (1)(2)(5) -- Developing energy-harvesting

|

||||||||||

|

machinery

of photosynthetic microbes to produce industrial

|

||||||||||

|

and

pharmaceutical molecules

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(C

|

)

|

988,204

|

$

|

385,400

|

|||||

|

Starfire

Systems, Inc. (1)(2)(5) --Producing ceramic-forming polymers

|

||||||||||

|

Common

Stock

|

(A

|

)

|

375,000

|

150,000

|

||||||

|

Series

A-1 Convertible Preferred Stock

|

(C

|

)

|

600,000

|

600,000

|

||||||

|

750,000

|

||||||||||

|

Xradia,

Inc. (1)(2)(4) - Designing, manufacturing and selling ultra

high

|

||||||||||

|

resolution

3D x-ray microscopes and fluorescence imaging systems.

|

||||||||||

|

Series

D Convertible Preferred Stock

|

(A

|

)

|

3,121,099

|

4,000,000

|

||||||

|

Zia

Laser, Inc. (1)(2)(5) -- Developing quantum dot semiconductor

lasers

|

||||||||||

|

Series

C Convertible Preferred Stock

|

(C

|

)

|

1,500,000

|

15,000

|

||||||

|

Total

Non-Controlled Private Placement Portfolio (cost:

$39,571,676)

|

$

|

32,128,054

|

||||||||

|

Total

Investments in Non-Controlled Affiliated Companies (cost:

$39,571,676)

|

$

|

32,128,054

|

||||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF DECEMBER 31,

2006

|

|

Method

of

|

Shares/

|

|

||||||||

|

|

Valuation

(3)

|

Principal

|

Value

|

|||||||

|

Investments

in Controlled Affiliated Companies (6)(9) - 3.30% of net

assets

|

||||||||||

|

Private

Placement Portfolio (Illiquid)

- 3.30% of net assets

|

||||||||||

|

Evolved

Nanomaterial Sciences, Inc. (1)(2)(4)(5) -- Developing

|

||||||||||

|

nanotechnology-enhanced

approaches for the resolution of

|

||||||||||

|

chiral

molecules

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(A

|

)

|

5,870,021

|

$

|

2,800,000

|

|||||

|

SiOnyx,

Inc. (1)(2)(4)(5) -- Developing silicon-based

|

||||||||||

|

optoelectronic

products enabled by its proprietary, "Black Silicon"

|

||||||||||

|

Series

A Convertible Preferred Stock

|

(C

|

)

|

233,499

|

70,050

|

||||||

|

Series

A-1 Convertible Preferred Stock

|

(C

|

)

|

2,966,667

|

890,000

|

||||||

|

960,050

|

||||||||||

|

Total

Controlled Private Placement Portfolio (cost:

$4,440,000)

|

$

|

3,760,050

|

||||||||

|

Total

Investments in Controlled Affiliated Companies (cost:

$4,440,000)

|

$

|

3,760,050

|

||||||||

|

U.S.

Government and Agency Securities - 51.48% of net

assets

|

||||||||||

|

U.S.

Treasury Bill -- due date 1/18/07

|

(J

|

)

|

2,217,000

|

2,212,677

|

||||||

|

U.S.

Treasury Notes -- due date 11/30/07, coupon 4.25%

|

(H

|

)

|

6,500,000

|

6,455,345

|

||||||

|

U.S.

Treasury Notes -- due date 02/15/08, coupon 3.375%

|

(H

|

)

|

9,000,000

|

8,842,860

|

||||||

|

U.S.

Treasury Notes -- due date 05/15/08, coupon 3.75%

|

(H

|

)

|

9,000,000

|

8,862,210

|

||||||

|

U.S.

Treasury Notes -- due date 09/15/08, coupon 3.125%

|

(H

|

)

|

5,000,000

|

4,861,350

|

||||||

|

U.S.

Treasury Notes -- due date 01/15/09, coupon 3.25%

|

(H

|

)

|

3,000,000

|

2,910,930

|

||||||

|

U.S.

Treasury Notes -- due date 02/15/09, coupon 4.50%

|

(H

|

)

|

5,100,000

|

5,069,145

|

||||||

|

U.S.

Treasury Notes -- due date 04/15/09, coupon 3.125%

|

(H

|

)

|

3,000,000

|

2,893,830

|

||||||

|

U.S.

Treasury Notes -- due date 07/15/09, coupon 3.625%

|

(H

|

)

|

3,000,000

|

2,920,890

|

||||||

|

U.S.

Treasury Notes -- due date 10/15/09, coupon 3.375%

|

(H

|

)

|

3,000,000

|

2,894,310

|

||||||

|

U.S.

Treasury Notes -- due date 01/15/10, coupon 3.625%

|

(H

|

)

|

3,000,000

|

2,907,420

|

||||||

|

U.S.

Treasury Notes -- due date 04/15/10, coupon 4.00%

|

(H

|

)

|

3,000,000

|

2,935,560

|

||||||

|

U.S.

Treasury Notes -- due date 07/15/10, coupon 3.875%

|

(H

|

)

|

3,000,000

|

2,920,560

|

||||||

|

U.S.

Treasury Notes -- due date 10/15/10, coupon 4.25%

|

(H

|

)

|

2,000,000

|

1,969,060

|

||||||

|

Total

Investments in U.S. Government and Agency Securities (cost:

$59,212,598)

|

$

|

58,656,147

|

||||||||

|

Total

Investments (cost: $121,331,398)

|

$

|

112,323,978

|

||||||||

|

HARRIS

& HARRIS GROUP, INC.

CONSOLIDATED

SCHEDULE OF INVESTMENTS AS OF DECEMBER 31,

2006

|

|

(1)

|

Represents

a non-income producing security. Equity investments that have not

paid

dividends within the last 12 months are considered to be non-income

producing.

|

|

(2)

|

Legal

restrictions on sale of investment.

|

|

(3)

|

See

Footnote to Schedule of Investments for a description of the Valuation

Procedures.

|

|

(4)

|

Initial

investment was made during 2006.

|

|

(5)

|

These

investments are development stage companies. A development stage

company

is defined as a company that is devoting substantially all of its

efforts

to establishing a new business, and either it has not yet commenced

its

planned principal operations, or it has commenced such operations

but has

not realized significant revenue from

them.

|

|

(6)

|

Investments

in unaffiliated companies consist of investments in which we own

less than

five percent of the voting shares of the portfolio company. Investments

in

non-controlled affiliated companies consist of investments in which

we own

five percent or more, but less than 25 percent, of the voting shares

of

the portfolio company or where we hold one or more seats on the portfolio

company’s Board of Directors. Investments in controlled affiliated

companies consist of investments in which we own 25 percent or more

of the

voting shares of the portfolio

company.

|

|

(7)

|

The

aggregate cost for federal income tax purposes of investments in

unaffiliated companies is $18,107,124. The gross unrealized appreciation

based on the tax cost for these securities is $1,732,194. The gross

unrealized depreciation based on the tax cost for these securities

is

$2,059,591.

|

|

(8)

|

The

aggregate cost for federal income tax purposes of investments in

non-controlled affiliated companies is $39,571,676. The gross unrealized

appreciation based on the tax cost for these securities is $333,269.

The

gross unrealized depreciation based on the tax cost for these securities

is $7,776,891.

|

|

(9)

|

The

aggregate cost for federal income tax purposes of investments in

controlled affiliated companies is $4,400,000. The gross unrealized

appreciation based on the tax cost for these securities is $0. The

gross

unrealized depreciation based on the tax cost for these securities

is

$679,950.

|

|

(10)

|

Continuum

Photonics, Inc., merged with Polatis, Ltd., to form Polatis,

Inc.

|

|

(11)

|

BridgeLux,

Inc., was previously named eLite Optoelectronics,

Inc.

|

|

(12)

|

Mersana

Therapeutics, Inc., was previously named Nanopharma

Corp.

|

|

(13)

|

D-Wave

Systems, Inc., is located and is doing business primarily in Canada.

We

invested in D-Wave Systems, Inc., through D-Wave USA, a Delaware

company.

Our investment is denominated in Canadian dollars and is subject

to